How To Get Tax Benefit On Second Home Loan The tax benefit on a second home loan governed by the Income Tax Act under Sections 80C and 24 can significantly impact your financial planning Whether your second home is a rental property or a

Calculate the tax benefit on a second Home Loan in advance to save time and unnecessary hassles in the future You can also use the free home loan tax benefit calculator available on Tax benefits on home loan interest and principal repayment are available for self occupied houses under the old tax regime

How To Get Tax Benefit On Second Home Loan

How To Get Tax Benefit On Second Home Loan

https://akm-img-a-in.tosshub.com/indiatoday/images/story/202209/Tax_Benefits.jpg?VersionId=KA.W.Wl1CpsUjL4.dw1jXJ24fvBRYd1v

Home Loan Tax Benefits Interest On Home Loan Section 24 And

https://i.ytimg.com/vi/M-wUkSDKAfk/maxresdefault.jpg

TAX BENEFITS ON SECOND HOME LOAN By PNBHousing Issuu

https://image.isu.pub/230607112253-2c6316284067344b4194cdfe81379dfc/jpg/page_1.jpg

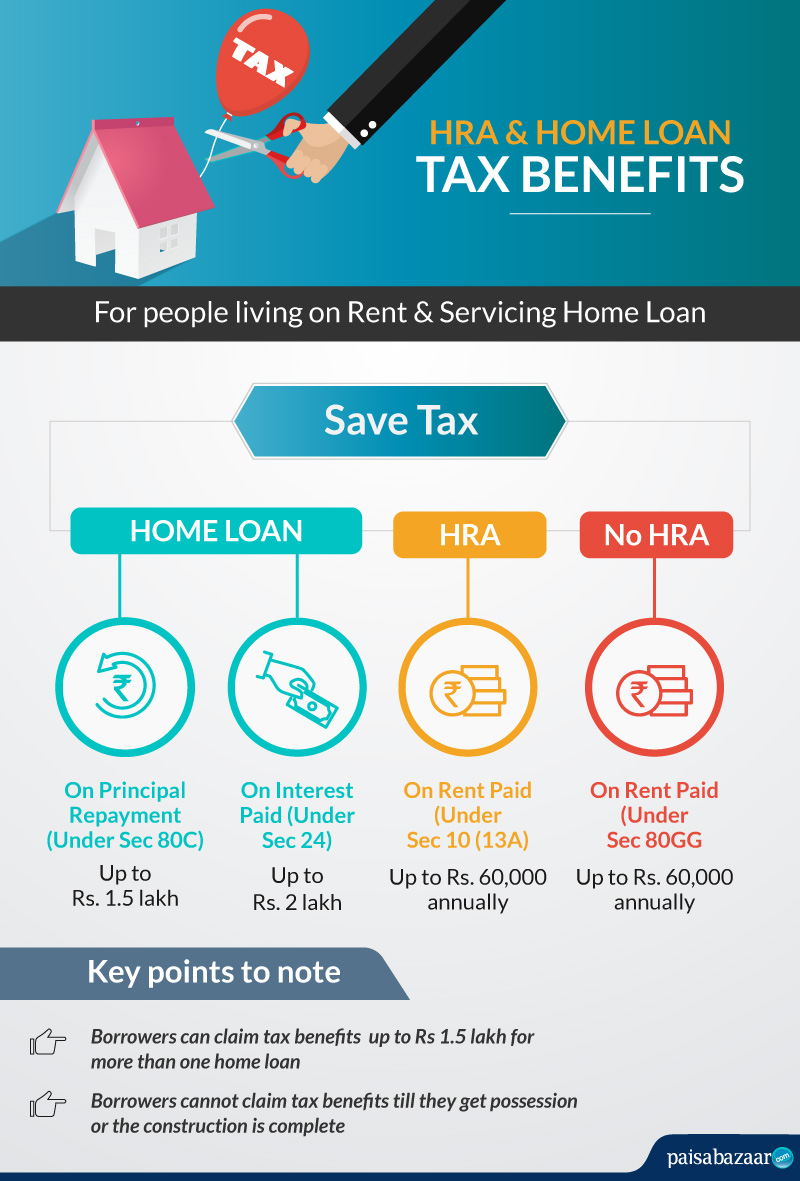

Learn how to get tax benefits calculate EMI and check eligibility for a second home loan Find tips and advice for buying a second property for different purposes Both of you can claim deduction under Section 80C up to Rs 1 5 lakh from your total income towards the principal component of home loans and deductions up to Rs 2 lakh

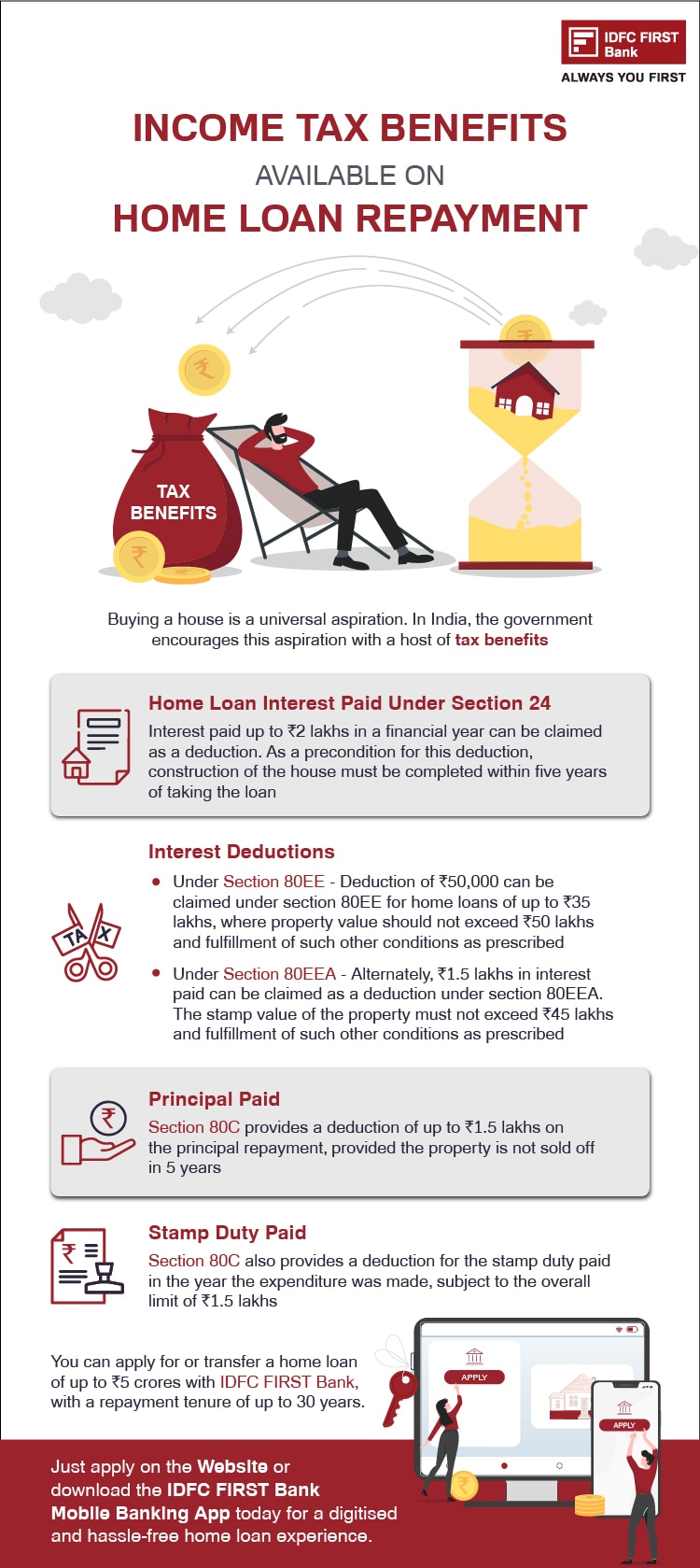

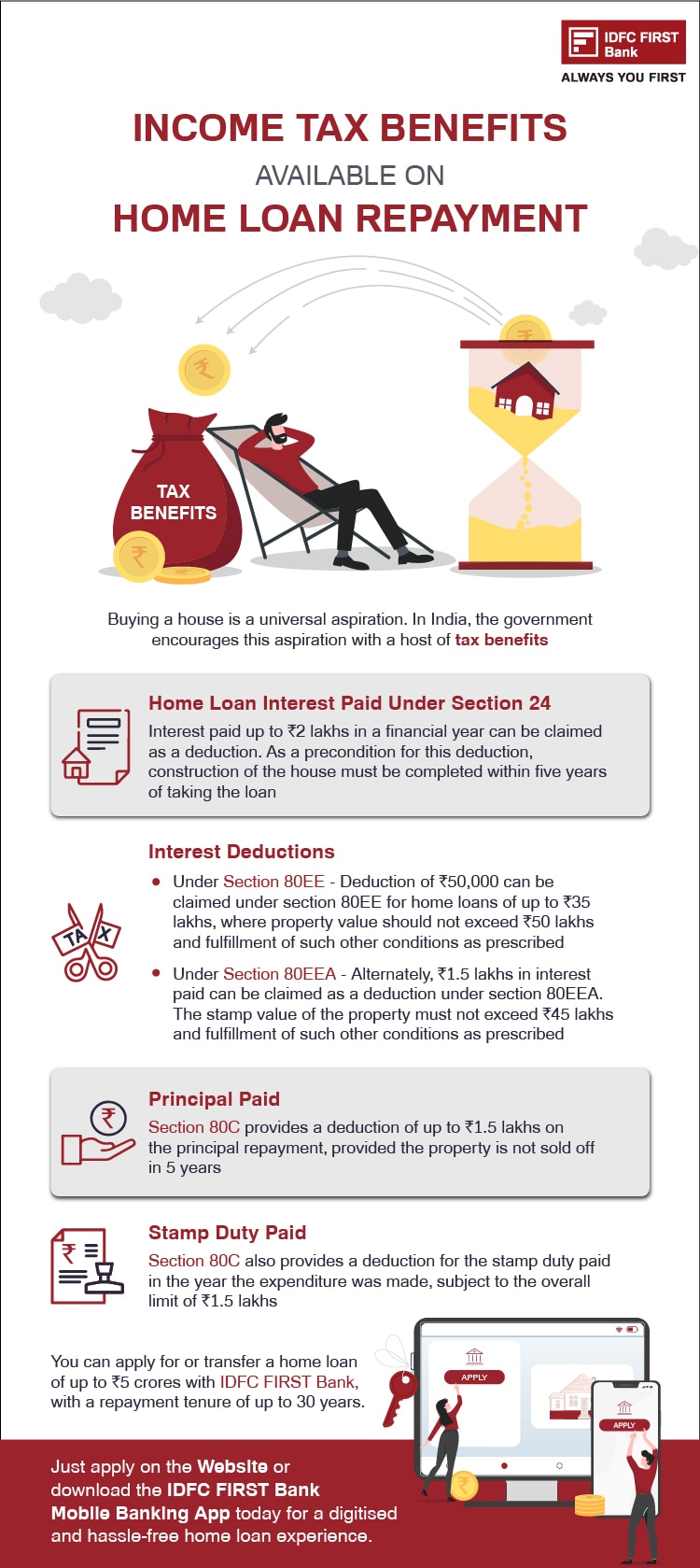

Learn how to claim tax deduction on home loan principal and interest under Sections 80C and 24 b of Income Tax Act Find out the eligibility conditions and limits for different types of home loans and properties Home loan tax benefits can be claimed for multiple houses without restriction Self occupied properties allow deductions up to Rs 2 lakh for interest while let out properties have

Download How To Get Tax Benefit On Second Home Loan

More picture related to How To Get Tax Benefit On Second Home Loan

How To Get Tax Benefits On A Personal Loan For Education

https://www.learnesl.net/wp-content/uploads/2023/02/Loan-Feature.jpg

Home Loan Comparison Chart Of Leading Banks Loanfasttrack

https://www.loanfasttrack.com/blog/wp-content/uploads/2020/12/Home-Loan-Comparison-768x513.png

Tax Benefit On Second Home Loan Money Doctor Show English EP 160

https://i.ytimg.com/vi/Yp63gAJaUHI/maxresdefault.jpg

You will be able to claim the interest paid on second home loan in fy 23 24 only once you get the possession and any unclaimed interest of prior years can be claimed in 5 Here are the key tax benefits for a second home loan in India 1 Interest deduction For self occupied property If you have taken a loan to purchase a second

You can claim a tax benefit of up to INR 2 Lakh on the interest repayment of your Second Home Loan Note You cannot claim tax benefits on properties that are under construction Tax Whether you have one home loan or more the deduction allowable under Section 80 C for repayment of home loan is restricted to Rs 1 50 lakh together with various other

What Is The Maximum Tax Benefit On Housing Loan Leia Aqui Is There A

https://www.idfcfirstbank.com/content/dam/idfcfirstbank/images/blog/finance/income-tax-benefit-on-home-loan-repayment.jpg

What Are The Income Tax Benefits On Second Home Loan In India

https://i1.wp.com/www.thewealthwisher.com/wp-content/uploads/2012/05/cache_4096473769.jpg?fit=1024%2C682&ssl=1

https://www.basichomeloan.com › blog …

The tax benefit on a second home loan governed by the Income Tax Act under Sections 80C and 24 can significantly impact your financial planning Whether your second home is a rental property or a

https://www.icicibank.com › blogs › home-loan › tax...

Calculate the tax benefit on a second Home Loan in advance to save time and unnecessary hassles in the future You can also use the free home loan tax benefit calculator available on

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

What Is The Maximum Tax Benefit On Housing Loan Leia Aqui Is There A

Income Tax Benefits On Housing Loan In India

Here Is The Tax Benefit On Personal Loans That You Can Avail

What Are The Tax Benefit On Home Loan FY 2020 2021

Home Loan Tax Benefits

Home Loan Tax Benefits

Tax Benefit On Second Home Loan

Can I Claim Both Home Loan And HRA Tax Benefits

Tax Implications On A Second Home Loan A Must Read 50 Plus Finance

How To Get Tax Benefit On Second Home Loan - Both of you can claim deduction under Section 80C up to Rs 1 5 lakh from your total income towards the principal component of home loans and deductions up to Rs 2 lakh