Home Loan Interest Tax Rebate Limit Section 80EEA Tax deduction against home loan interest paid Income tax rebate on home loan Budget 2021 Extension of safe harbour limit to benefit buyers inventory hit builders

Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C and up to Rs 2 lakh on interest payment under Section 24 b Section 80EE of the Income Tax Act allows a deduction of up to Rs 50 000 per financial year on the interest portion of a residential house property loan The deduction is only available to individuals who meet specific criteria and have taken a home loan between 1 April 2016 to 31 March 2017

Home Loan Interest Tax Rebate Limit

Home Loan Interest Tax Rebate Limit

https://nano.com.au/wp-content/uploads/2022/06/what-is-a-home-loan-loyalty-tax-scaled.jpg

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/Tax-benefits-on-Home-Loan-819x1024.jpeg

Pin On Property Finance

https://i.pinimg.com/originals/5b/9c/f2/5b9cf2873744df5288180e2fd7e7be02.jpg

If you have rented out the property the entire interest on the home loan is allowed as a deduction Your deduction on interest is limited to Rs 30 000 if you fail to meet any of the conditions given below The home loan must be for the purchase and construction of a property The loan must be taken on or after 1 April 1999 Under Section 24 of the Income Tax Act an individual can claim a tax deduction of the interest payment on the housing loan up to a maximum amount of Rs 2 00 000 You can claim this deduction if you complete the building of the house within 5 years otherwise you can claim only Rs 30 000

First time home buyers can claim deduction of up to Rs 50 000 under Section 80EE in a financial year against payment of home loan interest 80EE deductions can be claimed till the home loan is fully repaid Tax deduction under Section 80EE of the Income Tax Act 1961 can be claimed by first time home buyers for the amount they pay as interest on a home loan and the loan must be sanctioned between 01 04 2016 to 31 03 2022

Download Home Loan Interest Tax Rebate Limit

More picture related to Home Loan Interest Tax Rebate Limit

Home Loan Interest Tax Exemption Limit 2019 20 Home Sweet Home

https://www.relakhs.com/wp-content/uploads/2019/02/Income-Tax-Deductions-List-FY-2019-20-Latest-Tax-exemptions-for-AY-2020-2021-tax-saving-optionschart-tax-rebate.jpg

Best Home Loan Rates

https://images.livemint.com/img/2021/12/26/original/loan_1640547127620.png

Home Loan Lowest Interest Rate

https://marathikayda.com/wp-content/uploads/2022/12/home-loan-low-interest-rate-compressed.jpg

Claim a maximum home loan tax deduction of up to Rs 1 5 lakh from your taxable income on the principal repayment This may include deduction on stamp duty and registration charges but can be claimed only once and in the same year that they are incurred What is the maximum tax benefit on home loan The maximum tax deduction for a housing loan as per different sections in Income Tax Acts is listed below Up to Rs 2 lakh under Section 24 b for self occupied home Up to Rs 1 5 lakh under Section 80C

You can deduct the mortgage interest you paid during the tax year on the first 750 000 of your mortgage debt for your primary home or a second home If you are married filing separately the Limits on home mortgage interest Your deduction for home mortgage interest is subject to a number of limits If one or more of the following limits apply see Pub 936 to figure your deduction Also see Pub 936 if you later refinance your mortgage or buy a second home

Home Loan Interest Rates 2021 Best Home Loan 6 85 In India EMI

https://i.ytimg.com/vi/QVVsvtSyi1o/maxresdefault.jpg

Home Loan Interest Rates

https://image.slidesharecdn.com/homeloaninterestrates-170807085121/95/home-loan-interest-rates-1-1024.jpg?cb=1502096899

https://housing.com/news/home-loans-guide-claiming-tax-benefits

Section 80EEA Tax deduction against home loan interest paid Income tax rebate on home loan Budget 2021 Extension of safe harbour limit to benefit buyers inventory hit builders

https://www.paisabazaar.com/home-loan/home-loan-tax-benefits

Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C and up to Rs 2 lakh on interest payment under Section 24 b

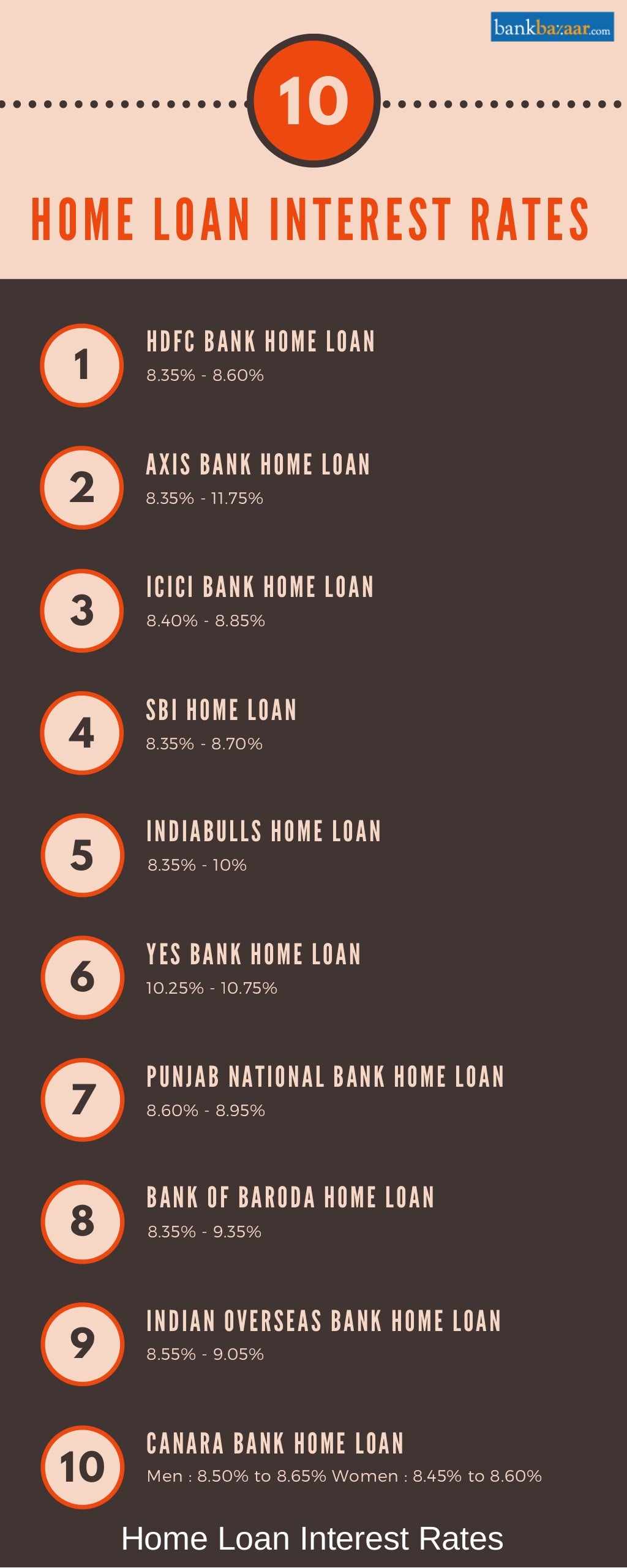

Home Loan Interest Rates Comparison Between SBI HDFC Bank Of Baroda

Home Loan Interest Rates 2021 Best Home Loan 6 85 In India EMI

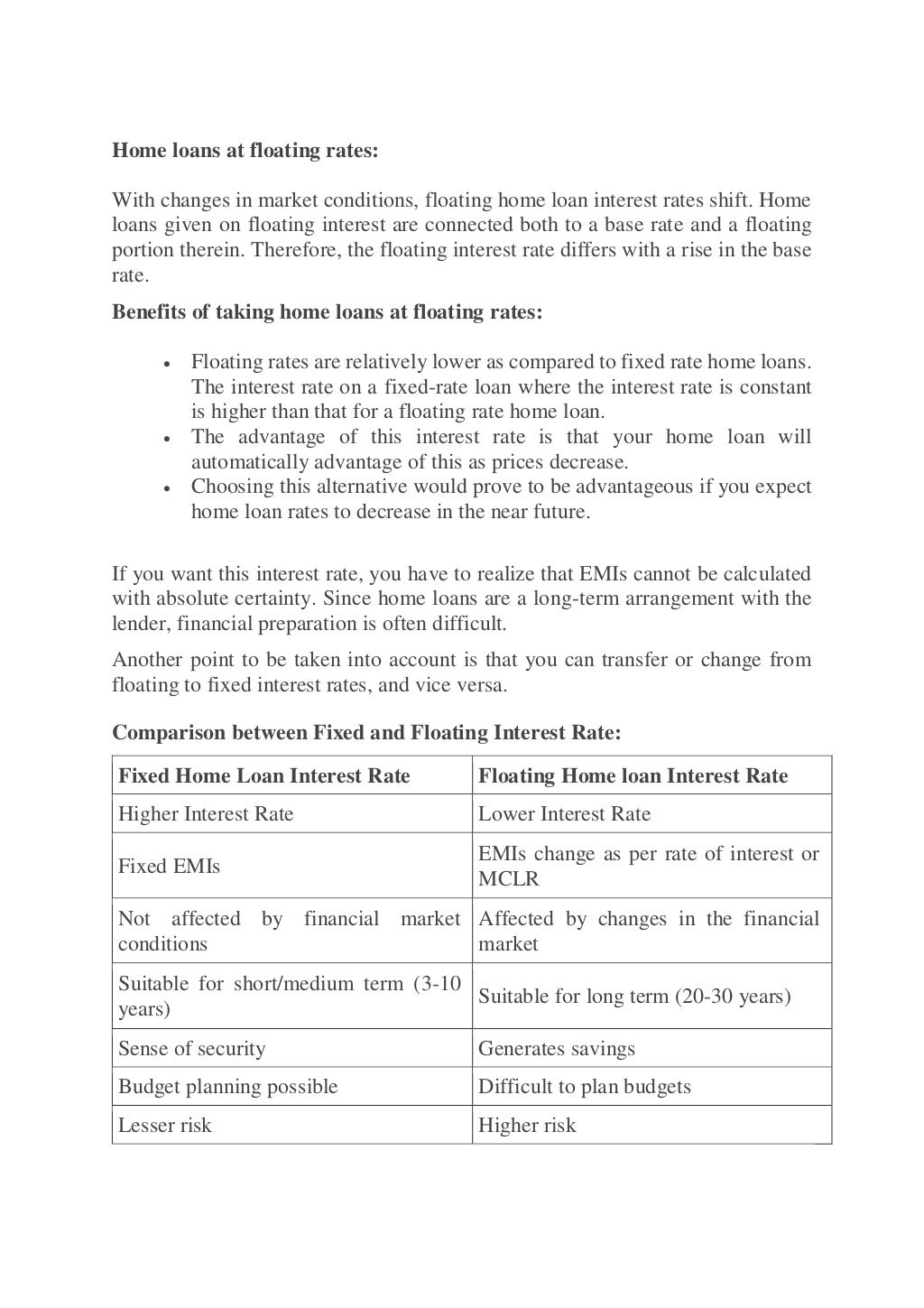

Fixed Vs Floating Home Loan Interest Rate Paytm Blog

Property Tax Rebate Checks Are Coming Here s How Much Money You re Due

Sbi Home Loan Rates From July 2019 Home Sweet Home Insurance

Home Loan Interest Rates List 2023 Of All Banks New Updated

Home Loan Interest Rates List 2023 Of All Banks New Updated

Tax Rebate For First Time Homeowners How To Claim Your Tax Rebate

Compare Home Loan Interest Rates On ApnaPaisa Check Rates Of The Top

Know About Fixed Home Loan Interest Rate

Home Loan Interest Tax Rebate Limit - Under Section 80EE you can claim a tax deduction of up to Rs 50 000 annually on the payment of home loan interest This deduction is offered only to first time home buyers in India and is applicable over and above the Rs 2 lakh deduction provided under Section 24