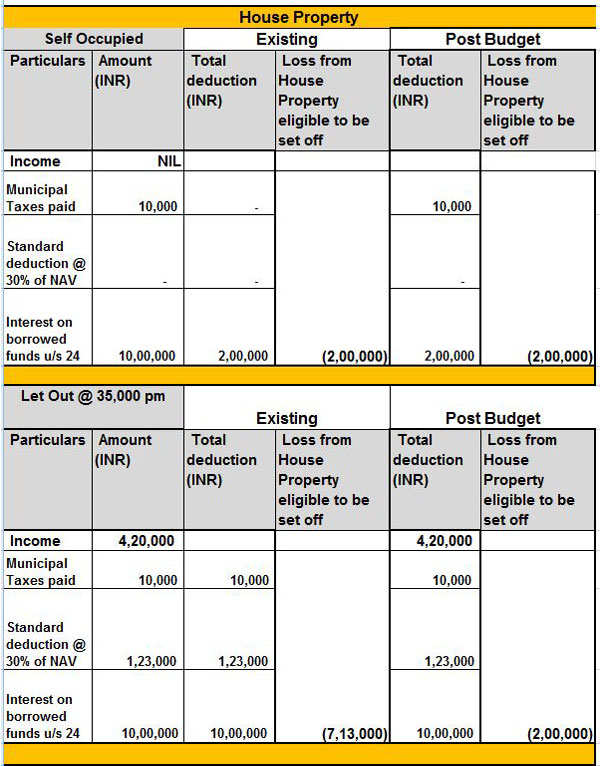

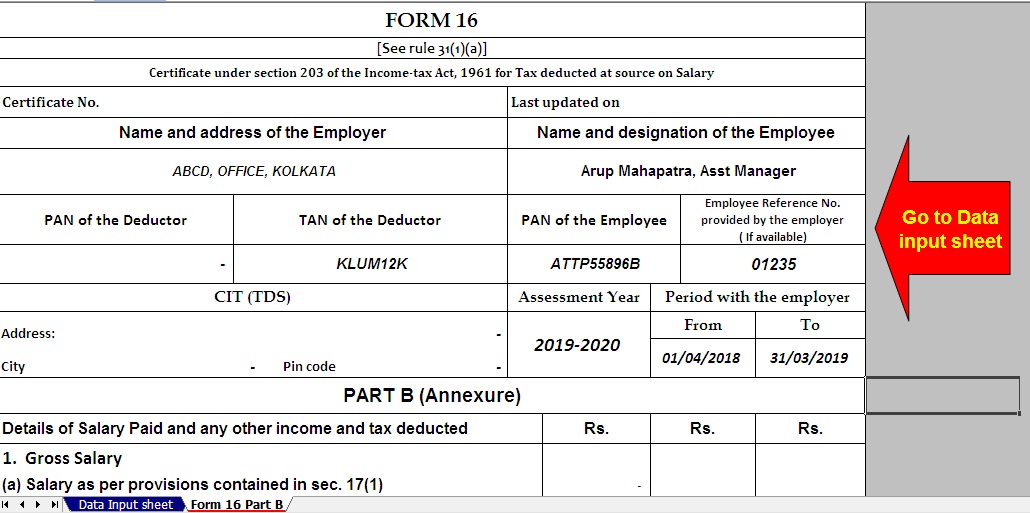

House Loan Interest Rebate In Income Tax Web 11 janv 2023 nbsp 0183 32 Upper limit on tax rebate for senior citizens Rs 2 lakhs per annum Tax deductions allowed on home loan interest Relevant Section s in the income tax law

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From Web under Section 24 of the Income Tax Act you can claim a maximum tax rebate of up to 2 lakh on the interest payable on your home loan however note that these deductions

House Loan Interest Rebate In Income Tax

House Loan Interest Rebate In Income Tax

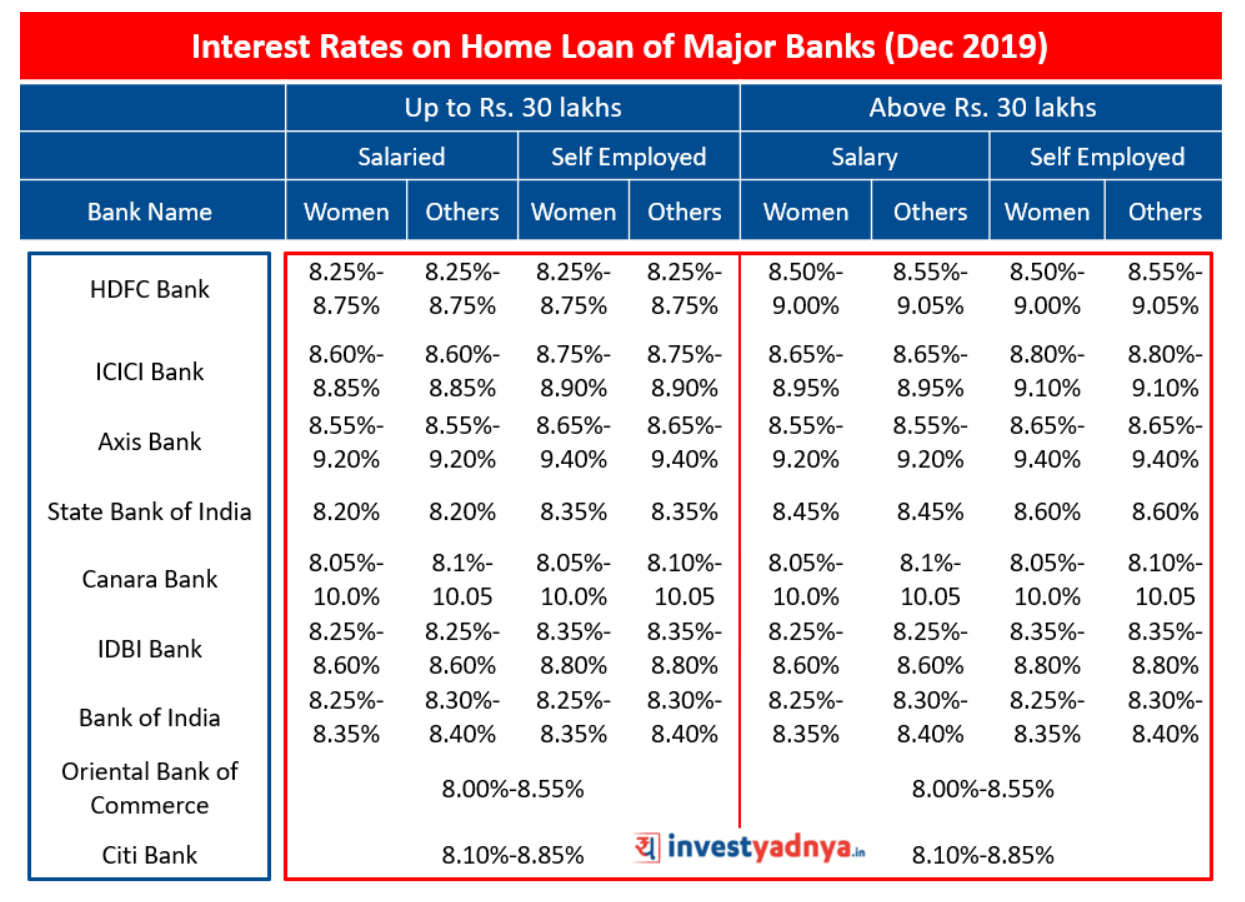

https://blog.investyadnya.in/wp-content/uploads/2019/11/Interest-Rates-on-Home-Loan-of-Major-Banks-Dec-2019_Featured.png

Oct 2016 Best Home Loan Interest Rates In 2016

https://myinvestmentideas.com/wp-content/uploads/2016/04/Latest-and-Lowest-Home-Loan-Interest-Rates-in-India-October-2016.jpg

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

https://assets-news.housing.com/news/wp-content/uploads/2020/02/26180556/Section-80EE.jpg

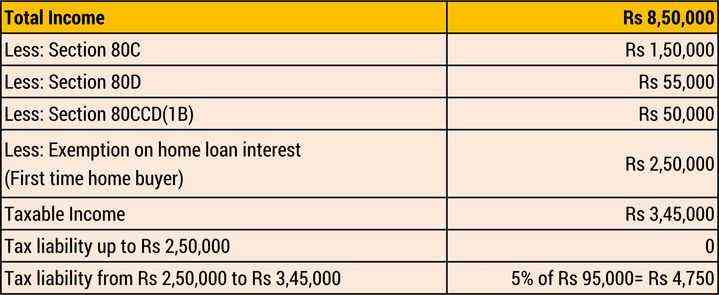

Web You will only receive a tax reduction if the deductible financing interest and fees exceed the amount added to your income for the imputed rental value of your home If your taxable Web 24 ao 251 t 2023 nbsp 0183 32 Sections of Income Tax Act Tax Deduction Section 80C Up to Rs 1 5 lakh on principal repayment including stamp duty and registration fee Section 24 b Up to

Web The maximum deduction on interest paid for self occupied houses is Rs 2 lakh This rule has been in effect from 2018 19 onwards However if your property is a let out then Web 17 mai 2019 nbsp 0183 32 Taxpayers who avail of a top up home loan for repairs or renovation of a house can claim a deduction for interest paid on such loans Under the Act the

Download House Loan Interest Rebate In Income Tax

More picture related to House Loan Interest Rebate In Income Tax

Latest Income Tax Exemptions FY 2017 18 AY 2018 19 Tax Deductions

http://www.relakhs.com/wp-content/uploads/2017/02/Budget-2017-2018-loss-income-from-house-property-limited-to-2-Lakh-interest-on-home-loan-Section-24-rental-income-pic.jpg

Home Loan Tax Benefit Calculator FrankiSoumya

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

Web 3 mars 2023 nbsp 0183 32 As per Section 24 a person can deduct amounts up to Rs 2 lakh an income tax rebate on a home loan from their overall revenue for the interest element of an EMI they paid throughout the year Income Web 7 janv 2023 nbsp 0183 32 There is an express need for more tax sops for home buyers as well as investors The tax rebate on housing loan interest under Section 24 b needs to be hiked to at least Rs 5 lakh This will add momentum

Web 13 juin 2020 nbsp 0183 32 If you have taken a home loan to build purchase a house for your own use then interest paid is eligible for deduction Generally in case of self occupied house the Web Income tax benefit on home loan is available under Section 80 EEA which provides income tax benefits of up to Rs 1 5 lakh on the home loan interests paid These home

Home Loan Interest Rebate On Home Loan Interest In Income Tax

https://3.bp.blogspot.com/-o4djNyyA8DU/T2P0RGOd-fI/AAAAAAAAAys/XWfuzicFqlk/w1200-h630-p-k-no-nu/Untitled.gif

Home Loan Interest Exemption In Income Tax Home Sweet Home

https://apps.indianmoney.com/images/article-images/Tax save 22.jpg

https://housing.com/news/home-loans-guide-claiming-tax-benefits

Web 11 janv 2023 nbsp 0183 32 Upper limit on tax rebate for senior citizens Rs 2 lakhs per annum Tax deductions allowed on home loan interest Relevant Section s in the income tax law

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

Don t Just Consider The Interest Rates When Taking A Home Loan Mint

Home Loan Interest Rebate On Home Loan Interest In Income Tax

House Loan Interest Rates

Home Loan Tax Saving Claiming Home Loan Interest Tax Break On Rented

Income Tax Rebate On Home Loan Fy 2019 20 A design system

Best Home Loan Interest Rates In India For Nri Home Sweet Home

Best Home Loan Interest Rates In India For Nri Home Sweet Home

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated Excel

Home Loan Interest In Itr 4 Home Sweet Home Modern Livingroom

Pag IBIG Or Bank Loan Which Is The Better Housing Loan Lamudi

House Loan Interest Rebate In Income Tax - Web 24 d 233 c 2021 nbsp 0183 32 Answer Since you have already sold the house in respect of which you were entitled to claim pre EMI interest for the next two years as no income is taxable in