Home Loan Interest Comes Under Which Section Learn how to get tax deductions on your Home Loan interest under Section 24 principal repayment under Section 80C and additional deduction for first time home

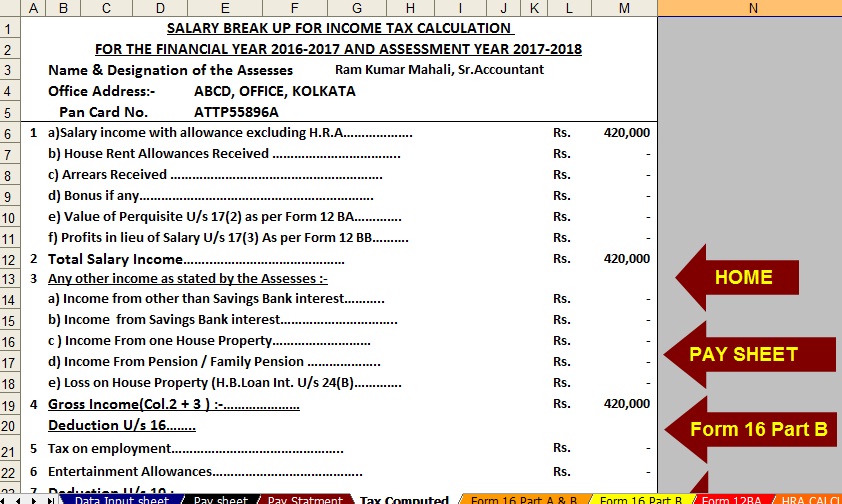

The interest portion of the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 Learn how to claim tax deductions on home loan principal and interest under four sections of the income tax act Section 80C Section 24 Section 80EE and Section 80EEA Find out the eligibility

Home Loan Interest Comes Under Which Section

Home Loan Interest Comes Under Which Section

https://raizinvest.com.au/investors/wp-content/uploads/2021/01/home.jpg

Home Loan Interest Deduction Procedure To Claim HomeCapital

https://i0.wp.com/blog.homecapital.in/wp-content/uploads/2022/08/HC_Blog-1-2.jpg?fit=600,337&ssl=1

Lic Home Loan Interest Rate 2020 Calculator Online Offer Save 61

https://blog.ruloans.com/wp-content/uploads/2018/03/Home-Loan-Interest-Rate.jpg

Interest on home loan If you have taken a loan for the acquisition construction or repair of the property you can claim the interest paid on the loan up to Learn how to claim tax benefits on the interest portion of a home loan under Section 80EE of the Income Tax Act 1961 Find out the eligibility conditions features and difference with Section 80EEA of the

By using Section 80EEA an individual is permitted to claim a deduction under Section 24B for the interest paid on home loans This section undertakes the general provisions Individuals are eligible for income tax benefits under Section 80EE of Income Tax Act on the interest component of residential property loans obtained from any financial institution

Download Home Loan Interest Comes Under Which Section

More picture related to Home Loan Interest Comes Under Which Section

Why Home Loan Interest Rates Will Remain Low In 2018 RefiGuide 2019

https://www.refiguide.org/wp-content/uploads/2017/09/iStock-636187984.jpg

Important Factor That Affect Your Home Loan Interest Rate Loan Trivia

https://1.bp.blogspot.com/-4I4cdISc3zA/YSM2pzXll_I/AAAAAAAABNE/UrDVmY6OYEY1bIr6IMteZJRCKrd5yUd-wCLcBGAsYHQ/s16000/home%2Bloan%2Binterest%2Brate.jpg

Commercial Bank Home Loan Interest Rate Starting From 14 5 PA SynergyY

https://synergyy.com/wp-content/uploads/2017/11/Commercial-Bank-Home-Loan-–-Interest-rate-starting-from-14.5-PA.jpg

Home Loan Income Tax Benefits For interest paid on home loans for affordable housing an additional Rs 1 5 lakh tax deduction under Section 80EE can be availed till 31 March Learn how to get income tax benefits on your home loan under different sections of the Income Tax Act Find out the eligibility conditions limits and deductions for principal repayment interest payment and joint

Discover the tax advantages of home loans under the Income Tax Act 1961 Explore Sections 24B 80C 80EE and 80EEA which offer deductions for interest on Tax deduction under Section 80EE of the Income Tax Act 1961 can be claimed by first time home buyers for the amount they pay as interest on home loan The maximum

Tips To Reduce Your Home Loan Interest Rates Burden

https://homefirstindia.com/app/uploads/2022/02/Untitled-design-20.png

Home Loan Interest Rates Compare Rates Of Top Banks Loanfasttrack

https://www.loanfasttrack.com/blog/wp-content/uploads/2020/07/Home-Loan-Interest-Rates-loanfasttrack-1-1024x684.png

https://blog.bankbazaar.com/home-loan-tax-benefits...

Learn how to get tax deductions on your Home Loan interest under Section 24 principal repayment under Section 80C and additional deduction for first time home

https://cleartax.in/s/home-loan-tax-benefit

The interest portion of the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24

How Do You Convert Your Home Loan Into An Interest Free Home Loan

Tips To Reduce Your Home Loan Interest Rates Burden

Home Loan Interest Home Loan Interest Deduction Under Which Section

6 Types Of Home Loan Interest Rates In Singapore

Find Out The Best Ways For Home Loan Interest Rates

Download Sbi Home Loan Processing Time Home

Download Sbi Home Loan Processing Time Home

Which Loan Provider Offers The Lowest Loan Interest Rates

Home Loan Bank Information Lowest Interest Rates

Interest On Home Loan Section Home Loan

Home Loan Interest Comes Under Which Section - Individuals are eligible for income tax benefits under Section 80EE of Income Tax Act on the interest component of residential property loans obtained from any financial institution