Income Tax Relief For Physically Handicapped The Volunteer Income Tax Assistance VITA program offers free tax help to people with low to moderate incomes persons with disabilities and limited English speaking taxpayers who need help preparing their own tax returns

If you are unable to complete your tax return because of a disability you may be able to obtain assistance from an IRS office or the Volunteer Income Tax Assistance or Tax Counseling for the Elderly Programs sponsored by IRS Most income is taxable but some is exempt like SSI payments workers comp settlements and some short term disability benefits If you made 50 000 of taxable income in 2023 but you qualify for 3 000 in tax deductions the IRS will only tax 47 000 of your income What are tax credits

Income Tax Relief For Physically Handicapped

Income Tax Relief For Physically Handicapped

https://iqiglobal.com/blog/wp-content/uploads/2023/01/tax-relief.jpg

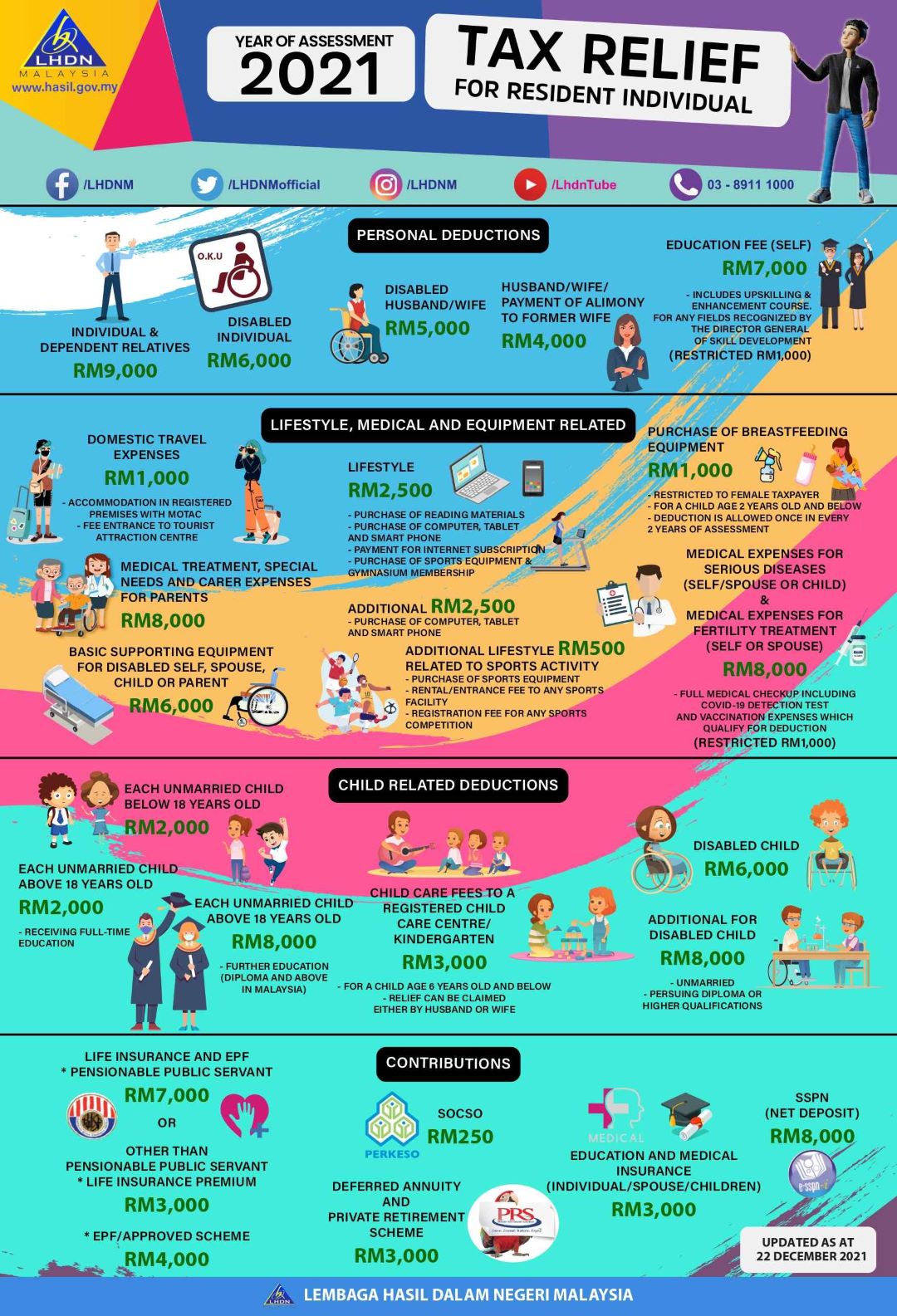

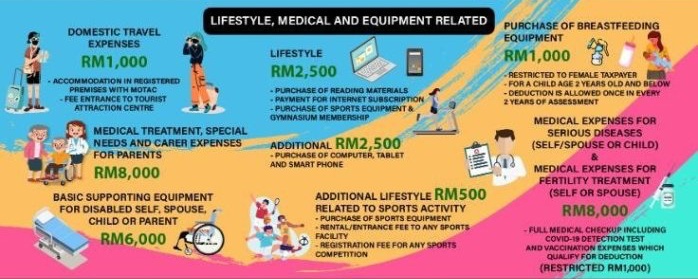

Malaysia Personal Income Tax Relief 2022

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjM81nSzJ2QiCATWboDACN2BpfNmw-0Wf5BApuHi91cjON32r6XUxhruNbA8f0o3K_H_4oIf1B4xQE6D0tInpJ7fFjXuaqCtw3-786N9ouUQ8nKcW7kxtIy0bZOmw2wXtBmRb63A-pQjcxK9mCdSvqTGiUvUxaePn9JkzlCVQKv7Gj0EukB_pdXpC10/s1585/Individual_Tax_Relief_2021.jpg

Tax Advisor For SEIS And EIS Tax Relief Gatwick Accountant

https://www.gatwickaccountant.com/wp-content/uploads/2022/07/accountant-for-tax-return-near-me.png

Government of India has in order to provide some relief to those who have a dependent with disability or sever disability provided some relief s from Income tax under section 80DD of the Income Tax Act 1961 AS A PERSON WITH A DISABILITY you may qualify for some of the following tax deductions income exclusions and credits More detailed information may be found in the IRS publications referenced Standard Deduction If you are legally blind you may be entitled to a higher standard deduction on your tax return

The Income Tax Act 1961 provides deduction u s 80U in pursuance of which an individual Indian citizen and foreign national who is resident of India and who suffers from not less than 40 per cent of any disability is eligible for deduction to the extent of Rs 75 000 and in case of severe disability to the extent of Rs 125 000 Section 80U provides tax deductions and rebates for persons with disabilities or physically handicapped individuals In this article you ll learn everything about section 80U its meaning eligibility deduction limit amount

Download Income Tax Relief For Physically Handicapped

More picture related to Income Tax Relief For Physically Handicapped

Company Tax Relief 2023 Malaysia Printable Forms Free Online

https://ringgitplus.com/en/blog/wp-content/uploads/2023/03/SPC-4467_IncomeTax-2022.png

Claim Tax Relief Of Employing A Carer Home Care Matters

https://homecarematters.ie/wp-content/uploads/2021/01/t2.png

Tax Relief For Home Workers

https://www.kateunderwoodhr.co.uk/wp-content/uploads/2022/03/KUHR-Blog-image-template-34-min-1080x675.png

800 829 1040 This program provides tax relief for eligible disabled individual taxpayers Determine your eligibility for this benefit The Income Tax Rebate for Physically Handicapped 80U primarily deals with tax deductions meant for Indian residents who can be categorized as disabled based on the government s rules

A number of tax deductions and exclusions benefit people who are on SSDI or SSI and they can also gain from a few special rules for tax advantaged savings and retirement accounts These deductions and rules are in addition to several tax credits that help recipients of disability benefits Salaried or wage earning physically handicapped persons or physically handicapped persons who are not liable to pay Income tax under the Income tax Act 1961 43 of 1961

A Guide To Maximize Your Income Tax Filing In 2022

https://www.etiqa.blog/wp-content/uploads/2022/03/tax-relief-2021-lifestyle-1.jpg

Tax Relief For Non discriminatory Companies

https://image.luminews.my/zojelx493f4fssojxoj8kce4ni1w

https://www.irs.gov/publications/p907

The Volunteer Income Tax Assistance VITA program offers free tax help to people with low to moderate incomes persons with disabilities and limited English speaking taxpayers who need help preparing their own tax returns

https://www.irs.gov/individuals/more-information...

If you are unable to complete your tax return because of a disability you may be able to obtain assistance from an IRS office or the Volunteer Income Tax Assistance or Tax Counseling for the Elderly Programs sponsored by IRS

Tax Relief In Real estate FactsToday

A Guide To Maximize Your Income Tax Filing In 2022

Tax Relief For Children 2021 Fill In The Declaration Now

Forms 3520 3520 A RESP Tax Relief Effisca

Tax Relief For Working From Home During The Pandemic Here s How To

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

Go Direct To Get Tax Relief On Work Expenses

Malaysia Income Tax Here Are The Tax Reliefs To Claim For YA 2022

Income Tax Relief For Physically Handicapped - Rs 75 000 exemption is allowed for people with disabilities and Rs 1 25 000 exemption for people with severe disabilities Obligation to Apply for Exemption Under Section 80U Form 10 IA does not require any documents other than a certificate of disability attested by a recognized medical authority