Income Tax Rebate For Physically Handicapped 80u Pdf Taxpayers with less than 80 but more than 40 disability get a deduction of Rs 75 000 and taxpayers with severe disabilities which is 80 or more get a deduction of Rs 1 25 000 The deduction is a fixed amount that is

Person with Disability If a person is suffering from at least 40 disability he she can claim a tax deduction upto Rs 75 000 on the taxable income under section 80U The Income Tax Act 1961 provides deduction u s 80U in pursuance of which an individual Indian citizen and foreign national who is resident of India and who suffers from

Income Tax Rebate For Physically Handicapped 80u Pdf

Income Tax Rebate For Physically Handicapped 80u Pdf

https://i.ytimg.com/vi/sbscDAKTM34/maxresdefault.jpg

How Can Taxpayers Obtain Income Tax Rebate In India

https://navi.com/blog/wp-content/uploads/2022/03/income-tax-rebate-1.jpg

DEDUCTION FOR TREATMENT OF HANDICAPPED Planning Deductions

https://www.practicaltaxplanning.com/ptp/wp-content/uploads/2022/05/A-6-3.jpg

The Income Tax Rebate for Physically Handicapped 80U primarily deals with tax deductions meant for Indian residents who can be categorized as disabled based on the government s rules The tax payer who is facing physical disability of at least 40 can claim Section 80U deduction of income tax act with maximum limit of Rs 75 000 disability between 40 to 79 and Rs 1 25 000 disability of 80 or above with old

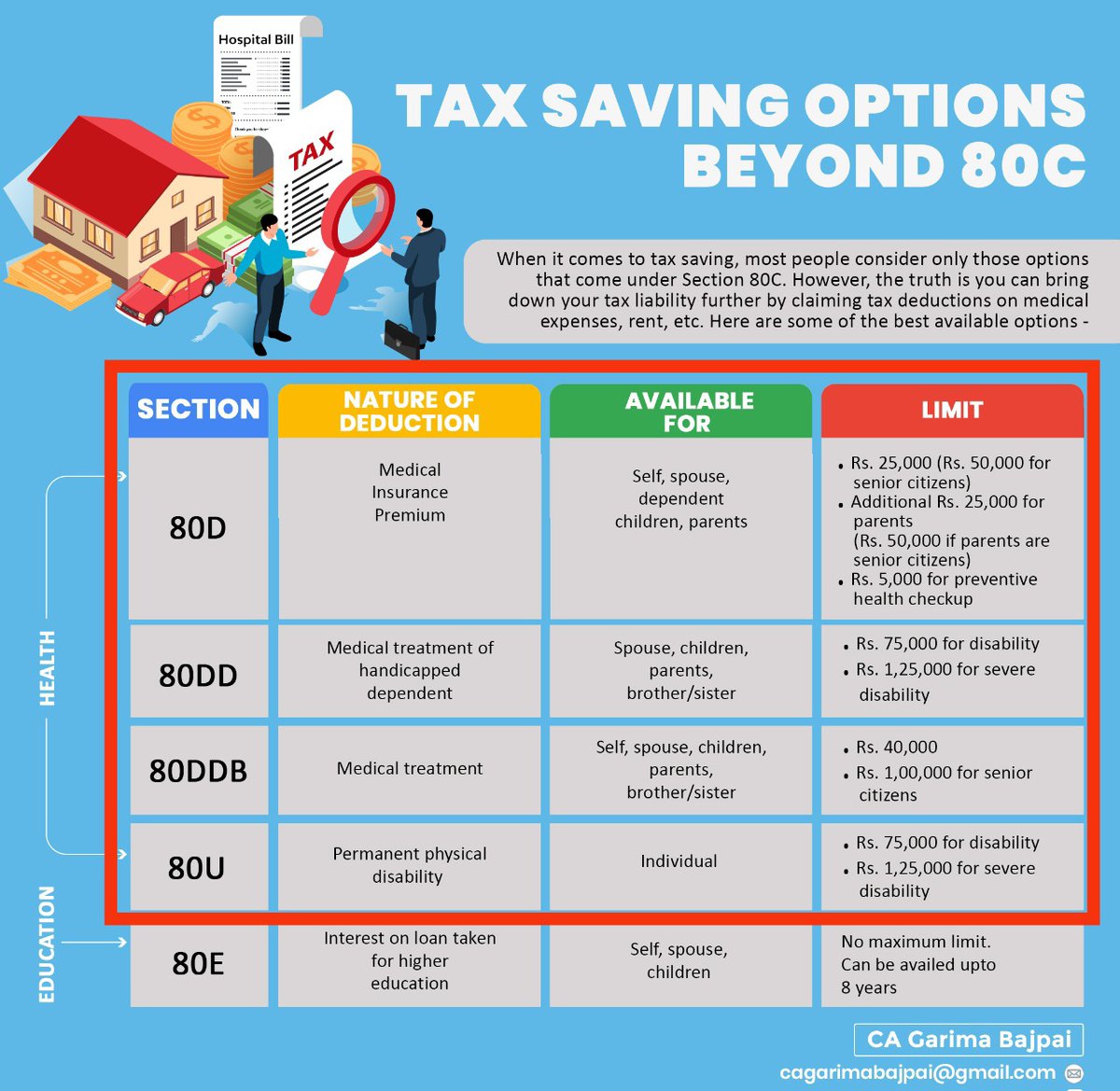

The Income Tax Act 1961 provides deduction u s 80 in pursuance of which an individual Indian citizen and foreign national who is resident of India and who suffers from not less than 40 per cent of any disability is eligible for The Income Tax Act provides relief for medical expenses incurred under sections 80D 80DD 80DDB and 80U If you are an individual with disabilities or your dependent family is then section 80DD and 80U

Download Income Tax Rebate For Physically Handicapped 80u Pdf

More picture related to Income Tax Rebate For Physically Handicapped 80u Pdf

Pennsylvania s Property Tax Rent Rebate Program May Help Low income

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/1648504189519-EYNC86JYEGG20QUA9STL/2022-PA+Dept+of+Revenue+property+tax-rent+rebate_Page_1.jpg

Income Tax Rebate Under Section 87A

https://life.futuregenerali.in/media/mu2i0shn/income-tax-rebate-under-section-87a.jpg

Tax Rebate For Individuals Swaper Investing Blog

https://swaper.com/blog/wp-content/uploads/SWAPER_blogpost_tax_1920x1080.png

Section 80U of the Income Tax Act provides specific deductions for resident individuals suffering from disabilities This article delves into the eligibility criteria deduction limits and important Section 80U of the Income Tax Act provides relief to individuals with disabilities by allowing them to claim deductions on their taxable income This section applies to both resident and non

Section 80U of the Income Tax Act provides a deduction to an individual who is certified by the medical authority to be a person with a disability or person with a severe disability No medical bills or insurance premium Section 80U provides tax deductions for Indian residents who have atleast 40 disability as specified by the law There are different criteria for this and a specific set of procedures for

Older Disabled Residents Can File For Property Tax Rent Rebate Program

https://cdn.centraljersey.com/wp-content/uploads/sites/28/2022/01/20425_rev_rentRebate_NK_01-1024x683.jpg

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A.jpg

https://tax2win.in/guide/income-tax-ded…

Taxpayers with less than 80 but more than 40 disability get a deduction of Rs 75 000 and taxpayers with severe disabilities which is 80 or more get a deduction of Rs 1 25 000 The deduction is a fixed amount that is

https://www.irtsa.net/pdfdocs/What-is-Section-80U...

Person with Disability If a person is suffering from at least 40 disability he she can claim a tax deduction upto Rs 75 000 on the taxable income under section 80U

Renters Printable Rebate Form

Older Disabled Residents Can File For Property Tax Rent Rebate Program

Income Tax Exemption For Physically Handicapped A Complete Guideline

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

Income Tax Deductions Related To Health Deduction For Medical

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

.png?ixlib=gatsbyFP&auto=compress%2Cformat&fit=max&fit=crop&w=1200&h=630&dpr=2)

Mechanics Tax Rebate Don t Let Your Tool Tax Throw A Spanner In The

Option To Accelerate Claims On Renovation And Refurbishment Costs

Income Tax Rebate For Physically Handicapped 80u Pdf - Individual taxpayers who are suffering from disability can benefit from section 80U of the income tax act Applicability A resident individual irrespective of citizenship NRI cannot take benefit