House Building Tax Deductions Web Most expenses associated with building a new home are not tax deductible You may deduct no part of your down payment and n part of the principal of your mortgage loan

Web 1 Tax Write Offs for Insulating Your House 2 Refundable amp Nonrefundable Education Tax Credits 3 Documentation Needed for a Geothermal Tax Credit Several tax breaks are available to Web 22 Juni 2023 nbsp 0183 32 Home improvement tax deduction Qualifying improvements to your home that qualify for tax deductions What Home Improvements Are Tax Deductible in 2023

House Building Tax Deductions

House Building Tax Deductions

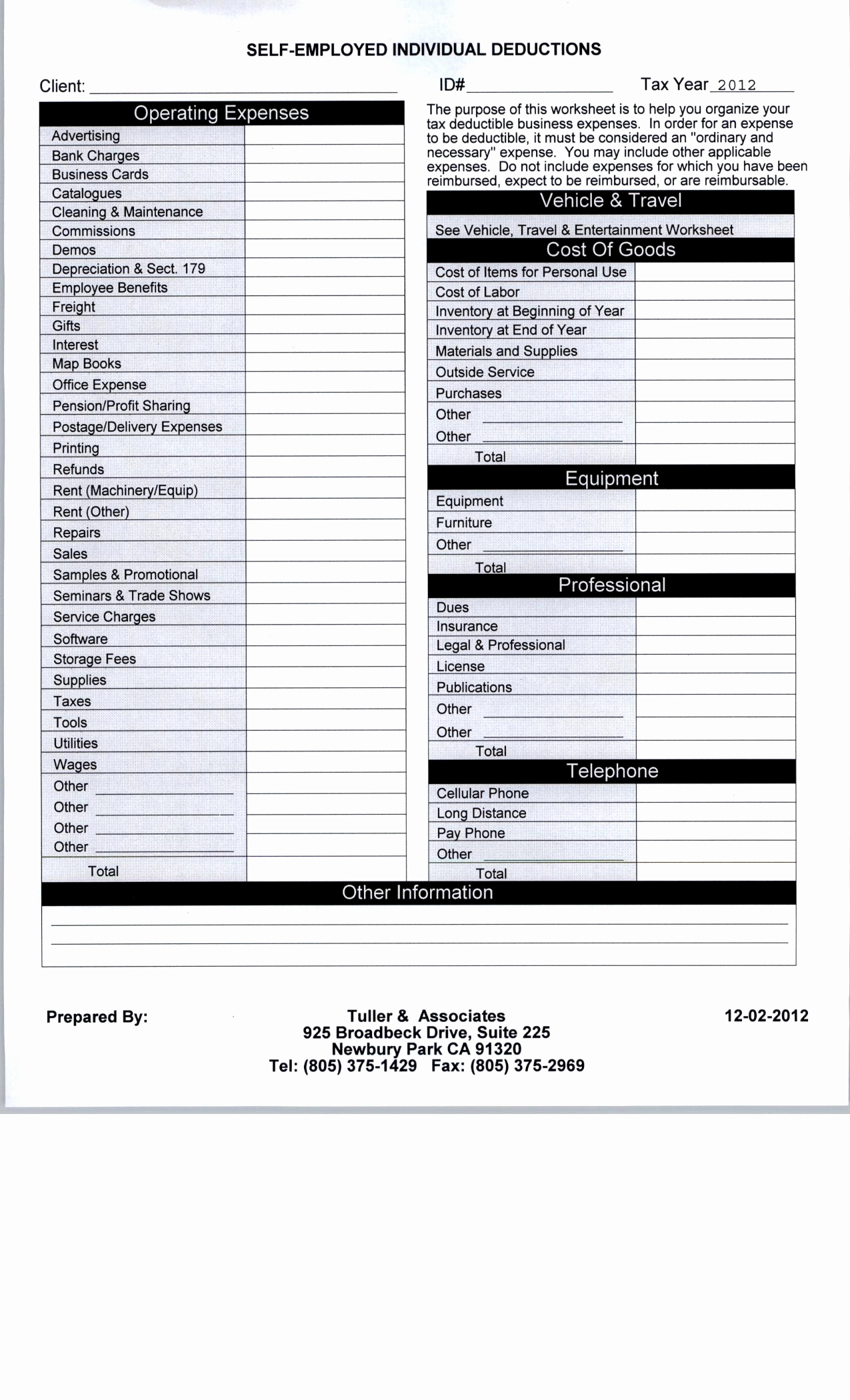

https://www.worksheeto.com/postpic/2014/10/self-employed-tax-deductions-worksheet_526560.png

How To Claim LTDC For Your Business Here s A Complete Process

https://okcredit-blog-images-prod.storage.googleapis.com/2021/01/Tax-deduction2.jpg

![]()

Tax Deduction Tracker Spreadsheet Spreadsheet Downloa Tax Deduction

http://db-excel.com/wp-content/uploads/2019/01/tax-deduction-tracker-spreadsheet-with-donation-spreadsheet-for-taxes-with-checklist-plus-mileage-google.jpg

Web 30 Sept 2010 nbsp 0183 32 Federal tax credits focus on energy generating devices and allow the homeowner to deduct up to 30 percent of the cost of the new system with no upper limit Web 5 Aug 2023 nbsp 0183 32 Are you looking to build a new home A range of tax credits for new home construction can alleviate some of the associated costs There are two types of tax breaks available to you tax deductions and

Web October 14 2022 Charlie Advertisement When you re ready to build your dream home you may be wondering if you can deduct the cost of construction on your taxes The Web 1 Sept 2023 nbsp 0183 32 There are tax credits available for new home construction They come in the form of tax deductions tax breaks and and tax credits A credit is used to reduce the

Download House Building Tax Deductions

More picture related to House Building Tax Deductions

Write It Off Deduct It The A to Z Guide To Tax Deductions For Home

https://i.pinimg.com/originals/08/ba/f5/08baf54ab65817689ab141185fc41895.jpg

Tax Deductions For Rideshare Uber And Lyft Drivers Get It Back Tax

http://www.eitcoutreach.org/wp-content/uploads/1099k.png

Farm Expenses Spreadsheet Charlotte Clergy Coalition

http://charlotteclergycoalition.com/wp-content/uploads/2018/08/farm-expenses-spreadsheet-farm-expense-spreadsheet-for-taxes.jpg

Web Vor 2 Tagen nbsp 0183 32 At a Glance Owning rental property allows for tax deductible depreciation expenses Depreciation is an income tax deduction that recovers the cost of property Web 31 M 228 rz 2023 nbsp 0183 32 The property tax deduction is one of many benefits of being a homeowner but you don t need to own a house to get this tax break there are other ways to qualify Get ready for simple tax

Web 26 Dez 2022 nbsp 0183 32 The deduction for property taxes is subject to certain limits including a cap on the combined amount of state and local taxes that can be deducted which is Web Vor 2 Tagen nbsp 0183 32 The standard deduction is the amount taxpayers can subtract from income if they don t list deductions separately When it comes to filing your taxes one of the first

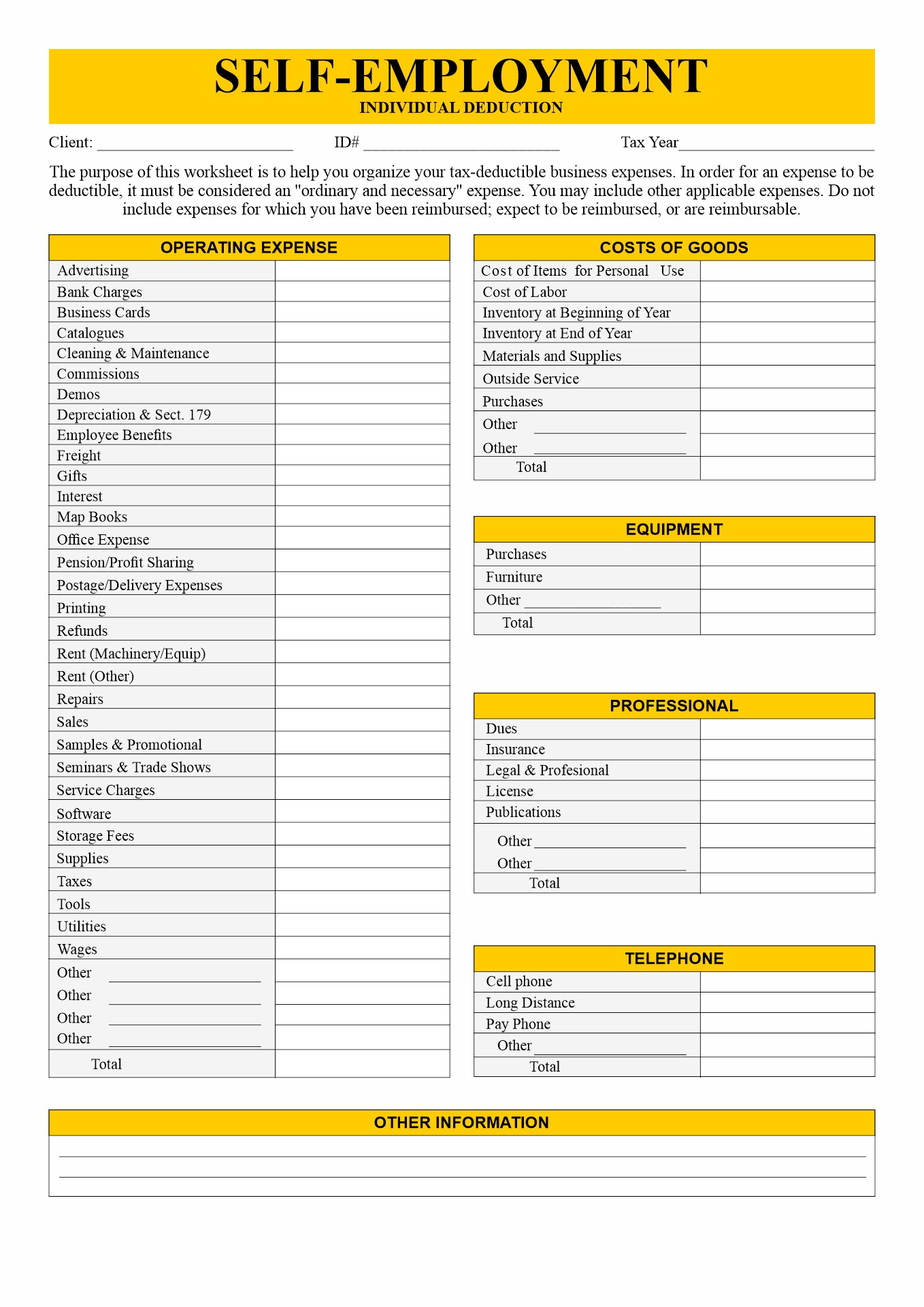

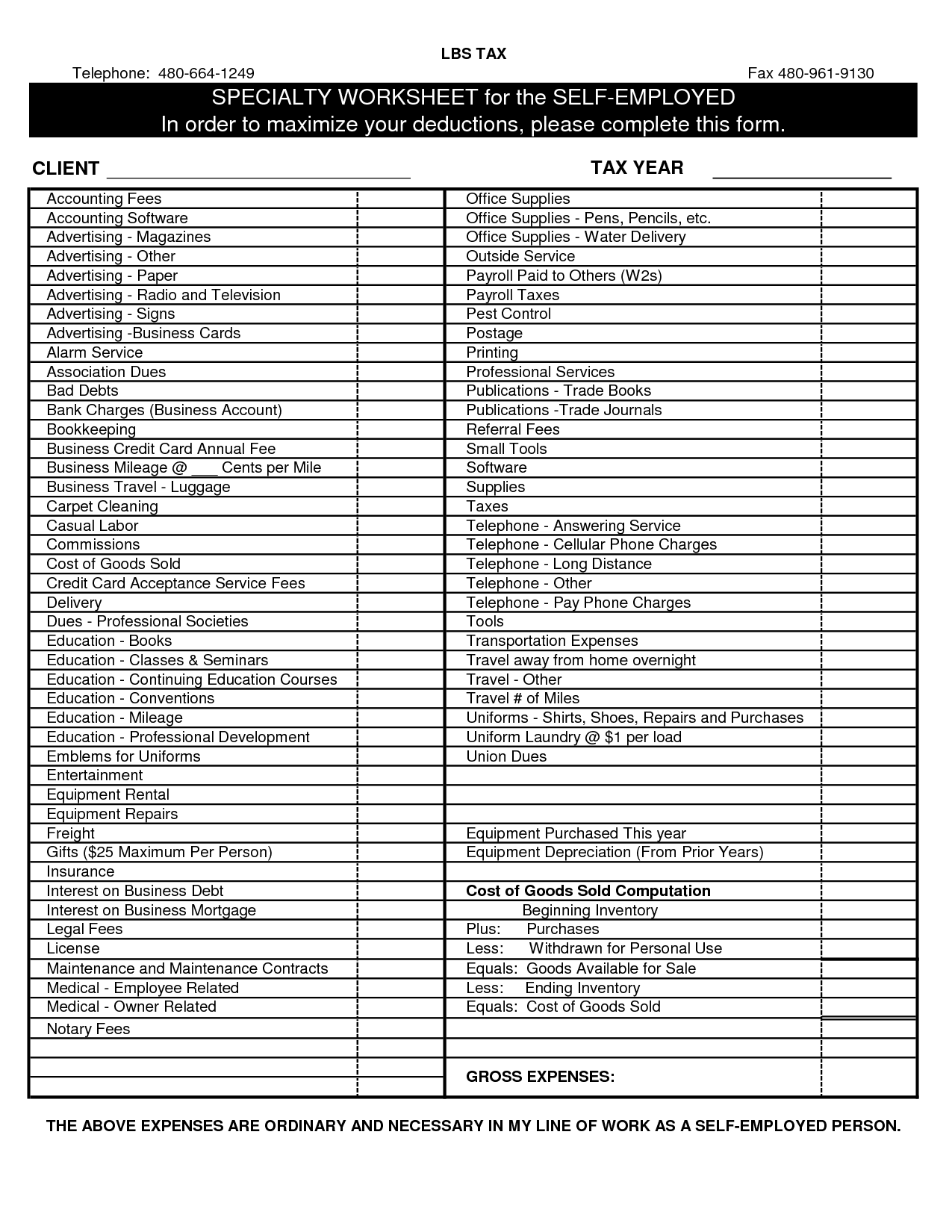

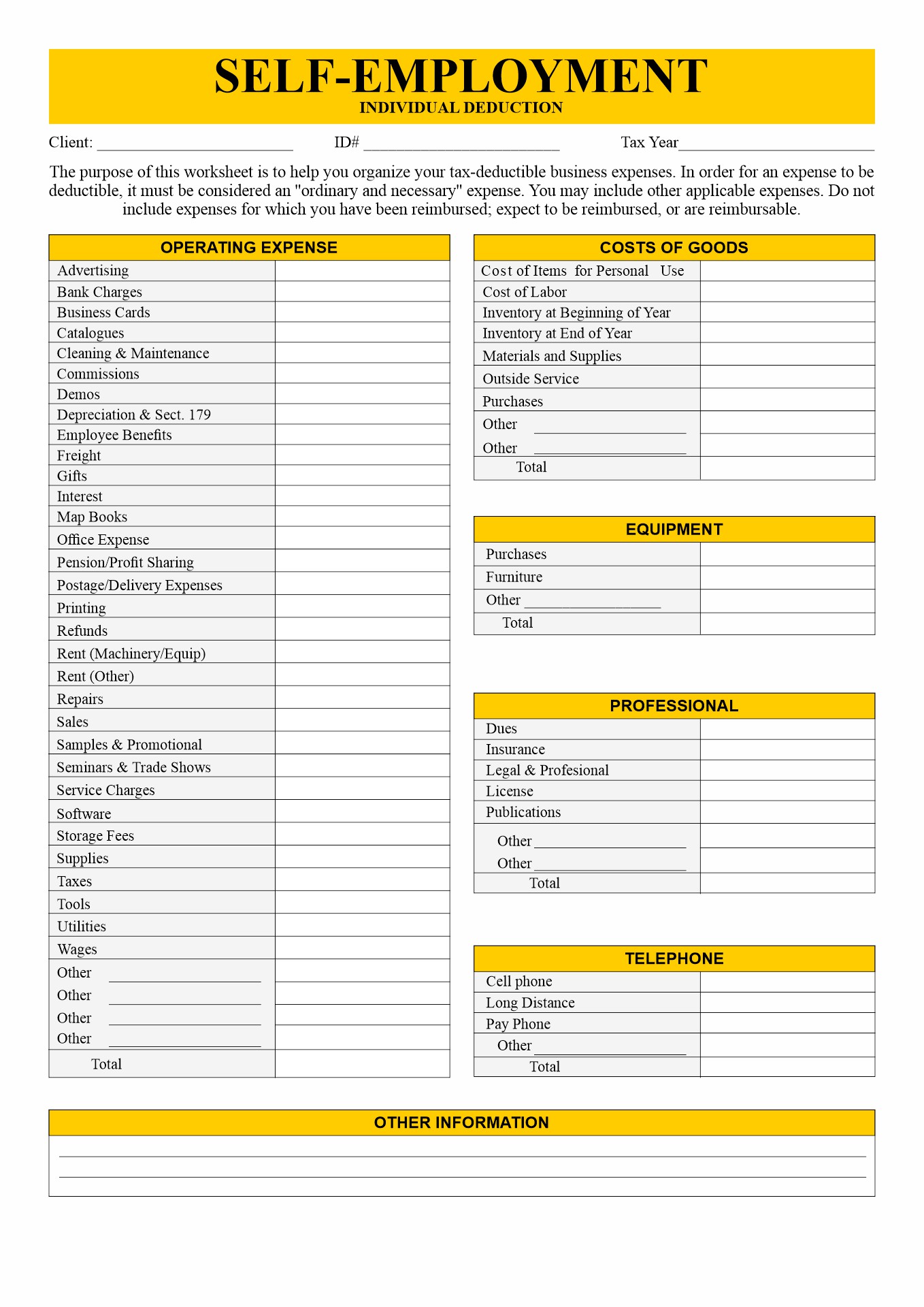

10 Business Tax Deductions Worksheet Worksheeto

https://www.worksheeto.com/postpic/2011/08/tax-itemized-deduction-worksheet_472223.png

8 Tax Itemized Deduction Worksheet Worksheeto

https://www.worksheeto.com/postpic/2009/10/small-business-tax-deduction-worksheet_449384.png

https://budgeting.thenest.com/tax-writeoffs-building-new-home-24347.html

Web Most expenses associated with building a new home are not tax deductible You may deduct no part of your down payment and n part of the principal of your mortgage loan

https://finance.zacks.com/tax-writeoffs-buildi…

Web 1 Tax Write Offs for Insulating Your House 2 Refundable amp Nonrefundable Education Tax Credits 3 Documentation Needed for a Geothermal Tax Credit Several tax breaks are available to

10 Small Business Tax Deductions Worksheet Worksheets Decoomo

10 Business Tax Deductions Worksheet Worksheeto

OECD Releases Final Plan To Crack Down On International Tax Evasion

Income Tax Deductions For Consultants In India

Business Expense Spreadsheet For Taxes New Self Employed Tax And

Tax Credits And Tax Deductions Are Not The Same Thing What s The

Tax Credits And Tax Deductions Are Not The Same Thing What s The

Your 2017 Tax Preparation Checklist The Motley Fool

10 Tax Deduction Worksheet Worksheeto

Claiming Tax Deductions For Property Renovations

House Building Tax Deductions - Web 28 Dez 2022 nbsp 0183 32 A construction tax deduction is a business expense write off that decreases your tax liability with the IRS Those expenses have to qualify your family