Home Loan Interest Tax Benefit India Verkko 4 huhtik 2017 nbsp 0183 32 Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution As per this

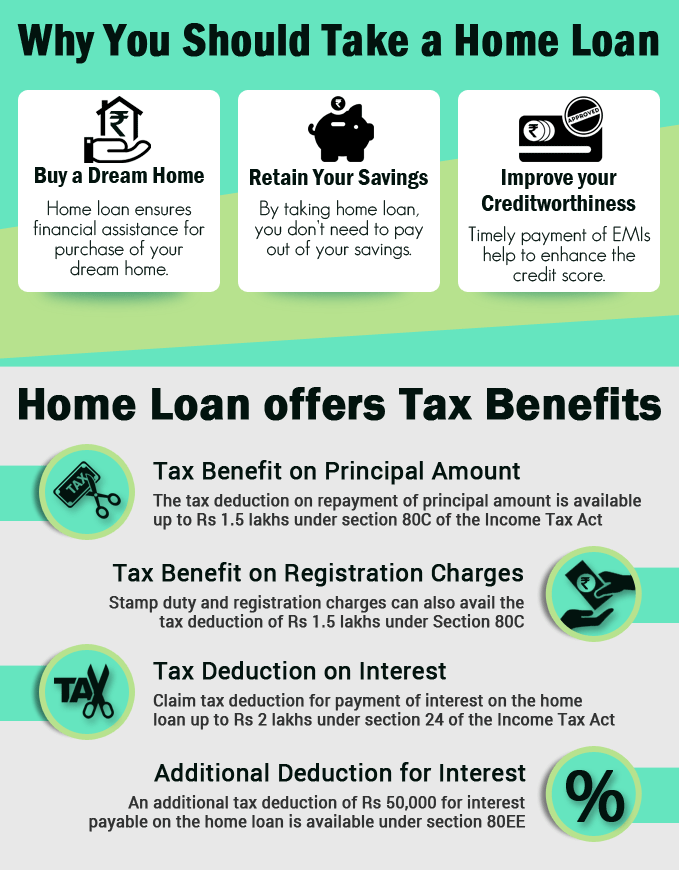

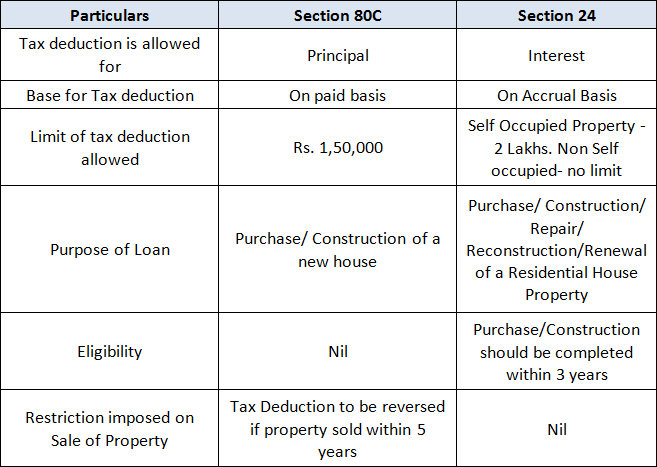

Verkko 3 tammik 2024 nbsp 0183 32 The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up to Rs 1 5 lakh on principal repayment Verkko 20 maalisk 2023 nbsp 0183 32 Additionally all co borrowers can claim a deduction on the principal amount and interest payment of the home loan under Section 80C upto 1 5lakh

Home Loan Interest Tax Benefit India

Home Loan Interest Tax Benefit India

https://www.jagranimages.com/images/newimg/08112022/08_11_2022-bb_23190635.jpg

Home Loan Lowest Interest Rate

https://marathikayda.com/wp-content/uploads/2022/12/home-loan-low-interest-rate-compressed.jpg

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/Tax-benefits-on-Home-Loan-819x1024.jpeg

Verkko 27 huhtik 2023 nbsp 0183 32 The tax deductions you can claim if you have a home loan in 2023 24 Advertisement Anagh Pal Apr 27 2023 11 28 IST Source Pixabay Apart from the Verkko 22 maalisk 2023 nbsp 0183 32 Home loan borrowers should note all income tax breaks offered on home loans because doing so can help you significantly lower your tax liabilities

Verkko 30 elok 2022 nbsp 0183 32 Rs 1 5 lakh is the maximum income tax benefit on a home loan in 2022 that can be claimed every year on the principal repayment portion of the home loan s Verkko 1 helmik 2020 nbsp 0183 32 Finance Minister Nirmala Sitharaman in her Budget 2020 speech proposed to extend the date of availing home loan for affordable housing scheme till

Download Home Loan Interest Tax Benefit India

More picture related to Home Loan Interest Tax Benefit India

Tax Benefits How To Use Home Loan Interest To Benefit Of Tax

https://blog.regrob.com/wp-content/uploads/2016/10/tax-benefit-on-home-loan-interest.png

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

https://homefirstindia.com/app/uploads/2022/07/Untitled-design-14.png

Verkko 26 elok 2020 nbsp 0183 32 Home loan tax benefits 2020 21 is one of the many advantages of investing in real estate in India because under the Income Tax Act of 1961 you are eligible for housing loan tax Verkko Under Sections 80C and 24 both the borrowers are eligible for up to Rs 2 lakh tax rebate on interest payment each and up to Rs 1 5 lakh benefit on the principal repayment

Verkko You can avail deduction on the interest paid on your home loan under section 24 b of the Income Tax Act For a self occupied house the maximum tax deduction of Rs 2 Verkko 15 kes 228 k 2023 nbsp 0183 32 One of the significant tax benefits of mortgage loans is the deduction available on the interest paid towards the loan Under Section 24 b of the Income

Tax Benefits Of Paying Home Loan EMI HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2021/10/benefits-of-paying-home-loan-emi.png

Income Tax Benefits On Home Loan Loanfasttrack

https://www.loanfasttrack.com/blog/wp-content/uploads/2020/12/IncomeTaxBenfits-800x534.png

https://cleartax.in/s/section-80ee-income-tax-deduction-for-interest...

Verkko 4 huhtik 2017 nbsp 0183 32 Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution As per this

https://www.paisabazaar.com/home-loan/home-loan-tax-benefits

Verkko 3 tammik 2024 nbsp 0183 32 The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up to Rs 1 5 lakh on principal repayment

What Is A Home Loan Loyalty Tax And Am I Paying It Nano Digital Home

Tax Benefits Of Paying Home Loan EMI HDFC Sales Blog

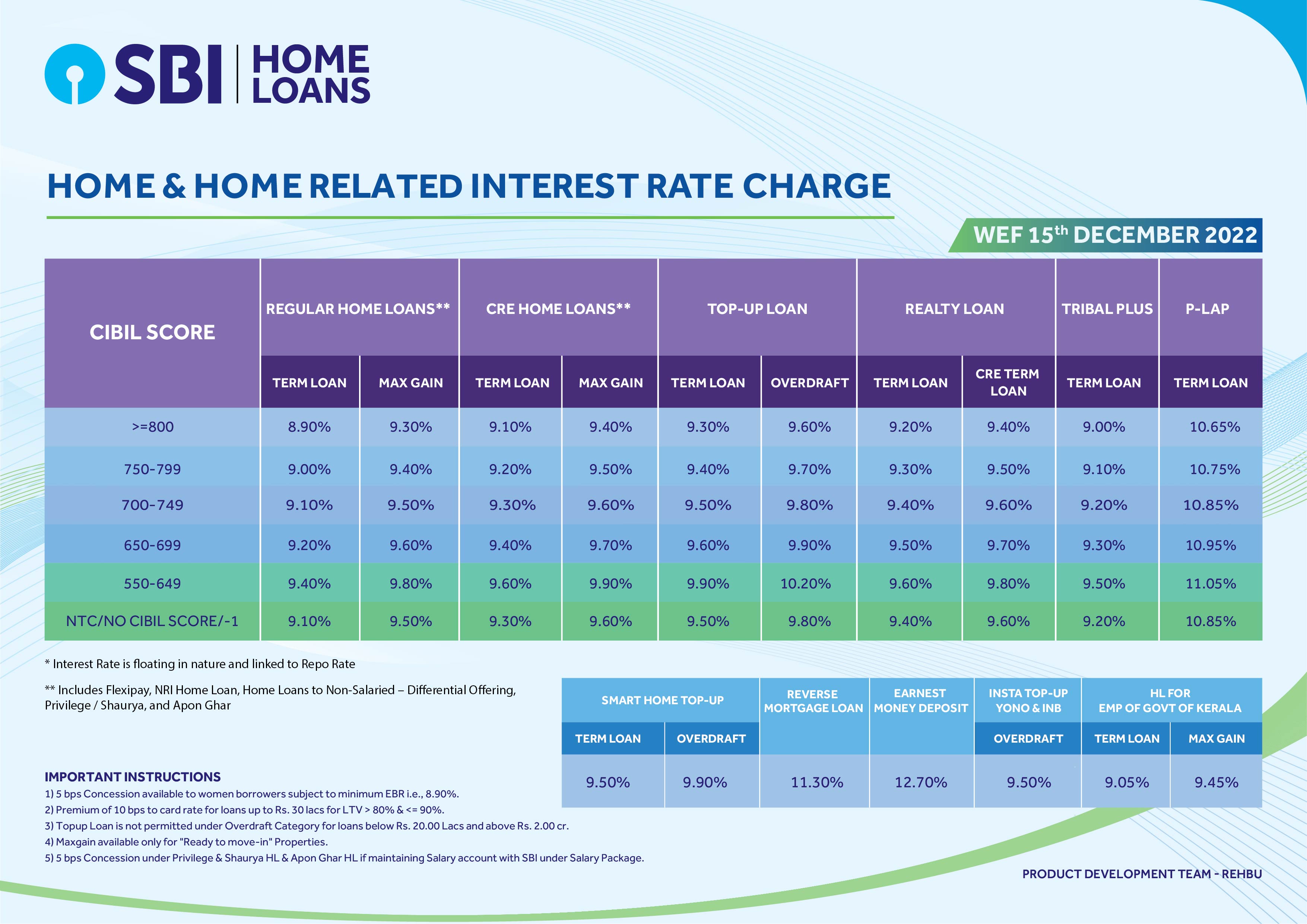

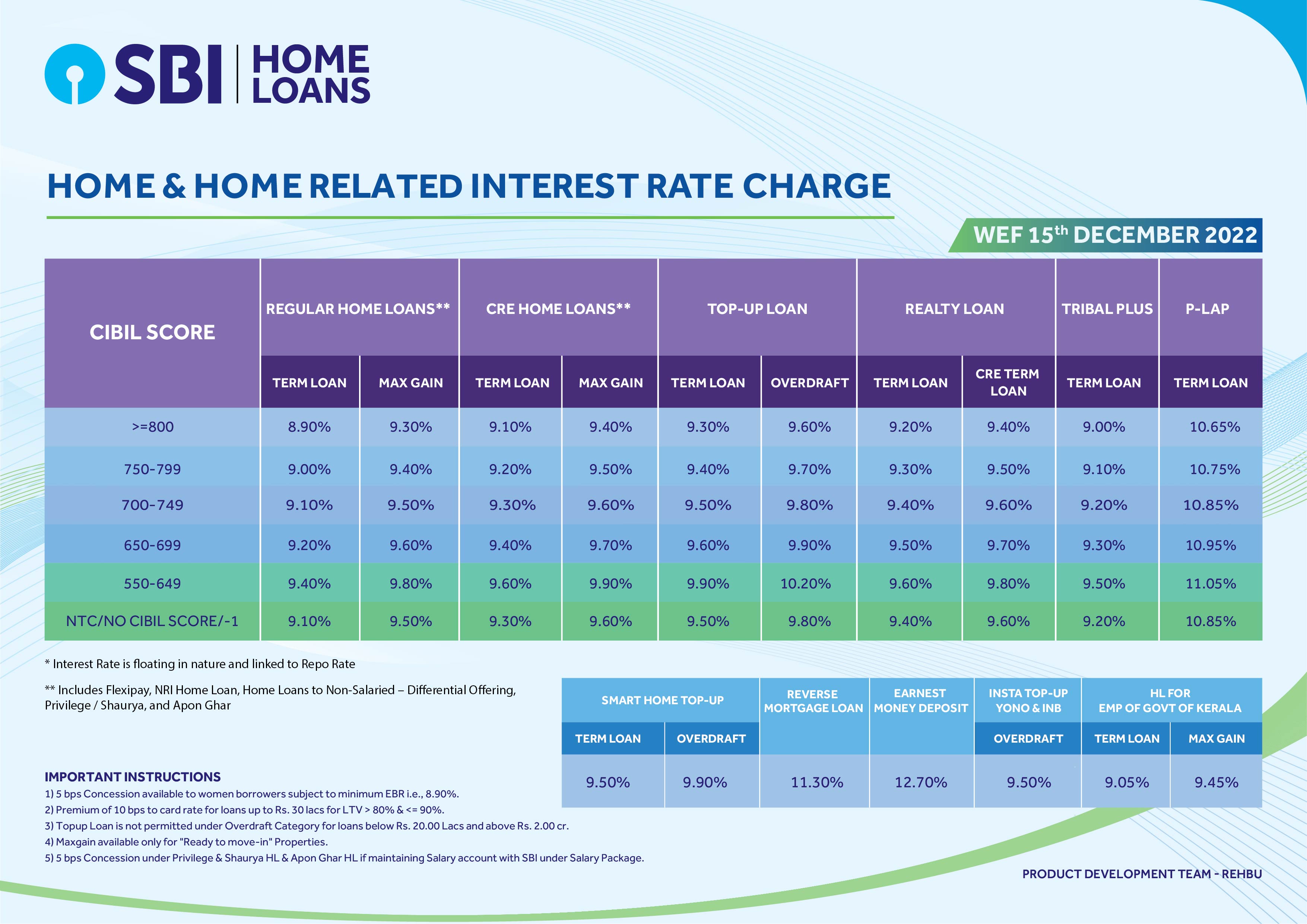

Best Home Loan Rates

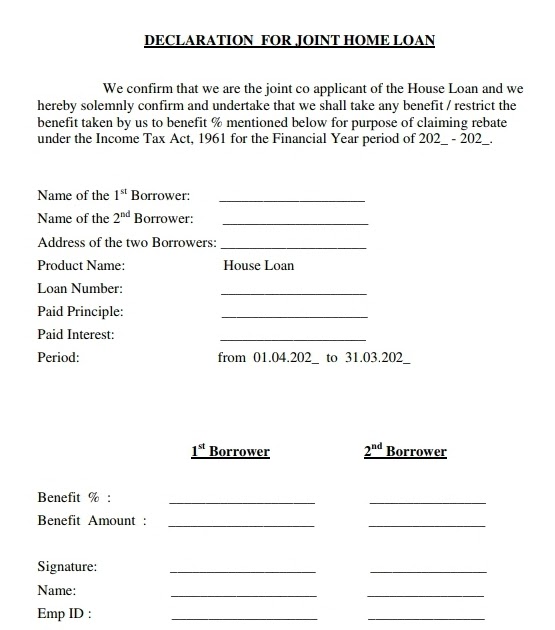

Joint Home Loan Declaration Form For Income Tax Savings And Non

RBI Guidelines For Home Loan Interest Rates 2024 LoanPaye

Home Loans Interest Rates Current Interest Rates

Home Loans Interest Rates Current Interest Rates

Home Loan Interest Rates Comparison Between SBI HDFC Bank Of Baroda

Income Tax Benefits On Housing Loan Interest And Principal House Poster

Income Tax Benefits On Housing Loan Interest And Principal House Poster

Home Loan Interest Tax Benefit India - Verkko 27 huhtik 2023 nbsp 0183 32 The tax deductions you can claim if you have a home loan in 2023 24 Advertisement Anagh Pal Apr 27 2023 11 28 IST Source Pixabay Apart from the