Income Tax Exemption For Physically Handicapped Dependent Pdf Deduction of a sum of seventy five thousand rupees from his gross total income in respect of the previous year Provided that where such dependant is a person with severe disability the

The article highlights the benefits government provides in Income Tax Act Professional Tax and a scheme to encourage private sector to provide employment opportunities to disabled The Section 80DD Here we explains everything about Section 80DD of income tax act including eligibility criteria deductions available and how to claim them Section 80DD is the

Income Tax Exemption For Physically Handicapped Dependent Pdf

Income Tax Exemption For Physically Handicapped Dependent Pdf

https://e68zy2pxt2x.exactdn.com/wp-content/uploads/2013/tax.jpg?strip=all&lossy=1&w=2560&ssl=1

I Tax Calculator For Ay 2020 21 Games overviews

https://taxguru.in/wp-content/uploads/2019/02/INCOME-TAX-SLABS-FOR-FY-2019-20.jpg

Income Tax Exemption For Physically Handicapped A Complete Guideline

https://www.inatecservices.com/wp-content/uploads/2023/03/Income-Tax-Exemption.jpg

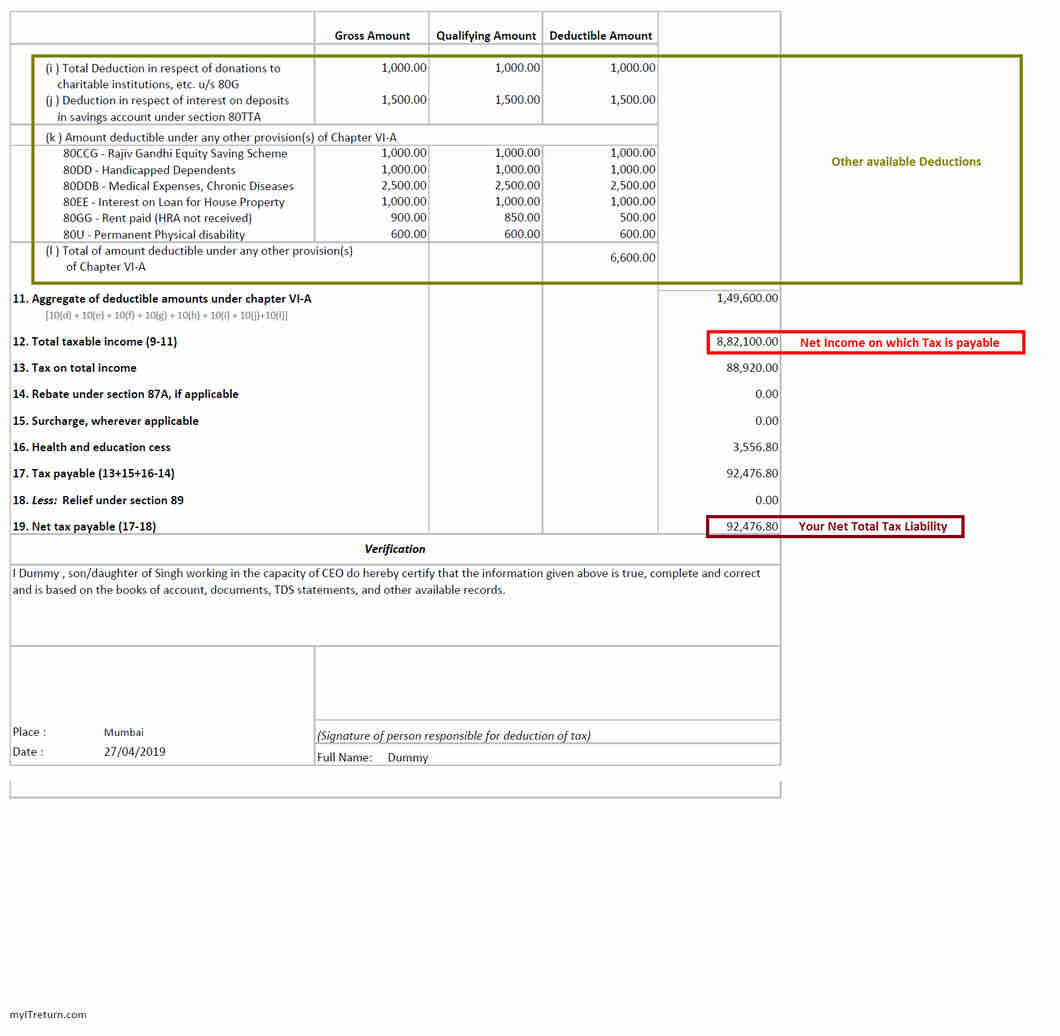

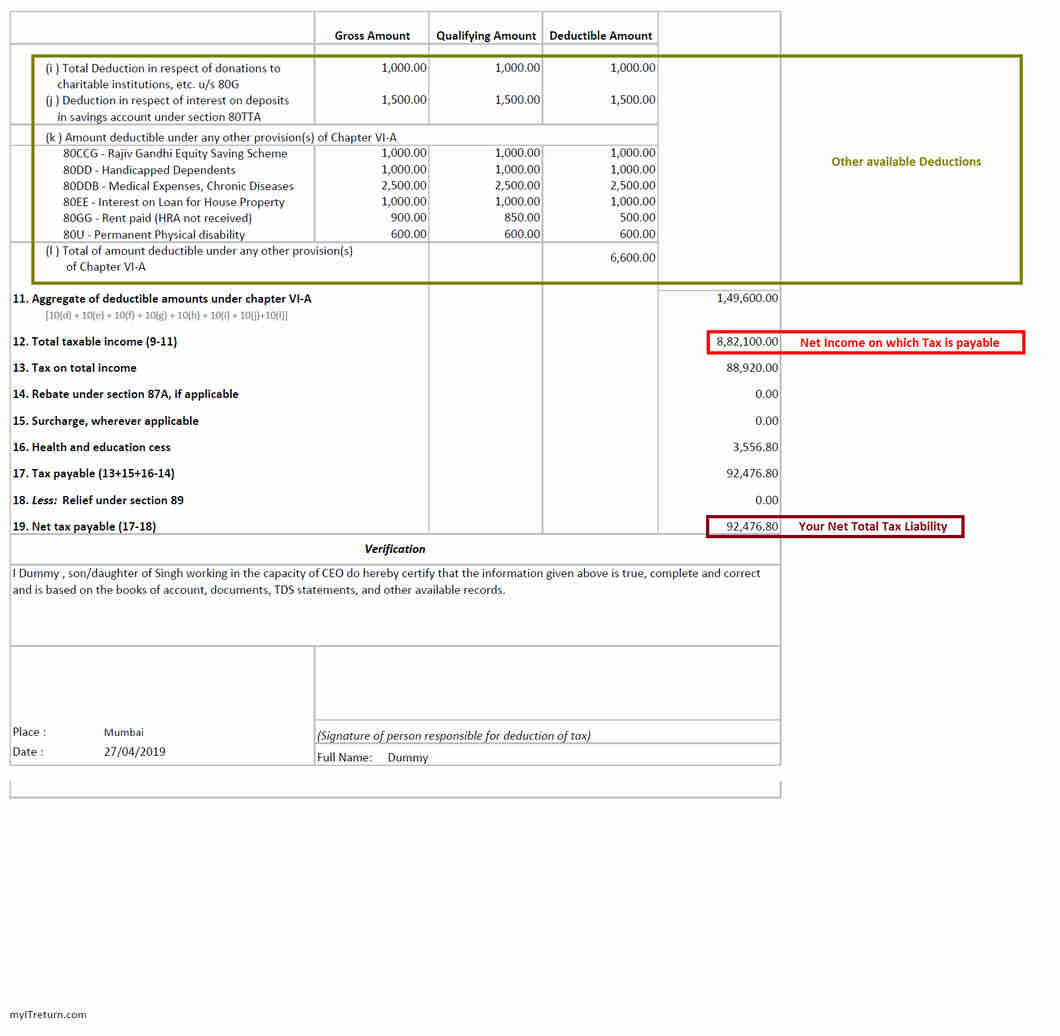

Deduction under Section 80DD of the income tax act is allowed to Resident Individuals or HUFs for a dependent who is differently abled and is wholly dependent on the Section 80U of the Income Tax Act of 1961 states the provisions for tax deductions or tax benefits for individual taxpayers who are suffering from a disability As per the law Indian residents who have more than 40 disability

AS A PERSON WITH A DISABILITY you may qualify for some of the following tax deductions income exclusions and credits More detailed information may be found in the IRS Article discusses Benefits under Income Tax and Profession Tax Act Available to Disabled or Handicapped Persons Income Tax Act Provides Deduction Under Section 80DD Section 80DDB and Section 80U and also

Download Income Tax Exemption For Physically Handicapped Dependent Pdf

More picture related to Income Tax Exemption For Physically Handicapped Dependent Pdf

Income Tax Exemption For Gratuity Enhanced Up To Rs 20 Lakhs YouTube

https://i.ytimg.com/vi/8JxQiLmrGvc/maxresdefault.jpg

Income Tax Exemption On Gifts Are The Gifts Above Rs 50 000 Taxable

https://i.ytimg.com/vi/poiiLhFa5Fw/maxresdefault.jpg

Income Tax

https://images.tv9marathi.com/wp-content/uploads/2023/01/01035710/Tax-2.jpg

Income Tax Act offers special deduction to the person suffering from permanent physical disability under the old tax regime The deduction is either available to the person suffering such permanent disability or can be Section 80U of the Income Tax Act offers tax benefits if an individual suffers a disability If you have a certified disability of at least 40 you can claim an 80U deduction of up to Rs 75000 on your income

Section 80DD is applicable if a taxpayer pays a certain amount as an insurance premium for the assistance of his or her dependent disabled person In section 80DD the Individuals or HUFs can claim an exemption under Section 80DD of the Income Tax Act for a disabled person who is wholly dependent on the Individual HUF for support and

Income Tax Form 16 What Is Form 16 Eligibility Benefits And Exemptions

https://www.godigit.com/content/dam/godigit/directportal/en/contenthm/tax-form-16-2.jpg

Claim Deduction Under Section 80DD Learn By Quicko

https://learn.quicko.com/wp-content/uploads/2023/01/10IA-1.png

https://www.taxsutra.com › sites › taxsutra.com › files...

Deduction of a sum of seventy five thousand rupees from his gross total income in respect of the previous year Provided that where such dependant is a person with severe disability the

https://www.ninafoundation.org › Articles › articleTax...

The article highlights the benefits government provides in Income Tax Act Professional Tax and a scheme to encourage private sector to provide employment opportunities to disabled The

Section 80DDB Deductions For Specified Diseases And Ailments

Income Tax Form 16 What Is Form 16 Eligibility Benefits And Exemptions

Estate Tax Exemption Amount Goes Up In 2023

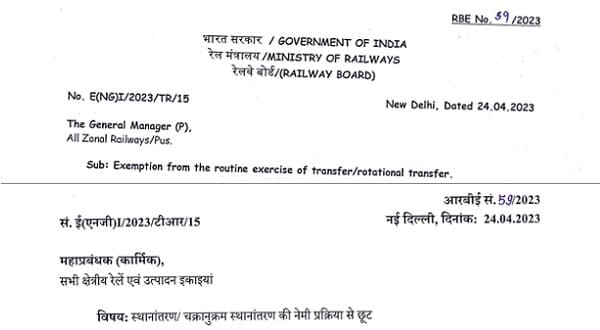

Exemption From The Routine Train Of Switch rotational Switch Railway

Five Income Tax Changes In Budget 2021 You Should Know Business League

2023 Tax Exemption Form Pennsylvania ExemptForm

2023 Tax Exemption Form Pennsylvania ExemptForm

Income From Digital Assets And Share Trading Need To Disclose Cbdt

501 c 3 Tax Exempt Form Definition Finance Strategists

Income Tax Calculation Example 2 For Salary Employees 2023 24

Income Tax Exemption For Physically Handicapped Dependent Pdf - Article discusses Benefits under Income Tax and Profession Tax Act Available to Disabled or Handicapped Persons Income Tax Act Provides Deduction Under Section 80DD Section 80DDB and Section 80U and also