Tax Return For Mortgage Loan When you apply for a mortgage your lender might ask for your tax returns Here s why they re requested and how they can affect your mortgage application

You can deduct the mortgage interest you paid during the tax year on the first 750 000 of your mortgage debt for your primary home or a second home If you are married filing separately the The mortgage interest deduction is a tax incentive for homeowners This itemized deduction allows homeowners to subtract

Tax Return For Mortgage Loan

Tax Return For Mortgage Loan

https://www.taxslayer.com/blog/wp-content/uploads/2023/02/Tax-Breaks-for-Homeowners-and-Renters-min-8.jpg

Mortgage Without Tax Returns 2023 Guide

https://homeabroadinc.com/wp-content/uploads/2023/08/No-Tax-Return-Mortgage.jpg

Belated Filing Of Income Tax Return FY 2019 20 Onlineideation

https://www.onlineideation.in/files/Belated-Filing-of-Income-Tax-Return-for-AY-2019-20-Onlineideation.jpg

Here s what you should know about claiming the mortgage interest deduction on your federal income tax return How does mortgage interest deduction work With the mortgage interest deduction MID you can write off a portion of the interest on your home loan lowering your taxable income and potentially moving you into a lower tax bracket

Mortgage interest is tax deductible on mortgages of up to 750 000 unless the mortgage was taken out before Dec 16 2017 then it s tax deductible on mortgages of up to 1 million A mortgage calculator can help you This interview will help you determine if you re able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage related

Download Tax Return For Mortgage Loan

More picture related to Tax Return For Mortgage Loan

Mortgage Without Tax Returns Required Options For 2024 Dream Home

https://dreamhomefinancing.com/wp-content/uploads/2022/07/No-Tax-Return-mortgage-1.jpg

32 Steps In Completing A Tax Return For Physicians MedTax ca

https://medtax.ca/wp-content/uploads/2021/07/income-tax-return-words-in-3d-wooden-letters-in-cr-HR89U2N-scaled.jpg

Self Employment Tax Return Form 2022 Employment Form

https://www.employementform.com/wp-content/uploads/2022/08/self-employment-tax-return-form-2022.jpg

If you own your own home you might be able to save on your tax returns Get the most value from your home with these seven tax deductions The home mortgage interest deduction HMID allows homeowners who itemize on their tax returns to deduct mortgage interest paid on up to 750 000 worth of their loan principal The HMID

The mortgage interest deduction is a tax incentive for homeownership It lets some taxpayers write off some of the interest charged by their home loan The deduction once was a staple of Income is going to be calculated based on your Federal Tax Returns General rule of thumb is that a two year average will be used Caveats to this are if you have been self

Track Down Income And Claims Before Filing Your Tax Return For 2022

https://bnh.finance/wp-content/uploads/2022/12/income-tax-return-2022-e1671091416470.jpg

Income Tax Return Filing ITR For FY 2022 23 Important Tips Form 16

https://static.toiimg.com/thumb/msid-100690943,width-1070,height-580,imgsize-23082,resizemode-75,overlay-toi_sw,pt-32,y_pad-40/photo.jpg

https://better.com › content › what-do-m…

When you apply for a mortgage your lender might ask for your tax returns Here s why they re requested and how they can affect your mortgage application

https://www.nerdwallet.com › article › t…

You can deduct the mortgage interest you paid during the tax year on the first 750 000 of your mortgage debt for your primary home or a second home If you are married filing separately the

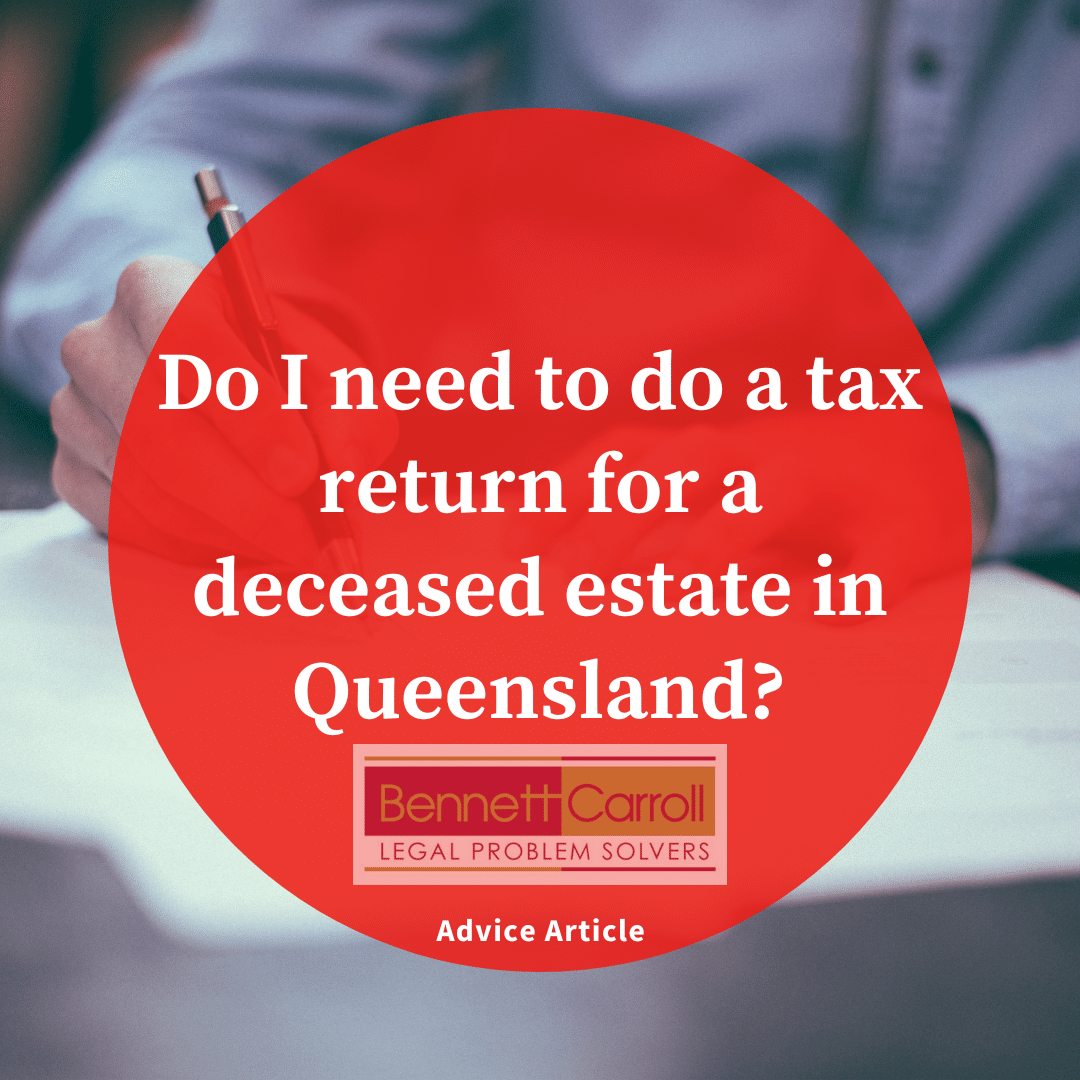

Do I Need To Do A Tax Return For A Deceased Estate In Queensland

Track Down Income And Claims Before Filing Your Tax Return For 2022

Mortgage Loan Payment Schedule

Breakdown Of Tax Return Filers Revealed By HMRC As This Year s January

The CRA Has Flagged My Tax Return For Review Now What Genesa CPA Corp

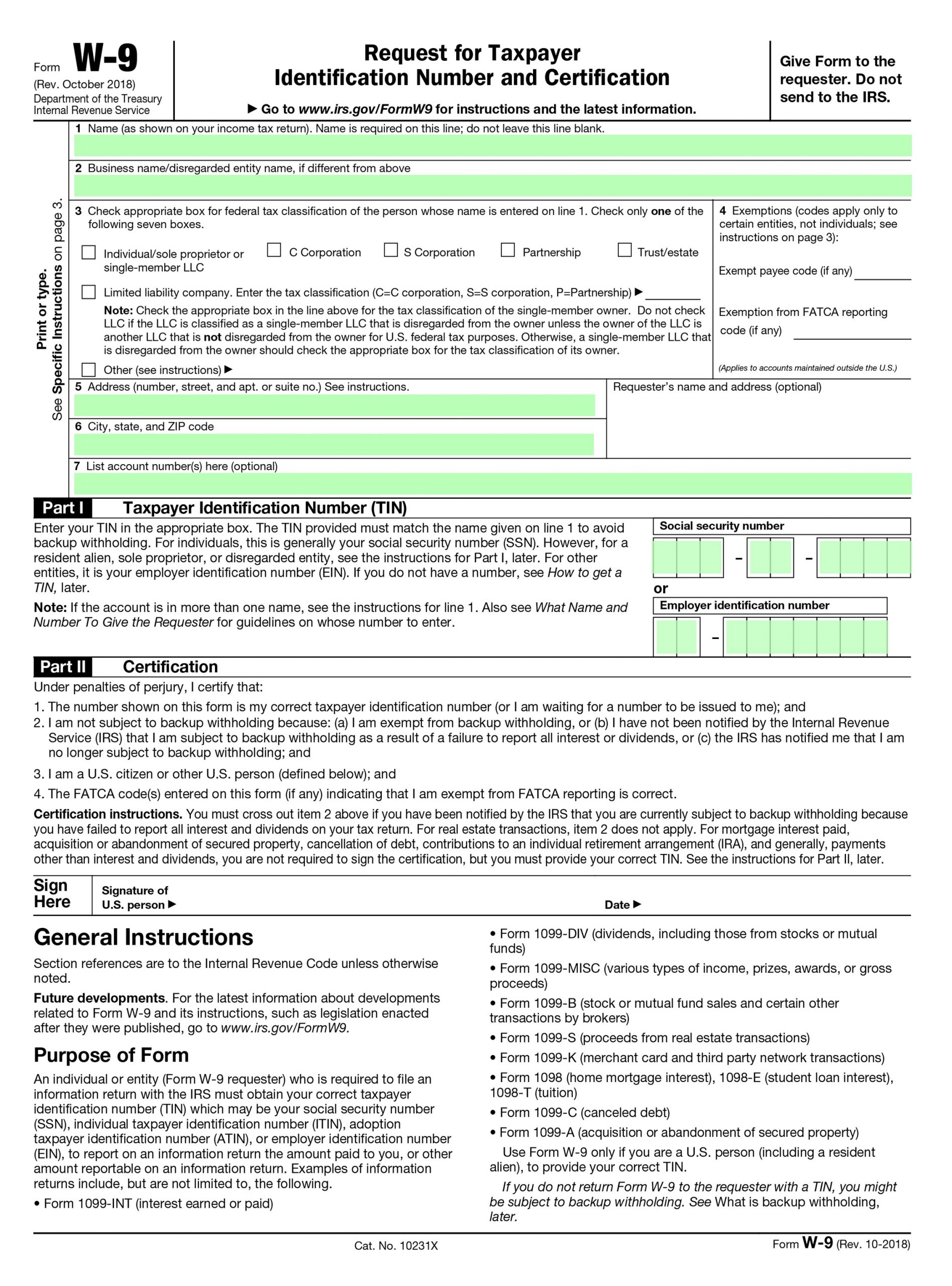

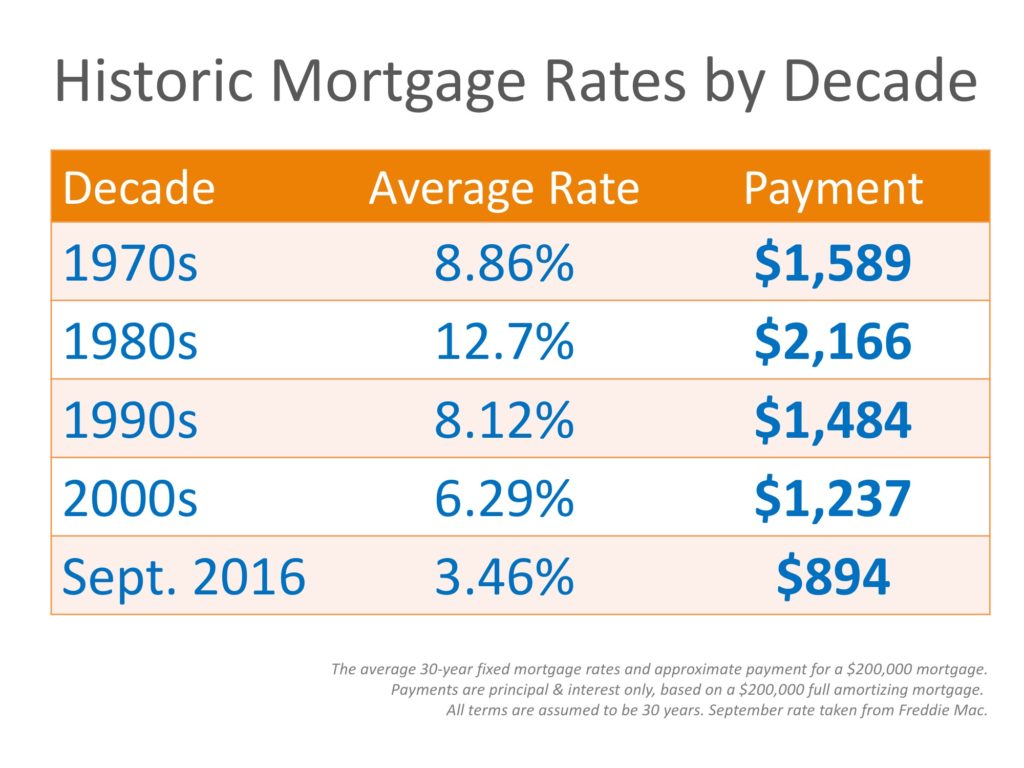

Mortgage Rates By Decade Compared To Today INFOGRAPHIC Steve Casalenda

Mortgage Rates By Decade Compared To Today INFOGRAPHIC Steve Casalenda

Tax Return Preparation Complete Guide 2022 Jasim Uddin Rasel

Do I Need To File A 2019 Tax Return TYSLLP

Webinar Income Tax Return For Residents And Non Residents On Vimeo

Tax Return For Mortgage Loan - This interview will help you determine if you re able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage related