Hmrc Tax Return Mileage Allowance The attached document is classified by HMRC as guidance and contains information about rates and allowances for travel including mileage and fuel

What is Mileage Allowance Relief Learn how to make a proper HMRC mileage claim See the current rates and how much you can claim in tax deductions HMRC mileage claim rules allow you to claim expenses connected with driving your personal vehicle for business purposes Also known as Mileage Allowance Relief MAR HMRC mileage claims help

Hmrc Tax Return Mileage Allowance

Hmrc Tax Return Mileage Allowance

https://www.whyattaccountancy.com/wp-content/uploads/2022/01/HMRC-tax-return.jpg

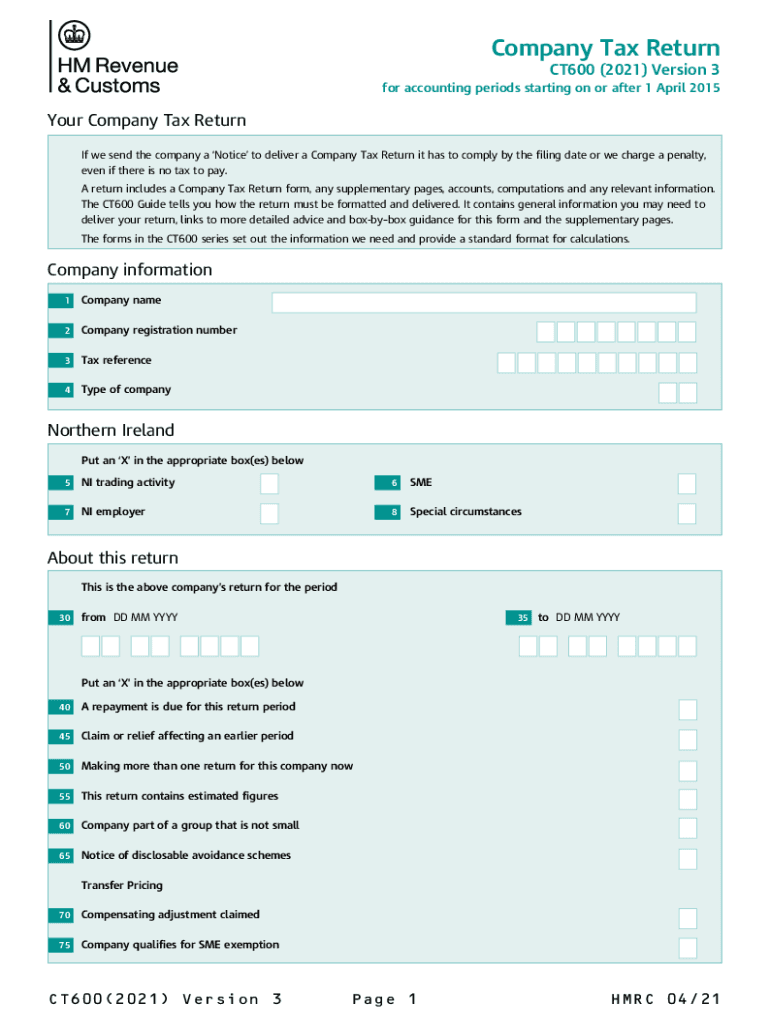

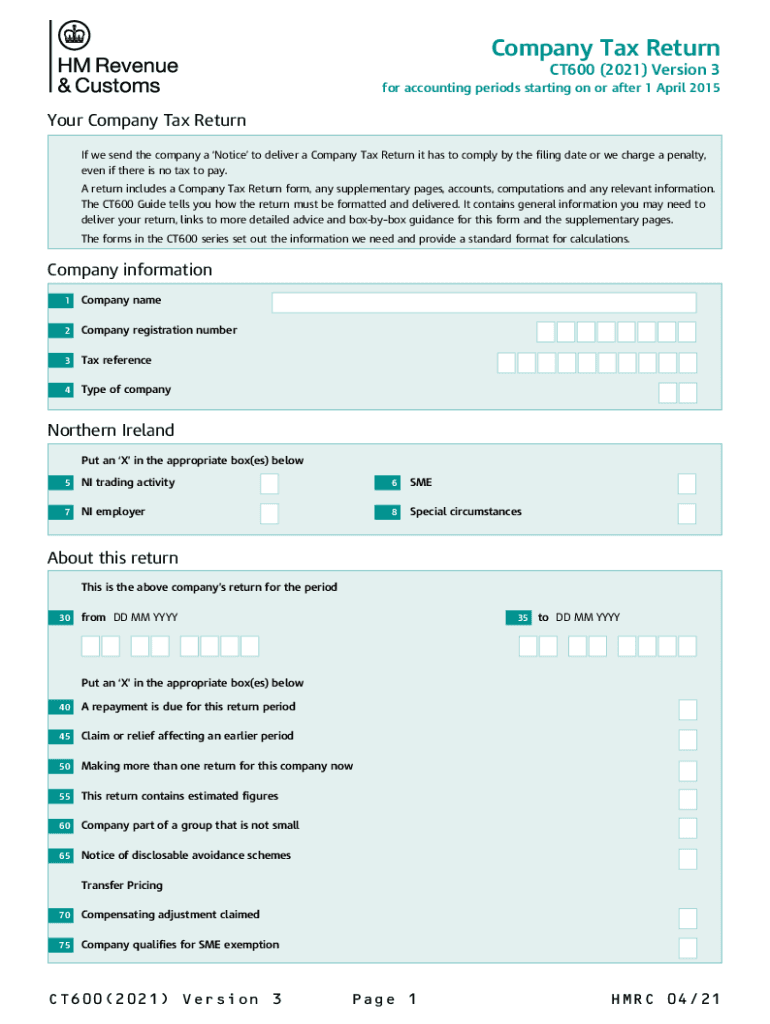

Ct600 Form Download Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/560/820/560820246/large.png

Business Mileage Allowance Debitam

https://www.debitam.com/wp-content/uploads/2019/12/Business-Mileage-Allowance.jpg

HMRC sets Approved Mileage Allowance Payment AMAP rates each tax year This means employers can reimburse employees up to a certain amount without You must complete form P87 online or use the self assessment system to claim mileage from HMRC Here s What We ll Cover What Costs Does Business

Mileage tax relief isn t automatically added to your annual return You have to file a claim with HMRC and you have up to four years from the end of the tax year to claim it To claim you must Ensure you Use our free mileage allowance relief guide to find out if you can claim a mileage tax rebate and how to claim it back Can I claim mileage tax relief It s important to

Download Hmrc Tax Return Mileage Allowance

More picture related to Hmrc Tax Return Mileage Allowance

HMRC Mileage Rates 2022 Company Car Allowance Explained

https://www.getmoss.com/guide/wp-content/uploads/2022/10/What-Are-HMRC-Mileage-Rates.png

New HMRC Data Reveals Contribution Businesses Make To UK Tax Receipts

https://www.depledgeswm.com/wp-content/uploads/2018/04/HMRC-scaled.jpeg

Stock Photo HMRC Tax Return Paul Maguire

https://paulmaguirephoto.com/wp-content/uploads/2020/07/c40910-1024x683.jpg

A mileage allowance is tax free if it doesn t exceed a threshold known as the Approved Mileage Allowance Payment AMAP HMRC sets AMAPs The current In this article we ll explore what HMRC mileage allowance payments are when trips qualify for tax free mileage allowances the HMRC mileage rates for 2023 how to

Using simplified expenses means you ll claim HMRC s standard allowance rates for tax relief The flat rates are also 45p per mile for the first 10 000 miles and 25p 45p per mile is the tax free approved mileage allowance for the first 10 000 miles in the financial year it s 25p per mile thereafter If a business chooses to pay

UK Mileage Log Book Template 2023 Free PDF Sheet Or Excel Best

https://revisionmonkey.com/013909cf/https/00fca4/storage.googleapis.com/driversnote-marketing-pages/UK_logbook_template_preview.png

1 In 10 UK SMEs Will Struggle To Meet HMRC Tax Deadline Channel Info

https://www.channelinfo.net/uploads/ofs/articles/2023/01/20/134929/16742185367899.jpg

https://www.gov.uk/government/publications/rates...

The attached document is classified by HMRC as guidance and contains information about rates and allowances for travel including mileage and fuel

https://www.driversnote.co.uk/hmrc-mileage-guide/...

What is Mileage Allowance Relief Learn how to make a proper HMRC mileage claim See the current rates and how much you can claim in tax deductions

Hmrc Tax Return Self Assessment Form PrintableRebateForm

UK Mileage Log Book Template 2023 Free PDF Sheet Or Excel Best

What Is The HMRC Mileage Tax Relief Policy

How To Print Your SA302 Or Tax Year Overview From HMRC Love

Time Taken To Settle HMRC Tax Investigations Reaches Record Length M

145 Surprising Vehicle Log Book Template Template Ideas

145 Surprising Vehicle Log Book Template Template Ideas

A Guide To Our HMRC Tax Calculation Tax Year Overview Requirements

24 Vehicle Lease Mileage Tracker Sample Excel Templates

HMRC Work Mileage Allowance Explained Claim My Tax Back

Hmrc Tax Return Mileage Allowance - Mileage tax relief isn t automatically added to your annual return You have to file a claim with HMRC and you have up to four years from the end of the tax year to claim it To claim you must Ensure you