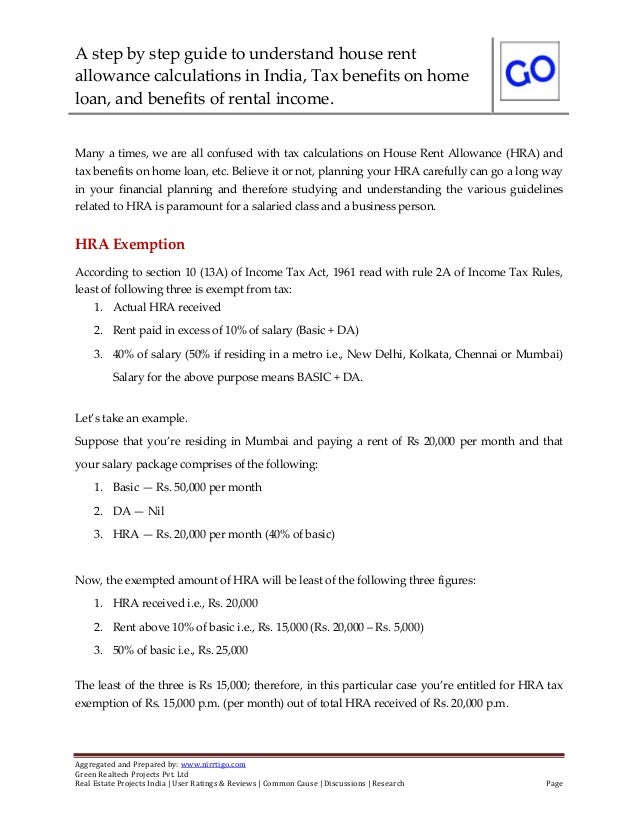

Tax Rebate For House Loan Web 11 janv 2023 nbsp 0183 32 Tax deductions allowed on home loan principal stamp duty registration charge Relevant Section s in the income tax law Section 80C Upper limit on tax

Web 28 mars 2017 nbsp 0183 32 know about Tax benefit on Home loan Housing loan interest deduction Income Tax rebate on Home loan Find out Income tax exemption and home loan tax Web under Section 80C of the Income Tax Act you can claim a maximum home loan tax deduction of up to 1 5 lakh from your annual taxable income on the principal loan

Tax Rebate For House Loan

Tax Rebate For House Loan

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

Latest Income Tax Rebate On Home Loan 2023

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/table_Rebate-for-Joint-House-Loan.png

What Are Reuluations About Getting A Home Loan On A Forclosed Home

https://www.paisabazaar.com/wp-content/uploads/2017/11/Tax-benefits-of-home-loan_2.jpg

Web 12 juin 2023 nbsp 0183 32 Updated on Jun 15th 2023 9 min read CONTENTS Show Acquiring a home loan can provide opportunities to save on taxes in accordance with the Web You will be eligible for a tax deduction of up to 1 5 lakh on the principal amount you paid in the EMIs for both the houses which are bought using home loans If the second house

Web 2 avr 2022 nbsp 0183 32 New income tax rules from April 2022 Those first time home buyers who have got home loan sanction letter before 1st April 2022 and their property value is less than Web 24 ao 251 t 2023 nbsp 0183 32 The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up to Rs 1 5 lakh on principal repayment under Section 80C

Download Tax Rebate For House Loan

More picture related to Tax Rebate For House Loan

Home Loan Tax Benefit Calculator FrankiSoumya

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/w1200-h630-p-k-no-nu/FORM12C_2015_16_001.jpg

How To Calculate Tax Rebate On Home Loan Grizzbye

https://image.slidesharecdn.com/houserentallowancecalculationsandhowtocalculatetaxbenefitsonhomeloaninindia-140205024645-phpapp02/95/house-rent-allowance-calculations-and-how-to-calculate-tax-benefits-on-home-loan-in-india-1-638.jpg?cb=1391568542

Web If your taxable income in 2021 exceeds 68 507 69 398 in 2022 it s important to note that you can offset the deductible mortgage interest at a maximum rate of 43 in 2021 while Web Tax credits and rebates for home energy efficiency The credits in the IRA fall mainly into two categories the Residential Clean Energy Credit and the Energy Efficient Home

Web 1 f 233 vr 2021 nbsp 0183 32 Under Section 80C you can claim a deduction of Rs 1 5 lakh against the principal repaid during the year This is the upper limit of the deduction you can claim Web Eligibility EMI Calculator Required Documents Fees amp Charges Interest Rates Balance Transfer Tax benefit on Home loan FY 2023 24 Home loan tax benefit is among the

Know The Tax Amount You Can Save On Your Home Loan Under Section 24 And

https://i.pinimg.com/originals/07/68/e8/0768e843fce468a6a866abfdec4820d1.jpg

Pennsylvania Property Tax Rent Rebate 5 Free Templates In PDF Word

http://www.formsbirds.com/formimg/pennsylvania-property-taxrent-rebate/21102/pa-1000-2014-property-tax-or-rent-rebate-claim-d1.png

https://housing.com/news/home-loans-guide-claiming-tax-benefits

Web 11 janv 2023 nbsp 0183 32 Tax deductions allowed on home loan principal stamp duty registration charge Relevant Section s in the income tax law Section 80C Upper limit on tax

https://cleartax.in/s/home-loan-tax-benefit

Web 28 mars 2017 nbsp 0183 32 know about Tax benefit on Home loan Housing loan interest deduction Income Tax rebate on Home loan Find out Income tax exemption and home loan tax

Home Loan Tax Benefits In India Important Facts

Know The Tax Amount You Can Save On Your Home Loan Under Section 24 And

Realtors Seek Tax Rebate On House Loans

Latest Income Tax Rebate On Home Loan 2023

Income Tax Deductions List FY 2020 21 Save Tax For AY 2021 22

New Housing Tax Rebate Canada Home Tax Rebate Rebates Tax Canada

New Housing Tax Rebate Canada Home Tax Rebate Rebates Tax Canada

How Do Banks Determine Home Loan Amounts LOANOLK

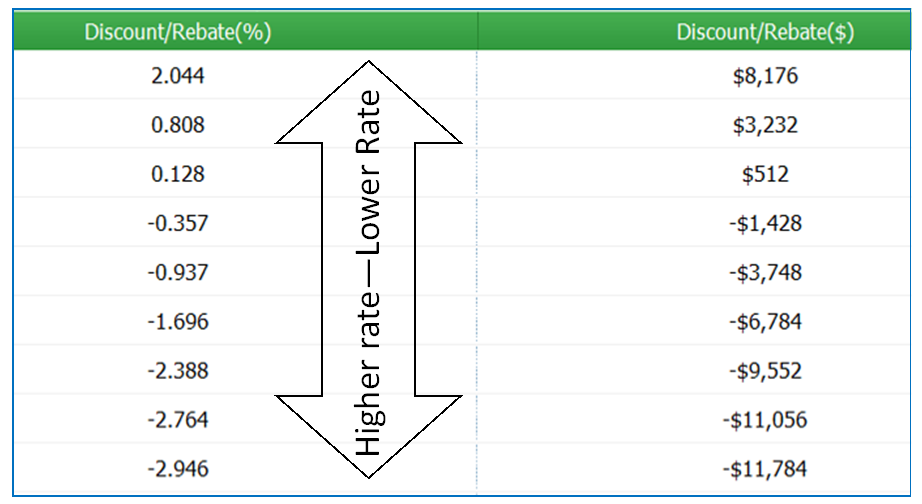

Using Rebate Pricing To Reduce Closing Cost On Your Refi Or Home Purchase

Tax Rebate 2019 Malaysia Homebuyers To Get Income Tax Rebate On

Tax Rebate For House Loan - Web Introduction Useful Items You may want to see State and Local Real Estate Taxes Where to deduct real estate taxes Real estate taxes paid at settlement or closing