Income Tax Handicapped Rebate Web 10 janv 2023 nbsp 0183 32 Ministry of Finance This simulator allows you to determine the amount of your income tax You can use one of the following 2 models Simplified model if you

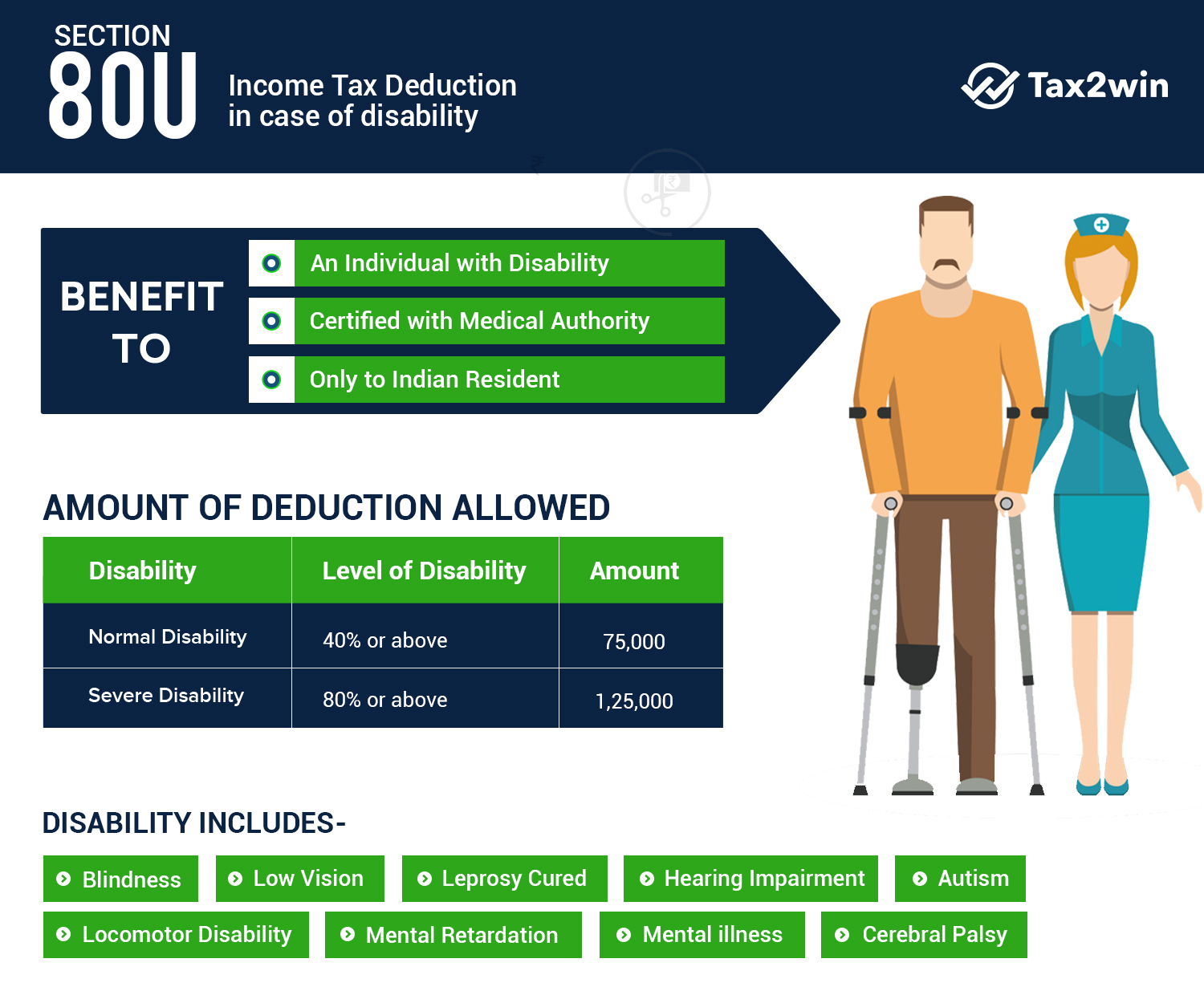

Web 22 mars 2018 nbsp 0183 32 A deduction of Rs 75 000 is allowed for people with disabilities and Rs 1 25 000 deduction for people with severe disability Requirements to Claim Deductions Web 20 juil 2019 nbsp 0183 32 What is Section 80DD of income tax Section 80DD is the deduction available to the resident individual or HUF for the medical

Income Tax Handicapped Rebate

Income Tax Handicapped Rebate

https://i.ytimg.com/vi/pV9QhdAvsxg/maxresdefault.jpg

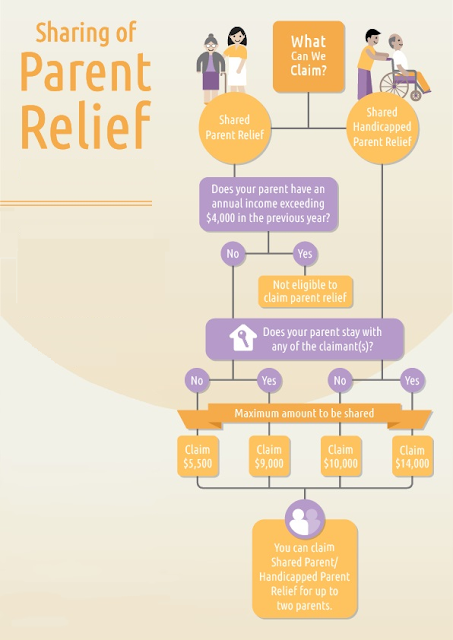

How To Reduce Your Income Tax In Singapore make Use Of These Tax

https://2.bp.blogspot.com/-N720ls7Vsnw/WsuZ2v9EW9I/AAAAAAAAYsA/5w4Clg9pP4cGP1pUnKBAbpIQgSDZeUhDwCLcBGAs/s640/Parent%2BRelief.png

Handicapped Certificate In Mumbai Information About Guidelines To

https://taxguru.in/wp-content/uploads/2018/07/Deducation-Under-Section-80U-of-Income-Tax-Act-1961-For-Disable-Persons-1280x720.jpg

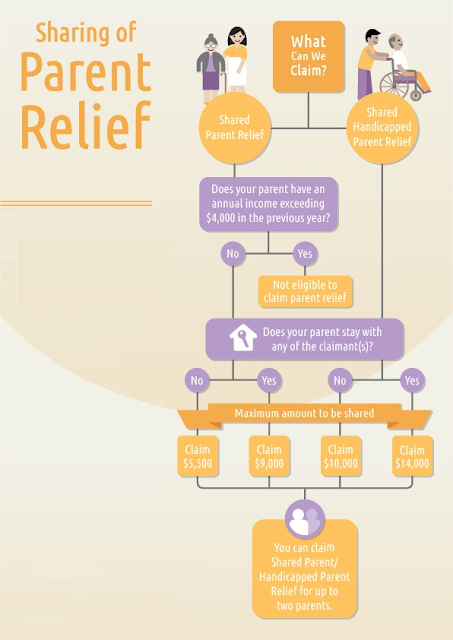

Web 7 avr 2023 nbsp 0183 32 April 7 2023 183 7 min read Why trust us Tax season in 2023 starts on January 24 and if you had income in 2022 you likely need to file a federal tax return by Tax Day Web Is this the first time you are claiming the relief Log in with your Singpass or Singpass Foreign user Account SFA at myTax Portal Go to Individuals gt File Income Tax

Web 6 sept 2023 nbsp 0183 32 A person with a disability means a person who is suffering from at least 40 of a disability If an individual has a severe disability i e 80 or more of a disability he is eligible for a deduction of Rs Web 24 juil 2018 nbsp 0183 32 The Income Tax Act 1961 provides deduction u s 80 in pursuance of which an individual Indian citizen and foreign national who is resident of India and who suffers from not less than 40 per cent of any

Download Income Tax Handicapped Rebate

More picture related to Income Tax Handicapped Rebate

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

https://blog.tax2win.in/wp-content/uploads/2019/03/80U-Deduction-in-case-of-disability.jpg

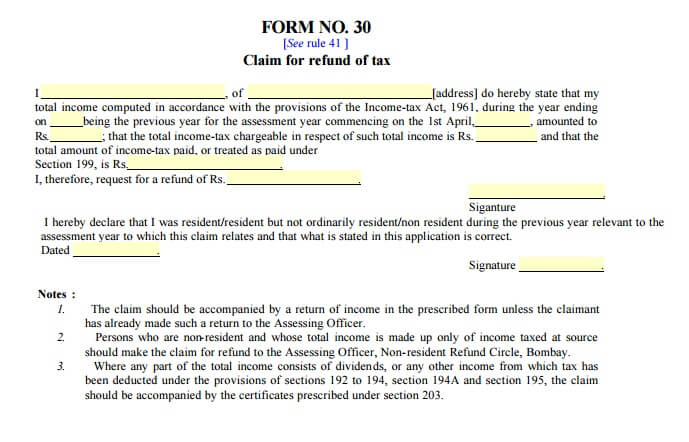

80DD FORM PDF

https://www.allindiaitr.com/App_Root/content/img/form30.jpg

Rebates Worth Thousands Of Dollars However Qualifying For A Refund Is

https://i.pinimg.com/originals/e4/5b/4f/e45b4fa7789b4f01f52ae901604545b2.png

Web 9 000 parent relief per dependant 14 000 handicapped parent relief per dependant For taxpayer who does not stay with dependant 5 500 parent relief per dependant 10 000 Web 11 juin 2018 nbsp 0183 32 We recently published an article about Section 80U under which persons with disabilities can claim tax benefits However not many people are aware that if they are caring for a dependent disabled person

Web 80U Deduction offers tax deductions for residents that have at least 40 disability as specified by the law There are varied criteria for this and a specific set of processes to Web 18 nov 2020 nbsp 0183 32 In this Video You can Know the details of Income tax rebate for handicapped person and their family member Please Like Our Facebook Page

Section 87A Tax Rebate Under Section 87A

https://www.nitsotech.com/blog/wp-content/uploads/2020/05/taxrebate87a.jpg

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

https://www.practicaltaxplanning.com/ptp/wp-content/uploads/2022/06/7PY4cfZG8ZE.jpg

https://www.service-public.fr/particuliers/vosdroits/R2740?lang=en

Web 10 janv 2023 nbsp 0183 32 Ministry of Finance This simulator allows you to determine the amount of your income tax You can use one of the following 2 models Simplified model if you

https://cleartax.in/s/section-80u-deduction

Web 22 mars 2018 nbsp 0183 32 A deduction of Rs 75 000 is allowed for people with disabilities and Rs 1 25 000 deduction for people with severe disability Requirements to Claim Deductions

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

Section 87A Tax Rebate Under Section 87A

Income Tax Deduction For Handicapped Disable Person Section 80DD

What To Know About Montana s New Income And Property Tax Rebates

Form Et 1 Pa 2019 Fill Out Sign Online DocHub

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Pin On Tigri

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

Income Tax Handicapped Rebate - Web 6 sept 2023 nbsp 0183 32 A person with a disability means a person who is suffering from at least 40 of a disability If an individual has a severe disability i e 80 or more of a disability he is eligible for a deduction of Rs