How To Claim Tax Benefit For Second Home Loan Concerning the deduction of repayment of principal repayment under Section 80C you can claim the same within the overall limit of 1 50 lakh along with other

By following these steps diligently you can effectively claim the tax benefits on your second home loan potentially leading to substantial savings on your tax To claim a tax benefit on your second home loan follow these steps Make sure the home loan is applied and granted under your name In case you are the

How To Claim Tax Benefit For Second Home Loan

How To Claim Tax Benefit For Second Home Loan

https://cdn.zeebiz.com/sites/default/files/styles/zeebiz_850x478/public/2018/01/31/28845-tax-pixabay.jpg?itok=_WFcBXXo&c=677b8bac55e75f19021565b82b592445

How To Claim Tax Benefit On Term Insurance Plans By Rimita Desai

https://miro.medium.com/max/634/1*lFmPQKw3O8_i_XBEjvVMvQ.jpeg

Claiming Tax Benefit On Serious Ailment Expenses Made Easy

https://i.ndtvimg.com/i/2015-09/income-tax_650x488_41442140391.jpg

Benefits of second home loan Under Section 80C You can claim a deduction on the principal amount repayment under section 80C of the income tax act The maximum If you are making such investments for the second time and acquiring funds for that through a home loan there are certain tax rebates you can enjoy Let us help you understand on which conditions you can

Answer Yes you can claim a home loan tax benefit on the second property This includes deductions on both the principal repayment under Section 80C and the interest payment under Section 24 b subject to If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs

Download How To Claim Tax Benefit For Second Home Loan

More picture related to How To Claim Tax Benefit For Second Home Loan

PM Cares Fund

https://d2k7qun4ucuqn1.cloudfront.net/wp-content/uploads/2021/07/income-tax-2.jpg

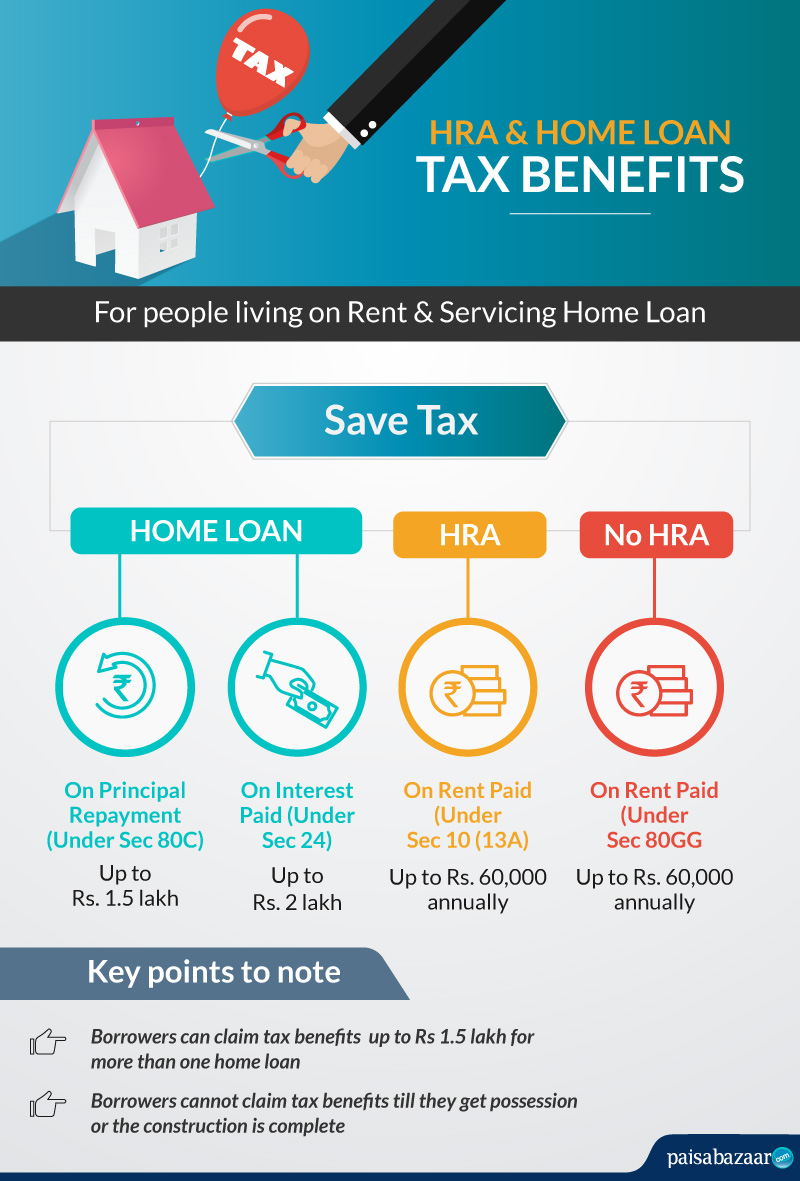

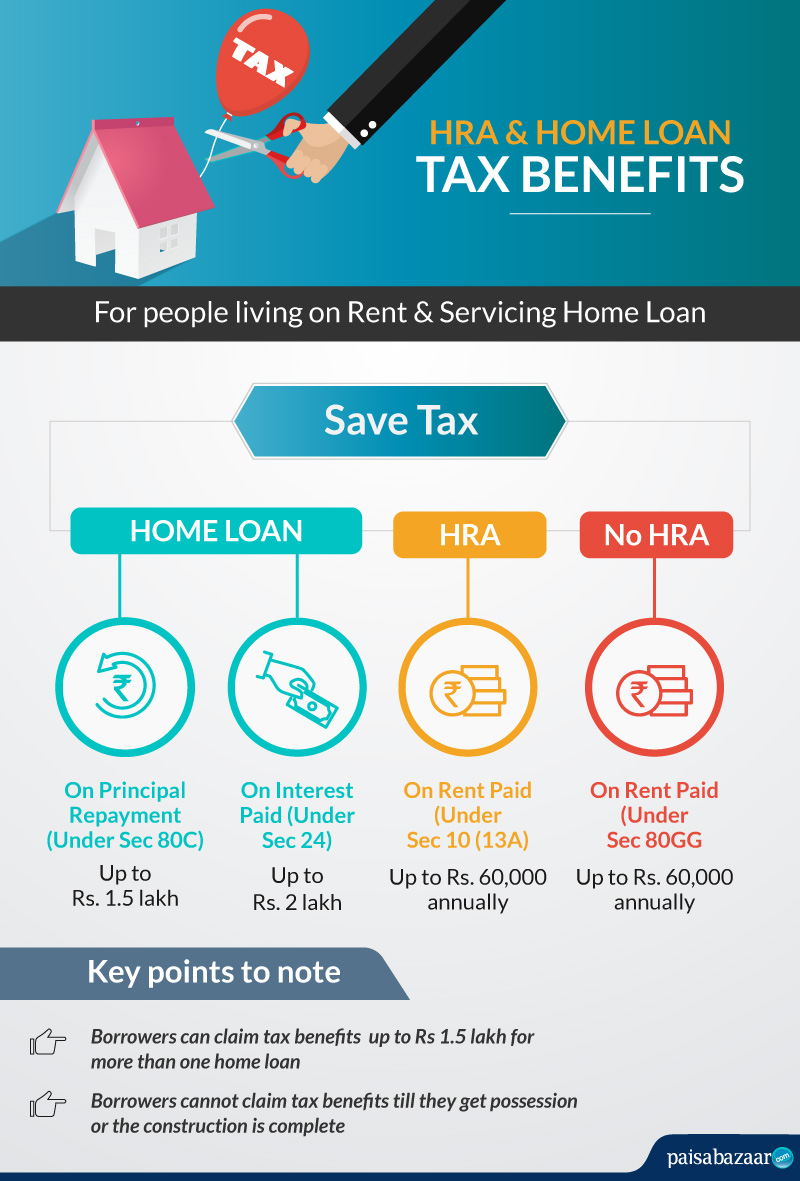

When To Claim Tax Benefit On Home Loan And HRA Both BusinessToday

https://akm-img-a-in.tosshub.com/businesstoday/images/story/202011/home_loan_660_271120090951.jpg

When To Claim Tax Benefit On Home Loan And HRA Both BusinessToday

https://akm-img-a-in.tosshub.com/businesstoday/images/story/202011/home_loan_660_271120090951.jpg?size=948:533

Step 1 To claim the tax benefits you must ensure the first and second home loan is in your name If the loan is co jointly owned you must be the owner or co Yes it is possible to get tax benefit on the second home loan in the same financial year The tax benefit on two home loans taken for the purchase of two self

If the second home is considered a personal residence you must file Form 1040 or 1040 SR and itemize deductions on Schedule A to claim the mortgage interest deduction Additionally the Here are the key tax benefits for a second home loan in India 1 Interest deduction For self occupied property If you have taken a loan to purchase a second

Income Tax Benefits On Home Loan Loanfasttrack

https://www.loanfasttrack.com/blog/wp-content/uploads/2020/12/IncomeTaxBenfits-800x534.png

How To Claim Tax Benefit On Second Home Loan Tata Capital Blog

https://www.tatacapital.com/blog/wp-content/uploads/2020/05/can-you-claim-tax-benefit-on-your-second-home-loan-1.jpg

https://www.livemint.com/money/ask-mint-money/...

Concerning the deduction of repayment of principal repayment under Section 80C you can claim the same within the overall limit of 1 50 lakh along with other

https://www.basichomeloan.com/blog/home-loans/tax...

By following these steps diligently you can effectively claim the tax benefits on your second home loan potentially leading to substantial savings on your tax

How To Claim Tax Benefits On More Than One Home Loan

Income Tax Benefits On Home Loan Loanfasttrack

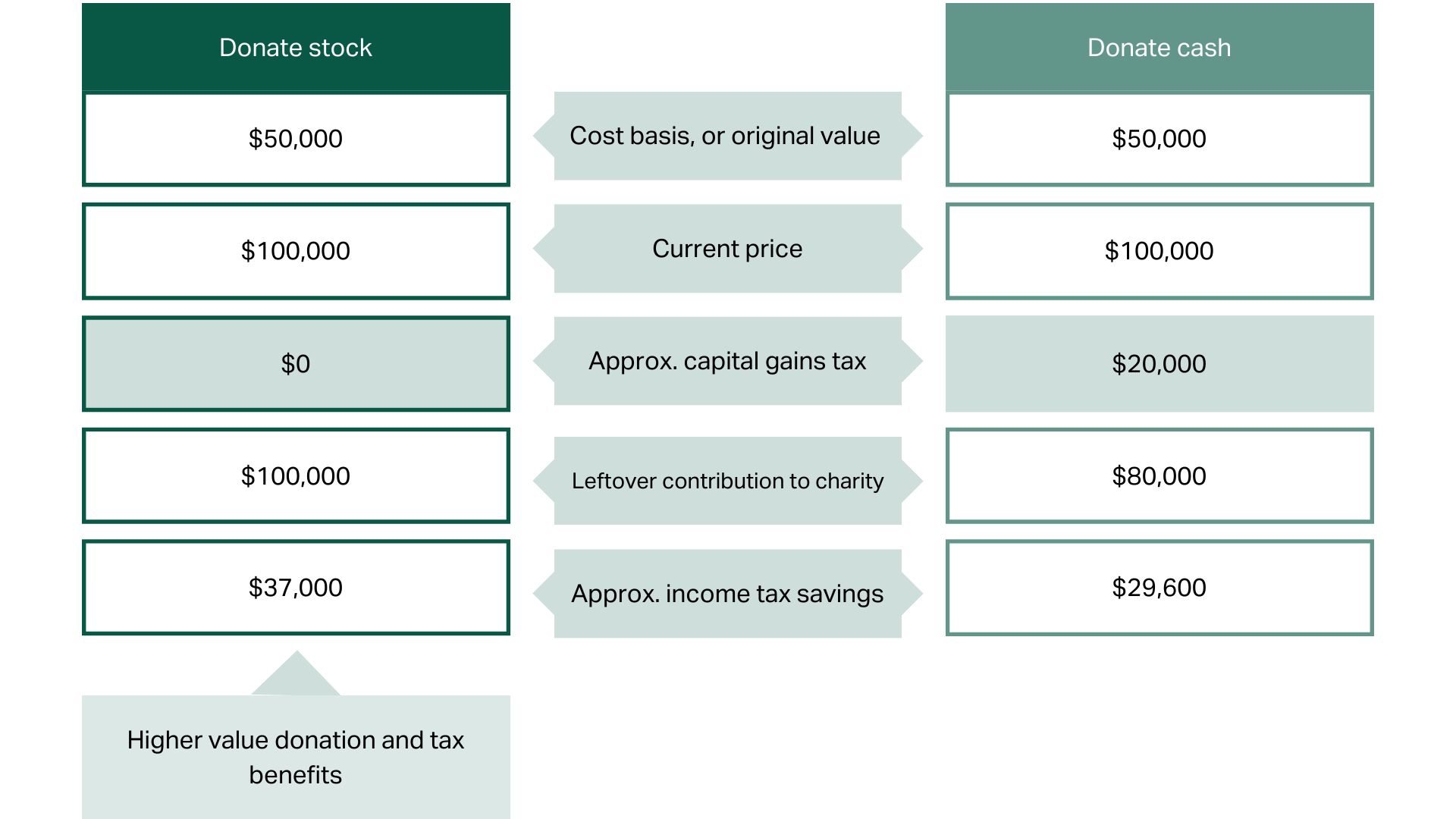

Guide To Donating Stocks And Mutual Funds GiveDirectly

Guide To Understand The Tax Benefits That You Can Claim On Home Loan

Tax Benefit On Second Home Loan Money Doctor Show English EP 160

Can I Claim Both Home Loan And HRA Tax Benefits

Can I Claim Both Home Loan And HRA Tax Benefits

How To Claim Tax Back Taxfiler

Where A Personal Loan Can Give You Tax Benefits Quora

How To Claim Tax Benefit On Second Home Loan Tata Capital Blog

How To Claim Tax Benefit For Second Home Loan - You will be able to claim the interest paid on second home loan in fy 23 24 only once you get the possession and any unclaimed interest of prior years can be