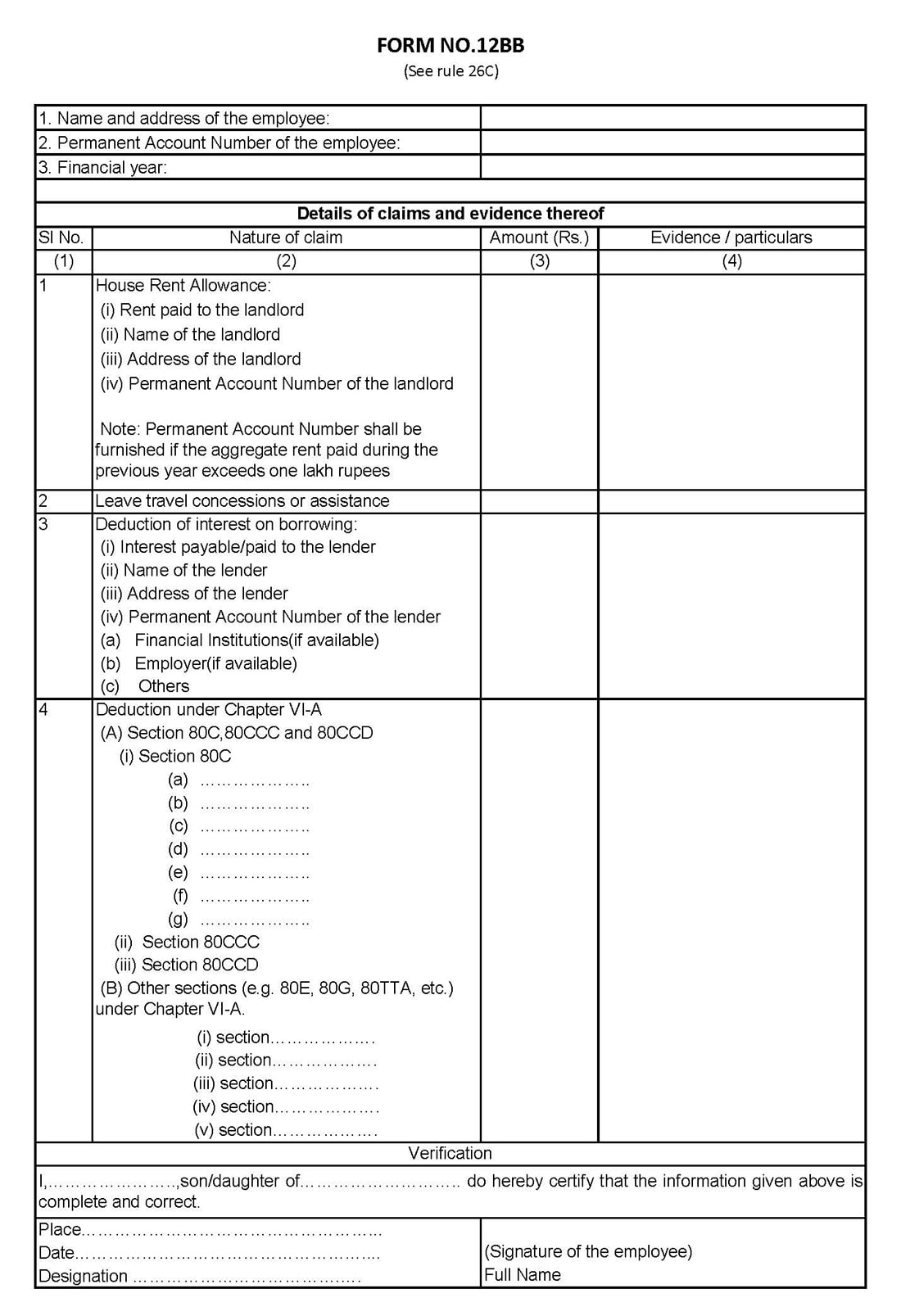

Home Loan Interest Tax Rebate Web 28 mars 2017 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

Web 11 janv 2023 nbsp 0183 32 Tax deduction on the principal component is limited to Rs 1 50 lakhs per annum under Section 80C while rebate towards interest is capped at Rs 2 lakhs Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

Home Loan Interest Tax Rebate

Home Loan Interest Tax Rebate

https://new-img.patrika.com/upload/2022/03/24/home_loan.jpg

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Understanding Home Loan Refinance Interest Rates In 2023 Money

https://i.pinimg.com/originals/1b/66/fd/1b66fda37115a14cabf98db5215efe2d.jpg

Web under Section 24 of the Income Tax Act you can claim a maximum tax rebate of up to 2 lakh on the interest payable on your home loan however note that these deductions Web If you receive a refund of mortgage interest you overpaid in a prior year you will generally receive a Form 1098 showing the refund in box 4 Generally you must include the refund

Web 24 ao 251 t 2023 nbsp 0183 32 Updated 24 08 2023 09 31 08 AM The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up Web 5 sept 2023 nbsp 0183 32 First time home buyers can claim deduction of up to Rs 50 000 under Section 80EE in a financial year against payment of home loan interest 80EE deductions can

Download Home Loan Interest Tax Rebate

More picture related to Home Loan Interest Tax Rebate

What Are Reuluations About Getting A Home Loan On A Forclosed Home

https://www.paisabazaar.com/wp-content/uploads/2017/11/Tax-benefits-of-home-loan_2.jpg

Home Loan Interest Tax Benefit 2019 20 Home Sweet Home Insurance

https://tax2win.in/assets-new/img/form-12bb/form-12bb.jpg

Oct 2016 Best Home Loan Interest Rates In 2016

https://myinvestmentideas.com/wp-content/uploads/2016/04/Latest-and-Lowest-Home-Loan-Interest-Rates-in-India-October-2016.jpg

Web Most homeowners can deduct all of their mortgage interest The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on Web Tax benefit on Home loan FY 2023 24 Home loan tax benefit is among the most important features of a home loan Tax saving on home loan increases the affordability

Web 13 janv 2023 nbsp 0183 32 The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750 000 of mortgage debt Homeowners who bought houses before Web Under certain conditions you can deduct the mortgage interest you pay on your mortgage from your taxable income in Box 1 on the tax return You will get money back from the

Home Loan Interest Rates November 2019 Archives Yadnya Investment Academy

https://blog.investyadnya.in/wp-content/uploads/2019/11/Interest-Rates-on-Home-Loan-of-Major-Banks-Dec-2019_Featured.png

Rising Home Loan Interests Have Begun To Impact Homebuyers

https://akm-img-a-in.tosshub.com/businesstoday/styles/medium_crop_simple/public/images/story/202210/home-loan-gfx5555.jpg?itok=B2YA7SED

https://cleartax.in/s/home-loan-tax-benefit

Web 28 mars 2017 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

https://housing.com/news/home-loans-guide-claiming-tax-benefits

Web 11 janv 2023 nbsp 0183 32 Tax deduction on the principal component is limited to Rs 1 50 lakhs per annum under Section 80C while rebate towards interest is capped at Rs 2 lakhs

Lowest Home Loan Interest Rate Loan Interest Rates Home Loans

Home Loan Interest Rates November 2019 Archives Yadnya Investment Academy

Online Free Stuffs Free Home Mortgage Calculator For Microsoft Excel

Home Loans Interest Rates Sbi Nitisara Samahita

Know The Tax Amount You Can Save On Your Home Loan Under Section 24 And

Income Tax Deductions List FY 2020 21 Save Tax For AY 2021 22

Income Tax Deductions List FY 2020 21 Save Tax For AY 2021 22

How To Claim Interest On Home Loan Deduction While Efiling ITR

Are Home Loan Interest Rates Going Up Funaya Park

New Form 12BB For LTA HRA And Home Loan Interest Proofs To Be

Home Loan Interest Tax Rebate - Web The Income Tax Act 1961 offers various provisions for a tax rebate on home loans The following are the three major areas where such a borrower can claim exemptions