Hmrc Tax Refund Customer Service Number Contact HMRC for help with questions about PAYE and Income Tax including coding notices and Marriage Allowance and for advice on savings including ISAs and claiming tax back on interest

Contact HMRC for help with questions about PAYE and Income Tax including coding notices and Marriage Allowance and for advice on savings including ISAs and claiming tax back on interest Check how to claim a tax refund You may be able to get a tax refund rebate if you ve paid too much tax Use this tool to find out what you need to do if you paid too much on pay from a

Hmrc Tax Refund Customer Service Number

Hmrc Tax Refund Customer Service Number

https://www.swiftrefunds.co.uk/wp-content/uploads/2019/08/tax-refund-min-e1566379729336.jpg

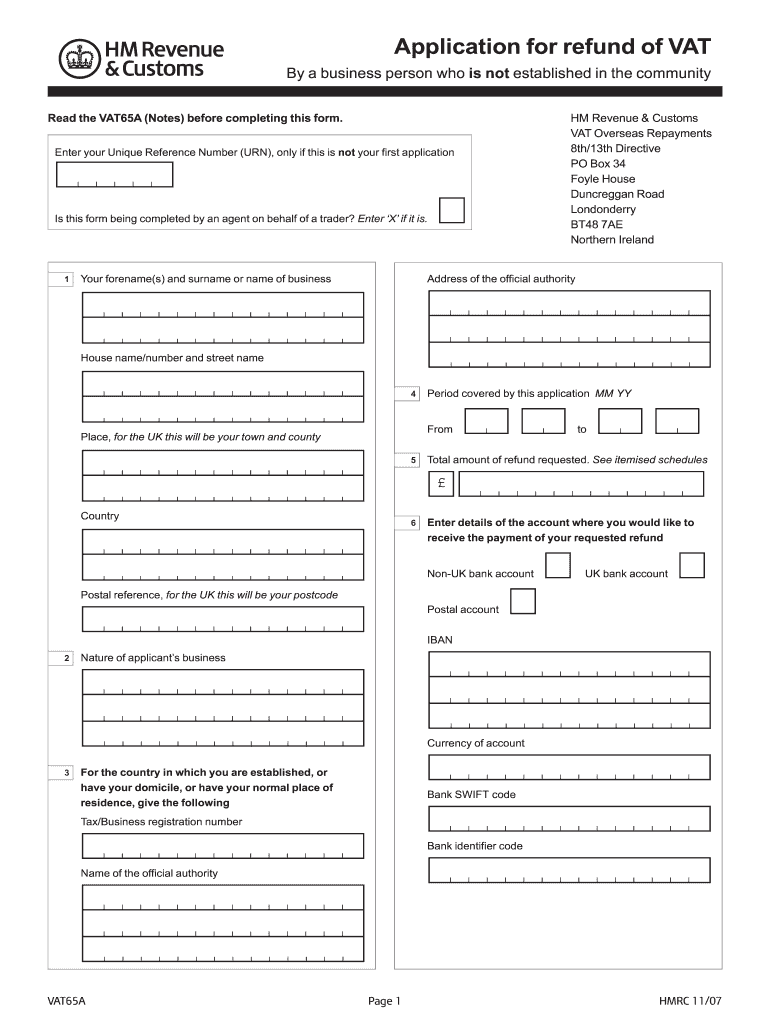

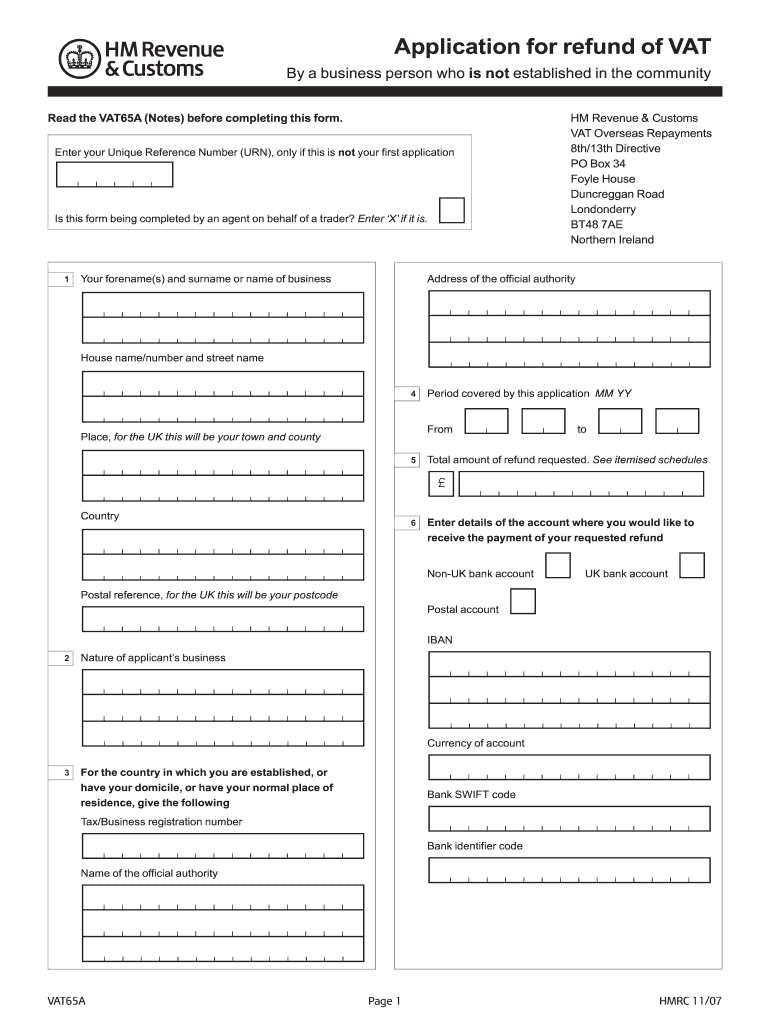

HMRC Form Refund Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/22/339/22339794/large.png

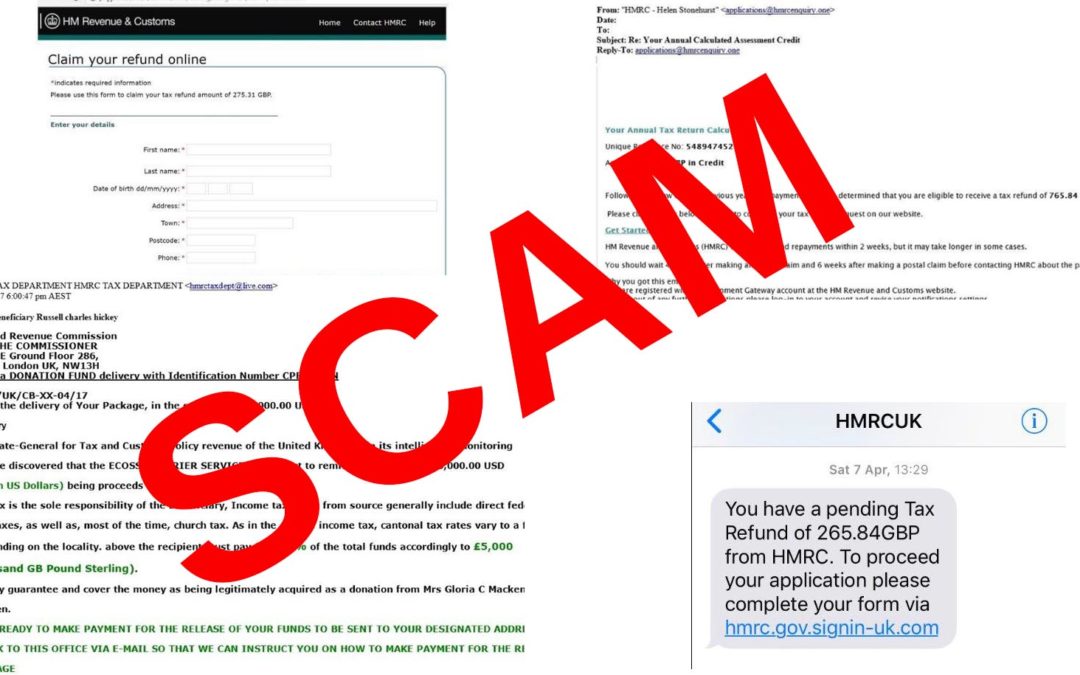

HMRC Refund Scams Must Read Guidelines And Reminder

https://gmpdrivercare.com/wp-content/uploads/2018/12/hmrc-scam-1080x675.jpg

Phone Call HMRC for advice if you complete a Self Assessment tax return Problems using HMRC s online services Contact HMRC s online services helpdesk if you have problems submitting The Income Tax general enquiries helpline is 0300 200 3300 Dial 18001 0300 200 3300 to contact the Income Tax general enquiries helpline by text relay HMRC also offers a textphone

Phone Only call HMRC if you cannot find an answer to your VAT question using our online guidance or services You ll need your postcode VAT registration number You cannot pay or agree time The Income Tax Office at HM Revenue Customs HMRC can accept most information over the phone but in certain circumstances you will need to write in This table will help you decide how to

Download Hmrc Tax Refund Customer Service Number

More picture related to Hmrc Tax Refund Customer Service Number

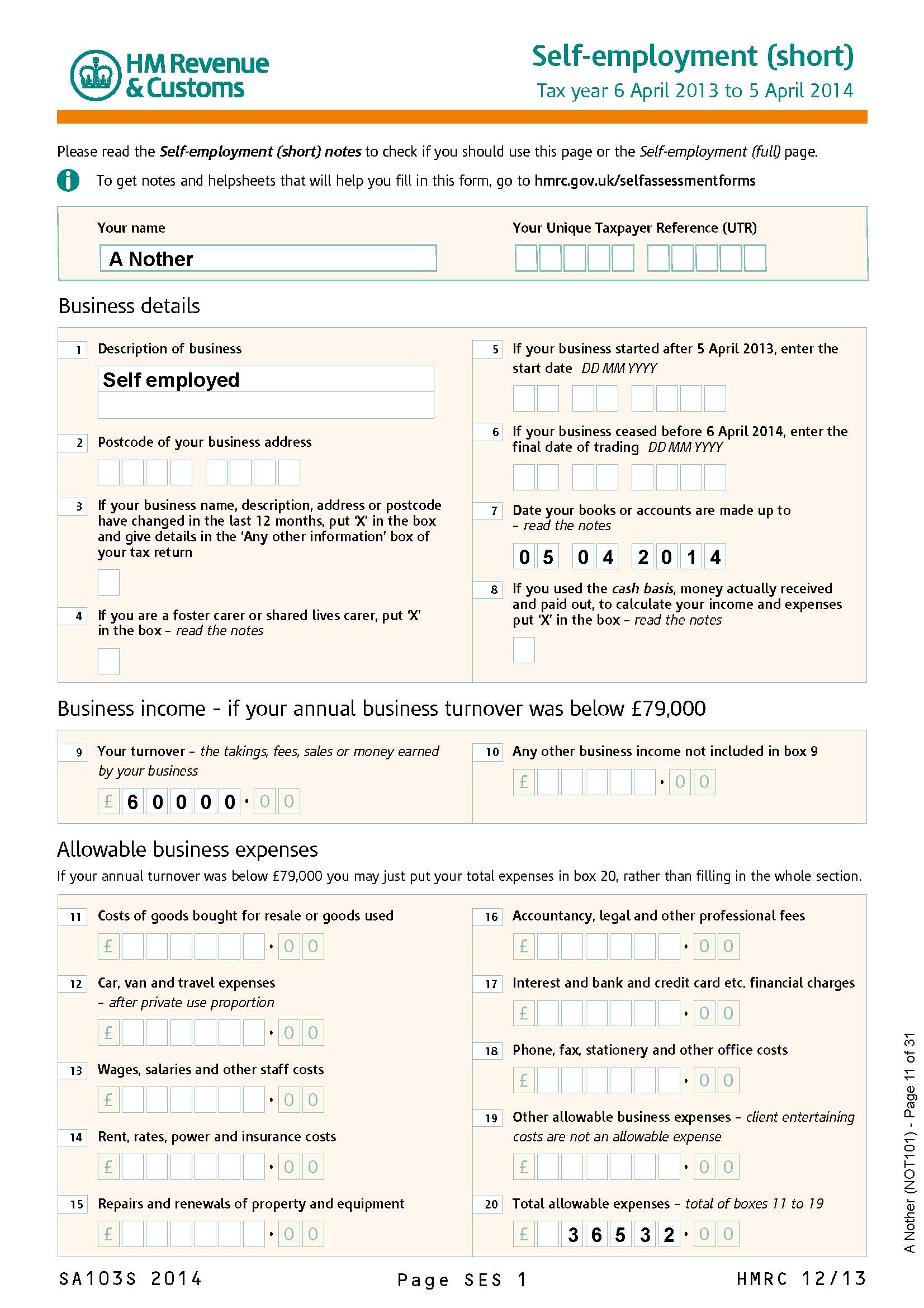

HMRC Tax Overview Online Self Document Templates Documents

https://i.pinimg.com/originals/64/20/f9/6420f98a972d6abb09fe061ad9d397e6.jpg

Company Tax Return Hmrc Company Tax Return Guide

http://www.real-price.co.uk/images/product-images/SPI1001_Page_11_2.jpg

HMRC 2021 Paper Tax Return Form

https://i0.wp.com/taxhelp.uk.com/wp-content/uploads/2021-HMRC-SA100-Tax-Return-m.jpg?w=1024&ssl=1

Claiming back overpaid tax should be easy enough to do yourself directly through HMRC Matthew Jenkin Senior writer If you think you ve paid too much tax over the course of a financial year then you may be eligible for a HMRC online services helpdesk 0300 200 3600 Online debit and credit card payment support 0300 200 3601 VAT general enquiries 0300 200 3700 Tax Credits helpline 0345 300 3900 You can find more relevant numbers on the contact HMRC page Contact HMRC by phone time your call right

A list of regularly used HMRC contact information including telephone numbers online contact options and postal addresses together with a number of tips This information will help direct tax agents to the appropriate point of contact within HMRC For Textphone call 0300 200 3319 for tax queries and 0300 200 3319 for Self Assessment queries If you have additional needs due to a disability or personal circumstances and require support you can phone the helpline to

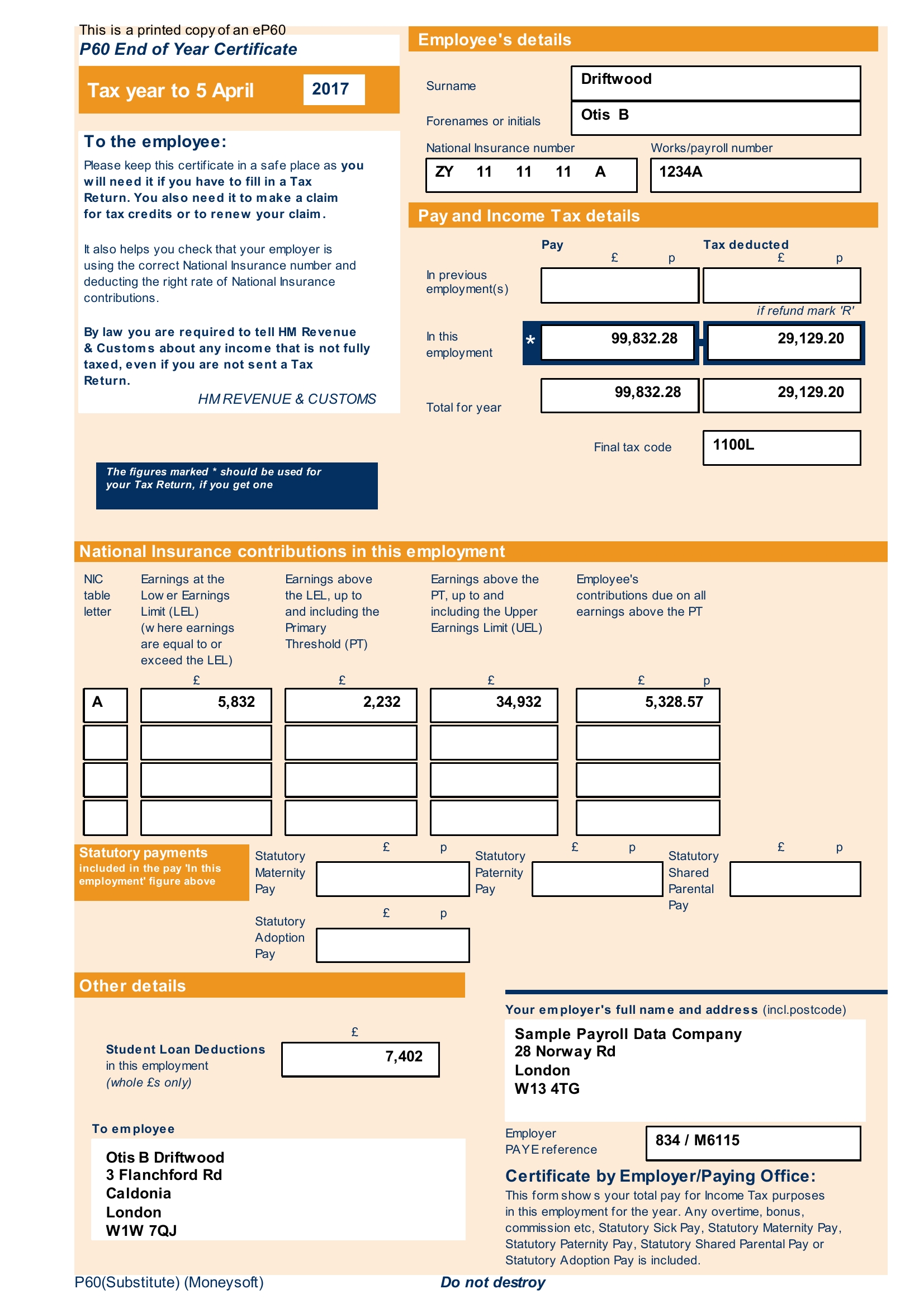

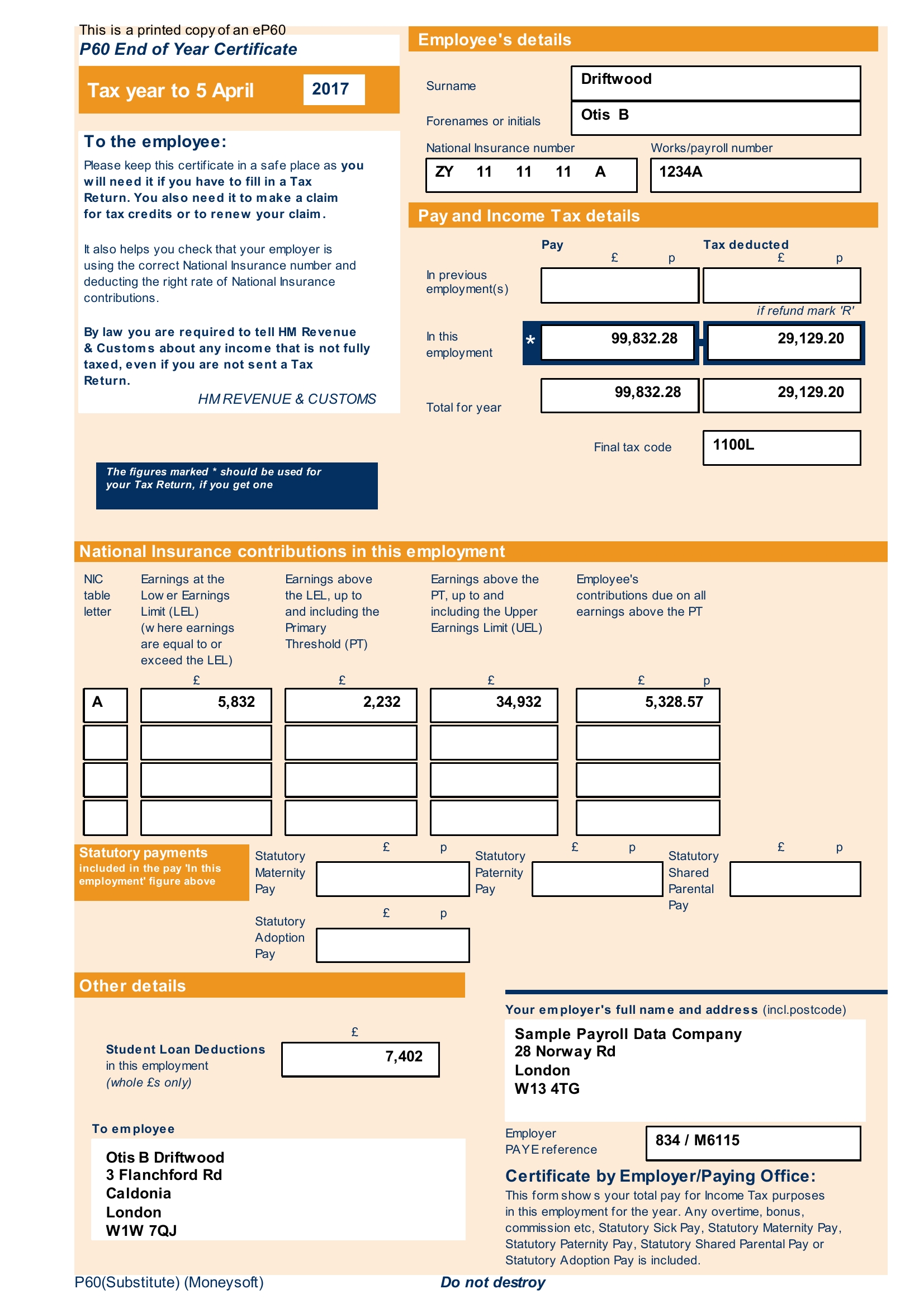

P60 Standard HMRC Email

https://www.payslipsonline.co.uk/resource/products/88853/234dda71.jpg

Why Is My Tax Refund Taking So Long Hmrc DTAXC

https://i.ytimg.com/vi/fHARONBG43g/maxresdefault.jpg

https://www.gov.uk/government/organisations/hm...

Contact HMRC for help with questions about PAYE and Income Tax including coding notices and Marriage Allowance and for advice on savings including ISAs and claiming tax back on interest

https://www.gov.uk/government/organisations/hm...

Contact HMRC for help with questions about PAYE and Income Tax including coding notices and Marriage Allowance and for advice on savings including ISAs and claiming tax back on interest

Hmrc Tax Return Letters With Logos And Cash Stock Photo Royalty Free

P60 Standard HMRC Email

HMRC Claims customer Service Progress After Joint Work With

Paying HMRC Tax Bills October 2013

Raising A DRC Sales Invoice cash Accounting

HMRC R D Compliance Check Eligibility Nudge Letters

HMRC R D Compliance Check Eligibility Nudge Letters

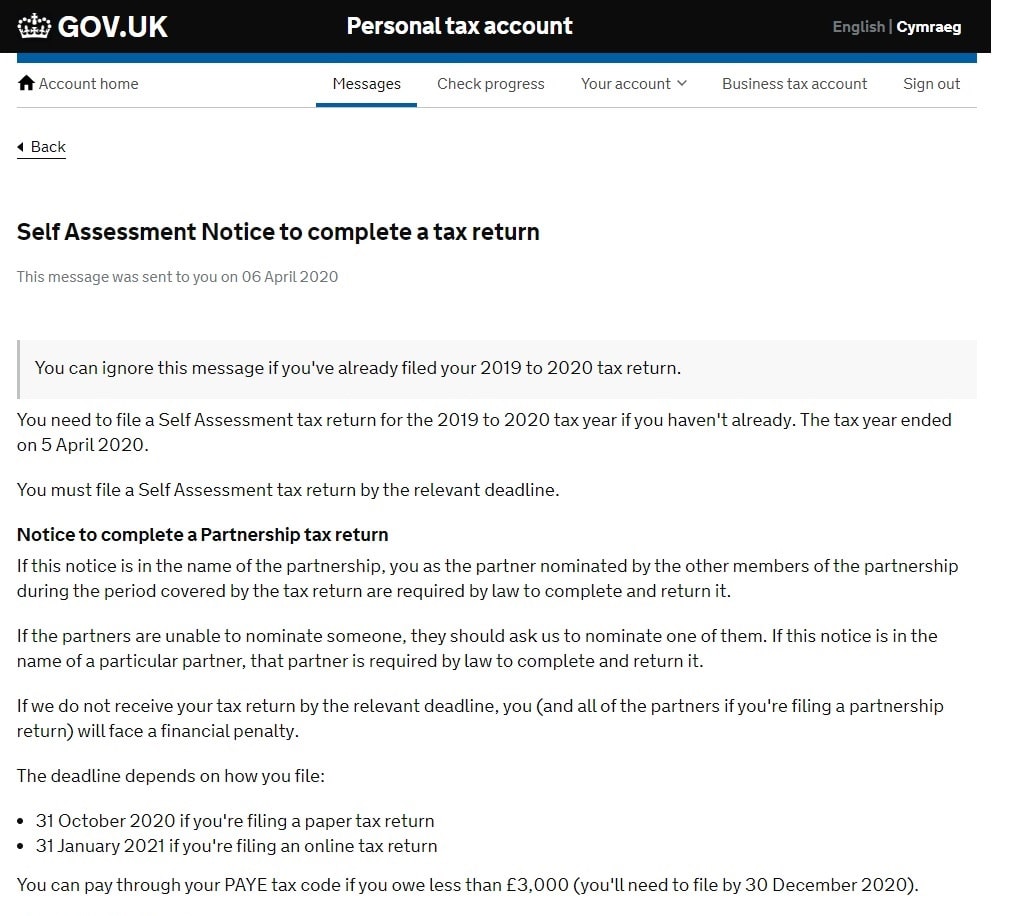

HMRC Notice To Complete A 2020 Tax Return

HMRC P60 In 2020

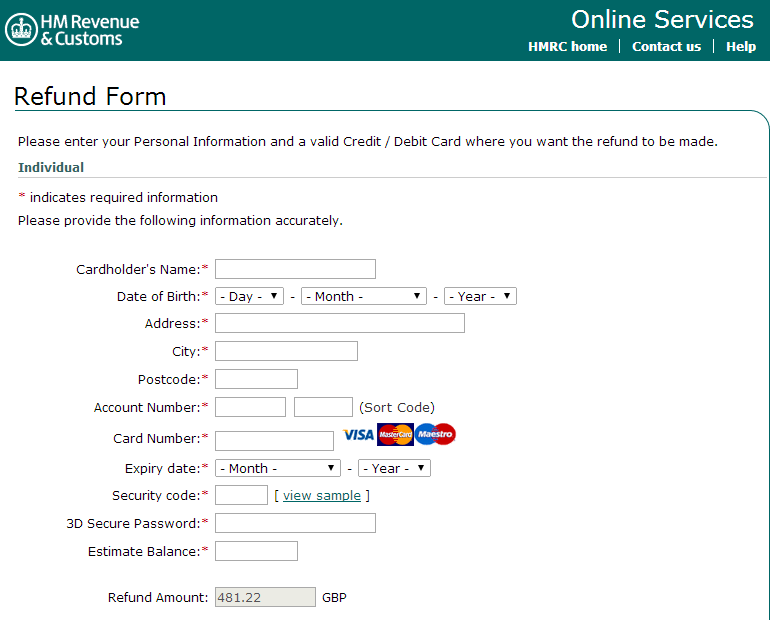

HMRC Scam Emails And Phone Calls On Tax Refund Targeting UK Citizens

Hmrc Tax Refund Customer Service Number - You will need to contact our Income Tax department as this sounds as though the request is not going through Income Tax general enquiries Thank you