Tax Rebate For Second Home Loan 1 One flat is given on rent of Rs 15000 per month For this flat home loan interest per annum is Rs 1 41 859 2 Second flat is also given on rent of Rs 15000

Under the income tax laws there are no restrictions on the number of houses for which you can claim the tax benefits for home loan Whether you have one home loan Yes you claim deductions on two home loans within the specific limit under Section 24 Rs 2 lakhs per annum if the properties are self occupied Only for your first home you can claim benefits under

Tax Rebate For Second Home Loan

Tax Rebate For Second Home Loan

https://cdn.centraljersey.com/wp-content/uploads/sites/28/2022/01/20425_rev_rentRebate_NK_01-scaled.jpg

Lhdn Tax Relief 2016 Megan Quinn

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi4EoUCYcQMowVkFCssu_CdI43zIKHrVC46Kba3BHcmZh3oeO18l7EDF2MRUyAcTAsJGJ4xoe-Ekdnfv4_Pv7Vwf9uH3fIfSDaX5l9O3cEd7zdy7J1TPcGn75nLB59_9Nl_SqNTLkJeFhMTJtIwlgtqjSOzqw1iz42LdAJ22TGq8dO7vpInhBCvgVt7/s1600-e60/Tax rebates 2021.jpg

Tax Rebate For Individuals Swaper Investing Blog

https://swaper.com/blog/wp-content/uploads/SWAPER_blogpost_tax_1920x1080-1536x864.png

While you might not be able to take Section 80C deductions on the loan s principal amount in the instance of your second home you might get an income tax rebate on a second home loan If you need help The answer to that is a resounding yes Read on to know more While purchasing a home has always been considered a good investment option the tax benefits on home loans were earlier restricted to only one loan

For maintenance purposes and general upkeeps the owner of that let out property can claim a tax rebate of 30 Under Section 24 of IT Act one can avail For tax years prior to 2018 you can write off 100 of the interest you pay on up to 1 1 million of debt secured by your first and second homes and used to acquire or

Download Tax Rebate For Second Home Loan

More picture related to Tax Rebate For Second Home Loan

Rebates

https://cljgives.org/wp-content/uploads/2017/08/20170809-MM0000809-rebates.png

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/9e98951b-5acf-419a-afcd-ce4692a6a772/2023-12-31+property+tax+rebate+DEADLINE.2-insta.jpg

Pennsylvania s Property Tax Rent Rebate Program May Help Low income

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/1648504189519-EYNC86JYEGG20QUA9STL/2022-PA+Dept+of+Revenue+property+tax-rent+rebate_Page_1.jpg

If your second property is considered a personal residence you can deduct mortgage interest in the same way you would on your primary home up to 750 000 if you are single or married Tax Benefits for Second Home Loan Those who own two homes are eligible for a bevy of tax breaks However if you have previously paid off your house loan in full you will not

Tax benefit on Home loan FY 2023 24 Home loan tax benefit is among the most important features of a home loan Tax saving on home loan increases the affordability of your Proc 2021 47 provides an optional method for certain homeowners who itemize their deductions to determine the amount you can deduct for home mortgage interest and

What Are The Income Tax Benefits On Second Home Loan In India

https://i1.wp.com/www.thewealthwisher.com/wp-content/uploads/2012/05/cache_4096473769.jpg?fit=1024%2C682&ssl=1

Tax Rebate For Small And Medium Enterprise Battchoo Yong

https://www.battchoo.com/wp-content/uploads/2022/10/Tax-Rebates-SME.png

https://taxguru.in/income-tax/income-tax-benefits...

1 One flat is given on rent of Rs 15000 per month For this flat home loan interest per annum is Rs 1 41 859 2 Second flat is also given on rent of Rs 15000

https://www.livemint.com/money/personal-finance/i...

Under the income tax laws there are no restrictions on the number of houses for which you can claim the tax benefits for home loan Whether you have one home loan

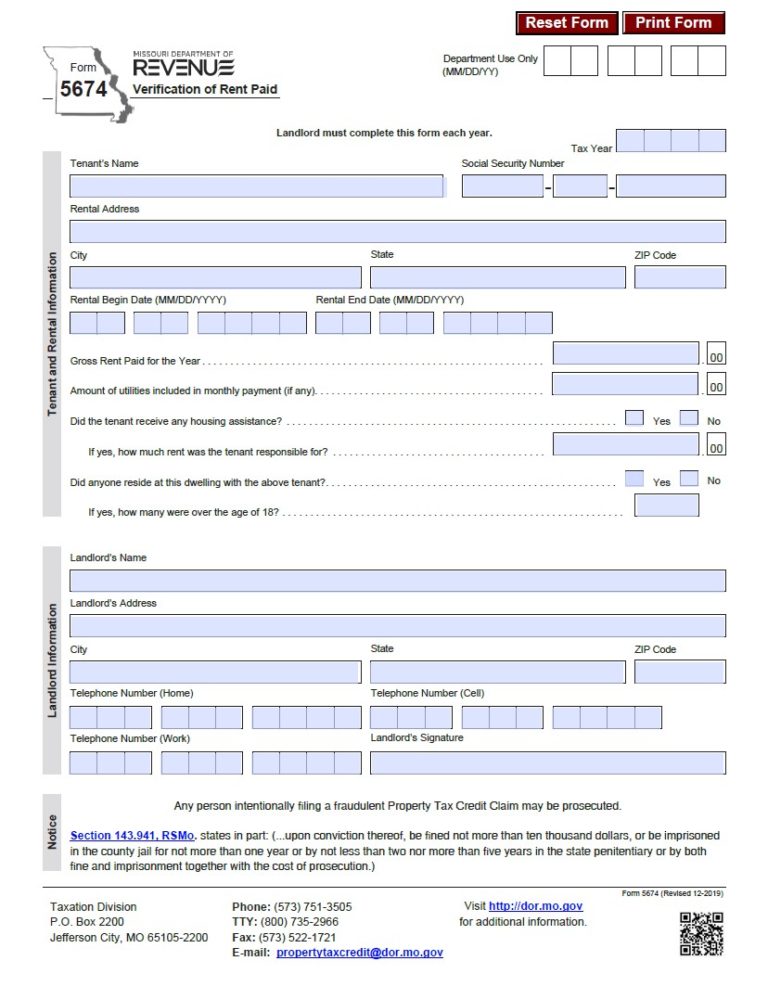

Rent Rebate Form Missouri Printable Rebate Form

What Are The Income Tax Benefits On Second Home Loan In India

Federal Tax Credits For Air Conditioners Heat Pumps 2023

Section 87A Income Tax Rebate

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template

State Income Tax Rebate Arrives McHenry County Blog

State Income Tax Rebate Arrives McHenry County Blog

.png?ixlib=gatsbyFP&auto=compress%2Cformat&fit=max&fit=crop&w=1200&h=630&dpr=2)

Mechanics Tax Rebate Don t Let Your Tool Tax Throw A Spanner In The

Tax Benefit On Second Home Loan Money Doctor Show English EP 160

Latest Income Tax Rebate On Home Loan 2024

Tax Rebate For Second Home Loan - If you buy a second home on Home Loan you can even avail of tax deductions on it While deductions under Section 80C on the principal amount of the loan may not be