Invite to Our blog, a space where inquisitiveness satisfies information, and where day-to-day topics come to be interesting conversations. Whether you're seeking understandings on way of life, technology, or a little bit of whatever in between, you have actually landed in the appropriate location. Join us on this expedition as we study the worlds of the common and amazing, understanding the world one post at once. Your journey right into the fascinating and diverse landscape of our Home Loan Deduction In Income Tax Fy 2022 23 starts right here. Check out the fascinating content that waits for in our Home Loan Deduction In Income Tax Fy 2022 23, where we decipher the complexities of numerous topics.

Home Loan Deduction In Income Tax Fy 2022 23

Home Loan Deduction In Income Tax Fy 2022 23

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

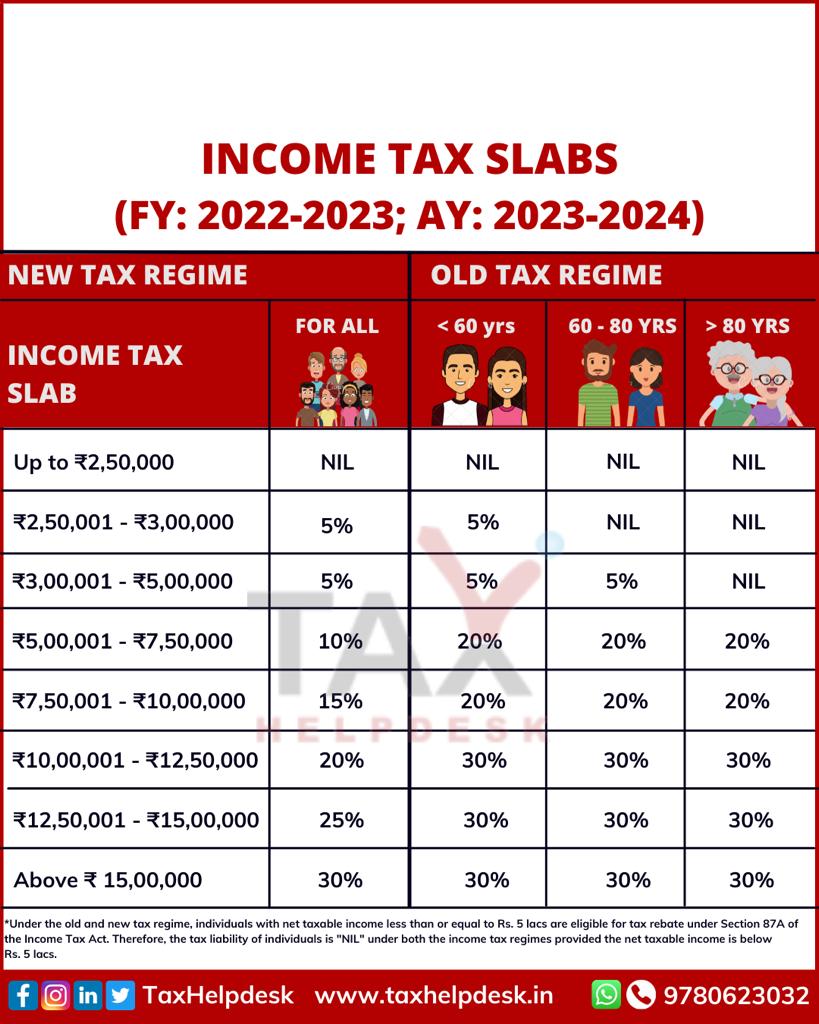

Tax Benefits On Home Loan Know More At Taxhelpdesk

Tax Benefits On Home Loan Know More At Taxhelpdesk

Gallery Image for Home Loan Deduction In Income Tax Fy 2022 23

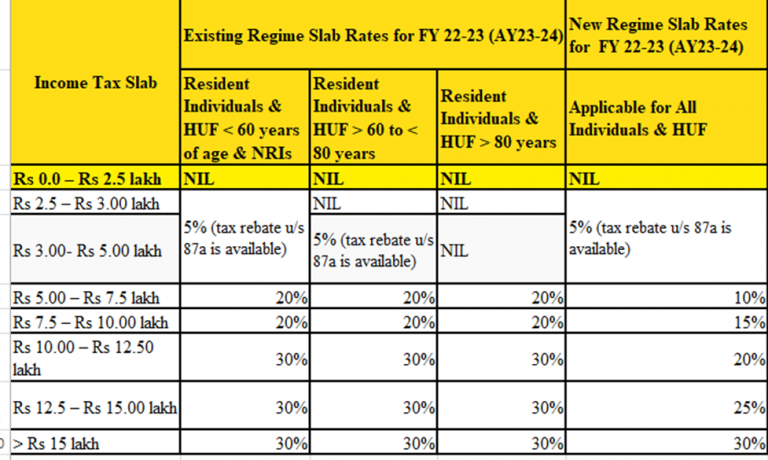

Income Tax Slabs New Old Tax Rates FY 2022 23 AY 2023 24 Janani

Latest Income Tax Slab Rates For FY 2022 23 AY 2023 24 Budget 2022

Section 24 Of Income Tax Act Deduction For Home Loan Interest

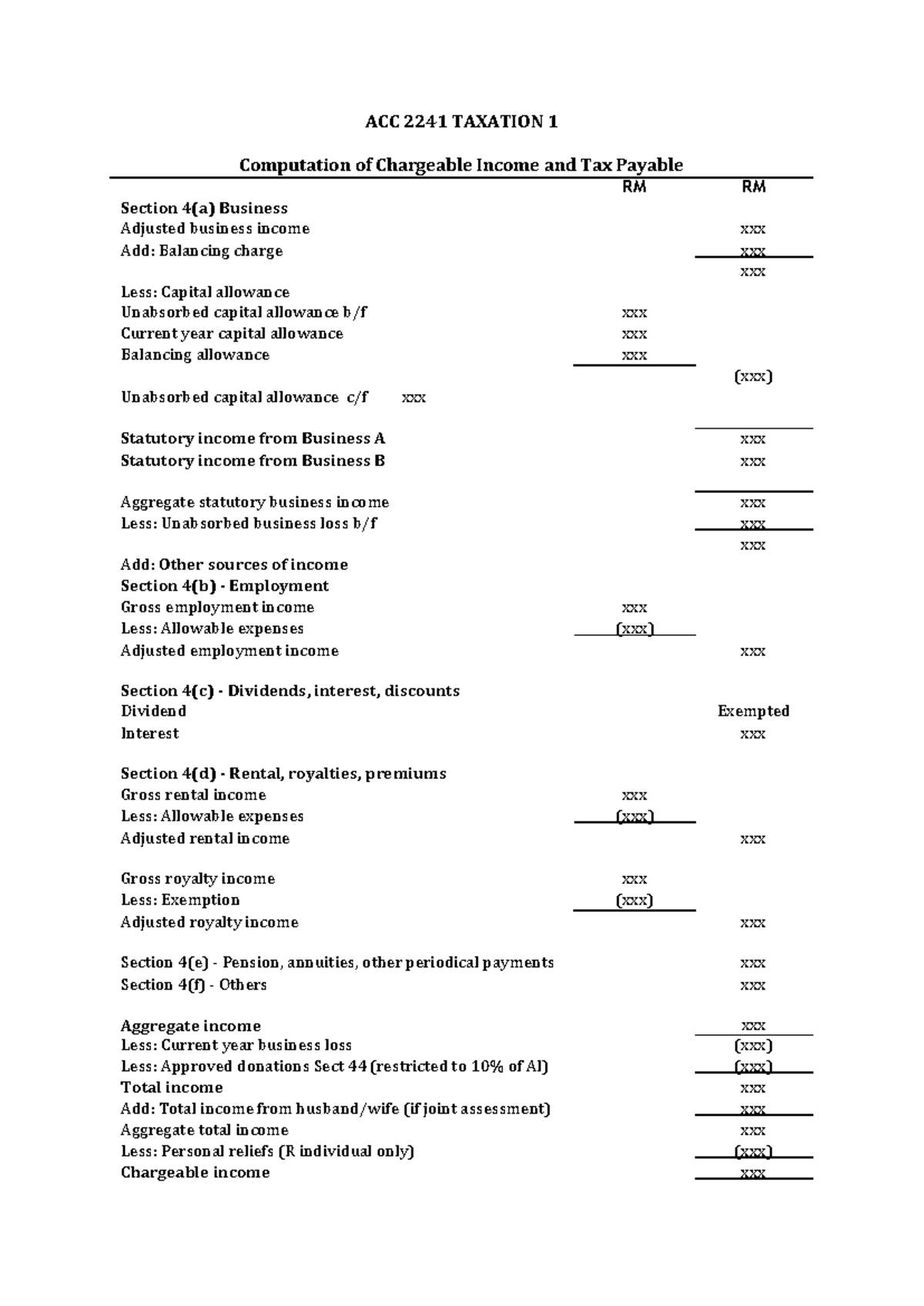

ACC 2241 Format For Chargeable Income ACC 2241 TAXATION 1 Computation

Income Tax Slabs For FY 2022 23 FY 2021 22

Section 24 Of Income Tax Act House Property Deduction

Section 24 Of Income Tax Act House Property Deduction

Capital Indexation Chart For Fy 2023 24 Image To U

Thanks for picking to explore our site. We truly wish your experience surpasses your assumptions, and that you find all the info and sources about Home Loan Deduction In Income Tax Fy 2022 23 that you are looking for. Our dedication is to supply an easy to use and informative system, so do not hesitate to navigate through our web pages with ease.