Homes Rebate Program 2022 Homeowners may be able to save thousands of dollars by claiming tax credits and rebates under the Inflation Reduction Act of 2022

The Home Efficiency Rebates Program also known as HOMES Home Owner Managing Energy Savings will offer rebates for projects that reduce energy With nearly 9 billion to be made available through states and Tribes for consumer home energy rebate programs focused on low income consumers

Homes Rebate Program 2022

Homes Rebate Program 2022

https://pngimg.com/uploads/2022_year/2022_year_PNG4.png

Bicicleta De Munte Hardtail Cannondale Trail 7 Negru 2022 Articole

https://d2bvnhhspgbxyn.cloudfront.net/media/catalog/product/c/2/c21_c26751m_trail_7_blk_pd.jpg

Spartan SRT XDe 61 2022 Meadows Farm Equipment

https://www.meadowsfarmequipment.com/assets/uploads/2022/01/SRT-XDe-61-2022.png

Key Points The Inflation Reduction Act includes thousands of dollars in tax credits and rebates for consumers who buy electric vehicles install solar panels or make other energy efficient A homeowner can access rebates through the Home Efficiency Rebates program if a project was initiated on or after Aug 16 2022 only if the project fulfills all DOE and state

The Inflation Reduction Act of 2022 created two programs to encourage home energy retrofits Home Efficiency Rebates HOMES to fund whole house energy The new rebate program funding could support up to 1 6 million households nationwide in upgrading homes and apartments to lower energy bills including by

Download Homes Rebate Program 2022

More picture related to Homes Rebate Program 2022

2023 Home Energy Rebates Grants And Incentives Top Rated Barrie

https://weaverexterior.ca/wp-content/uploads/2022/01/Weaver-Ontario-Energy-Rebate.jpg

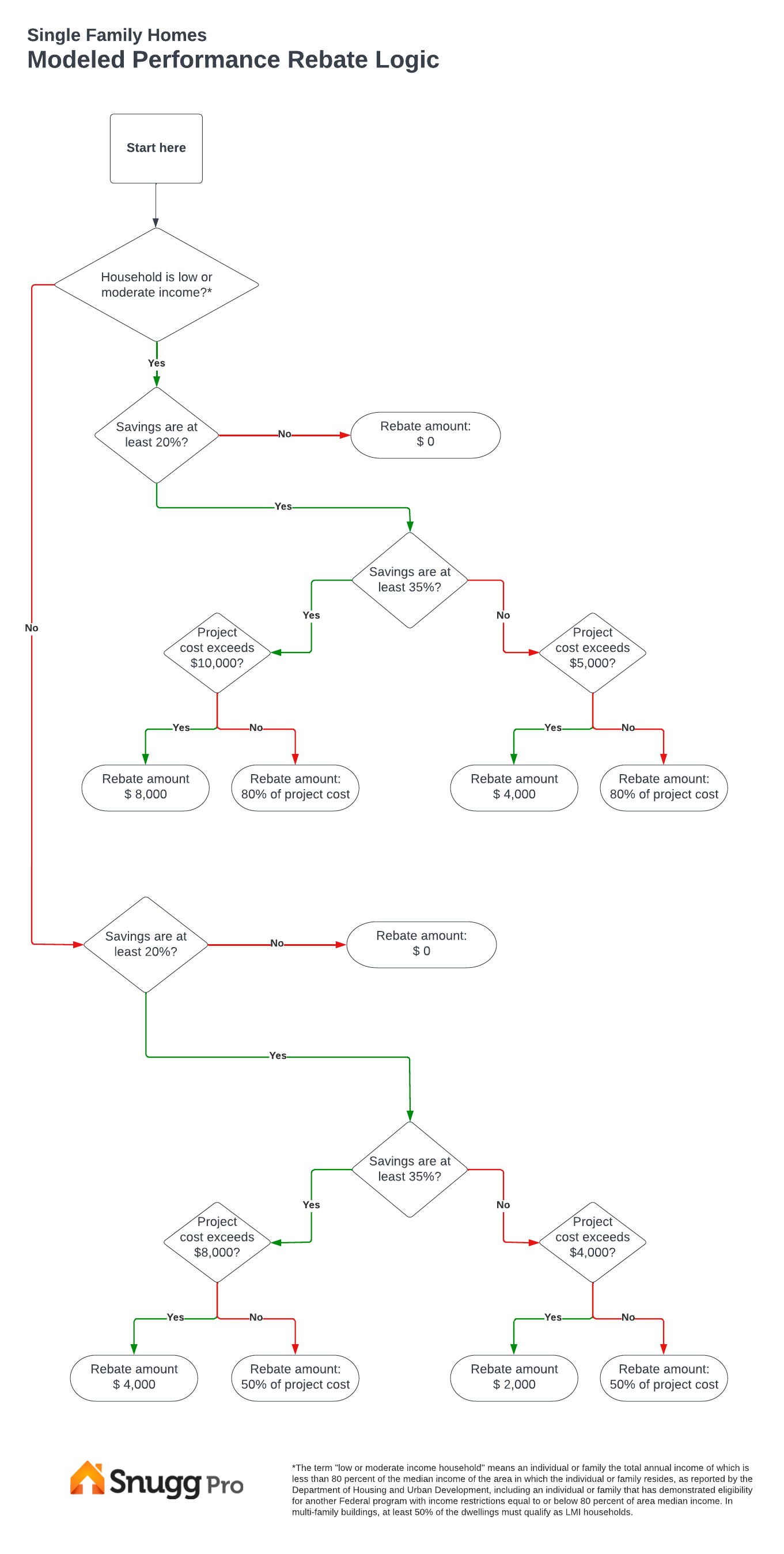

What The Climate Bill s HOMES Rebates Program Means For States Energy

https://snuggpro.com/images/uploads/HOMES_Rebate_Program_Modeled_Savings.png

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

http://static1.squarespace.com/static/5d8d4c603aab2563d4a30208/t/62ebf2c02ff2b767de17f485/1659630272071/2022-8-4+one-time+bonus+rebate+-+property+tax+rebate-insta.jpg?format=1500w

The Inflation Reduction Act of 2022 invests 8 8 billion in Home Energy Rebates via two programs the Home Efficiency Rebates HOMES and the Home The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements This groundbreaking legislation provides billions of dollars over 10 billion in fact in federal home energy rebates market incentives and tax credits to help households

Heat Pumps Rebates 2019 Coastal Energy PumpRebate

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2022/09/heat-pumps-rebates-2019-coastal-energy-118.png

Tce logo horiz 3000px Confident Expert Program

https://confidentexpertprogram.com/wp-content/uploads/2020/10/TCE_2020-Logo-without-circle_GOLD.png

https://www.investopedia.com/tax-credits-for...

Homeowners may be able to save thousands of dollars by claiming tax credits and rebates under the Inflation Reduction Act of 2022

https://crsreports.congress.gov/product/pdf/R/R47698/26

The Home Efficiency Rebates Program also known as HOMES Home Owner Managing Energy Savings will offer rebates for projects that reduce energy

Wasbo Federal Funding Conference 2022 Tim Lowe Buzz

Heat Pumps Rebates 2019 Coastal Energy PumpRebate

X Caliber 2022 Sites unimi it

CelebMafia Celebrity Style Fashion Clothes Outfits Photos GIFs

File Iceland Keldur Earth Covered Homes JPG Wikipedia

View Acne Face Map Temples Background Acne Problems

View Acne Face Map Temples Background Acne Problems

The HOMES Rebate Program Efficiency For Everyone

Dinner png Forever Built Homes

Rieke Zeltlager Rantum I 2022

Homes Rebate Program 2022 - The Inflation Reduction Act of 2022 created two programs to encourage home energy retrofits Home Efficiency Rebates HOMES to fund whole house energy