What Is 80dd Deduction Learn how to claim a flat deduction of Rs 75 000 for the medical treatment of a disabled dependent under Section 80DD of the income tax act Find out the eligibility criteria definition of disability diseases covered and documents required for this deduction

Section 80DD allows taxpayers to claim a deduction on expenses incurred on the maintenance and medical treatment of their disabled dependent family members The deduction limit under Section 80DD varies based on the extent of the disability of the dependent family member To provide financial relief to individuals who bear the medical and caregiving expenses of a disabled dependent the Indian government offers a tax deduction under Section 80DD of the Income Tax Act

What Is 80dd Deduction

What Is 80dd Deduction

http://taxreceipts.com/wp-content/uploads/2012/03/what-is-a-deduction.jpg

Section 80DD Of Income Tax Act Deductions For Disabled Persons Tax2win

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80dd.jpg

Section 80DD Deductions Claim Tax Deduction On Medical Expenses Of

https://life.futuregenerali.in/media/2xjl3phd/section-80dd-tax-deduction.jpg

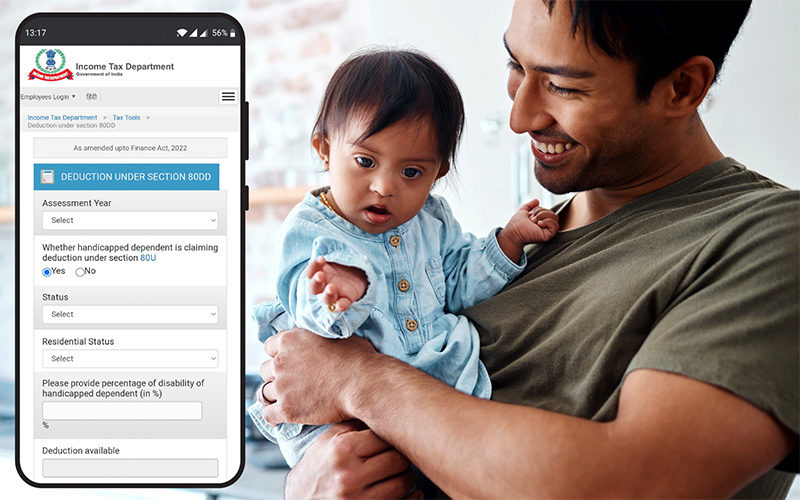

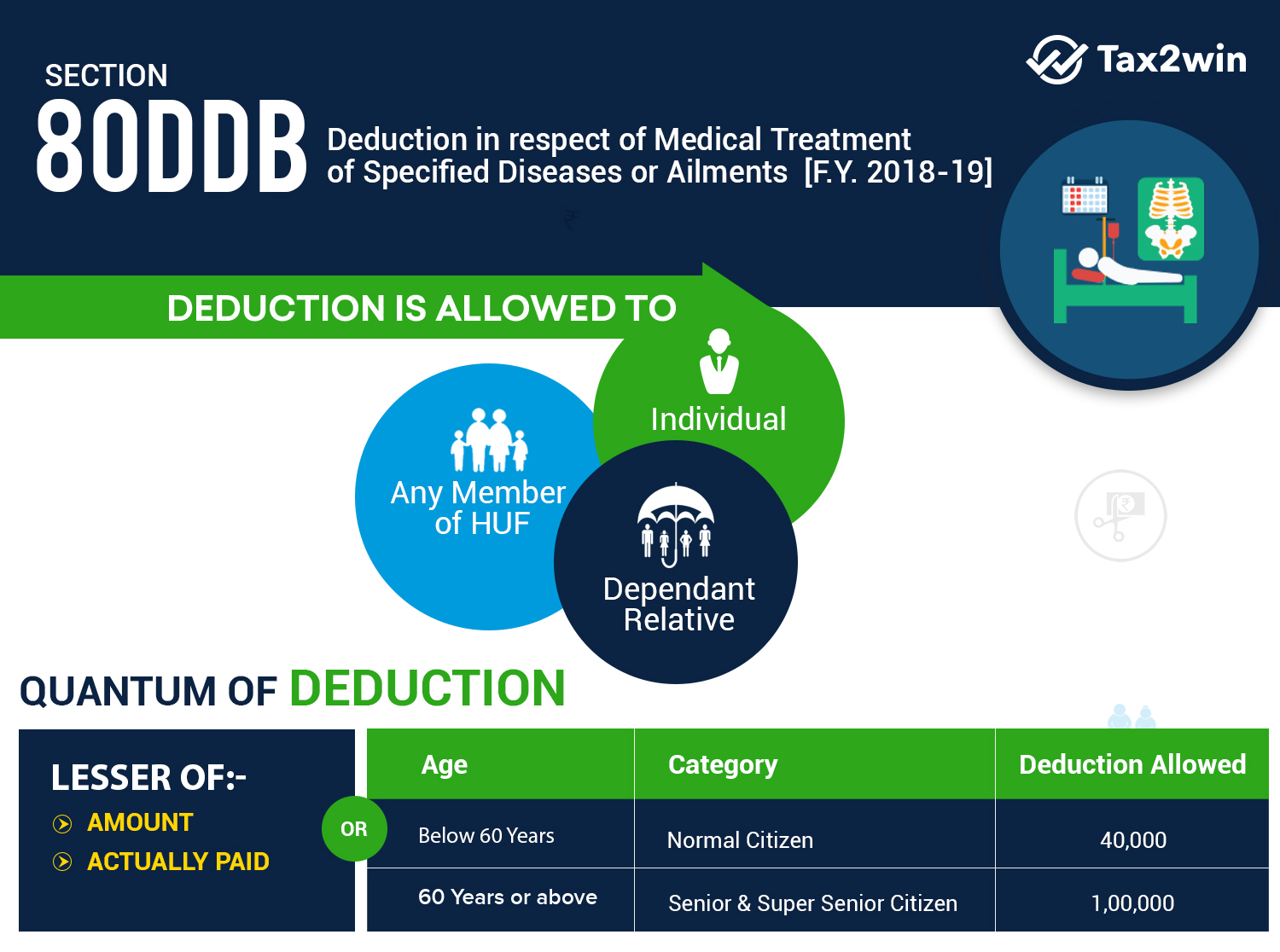

Learn how to claim deduction for medical expenses or insurance premium of a disabled dependant under section 80DD of the Income Tax Act Find out the eligibility amount conditions and list of specified disabilities covered under this section Learn how to claim tax deduction under Section 80DD of the Income Tax Act 1961 for the medical treatment of your dependent and disabled family member Find out the eligibility documents expenses and disabilities that qualify for this deduction

The maximum deduction allowed under Section 80DD varies based on the severity of the disability For disability of more than 40 and less than 80 You can claim a deduction of 75 000 per year For disability of more than 80 You can claim a Learn how to claim tax deduction under Section 80DD for expenses on medical treatment training and rehabilitation of a disabled dependent Find out the eligibility conditions policies and certificates required for this deduction

Download What Is 80dd Deduction

More picture related to What Is 80dd Deduction

Deduction U s 80D 80DD 80DDB YouTube

https://i.ytimg.com/vi/v7VJVEmq67Q/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH6CYAC0AWKAgwIABABGEUgXihlMA8=&rs=AOn4CLDjxKzc26MCs1NKmrGwqMtg95kAFQ

Qbi Deduction Explained Inflation Protection

https://i.ytimg.com/vi/FM4NF0-e4Ls/maxresdefault.jpg

80DD Deduction Income Tax I 80DD Deduction For Ay 2021 22 YouTube

https://i.ytimg.com/vi/-c0xDC6uha0/maxresdefault.jpg

Learn how to claim a flat tax deduction of up to 1 25 000 for expenses on medical treatment training and rehabilitation of a dependent with a disability Find out the eligibility criteria disabilities covered and limitations of Section 80DD of the Income Tax Act Section 80DD provides tax deductions for expenses on the maintenance treatment and rehabilitation of a dependent with a disability The deduction is 75 000 for disability and 1 25 lakh for severe disability

Section 80DD caters to a deduction for medical treatment of a disabled or dependent family member You can claim this deduction if You have incurred expenses for medical treatment including nursing training and rehabilitation of the aforesaid family member Learn how to claim a flat deduction of INR 75 000 or 1 25 000 for a disabled or severely disabled dependent under section 80DD of the Income Tax Act Find out the conditions documents and ITR forms required to avail of this tax benefit

Deduction Under Section 80DD 80DDB And 80U

https://1.bp.blogspot.com/-W76ENVY8FC0/XyZXxMW9aKI/AAAAAAAANf4/bIg5ox4TLFQBxxOSNULkGYSJlrFHCcPjgCLcBGAsYHQ/s1200/saying-cover-saying-quote-wording-beak-art-1-5f03ecaba5416.png

Claim Deduction Under Section 80DD Learn By Quicko

https://learn.quicko.com/wp-content/uploads/2023/01/10IA-1.png

https://tax2win.in › guide

Learn how to claim a flat deduction of Rs 75 000 for the medical treatment of a disabled dependent under Section 80DD of the income tax act Find out the eligibility criteria definition of disability diseases covered and documents required for this deduction

https://margcompusoft.com

Section 80DD allows taxpayers to claim a deduction on expenses incurred on the maintenance and medical treatment of their disabled dependent family members The deduction limit under Section 80DD varies based on the extent of the disability of the dependent family member

Income Tax Sec 80DD Deduction In Relation To Disable Autism Etc

Deduction Under Section 80DD 80DDB And 80U

Disability Deduction In ITR I Sec 80U And 80DD Deduction Of Income Tax

YouTube Earnings Deduction Issue Explained YouTube

Section 80DD Section 80U Deduction I r o Expenditure On Person Or

Tax Deduction Under Section 80DD Of Income Tax Eligibility Criteria

Tax Deduction Under Section 80DD Of Income Tax Eligibility Criteria

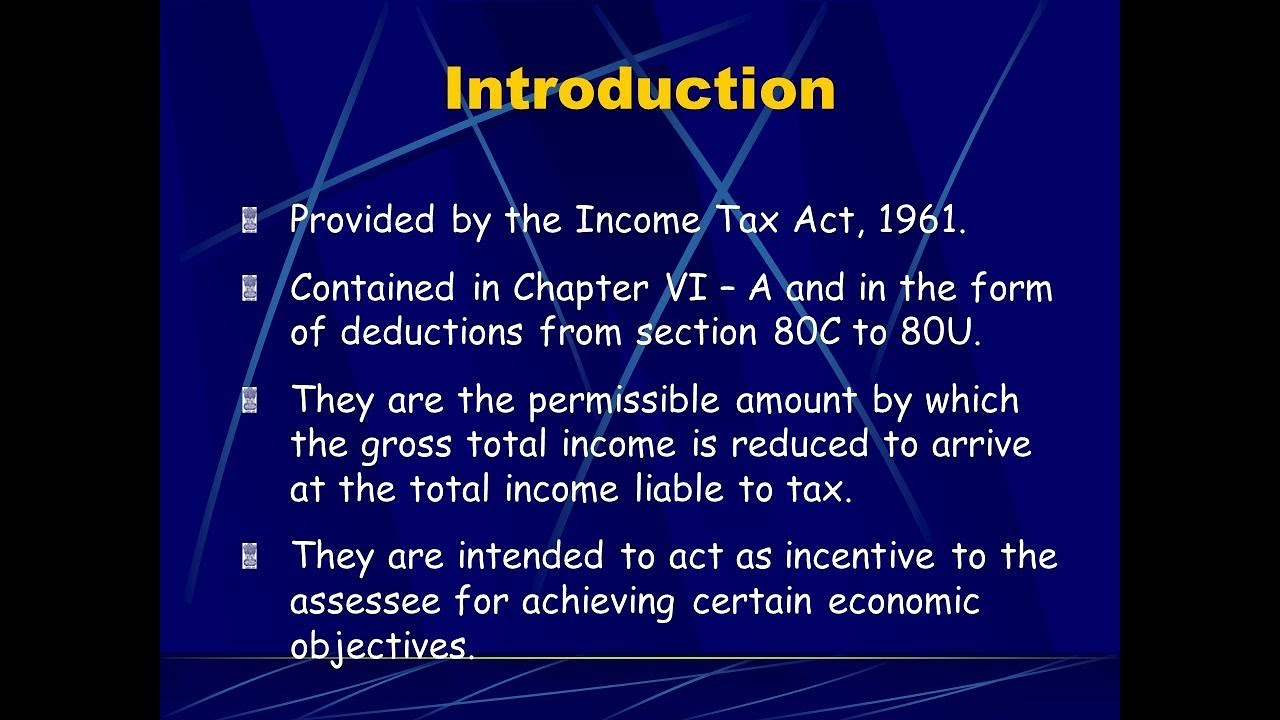

DEDUCTION UNDER SECTION 80C TO 80U PDF

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

How To Save Tax On Medical Expenses Under Section 80D 80DD What Is

What Is 80dd Deduction - Learn how to claim tax deduction under Section 80DD of the Income Tax Act 1961 for the medical treatment of your dependent and disabled family member Find out the eligibility documents expenses and disabilities that qualify for this deduction