Homestead Exemption Florida Application When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent the property owner may be eligible to receive a homestead exemption that would decrease the property s taxable value by

When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent the property owner may be eligible to receive a homestead exemption up to 50 000 The first 25 000 applies to all property taxes including school district taxes Homestead Exemption and Portability Property owners with Homestead Exemption and an accumulated SOH Cap can apply to transfer or Port the SOH Cap value up to 500 000 to a new homestead property

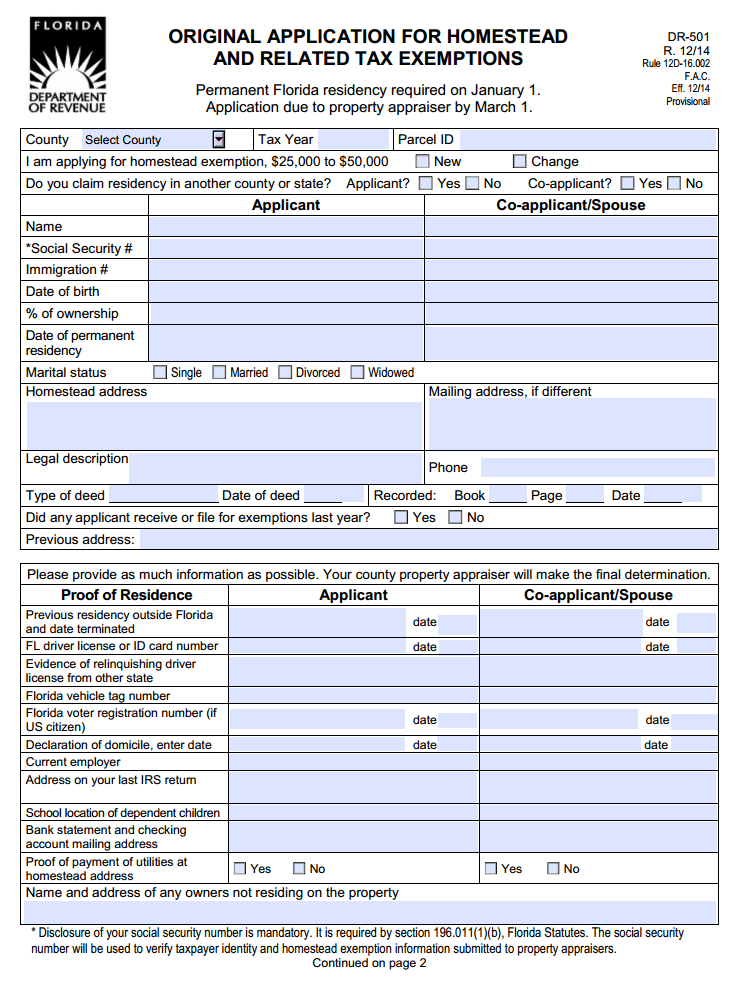

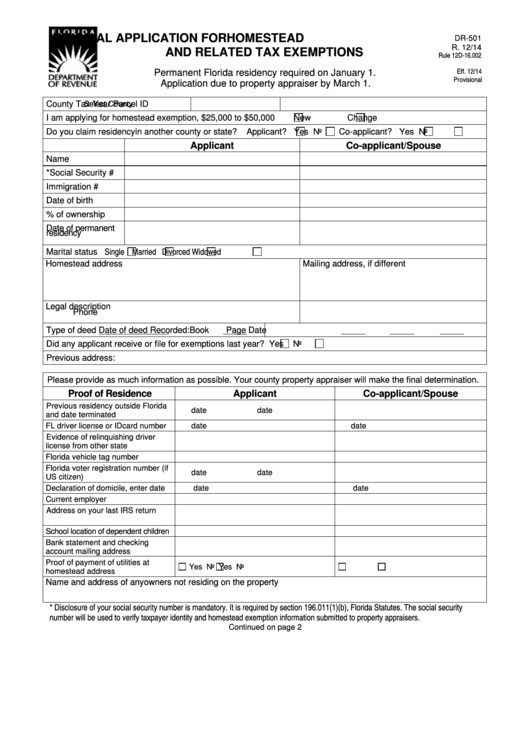

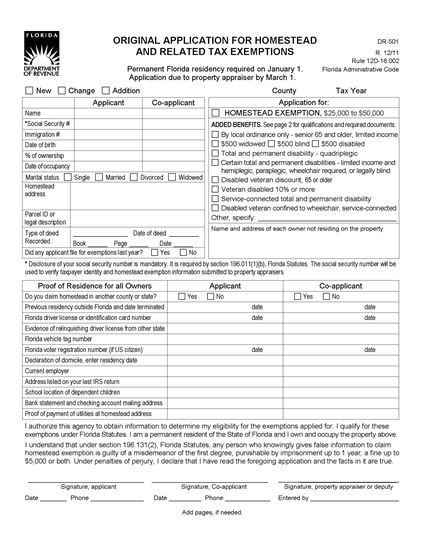

Homestead Exemption Florida Application

Homestead Exemption Florida Application

https://www.pdffiller.com/preview/547/892/547892759/large.png

Florida Homestead Exemptions Emerald Coast Title Services

https://ects.com/wp-content/uploads/2019/12/Florida-Homestead-Exemption-Flyer-1-768x772.jpg

Free Application Forms PDF Template Form Download

https://formdownload.org/wp-content/uploads/2016/08/Florida-Application-for-Homestead-and-Related-Tax-Exemptions.png

The homestead exemption in Florida can save you hundreds of dollars in property taxes if you are a permanent Florida resident If you qualify you can reduce the assessed value of your homestead up to 50 000 There is a standard 25 000 exemption plus an additional exemption up to 25 000 The exemption results in approximately a 500 1 000 property tax savings to Florida residents When you purchase a home and want to qualify for an exemption you may apply online or in person at one of our offices

Welcome to the online homestead exemption application Our online exemption application login process has changed as of February 1 2021 If you currently are in possession of a username and password you will no longer need it to start your online application Please see below for the new login process involving Parcel ID number and Use this online service to apply for Homestead Exemption and Transfer of Homestead Difference Better known as Portability Before you begin each applicant will need the following Asterisk indicates a response is required See the online functions available at the Property Appraiser s Office

Download Homestead Exemption Florida Application

More picture related to Homestead Exemption Florida Application

Walton County Florida Homestead Exemption Form ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/fillable-form-dr-501-original-application-for-homestead-and-related-3.png

How To Apply For A Homestead Exemption In Florida 15 Steps

https://www.wikihow.com/images/f/f0/Apply-for-a-Homestead-Exemption-in-Florida-Step-15.jpg

How To Apply For A Homestead Exemption In Florida 15 Steps

https://www.wikihow.com/images/thumb/6/67/Apply-for-a-Homestead-Exemption-in-Florida-Step-1.jpg/aid8705792-v4-728px-Apply-for-a-Homestead-Exemption-in-Florida-Step-1.jpg

The property where you apply for Homestead Exemption must be your primary permanent residence on January 1 of the year for which you are making an application The Pasco County Property Appraiser s Office accepts applications for Homestead Exemption online for your convenience When you move and make a new application for homestead exemption you will be eligible to port all or a portion of the capped value See Portability below for more information Check the status of your exemption application

[desc-10] [desc-11]

Must Know Facts About Florida Homestead Exemptions Lakeland Real Estate

https://lakelandfloridaliving.com/wp-content/uploads/2021/09/homestead-exemption-copy.jpg

How To Apply For A Homestead Exemption In Florida 15 Steps

https://www.wikihow.com/images/thumb/8/80/Apply-for-a-Homestead-Exemption-in-Florida-Step-2.jpg/aid8705792-v4-728px-Apply-for-a-Homestead-Exemption-in-Florida-Step-2.jpg

https://floridarevenue.com/property/pages/...

When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent the property owner may be eligible to receive a homestead exemption that would decrease the property s taxable value by

https://floridarevenue.com/property/documents/pt113.pdf

When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent the property owner may be eligible to receive a homestead exemption up to 50 000 The first 25 000 applies to all property taxes including school district taxes

What Are The Filing Requirements For The Florida Homestead Exemption

Must Know Facts About Florida Homestead Exemptions Lakeland Real Estate

How To File For Florida Homestead Exemption Waypointe Realty YouTube

How To Apply For A Homestead Exemption In Florida 15 Steps

How To Apply For A Homestead Exemption In Florida 15 Steps

Florida Homestead Exemption Explained YouTube

Florida Homestead Exemption Explained YouTube

Florida Original Application For Homestead Legal Forms And Business

SC Application For Homestead Exemption Fill And Sign Printable

Florida Homestead Exemption Application Deadline ASR Law Firm

Homestead Exemption Florida Application - [desc-12]