Income Tax Rebate For Physically Handicapped 80dd An individual or person with physical disabilities can claim the deduction under section 80U while reporting income in an income tax return Which certificate should I furnish to claim a deduction under section 80U

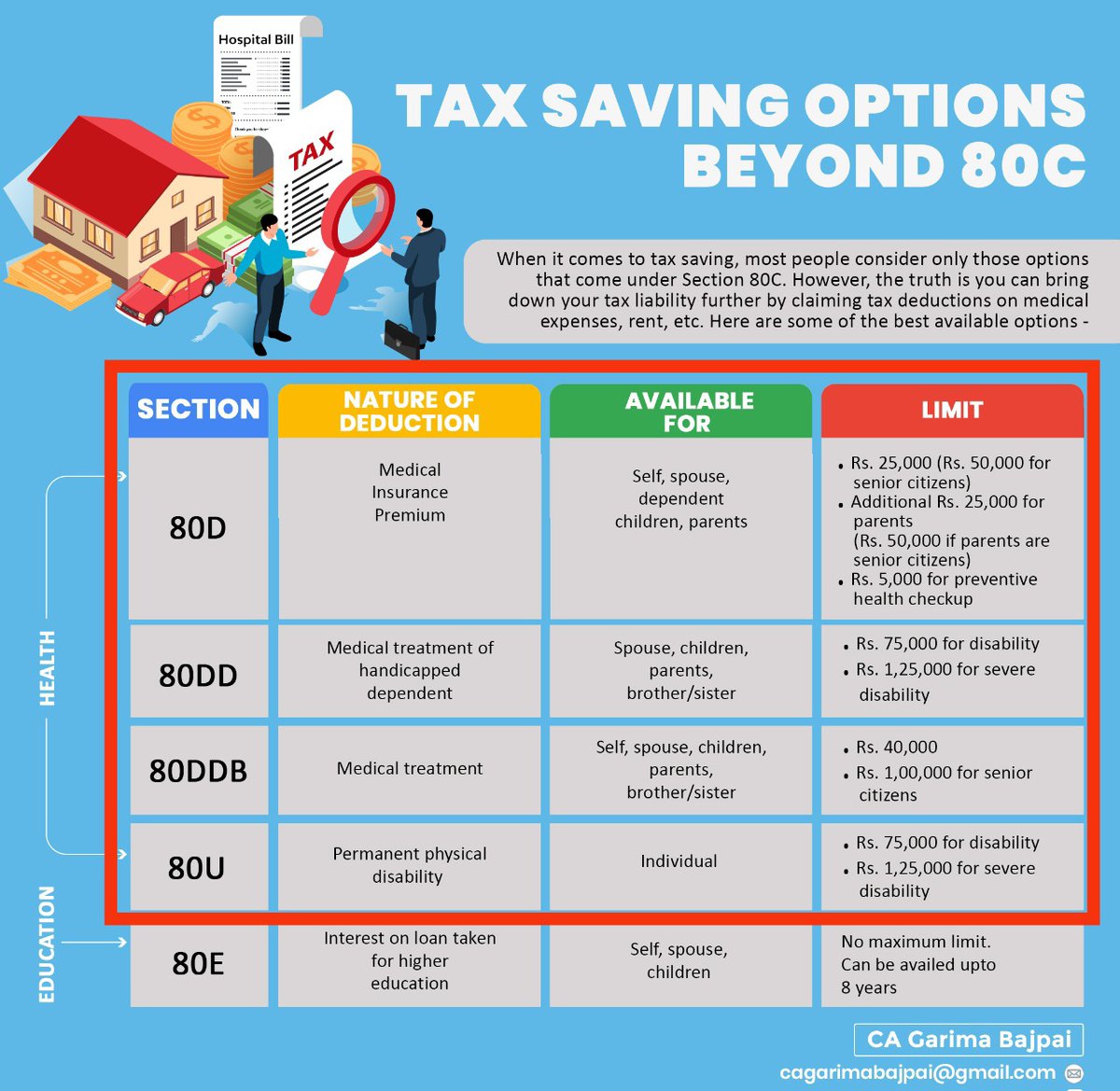

The Income Tax Act provides relief for medical expenses incurred under sections 80D 80DD 80DDB and 80U If you are an individual with disabilities or your dependent family is then section 80DD and 80U Section 80DD of the Income Tax Act provides for a deduction for residents for maintenance of disabled dependents Relief for persons with disabled dependents is available as a deduction of such amounts invested in

Income Tax Rebate For Physically Handicapped 80dd

Income Tax Rebate For Physically Handicapped 80dd

https://ttplimages.imgix.net/tax-practice-images/IT-VIA-R-12.jpg?w=1200

LHDN IRB Personal Income Tax Rebate 2022

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi4EoUCYcQMowVkFCssu_CdI43zIKHrVC46Kba3BHcmZh3oeO18l7EDF2MRUyAcTAsJGJ4xoe-Ekdnfv4_Pv7Vwf9uH3fIfSDaX5l9O3cEd7zdy7J1TPcGn75nLB59_9Nl_SqNTLkJeFhMTJtIwlgtqjSOzqw1iz42LdAJ22TGq8dO7vpInhBCvgVt7/s1600-e60/Tax rebates 2021.jpg

Section 80D Deductions Income Tax Rebate For Physically Handicapped

https://i.ytimg.com/vi/sbscDAKTM34/maxresdefault.jpg

All Indian residents can claim tax deductions under Section 80DD of the Income Tax Act 1961 on the medical treatment of their dependent and disabled family member To claim an individual Section 80DD allows a deduction of up to Rs 75 000 a year and if the disability is severe up to Rs 1 25 000 a year Severe disability means a person with 80 per cent or more

Learn how to claim tax rebate under Section 80DD for caring for a dependent disabled We explain the eligibility and documents required for this deduction Section 80DD allows for tax deductions for anyone who pays for a disabled dependent Learn its meaning eligibility benefits limitations etc Section 80DD Deduction of the income tax offers

Download Income Tax Rebate For Physically Handicapped 80dd

More picture related to Income Tax Rebate For Physically Handicapped 80dd

Rahul Gandhi Why Tax Products For Physically Handicapped People

http://media2.intoday.in/indiatoday/images/stories/handicap-story_647_070317063958.jpg

Tax Rebate For Individuals Swaper Investing Blog

https://swaper.com/blog/wp-content/uploads/SWAPER_blogpost_tax_1920x1080.png

Claim Deduction Under Section 80DD Learn By Quicko

https://learn.quicko.com/wp-content/uploads/2023/01/10IA-1.png

Residents Individuals or HUFs can claim a deduction under section 80DD of the Income Tax Act for a dependent who is differently abled and relies on the individual or HUF for assistance The Income tax Act 1961 allows deductions from your gross total income before the levy of tax if medical expenditure has been incurred on the treatment of a differently abled person Sections 80DD and 80U of the Income

Section 80DD of the Income Tax Act in India provides a deduction for individuals or Hindu Undivided Families HUFs in respect of expenses incurred for the caring and maintenance Successful claimants are eligible to receive Rs 75 000 for a disabled dependent with between 40 and 80 disability as defined by the Indian government in the Rights of

The Self care Prime Day Deals You Actually Won t Regret Buying GoodTo

https://cdn.mos.cms.futurecdn.net/75PgJj8f2aF6LLuzagky8m.jpg

Section 80DD Of Income Tax Act Deductions For Disabled Persons Tax2win

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80dd.jpg

https://cleartax.in

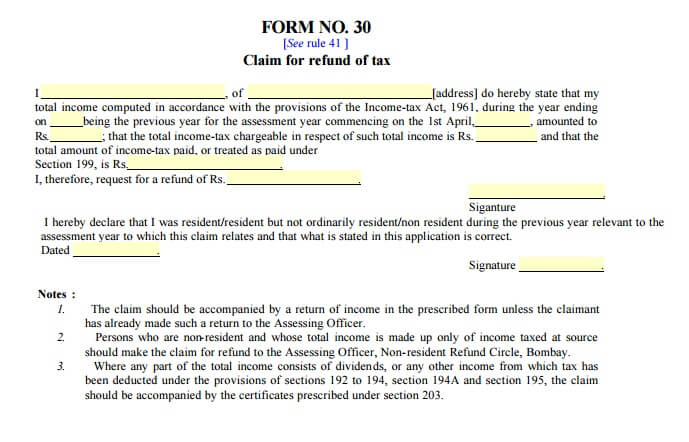

An individual or person with physical disabilities can claim the deduction under section 80U while reporting income in an income tax return Which certificate should I furnish to claim a deduction under section 80U

https://cleartax.in

The Income Tax Act provides relief for medical expenses incurred under sections 80D 80DD 80DDB and 80U If you are an individual with disabilities or your dependent family is then section 80DD and 80U

Income Tax Deduction For Handicapped Disable Person Section 80DD

The Self care Prime Day Deals You Actually Won t Regret Buying GoodTo

Income Tax Exemption For Physically Handicapped A Complete Guideline

Income Tax Deductions Related To Health Deduction For Medical

Cukai Pendapatan How To File Income Tax In Malaysia JobStreet Malaysia

Anything To Everything Income Tax Guide For Individuals Including

Anything To Everything Income Tax Guide For Individuals Including

Property Tax Or Rent Rebate Claim PA 1000 FormsPublications Fill Out

80DD FORM PDF

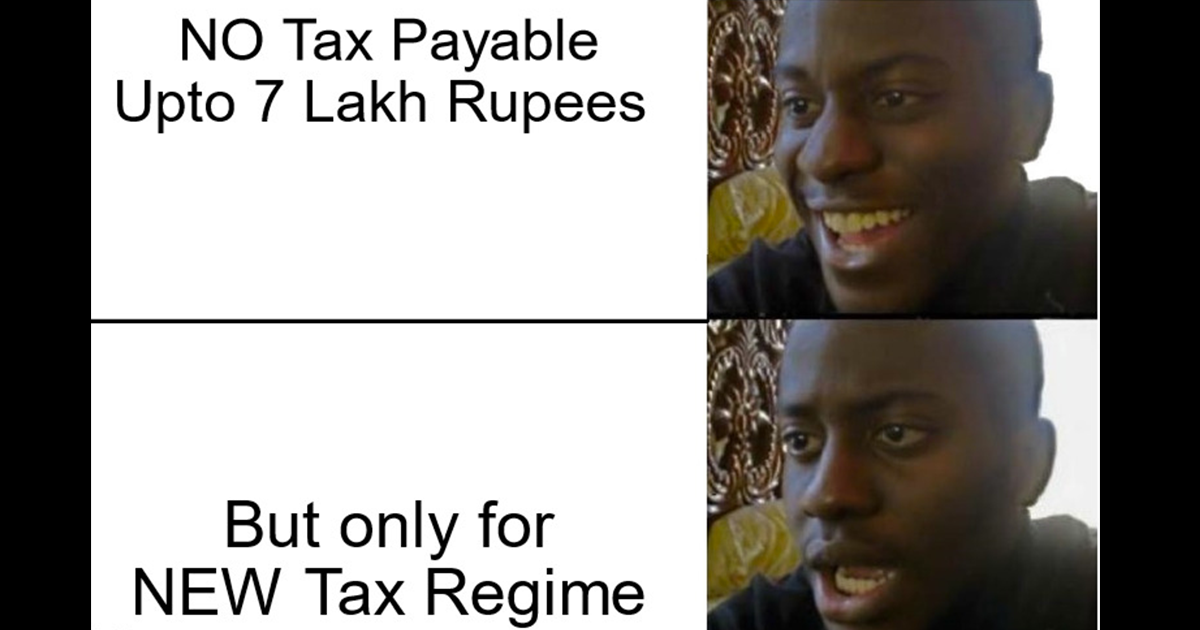

Budget 2023 Increase In Income Tax Rebate For The New Regime Has

Income Tax Rebate For Physically Handicapped 80dd - Section 80DDB Deductions Deduction in respect of Medical Treatment of Specified Diseases or Ailments If an Individual or HUF incurs any expenditure on the