Hmrc Tax Relief Contact Number Phone Call HMRC for help with questions about PAYE Income Tax and Class 4 National Insurance including issues with your tax code tax overpayments or underpayments a P800 tax calculation

The Income Tax Office at HM Revenue Customs HMRC can accept most information over the phone but in certain circumstances you will need to write in This table will help you decide how to contact HMRC Please note that the Income Tax year runs from 6 April to 5 April For some changes HMRC can only accept information about changes in this Five tips for tackling delays 1 Do your preparation before contacting HMRC In theory your registered address should bring up all of your tax details But not in my experience Before you

Hmrc Tax Relief Contact Number

Hmrc Tax Relief Contact Number

https://blog.shorts.uk.com/hubfs/HMRC R-and-D enquiries.jpg

HMRC Research And Development Tax Relief New HMRC Service

https://www.steedman.co.uk/wp-content/uploads/2020/02/research-development-image.jpg

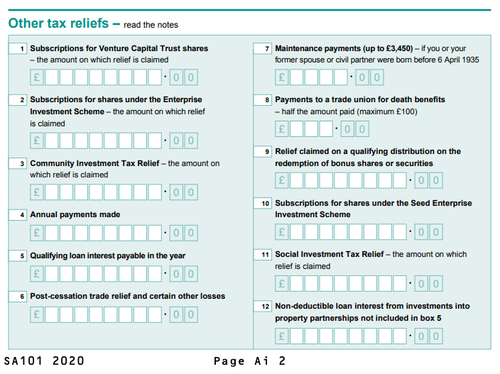

How To Claim SEIS Tax Reliefs Illustrated Guide

https://static-web-wealthclub.s3.amazonaws.com/images/SA101__Other_tax_reliefs-min.width-500.png

Higher rate taxpayers can claim 40 of the 6 2 40 a week Over the course of the year this means people could reduce the tax they pay by 62 40 or 124 80 respectively It s still possible to claim this tax relief for 2021 22 however for claims for 2022 23 these rules are no longer relaxed If you re employed you cannot claim tax Many of us had to shift gears and work from home at some point throughout the pandemic In fact the latest numbers show that 5 6 million people went from the office to their home office or kitchen table at some point during 2020 Surprisingly though only 800 000 have so far made applications for the working from home tax relief At a rate of

Contacting HMRC by telephone The main telephone number is HMRC s tax credit helpline 0345 300 3900 There is also NGT text relay if you cannot hear or speak on the phone dial 18001 then 0345 300 3900 From abroad you can ring 44 2890 538 192 You will normally be asked for your national insurance number Latest tax news A list of regularly used HMRC contact information including telephone numbers online contact options and postal addresses together with a number of tips This information will help direct tax agents to the appropriate point of contact within HMRC

Download Hmrc Tax Relief Contact Number

More picture related to Hmrc Tax Relief Contact Number

Working From Home The HMRC Tax Relief Explained Pleo Blog

https://images.prismic.io/commercial-helios/25affc8e-6110-472f-b783-6ef073de652e_petty-cashbox-header.png?ixlib=gatsbyFP&auto=compress%2Cformat&fit=max&q=50&dpr=2&w=2480

Working From Home HMRC Tax Relief Explained Pleo Blog

https://images.prismic.io/commercial-helios/8f07396b-fdfd-4e99-acc0-ce9156393921_BLOG_WFH-Allowance_Header.png?ixlib=gatsbyFP&auto=compress%2Cformat&fit=max&q=50&fit=crop&w=1200&h=630&dpr=2

HMRC Working From Home Tax Relief How To Claim And Save Up To 500

https://cdn.images.express.co.uk/img/dynamic/23/590x/secondary/HMRC-working-from-home-tax-relief-3126531.jpg?r=1625056999931

Tax relief is paid on your pension contributions at the highest rate of income tax you pay So Basic rate taxpayers get 20 pension tax relief Higher rate taxpayers can claim 40 pension tax relief Additional rate taxpayers can claim 45 pension tax relief In Scotland income tax is banded differently and pension tax relief is applied in a Fail to file for a further three months and you will incur additional daily penalties of 10 up to a maximum of 900 As well as penalties for filing late HMRC can fine taxpayers for up to

Employer helpline 0300 200 3200 Income Tax helpline 0300 200 3300 National Insurance helpline 0300 200 3500 HMRC online services helpdesk 0300 200 3600 Online debit and credit card payment support 0300 200 3601 VAT general enquiries 0300 200 3700 Tax Credits helpline 0345 300 3900 There are a number of tax refunds and allowances available to UK taxpayers depending on their employment status and personal circumstances And while you may be automatically given a tax rebate you may also be eligible for some refunds you aren t aware of Here s everything you need to know about HMRC tax refunds Summary

HMRC Tax Form P87 Tax Relief For Employee Business Mileage

https://assets-global.website-files.com/61017e6b22c7fa6cb9edc36a/6110ca8660056342f1232648_60d828fa501fb52c317bfa73_tax-relief-hmrc-form-p87.jpeg

HMRC Issue Reminder On Tax Reliefs For Working From Home

https://media.licdn.com/dms/image/C4D12AQG19vAaPc14DA/article-cover_image-shrink_720_1280/0/1625343128455?e=2147483647&v=beta&t=f6-ABTKwtdYpsO45J25nHBIfPN8fkvnHvExRZ4T0dW0

https://www. gov.uk /government/organisations/hm...

Phone Call HMRC for help with questions about PAYE Income Tax and Class 4 National Insurance including issues with your tax code tax overpayments or underpayments a P800 tax calculation

https:// assets.publishing.service.gov.uk /...

The Income Tax Office at HM Revenue Customs HMRC can accept most information over the phone but in certain circumstances you will need to write in This table will help you decide how to contact HMRC Please note that the Income Tax year runs from 6 April to 5 April For some changes HMRC can only accept information about changes in this

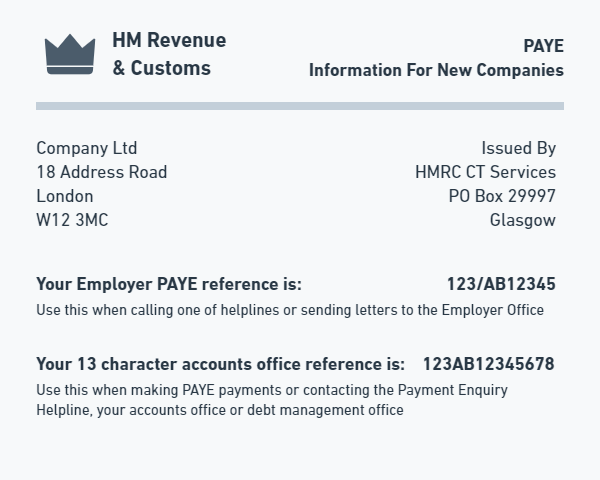

Information Guide For Unique Tax Reference Numbers

HMRC Tax Form P87 Tax Relief For Employee Business Mileage

HMRC Customer Service Contact Numbers Tax Helpline 0300 200 3300

Getting Started With HMRC For Limited Companies

How To Claim Tax Relief On Pension Contributions From Hmrc Asbakku

HMRC Give Tax Relief Pre approval Save The Thorold Arms

HMRC Give Tax Relief Pre approval Save The Thorold Arms

EPayMe If You Work From Home Then You May Be Eligible To Claim HMRC

Login register HMRC UK Contact Numbers

Hmrc Tax

Hmrc Tax Relief Contact Number - Higher rate taxpayers can claim 40 of the 6 2 40 a week Over the course of the year this means people could reduce the tax they pay by 62 40 or 124 80 respectively It s still possible to claim this tax relief for 2021 22 however for claims for 2022 23 these rules are no longer relaxed If you re employed you cannot claim tax