House Loan Rebate In Income Tax Web 12 juin 2023 nbsp 0183 32 how much tax benefit on home loan The tax benefit for a home loan as per different sections in Income Tax Acts is listed below Up to Rs 2 lakh under Section 24 b

Web 4 avr 2017 nbsp 0183 32 Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution You can claim a Web 31 mai 2022 nbsp 0183 32 Section 80EE First time homebuyers can enjoy an additional tax rebate of up to Rs 50 000 under Section 80EE provided the loan was sanctioned in FY 2016 17 However there are a few conditions to be

House Loan Rebate In Income Tax

House Loan Rebate In Income Tax

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

Income Tax Rebate On Home Loan Fy 2019 20 A design system

https://www.nitsotech.com/blog/wp-content/uploads/2020/05/taxrebate87a.jpg

Latest Income Tax Rebate On Home Loan 2023

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/table_Rebate-for-Joint-House-Loan.png

Web 2 avr 2022 nbsp 0183 32 So from 1st April 2022 first time home buyers won t be able to claim income tax benefit on up to 1 50 lakh home loan interest payment under Section 80EEA of the Web under Section 24 of the Income Tax Act you can claim a maximum tax rebate of up to 2 lakh on the interest payable on your home loan however note that these deductions are

Web 26 juil 2018 nbsp 0183 32 In case you are living in the house for which home loan is taken both of you shall be entitled to deduction in the ratio 3 1 on account of interest on borrowed money Web Section 80EEA Under Section 80EEA of the Income Tax Act 1961 first time home buyers can claim an additional deduction of up to Rs 1 5 lakh on the interest paid on home

Download House Loan Rebate In Income Tax

More picture related to House Loan Rebate In Income Tax

Home Loan Tax Benefit Calculator FrankiSoumya

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

What Are Reuluations About Getting A Home Loan On A Forclosed Home

https://www.paisabazaar.com/wp-content/uploads/2017/11/Tax-benefits-of-home-loan_2.jpg

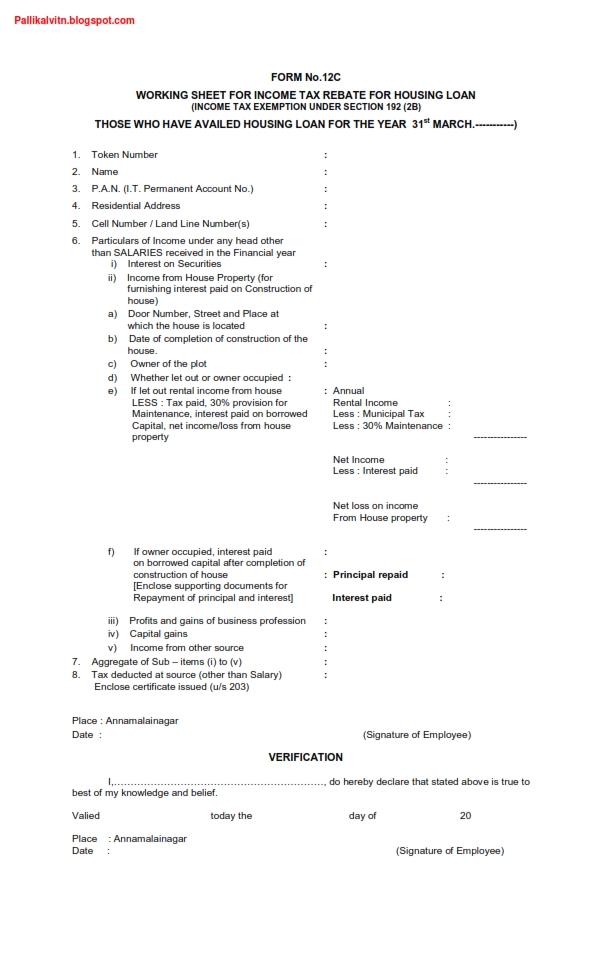

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/w1200-h630-p-k-no-nu/FORM12C_2015_16_001.jpg

Web Income Tax Benefits on Home Loans The Income Tax Act 1961 offers various provisions for a tax rebate on home loans The following are the three major areas where such a Web 24 ao 251 t 2023 nbsp 0183 32 Updated 24 08 2023 09 31 08 AM The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up to Rs 1 5 lakh on

Web Income tax rebate on home loan Tax deductions Tax deductions for a mortgage loan FY 2022 23 Repayment of a home loan s principal is tax deductible under Section 80C Web 31 mars 2022 nbsp 0183 32 In 2020 21 the Union Minister of India announced that all old regimes of income tax rebates on home loans are applicable till the year 2024 The following are

Know The Tax Amount You Can Save On Your Home Loan Under Section 24 And

https://i.pinimg.com/originals/07/68/e8/0768e843fce468a6a866abfdec4820d1.jpg

Home Loan Tax Benefits In India Important Facts

https://propertyadviser.in/assets/front/images/real-estate-news/s1/income-tax-rebate-on-home-loan-819-s1.jpg

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 how much tax benefit on home loan The tax benefit for a home loan as per different sections in Income Tax Acts is listed below Up to Rs 2 lakh under Section 24 b

https://cleartax.in/s/section-80ee-income-tax-deduction-for-interest...

Web 4 avr 2017 nbsp 0183 32 Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution You can claim a

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

Know The Tax Amount You Can Save On Your Home Loan Under Section 24 And

Latest Income Tax Rebate On Home Loan 2023

DEDUCTION UNDER SECTION 80C TO 80U PDF

Home Loan Rebate In Income Tax In Hindi

SBI Credai Sign MoU For Home Loan Rebate For Budget Housing

SBI Credai Sign MoU For Home Loan Rebate For Budget Housing

Interim Budget 2019 20 The Talk Of The Town Trade Brains

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

Tax Rebate On Income Upto 5 Lakh Under Section 87A

House Loan Rebate In Income Tax - Web Section 80C deals with the principal amount deductions For both self occupied and let out properties you can claim up to a maximum of Rs 1 5 lakh every year from taxable