Hmrc Work Mileage Tax Rebate Web 28 mars 2014 nbsp 0183 32 There are special rules for working out the tax relief on motoring expenses paid to employees who use their own vehicles for business travel go to paragraph 9 12

Web 1 ao 251 t 2023 nbsp 0183 32 Mileage claims are calculated by multiplying your work related mileage throughout the tax year with the applicable HMRC mileage rate What mileage rate can Web 28 mars 2014 nbsp 0183 32 Tax relief is available for the full cost of the travel between the 2 workplaces because it s undertaken in the performance of Amanda s duties

Hmrc Work Mileage Tax Rebate

Hmrc Work Mileage Tax Rebate

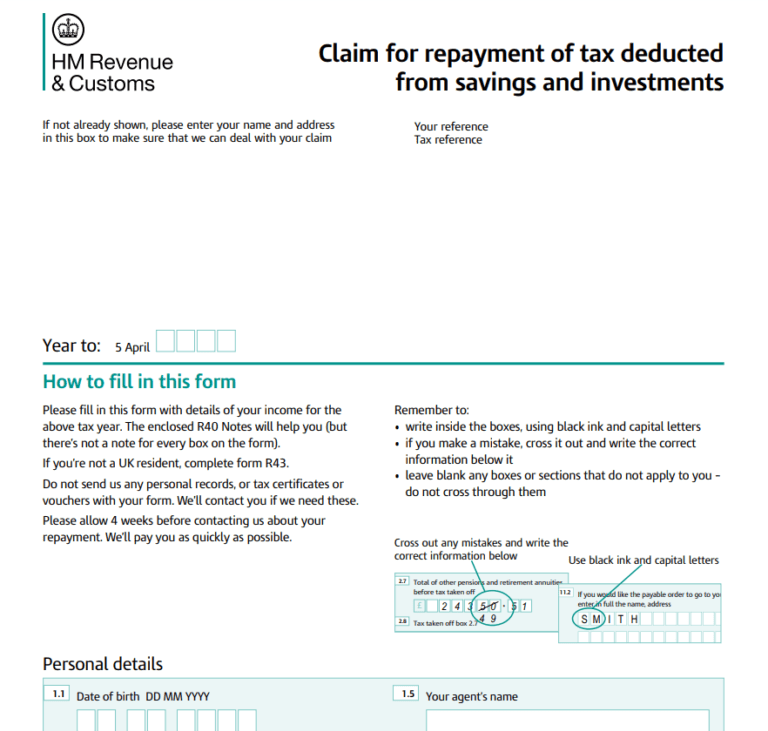

https://printablerebateform.net/wp-content/uploads/2022/09/HMRC-Tax-Rebate-Form-768x731.png

Business Mileage Claim Form Hmrc Armando Friend s Template

https://i.pinimg.com/originals/a3/57/98/a35798c39554e86a5d9d241e9c213dab.png

How To Claim The Work Mileage Tax Rebate Goselfemployed co

https://goselfemployed.co/wp-content/uploads/2019/02/tax-rebate-work-mileage-2-1024x319.png

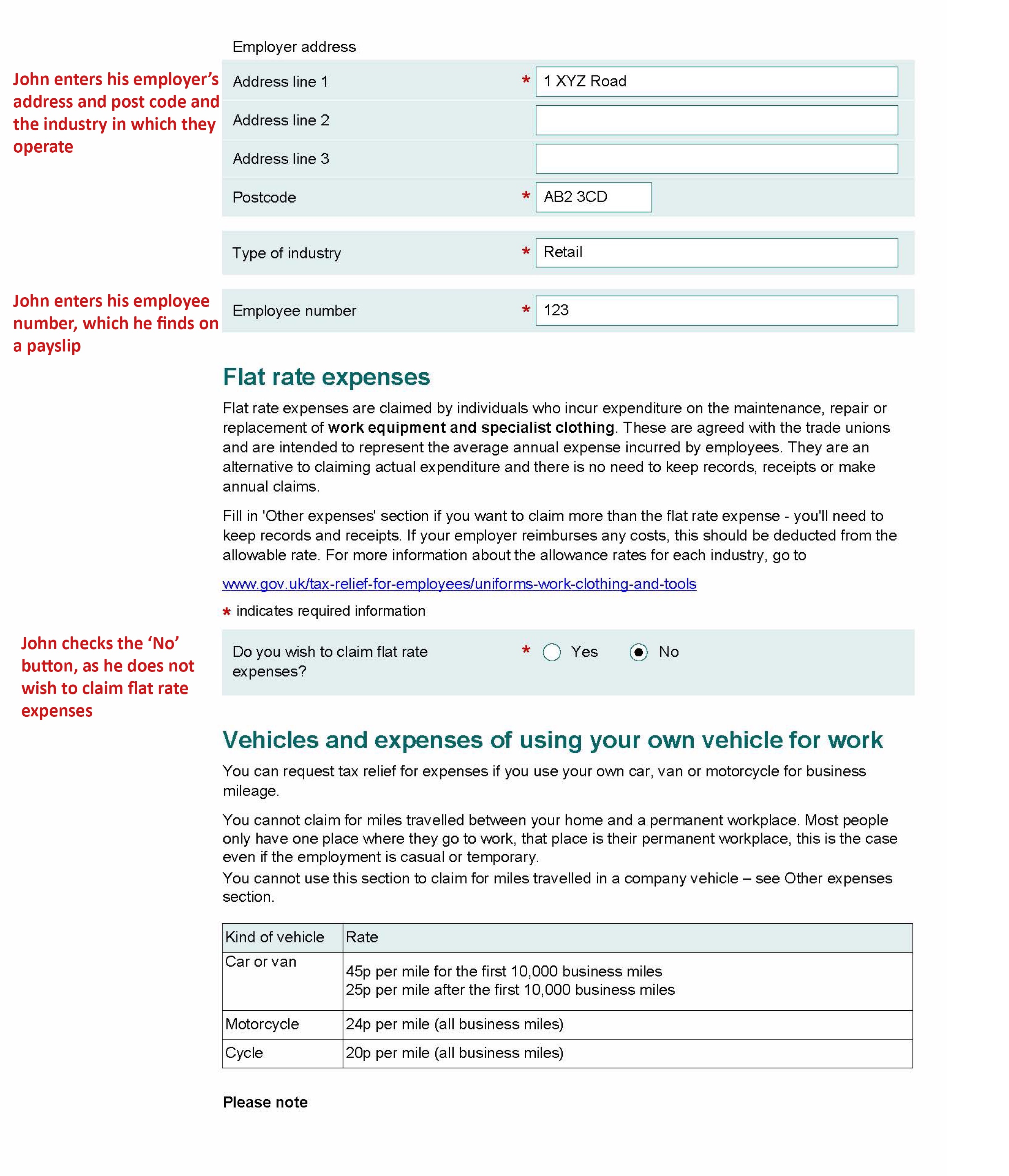

Web If you pay the 20 basic rate of tax and claim tax relief on 163 6 a week you would get 163 1 20 per week in tax relief 20 of 163 6 You ll usually get tax relief through a change to your Web 13 mai 2021 nbsp 0183 32 13 May 2021 HM Revenue and Customs HMRC is accepting tax relief claims for working from home due to coronavirus during 2021 to 2022 More than

Web 10 000 miles 45p per mile 163 4500 Mileage 163 4500 20 tax relief 163 900 In this example if you were paying tax at 20 your claim would be worth in the region of 163 900 Web The work mileage tax rebate is a tax refund given when employees use their personal vehicles for work reasons but their employers pay them below the HMRC standard mileage allowance rates The standard

Download Hmrc Work Mileage Tax Rebate

More picture related to Hmrc Work Mileage Tax Rebate

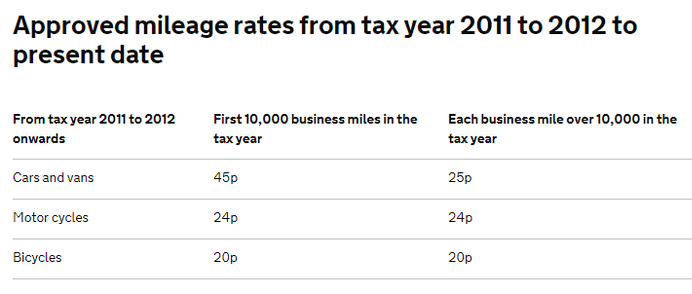

HMRC Approved Mileage Rates From 2011 12 Onwards

https://www.sexaccountants.co.uk/images/blog/4c0d4a7e67711dc551daf16d7d8b3955__2cb7/zoom692x294z100000cw668.png?etag=41d541899f8597af103bf7f6f59b437b

PSA HMRC Will Not E mail Or Call You About Tax Rebates CasualUK

https://i.imgur.com/NPT0C0n.png

Work Mileage Allowance Relief Greater Manchester

https://yourtaxrebates.co.uk/wp-content/uploads/2020/12/Pics-2048x1024.png

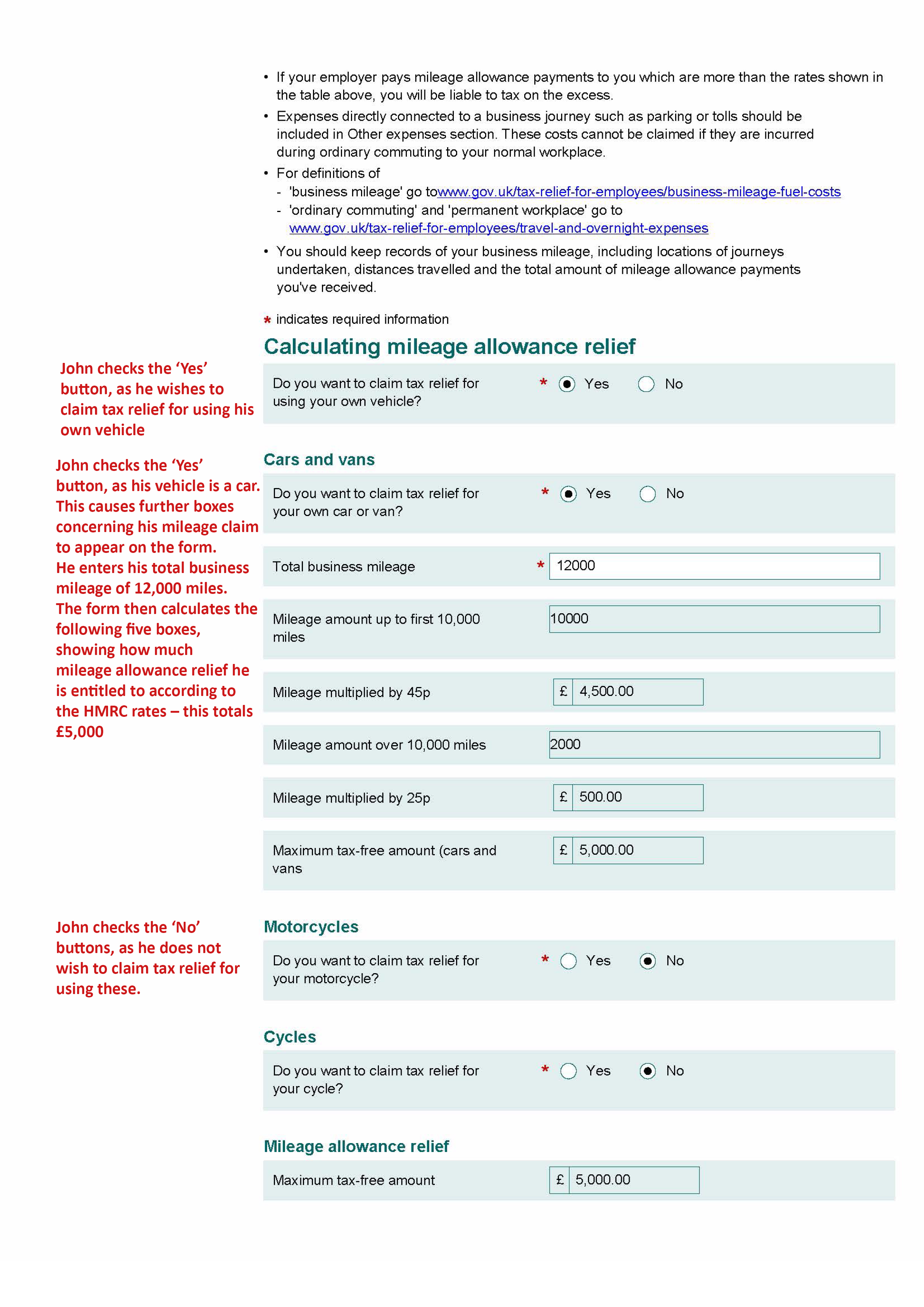

Web 5 mai 2020 nbsp 0183 32 You can claim for Work Mileage Tax Allowance on the vehicles you use for work This includes cars vans motorcycles and bicycles used for work Please note Web If you are required to use your own vehicle for work you may be able to claim Mileage Allowance Relief from HMRC based on the number of business miles you travel This tax

Web 8 mars 2023 nbsp 0183 32 45p per mile for the first 10 000 miles for cars and vans 25p per mile after that for cars and vans 24p per mile for motorcycles 20p per mile for cycles Use the Web MILEAGE ALLOWANCE If You Are Required To Use Your Own Vehicle For Work You May Be Able To Claim Mileage Allowance Rebate From HMRC Based On The

2011 Form UK HMRC P87 Fill Online Printable Fillable Blank PDFfiller

https://www.pdffiller.com/preview/100/57/100057253/large.png

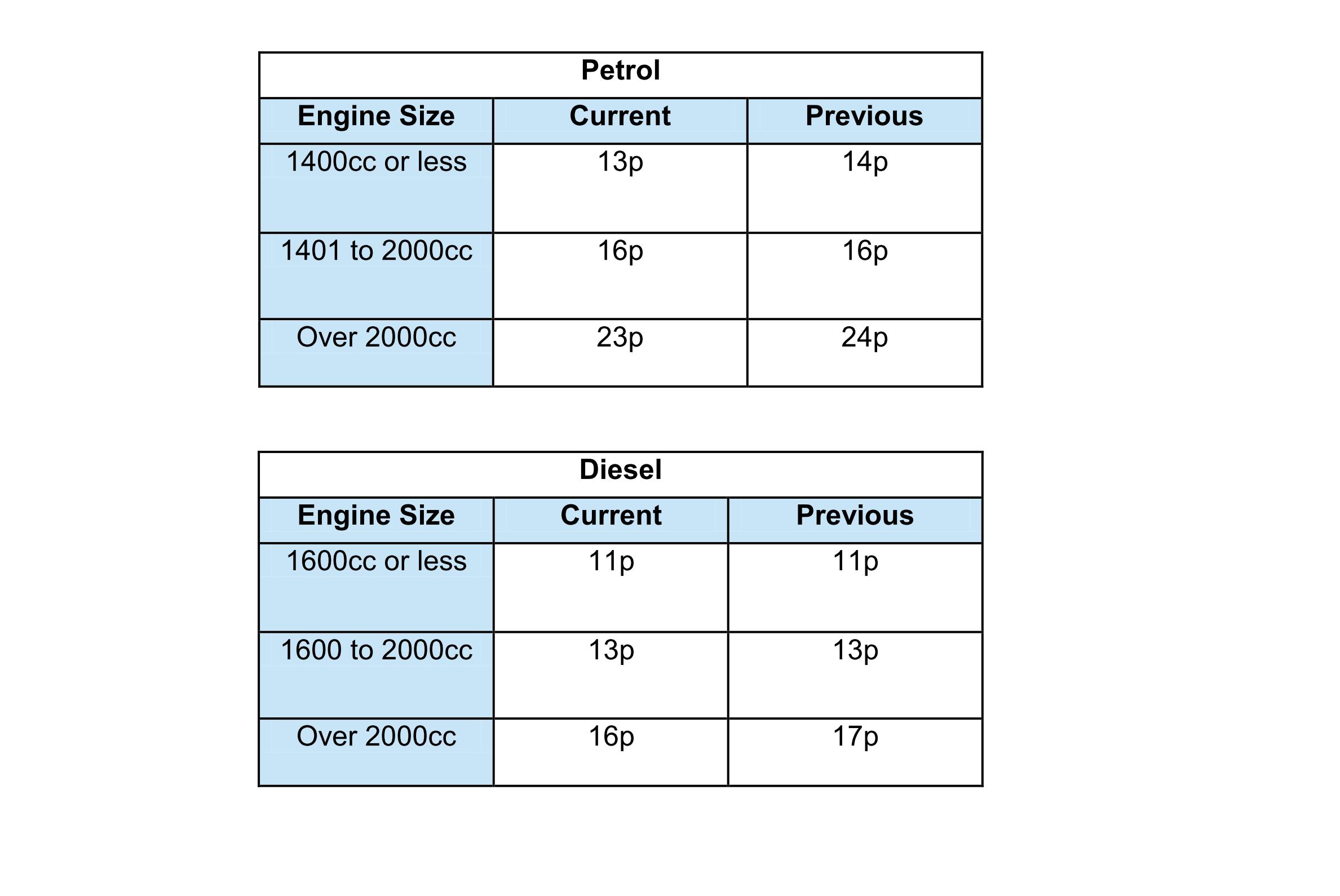

Hmrc Mileage Rates 2021 Own Car

https://www.dains.com/assets/images/PR/Fuel rates.jpg

https://www.gov.uk/guidance/business-journeys-tax-relief-490-chapter-5

Web 28 mars 2014 nbsp 0183 32 There are special rules for working out the tax relief on motoring expenses paid to employees who use their own vehicles for business travel go to paragraph 9 12

https://www.driversnote.co.uk/hmrc-mileage-guide/mileage-allowance-relief

Web 1 ao 251 t 2023 nbsp 0183 32 Mileage claims are calculated by multiplying your work related mileage throughout the tax year with the applicable HMRC mileage rate What mileage rate can

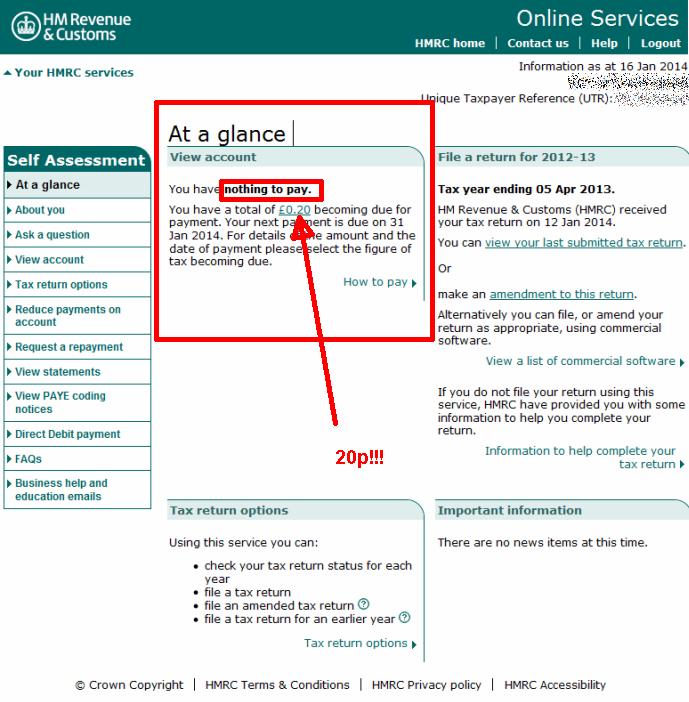

How To Claim and Increase Your P800 Refund Tax Rebates

2011 Form UK HMRC P87 Fill Online Printable Fillable Blank PDFfiller

HMRC Give Tax Relief Pre approval Save The Thorold Arms

Cash Declaration HM Revenue Customs Hmrc Gov Fill And Sign

Hmrc Private Mileage Claim Form Erin Anderson s Template

It s Not A Tax Rebate It s An HMRC Phishing Scam IT Governance Blog

It s Not A Tax Rebate It s An HMRC Phishing Scam IT Governance Blog

January 2014 Andysworld

Hmrc P87 Printable Form Printable Forms Free Online

Hmrc P87 Printable Form Printable Forms Free Online

Hmrc Work Mileage Tax Rebate - Web 12 juil 2022 nbsp 0183 32 You can fill out form P87 on HMRC s website to claim mileage if you re claiming less than 163 2 500 in expenses If your claims are greater than 163 2 500 you ll need