Income Tax Rebate For Physically Handicapped 80u Web 3 juin 2019 nbsp 0183 32 Taxpayers with less than 80 but more than 40 disability get a deduction of Rs 75 000 and taxpayers with severe disabilities which

Web Deduction Under Section 80U Assessment Year You are an Individual Yes No Residential Status Please provide percentage of disability Amount of deduction Web Section 80U of Income Tax Section 80U of the Income Tax Act offers tax benefits if an individual suffers a disability People can claim an 80U deduction if they have a disability If the disability is at least 40 they

Income Tax Rebate For Physically Handicapped 80u

Income Tax Rebate For Physically Handicapped 80u

https://i.ytimg.com/vi/Jrs4fApB7Fs/maxresdefault.jpg

Income Profession Tax Benefits For Disabled Handicapped Persons

https://taxguru.in/wp-content/uploads/2018/07/Deducation-Under-Section-80U-of-Income-Tax-Act-1961-For-Disable-Persons.jpg

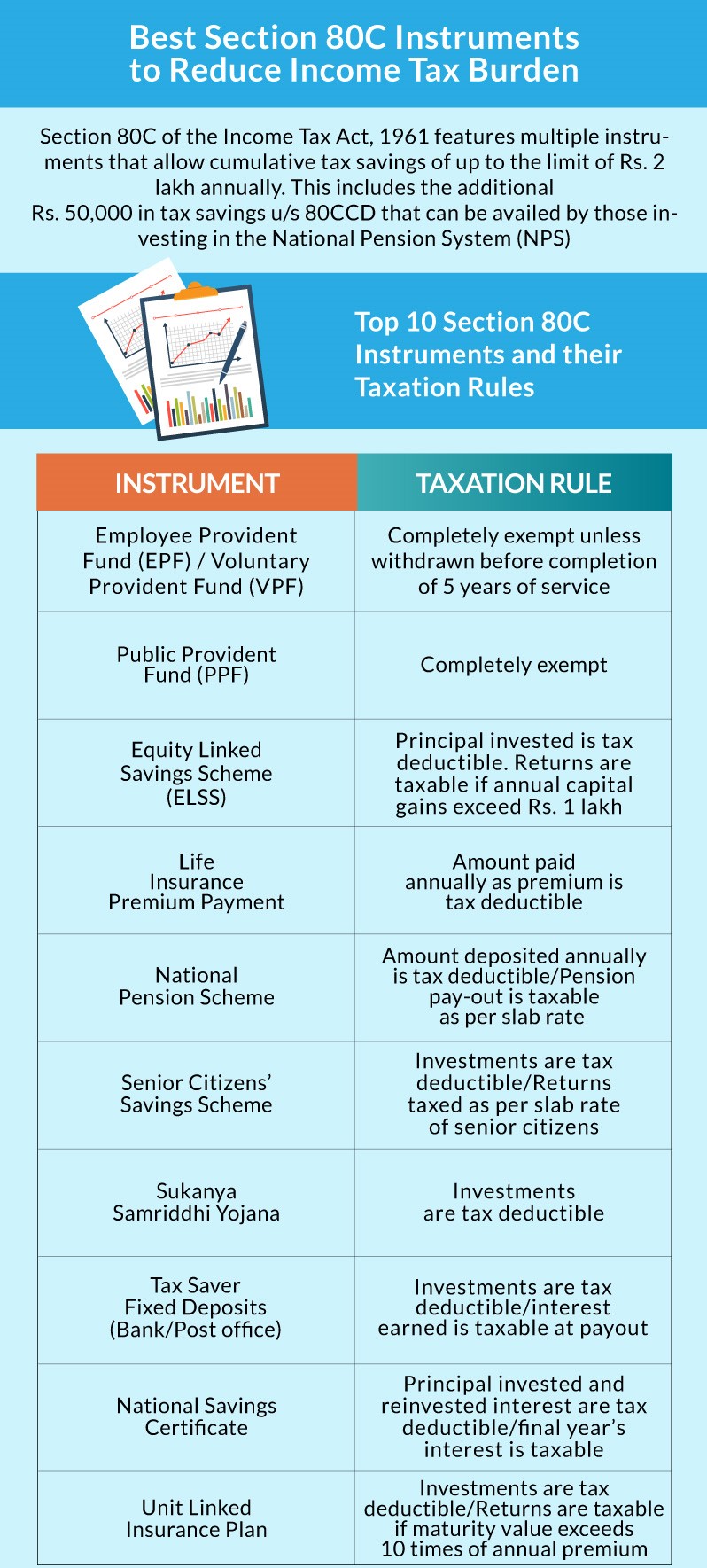

80C TO 80U DEDUCTIONS LIST PDF

https://wealthtechspeaks.in/wp-content/uploads/2017/04/Tax-Deduction-Under-Section-80C.png

Web 21 juil 2023 nbsp 0183 32 Section 80U provides tax deductions and rebates for persons with disabilities or physically handicapped individuals In this article you ll learn everything about Web 11 juil 2023 nbsp 0183 32 Section 80U of the Income Tax Act 1961 includes provisions for tax deduction benefit to individual taxpayers suffering from a disability In order to claim tax

Web 80U Deduction offers tax deductions for residents that have at least 40 disability as specified by the law There are varied criteria for this and a specific set of processes to Web 23 janv 2023 nbsp 0183 32 Quantum Of Tax deduction Under Section 80U A physically disabled individual suffering from blindness or mental retardation is eligible for tax deductions of

Download Income Tax Rebate For Physically Handicapped 80u

More picture related to Income Tax Rebate For Physically Handicapped 80u

80 Disability With Dependents Na Gear

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80dd.jpg

DEDUCTION UNDER SECTION 80C TO 80U PDF

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

Income Tax Deduction U s 80C 80U Rajput Jain Associates

https://carajput.com/blog/wp-content/uploads/2020/10/Section80C-infographic-Content.jpg

Web 14 avr 2020 nbsp 0183 32 Section 80U of the Income Tax Act provides a deduction to an individual who is certified by the medical authority to be a person with a disability or person with a severe disability No medical bills or insurance Web Section 80DD amp Section 80U deal with income tax deductions for individuals and their family members with disabilities Deduction under Section 80U is provided in case the

Web 27 juin 2018 nbsp 0183 32 The Income Tax Act 1961 provides deduction u s 80U in pursuance of which an individual Indian citizen and foreign national who is resident of India and who Web Person with Severe Disability If a person is suffering from severe disability i e suffering 80 disability either from one or multiple ailments can claim a tax deduction upto Rs 1 25

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

https://blog.tax2win.in/wp-content/uploads/2018/07/80DD-80DDB-80U.jpg

Income Tax Exemption For Physically Handicapped A Complete Guideline

https://www.inatecservices.com/wp-content/uploads/2023/03/Income-Tax-Exemption-768x495.jpg

https://tax2win.in/guide/income-tax-deductio…

Web 3 juin 2019 nbsp 0183 32 Taxpayers with less than 80 but more than 40 disability get a deduction of Rs 75 000 and taxpayers with severe disabilities which

https://incometaxindia.gov.in/Pages/tools/deduction-under-section-80u.…

Web Deduction Under Section 80U Assessment Year You are an Individual Yes No Residential Status Please provide percentage of disability Amount of deduction

Section 80DD Tax Deduction For Care Of Handicapped Disabled Persons

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

Section 80EEB World Of Electric Ather Community

Senior Citizen Income Tax Calculation 2023 24 Examples New Tax Slabs

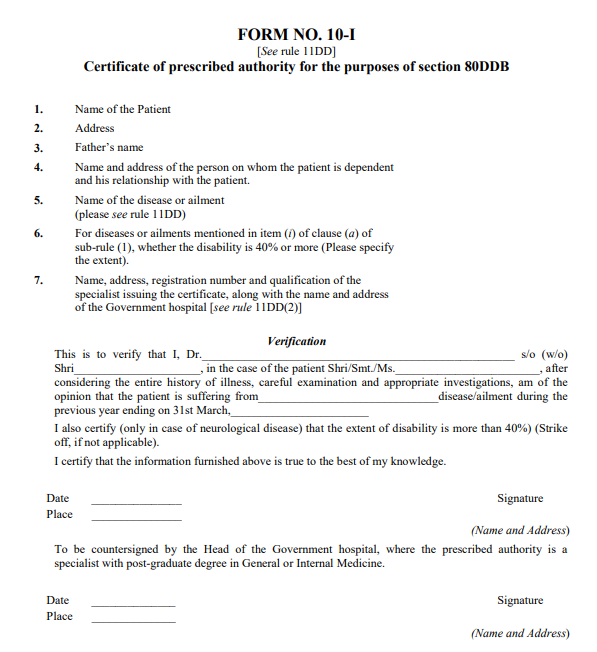

FORM 80DDB PDF

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

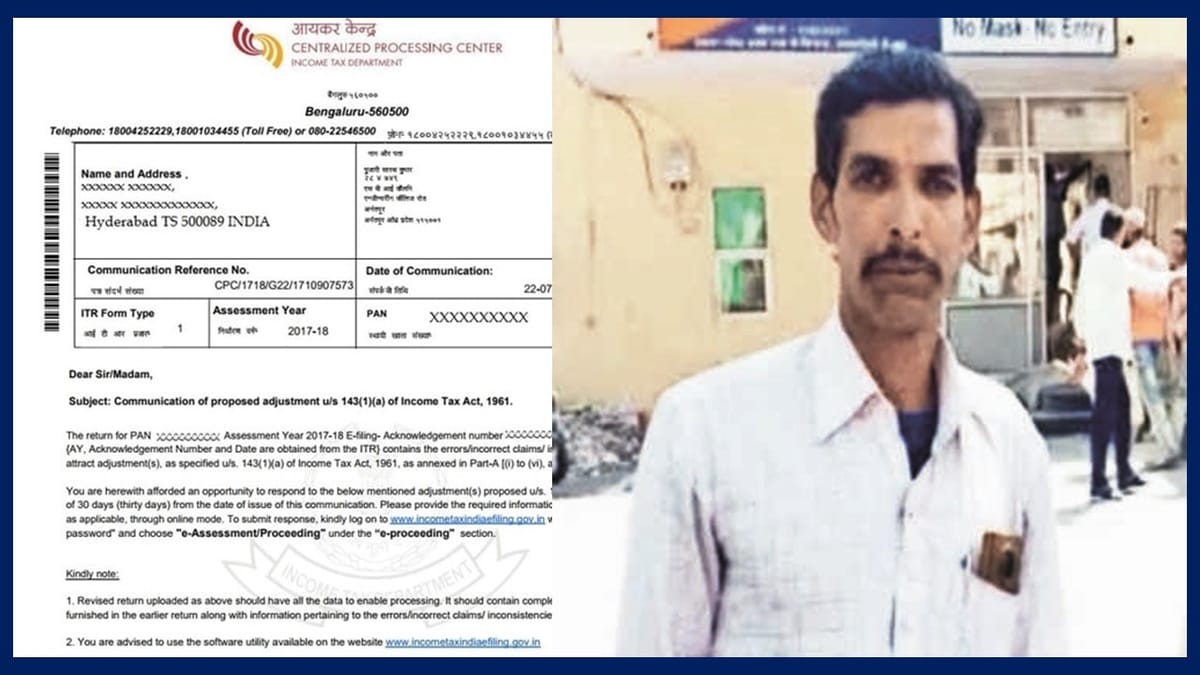

Physically Challenged Small Shop Owner Receives Income Tax Notice Of Rs

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

Income Tax Rebate For Physically Handicapped 80u - Web 21 juil 2023 nbsp 0183 32 Section 80U provides tax deductions and rebates for persons with disabilities or physically handicapped individuals In this article you ll learn everything about