Home Loan Principal Amount Deduction Under Which Section Web 18 Dez 2023 nbsp 0183 32 The principal paid on the home loan EMI for the year is allowed as a deduction under

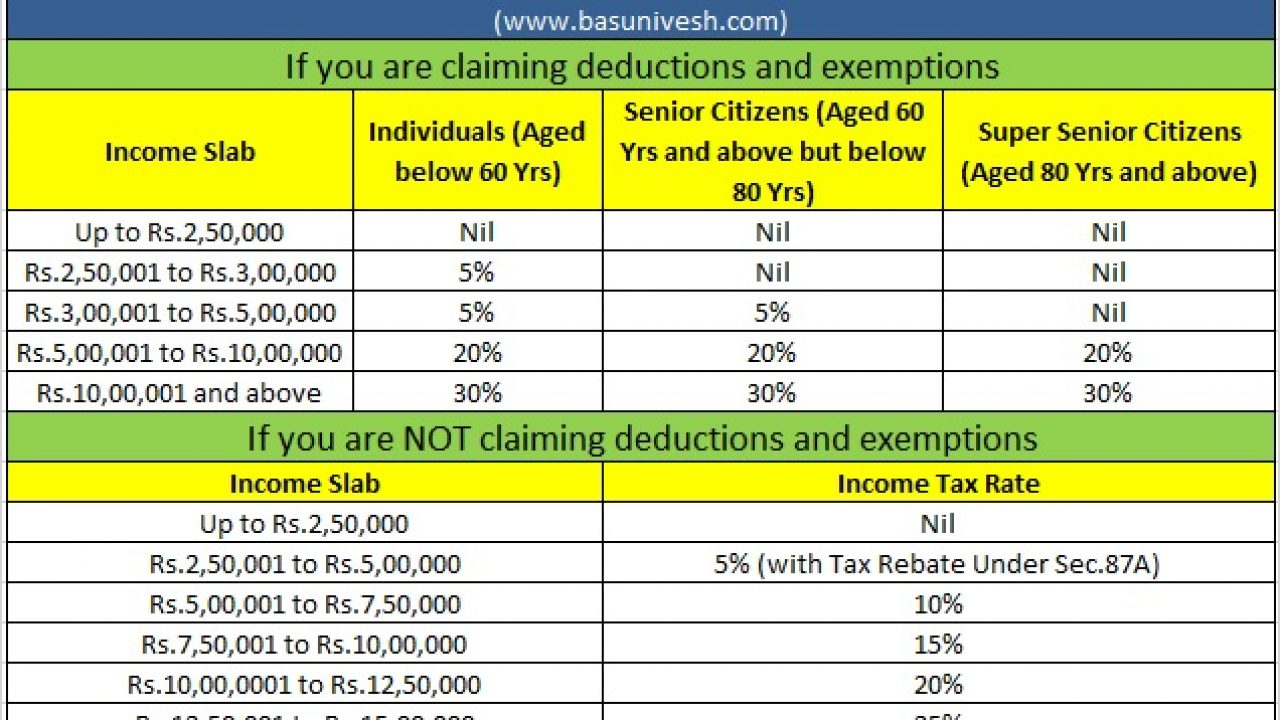

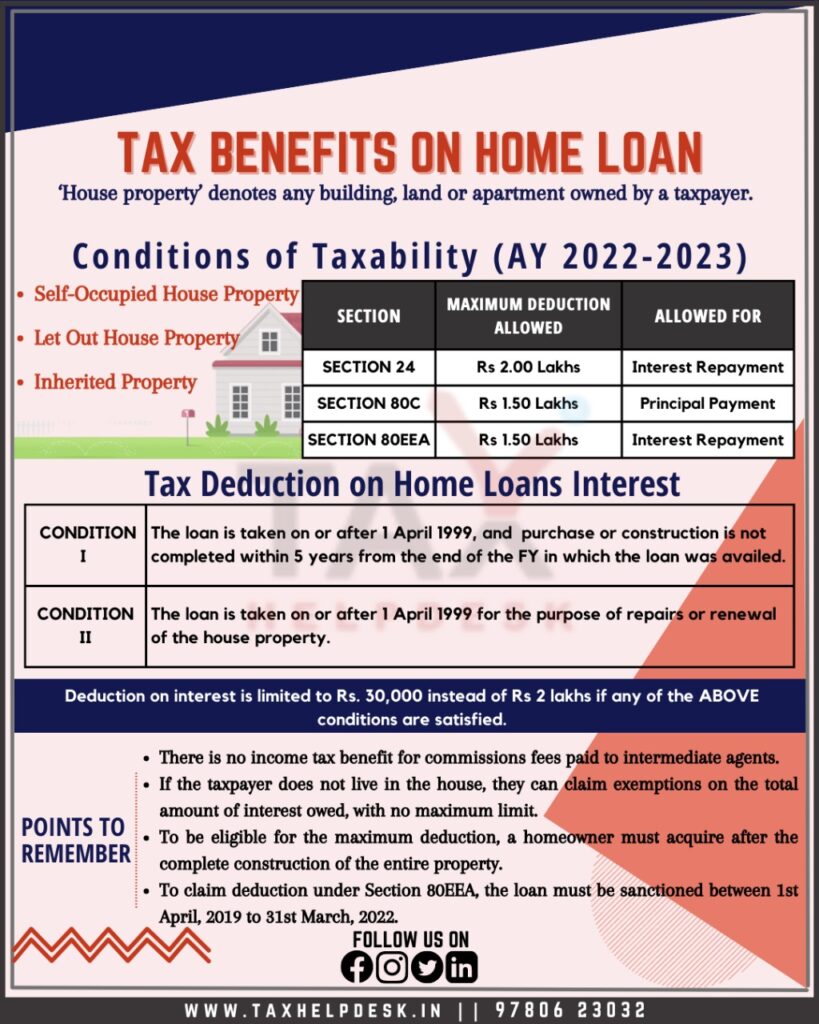

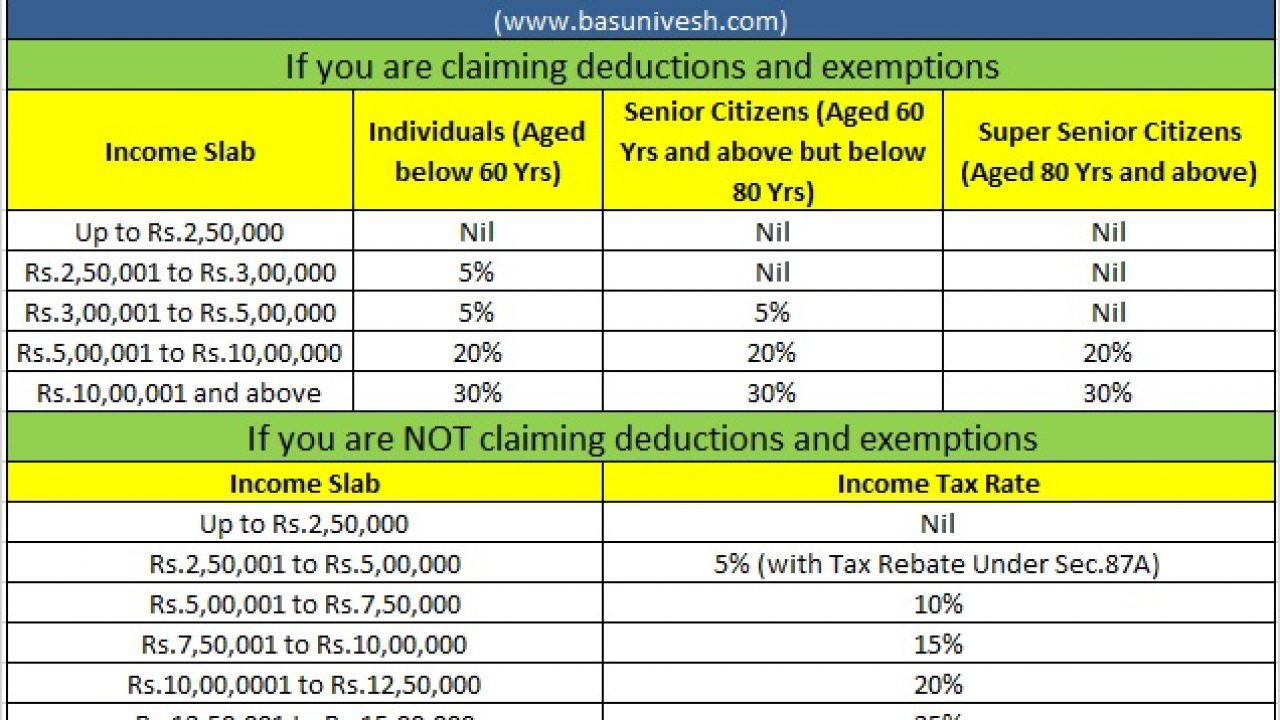

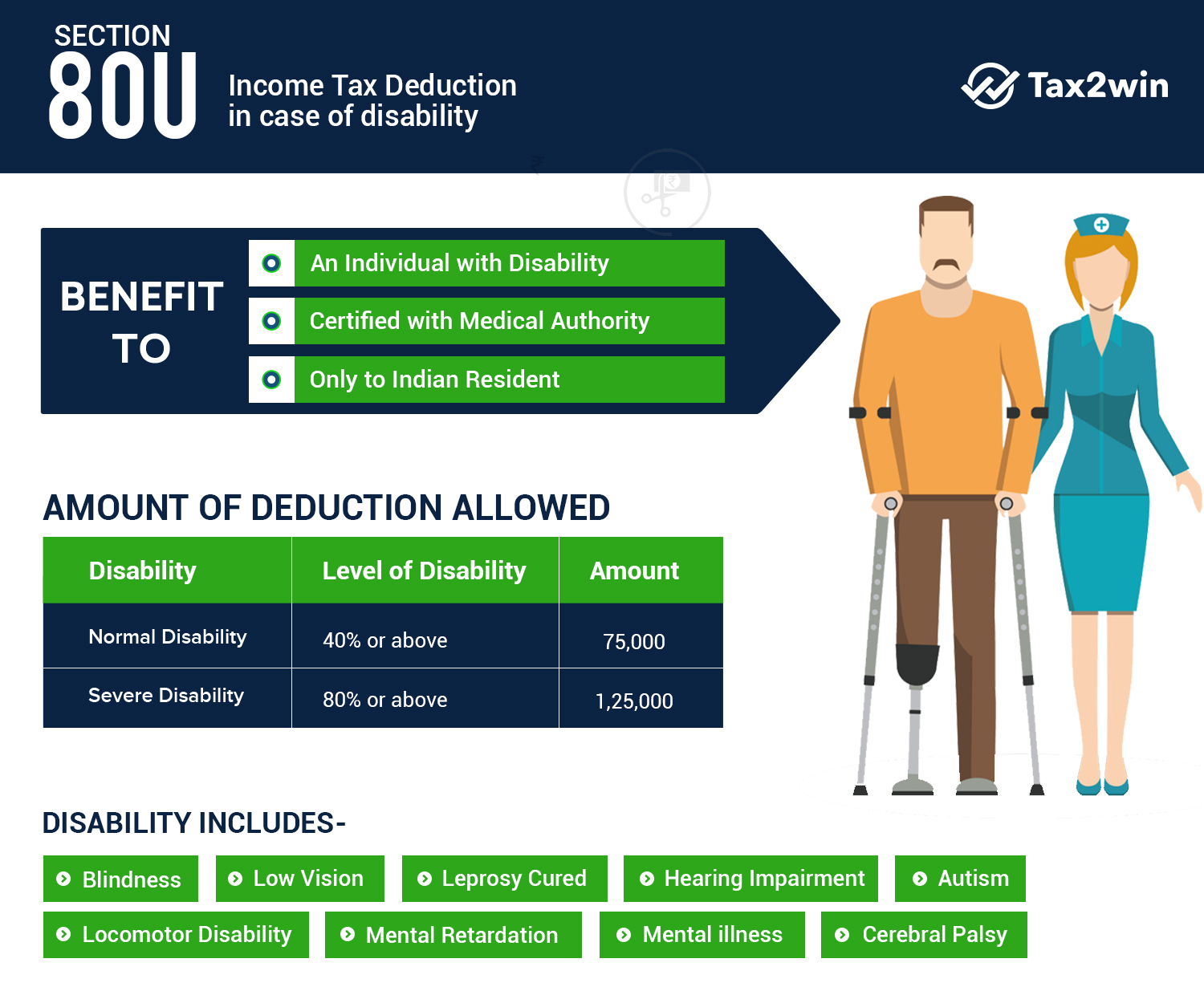

Web Eligibility criteria The deduction under this section is available only to individuals This means that if you are a HUF AOP a company or any other kind of taxpayer you cannot claim the benefit under this section Amount limit The deduction is up to Rs 50 000 It is over and above the Rs 2 lakh limit under Section 24 of the Income Tax Act Web 3 Jan 2024 nbsp 0183 32 Updated 20 10 2023 09 45 45 AM The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up to Rs 1 5 lakh on principal repayment under Section 80C and up to Rs 2 lakh on interest payment under Section 24 b To boost affordable housing segment the government had also

Home Loan Principal Amount Deduction Under Which Section

Home Loan Principal Amount Deduction Under Which Section

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/Tax-benefits-on-Home-Loan-819x1024.jpeg

Pay Deduction Calculator 2021 Tax Withholding Estimator 2021

https://taxwithholdingestimator.com/wp-content/uploads/2021/08/standard-deduction-for-salary-ay-2021-22-standard.jpg

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

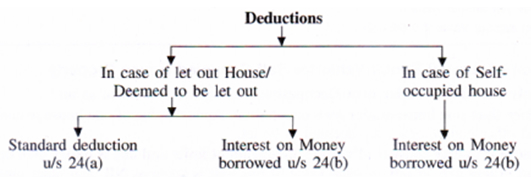

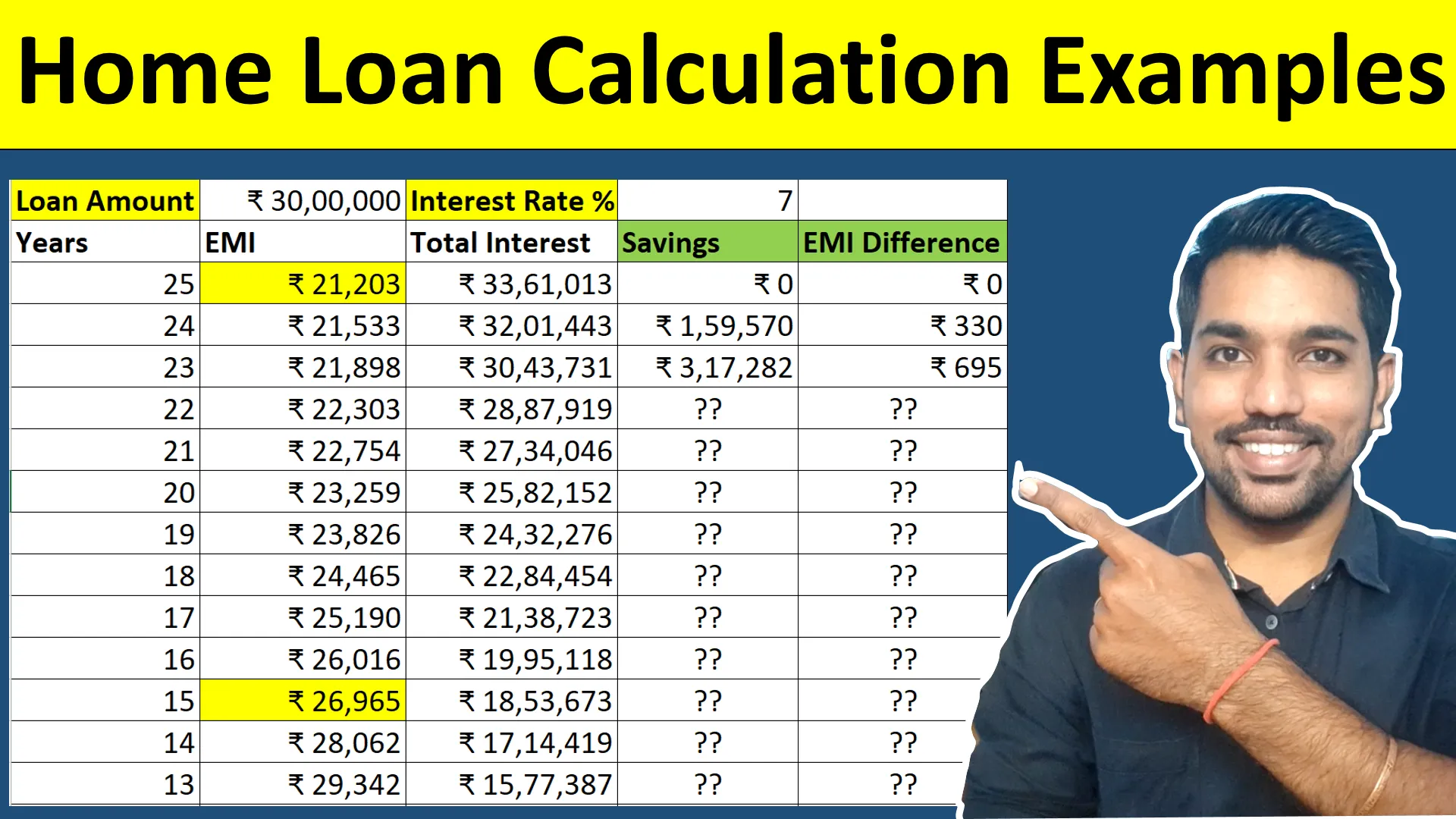

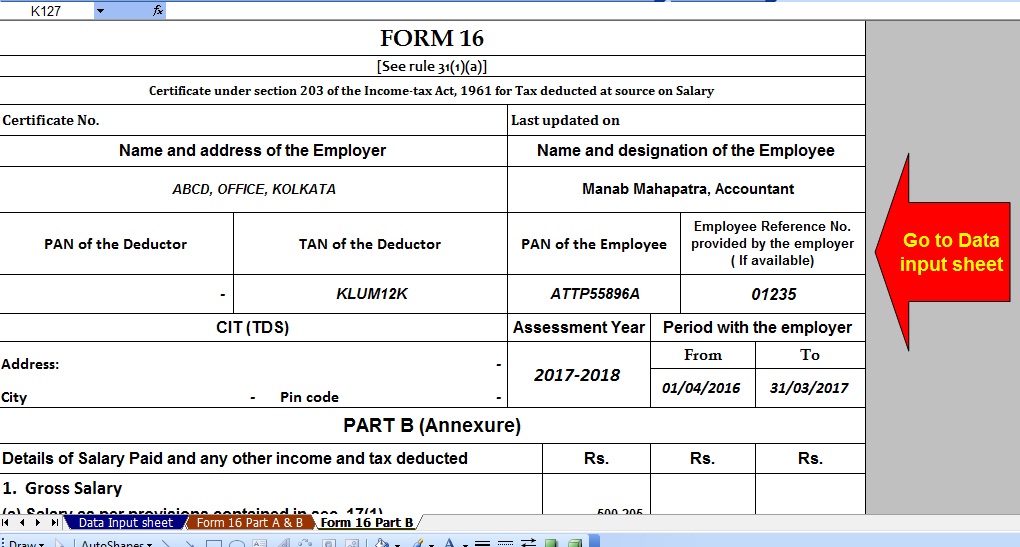

Web 18 Dez 2023 nbsp 0183 32 Home loan borrowers can avail of tax deductions on both principal and interest repayments under Sections 80C and 24 b Advantages of Home Loans When you take a home loan it comes with the benefit of tax savings There are two components of a home loan EMI the principal amount and the interest charged on the loan Web 16 Juni 2020 nbsp 0183 32 1 Deduction under section 80C Your home loan s Principal amount stamp duty registration fee or any other expenses is a part of Section 80C of the Income Tax Act Under this an individual is entitled to tax deduction on the amount paid as repayment of the principal component on the housing loan

Web The amount paid as Repayment of Principal Amount of Home Loan by an Individual HUF is allowed as tax deduction under Section 80C of the Income Tax Act The maximum tax deduction allowed under Section 80C is Rs 1 50 000 Web 25 M 228 rz 2016 nbsp 0183 32 The home loan should have been sanctioned during after FY 2016 17 Loan amount should be less than Rs 35 Lakh The value of the house should not be more than Rs 50 Lakh amp The home buyer should not have any other existing residential house in his name Get to know the tax benefits on home loan interest for the F Y 2022 23

Download Home Loan Principal Amount Deduction Under Which Section

More picture related to Home Loan Principal Amount Deduction Under Which Section

DEDUCTIONS U S 24 Out Of Net Annual Value NAV Of House Property Income

https://incometaxmanagement.com/Pages/Tax-Ready-Reckoner/GTI/House-Property/Images/Deductions-U-S-24.jpg

Section 80 Eligibility Limit Investments For Which Deduction Is Claimed

https://assets-news.housing.com/news/wp-content/uploads/2021/12/28201150/Section-80-Deduction-All-about-Income-Tax-Act-Section-80C-80CCC-and-80CCD.jpg

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

https://carajput.com/blog/wp-content/uploads/2023/05/Deduction-913x1024.jpg

Web 14 Dez 2022 nbsp 0183 32 For home loan principal amount payment the borrower can claim tax deductions under Section 80C of the Income Tax I T act See also 11 key facts about home loans in India Deduction amount is capped at Rs 1 5 Lakh Web Vor 9 Stunden nbsp 0183 32 You can deduct the interest you paid on the first 750 000 of your mortgage during the relevant tax year For married couples filing separately that limit is 375 000

Web Home Loan Tax Benefits under Section 80C Principal Deductions Section 80C deals with the principal amount deductions For both self occupied and let out properties you can claim up to a maximum of Rs 1 5 lakh every Web 19 Mai 2023 nbsp 0183 32 It is typically between 75 to 90 of the value of the home depending on the credit score of the borrower and other aspects Tenure of the Loan This is the duration during which the home buyer will be repaying the loan Interest Rate This is the rate of interest on the amount due It is a charge on the amount of the loan that is due

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2022/10/Is-plot-loan-eligible-for-tax-exemption-V1-724x1024.png

Section 80C Deductions List To Save Income Tax FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2022/09/section-80C-deductions-list-to-save-income-tax-video.webp

https://cleartax.in/s/home-loan-tax-benefits

Web 18 Dez 2023 nbsp 0183 32 The principal paid on the home loan EMI for the year is allowed as a deduction under

https://cleartax.in/s/section-80ee-income-tax-deduction-for-interest...

Web Eligibility criteria The deduction under this section is available only to individuals This means that if you are a HUF AOP a company or any other kind of taxpayer you cannot claim the benefit under this section Amount limit The deduction is up to Rs 50 000 It is over and above the Rs 2 lakh limit under Section 24 of the Income Tax Act

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

How To Calculate Home Loan EMI FREE CALCULATOR FinCalC Blog

Section 24 Of Income Tax Act Deduction For Home Loan Interest

Section 24 Of Income Tax Act House Property Deduction

Actualizar 59 Imagen What Is The Standard Deduction For A Senior

Actualizar 59 Imagen What Is The Standard Deduction For A Senior

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

How To Claim Both HRA Home Loans Tax Deductions With Section 24 And

Home Loan Principal Amount Deduction Under Which Section - Web 18 Dez 2023 nbsp 0183 32 Home loan borrowers can avail of tax deductions on both principal and interest repayments under Sections 80C and 24 b Advantages of Home Loans When you take a home loan it comes with the benefit of tax savings There are two components of a home loan EMI the principal amount and the interest charged on the loan