House Building Loan Income Tax Rebate Web 28 mars 2017 nbsp 0183 32 know about Tax benefit on Home loan Housing loan interest deduction Income Tax rebate on Home loan Find out Income tax exemption and home loan tax

Web 31 mai 2022 nbsp 0183 32 31 May 2022 Home Loan One of the primary benefits of home loans is that you get to enjoy substantial tax rebates which significantly reduce your tax outgo If you already have a home loan Web Under Section 24 of the Income Tax Act an individual can claim a tax deduction of the interest payment on the housing loan up to a maximum amount of Rs 2 00 000 You can

House Building Loan Income Tax Rebate

House Building Loan Income Tax Rebate

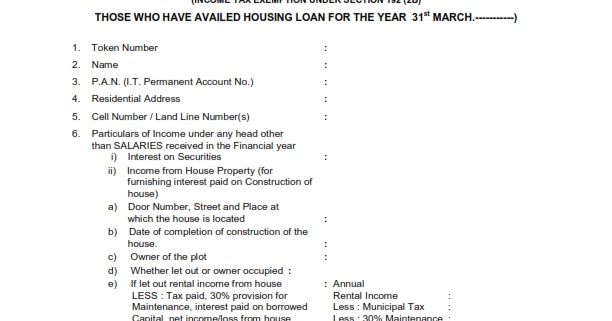

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/w1200-h630-p-k-no-nu/FORM12C_2015_16_001.jpg

How To Calculate Tax Rebate On Home Loan Grizzbye

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

Web 11 janv 2023 nbsp 0183 32 Section 80C Deduction Terms and conditions for home buyers to avail of benefits under Section 80C How to maximise tax rebate under Section 80C Deductions Web 28 janv 2014 nbsp 0183 32 Tax rebate on house loan for under construction property I have purchased a flat which is about to be completed by Dec 2014 As per the law I can get

Web Income tax rebate on home loan Tax deductions Homebuyers in India may deduct up to Rs 1 5 lakhs in principal payments under Section 80C and up to Rs 2 million in interest Web 28 mars 2022 nbsp 0183 32 A 2 5 refund is available on HBA loans provided all requirements connected to the advance s authorisation and recovery of the total amount are met

Download House Building Loan Income Tax Rebate

More picture related to House Building Loan Income Tax Rebate

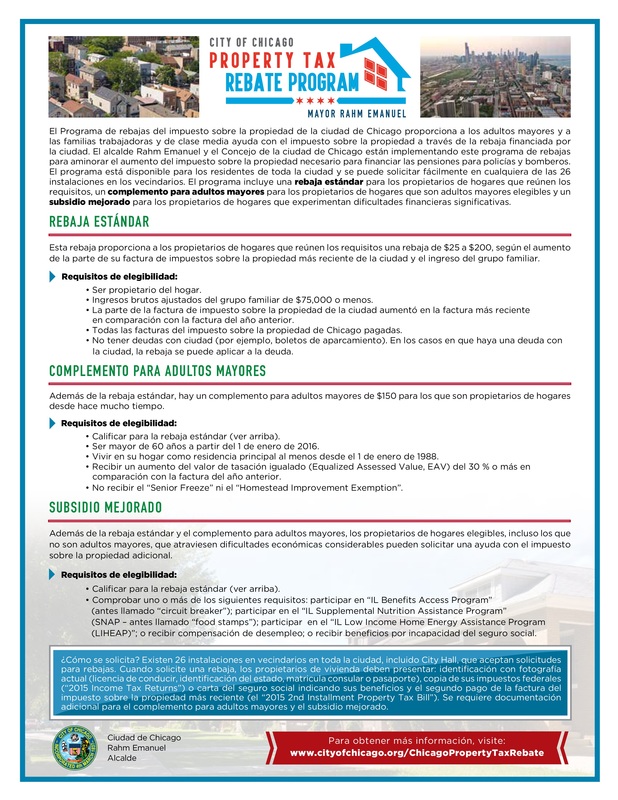

City Of Chicago Proper ty Tax Rebate Program CLARETIAN ASSOCIATES

https://www.claretianassociates.org/uploads/5/4/8/2/54823307/property-tax-rebate-flyer-spanish_orig.jpg

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

https://images.moneycontrol.com/static-mcnews/2021/02/affordable-housing.jpg

Home Loan Tax Benefit Calculator FrankiSoumya

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Web under Section 80C of the Income Tax Act you can claim a maximum home loan tax deduction of up to 1 5 lakh from your annual taxable income on the principal loan Web Income tax benefit on home loan is available under Section 80 EEA which provides income tax benefits of up to Rs 1 5 lakh on the home loan interests paid These home

Web 4 ao 251 t 2021 nbsp 0183 32 FY 2021 22 from July 2021 to March 2022 Rs 1 0 lakh FY 2022 23 from April 2022 to March 2023 Rs 1 2 lakh FY 2023 24 from April 2023 to March 2024 Web 24 ao 251 t 2023 nbsp 0183 32 Updated 24 08 2023 09 31 08 AM The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up to Rs 1 5 lakh on

Tax Rebate 2019 Malaysia Homebuyers To Get Income Tax Rebate On

https://www.rmofsifton.com/wp-content/uploads/2020/09/RMS-FARMLAND-TAX-REBATE.jpg

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

https://assets-news.housing.com/news/wp-content/uploads/2020/02/26180556/Section-80EE-662x400.jpg

https://cleartax.in/s/home-loan-tax-benefit

Web 28 mars 2017 nbsp 0183 32 know about Tax benefit on Home loan Housing loan interest deduction Income Tax rebate on Home loan Find out Income tax exemption and home loan tax

https://navi.com/blog/tax-benefit-on-home-loan

Web 31 mai 2022 nbsp 0183 32 31 May 2022 Home Loan One of the primary benefits of home loans is that you get to enjoy substantial tax rebates which significantly reduce your tax outgo If you already have a home loan

Home Loan Tax Benefits In India Important Facts

Tax Rebate 2019 Malaysia Homebuyers To Get Income Tax Rebate On

Income Tax And Rebate For Apartment Owners Association

Know The Tax Amount You Can Save On Your Home Loan Under Section 24 And

Form 12BB New Form To Claim Income Tax Benefits Rebate

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Joint Home Loan Declaration Form For Income Tax Savings And Non

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

House Building Loan Income Tax Rebate - Web 18 juil 2018 nbsp 0183 32 Home loan becomes necessity to Purchase a house In this article we will discuss the tax benefits which one can avail under the Income Tax Act 1961 on