Marriage Allowance Tax Rebate Phone Number Web Contact HMRC for help with questions about Income Tax including PAYE coding notices and Marriage Allowance and Class 4 National Insurance and for advice on your

Web Telephone 0300 200 3300 Telephone from outside the UK 44 135 535 9022 Monday to Friday 8am to 6pm Find out about call charges After you cancel If you cancel because Web If you have come to the UK and you do not plan to work or study you cannot get a National Insurance number Phone the Income Tax helpline to apply for Marriage Allowance

Marriage Allowance Tax Rebate Phone Number

Marriage Allowance Tax Rebate Phone Number

https://performanceaccountancy.co.uk/wp-content/uploads/2016/07/Marriage_allowance_details.png

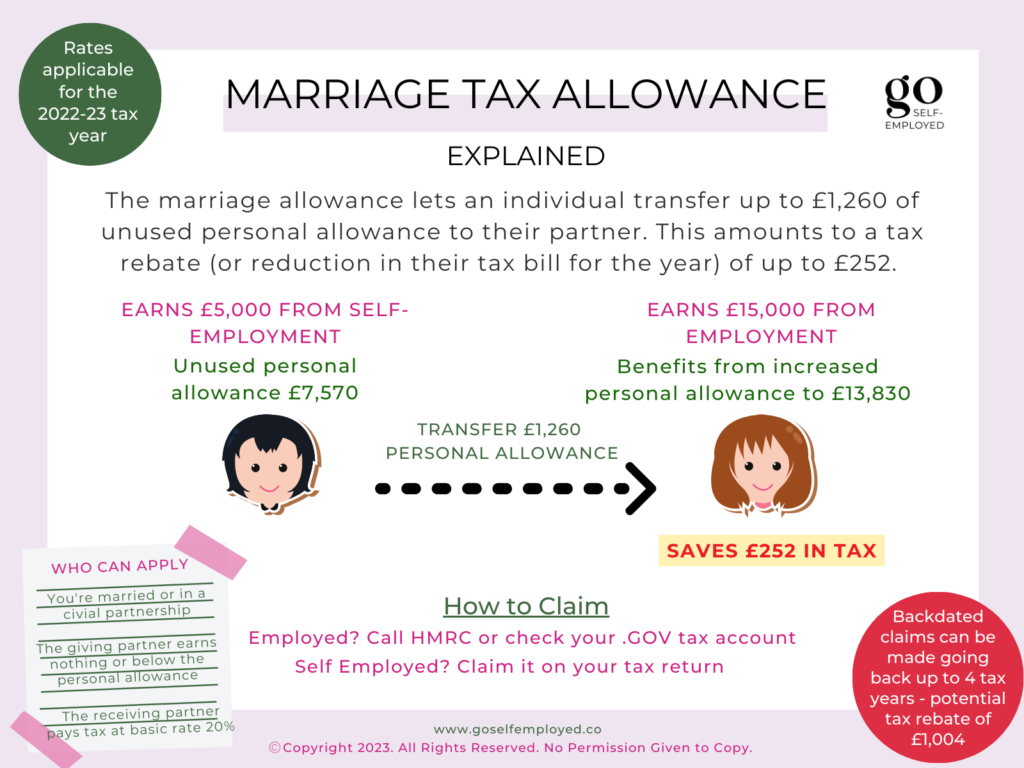

Marriage Tax Allowance Explained Goselfemployed co

https://goselfemployed.co/wp-content/uploads/2018/07/Marriage-Tax-Allowance-1024x768.png

How To Take Advantage Of The Marriage Allowance Tax Rebates

https://www.taxrebates.co.uk/wp-content/uploads/Marriage_Allowance-768x402.jpeg

Web Updated 16 May 2023 If you re married or in a civil partnership and under 88 years old you may be entitled to a 163 1 260 tax break called the Web You can call the Income Tax helpline if you re unsure Changes to your Personal Allowances will be backdated to the start of the tax year 6 April if your application is

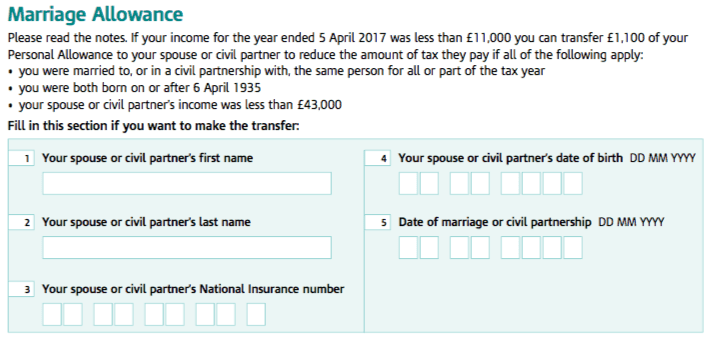

Web 11 f 233 vr 2022 nbsp 0183 32 HM Revenue amp Customs Published 11 February 2022 Married couples and people in civil partnerships could receive extra cash this Valentine s Day as HM Revenue Web How to claim If you fill in a Self Assessment tax return each year Claim by completing the Married Couple s Allowance section of the tax return If you do not fill in a Self

Download Marriage Allowance Tax Rebate Phone Number

More picture related to Marriage Allowance Tax Rebate Phone Number

Marriage Allowance Claim Your 252 Tax Rebate

https://www.pattersonhallaccountants.co.uk/wp-content/uploads/2023/02/Marriage-Allowance-1024x576.jpg

Marriage Tax Allowance Rebate My Tax Ltd

https://www.rebatemytax.com/wp-content/uploads/2020/09/Marriage-Allowance.png

Marriage Tax Allowance Explained Goselfemployed co

https://goselfemployed.co/wp-content/uploads/2018/07/marriage-allowance-self-employed.png

Web 6 avr 2023 nbsp 0183 32 Updated on 6 April 2023 Tax basics The marriage allowance has been in effect since 6 April 2015 Some couples are only just becoming aware of the marriage allowance The good news is that Web Filing and correcting an income tax return Filing a return You can file your return online It s easy reliable and secure and online filers are granted an extended filing deadline

Web 11 sept 2023 nbsp 0183 32 To receive backdated marriage allowance you can apply online or phone the HMRC Income Tax helpline If your partner was the lower earner in the couple the Web Marriage Allowance Claim We ll need your contact details and a few other things to get going National Insurance number P45 and P60 slips if you don t have these your

UK Marriage Allowance

https://static.wixstatic.com/media/cc79c9_99301036cfc64b4c8ca86151700a2b20~mv2.png/v1/fill/w_940,h_788,al_c,q_90/cc79c9_99301036cfc64b4c8ca86151700a2b20~mv2.png

Draw Your Signature Marriage Tax Allowance Rebate

https://phillipsonhardwickadvisory.co.uk/wp-content/uploads/2022/08/Captured.png

https://www.gov.uk/government/organisations/hm-revenue-customs/cont…

Web Contact HMRC for help with questions about Income Tax including PAYE coding notices and Marriage Allowance and Class 4 National Insurance and for advice on your

https://www.gov.uk/marriage-allowance/if-your-circumstances-change

Web Telephone 0300 200 3300 Telephone from outside the UK 44 135 535 9022 Monday to Friday 8am to 6pm Find out about call charges After you cancel If you cancel because

Marriage Allowance Transfers Bradley Accounting

UK Marriage Allowance

Marriage Allowance Tax Rebate YouTube

Marriage Allowances You Can Claim

Tax Claimer Marriage Allowance Tax Rebate

Marriage Tax Allowance Tax Rebate Online

Marriage Tax Allowance Tax Rebate Online

Marriage Allowance Tax Rebate In UK EmployeeTax

Tax Claimer Marriage Allowance Tax Rebate

Marriage Allowance Tax Advantages For Married Couples

Marriage Allowance Tax Rebate Phone Number - Web If you re married or in a civil partnership you may be entitled to a 163 1 150 tax break called marriage tax allowance Claim now with the Rebate Gateway Claim now with the Rebate