How To Claim Tax Benefit On Second Home Loan You will be able to claim the interest paid on second home loan in fy 23 24 only once you get the possession and any unclaimed interest of prior years can be claimed in 5

A Second Home Loan comes with limited tax benefits which depend on the use of the loan and the current income tax law It s prudent to know your home loan eligibility and use an EMI Below is the process to claim home loan benefits Keep the documents ready such as ownership documents loan details certificate from the bank with the interest and

How To Claim Tax Benefit On Second Home Loan

How To Claim Tax Benefit On Second Home Loan

https://assetyogi.b-cdn.net/wp-content/uploads/2017/06/income-tax-benefit-on-second-home-loan-889x500-768x432.jpg

Want To Claim Tax Benefit Remember These Sections Under IT Act Zee

https://cdn.zeebiz.com/sites/default/files/styles/zeebiz_850x478/public/2018/01/31/28845-tax-pixabay.jpg?itok=_WFcBXXo&c=677b8bac55e75f19021565b82b592445

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/Tax-benefits-on-Home-Loan-819x1024.jpeg

Procedure to Claim Home Loan Tax Benefits To begin with ensure that both the first and second Home Loan is in your name In case of a joint loan application ensure that you are a co owner How to Claim Tax Benefits on a Second Home Loan To avail of tax benefits on a second Home Loan ensure that both the first and second Home Loans are under your name You can also

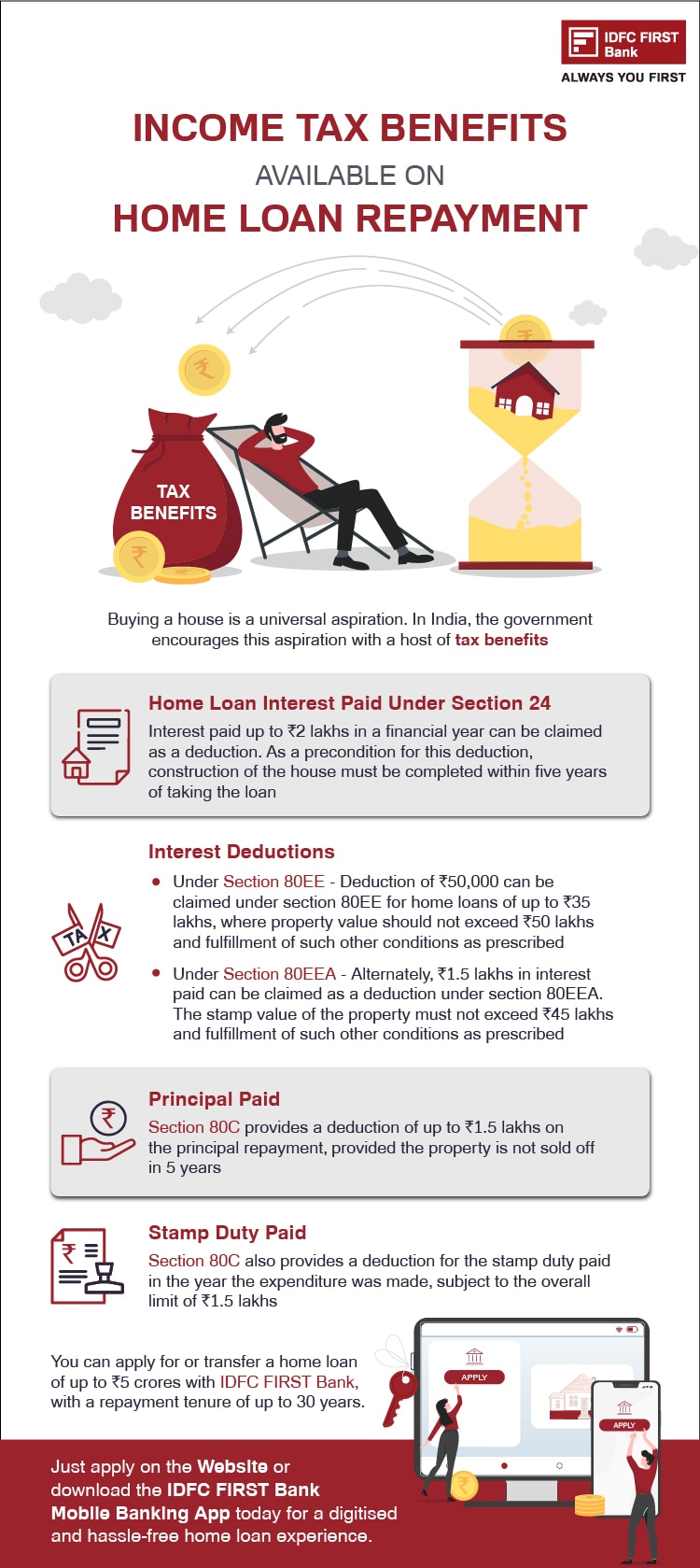

If you buy a second home on Home Loan you can even avail of tax deductions on it While deductions under Section 80C on the principal amount of the loan may not be available in case of your second house you can enjoy tax benefits For the rented property you can deduct municipal taxes paid a 30 standard deduction and interest on a home loan from your annual rental income You can claim the entire interest amount paid as a deduction There are several factors

Download How To Claim Tax Benefit On Second Home Loan

More picture related to How To Claim Tax Benefit On Second Home Loan

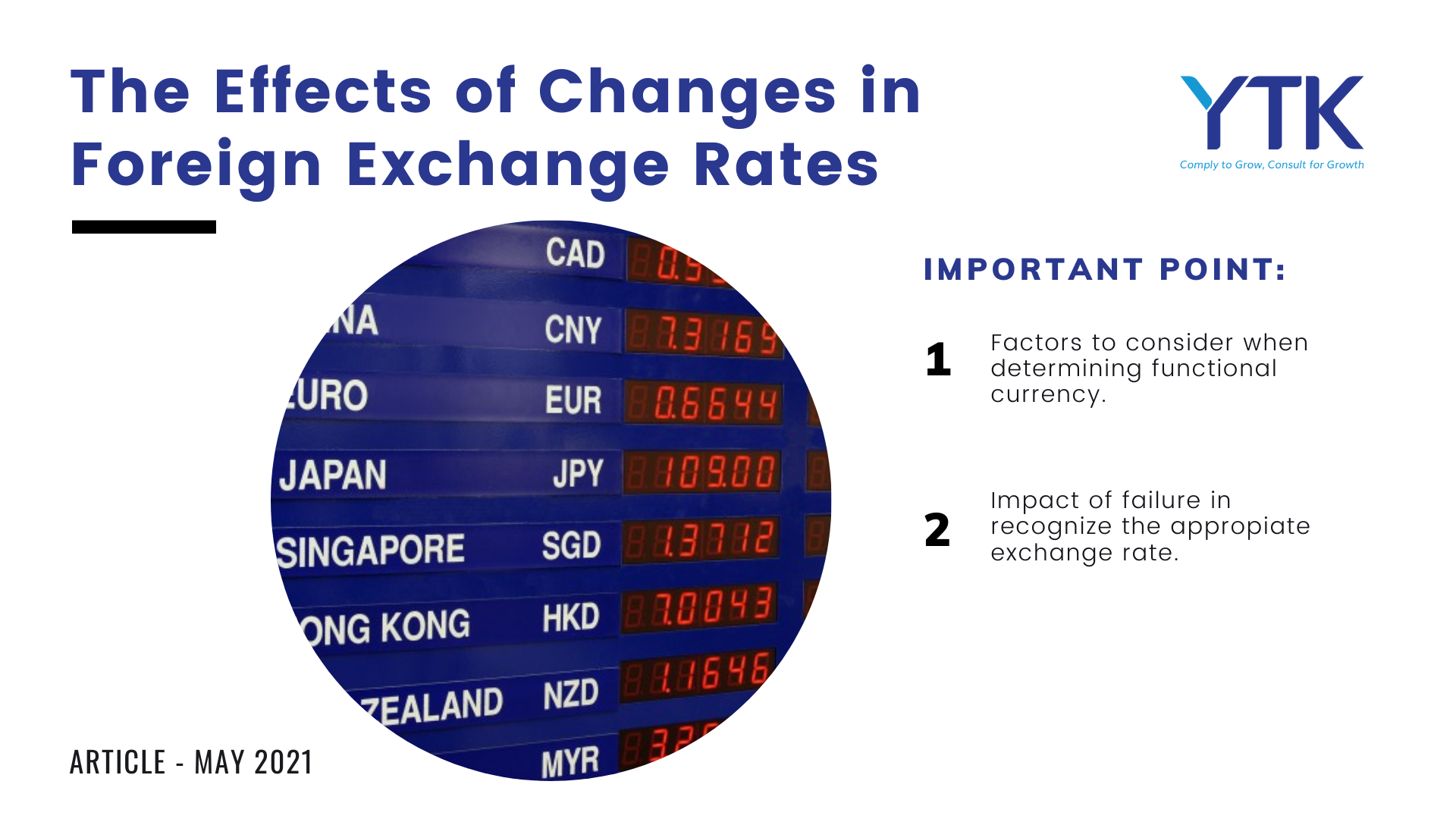

The Effects Of Changes In Foreign Exchange Rates Accounting Tax

https://ytkmgt.com.sg/wp-content/uploads/2021/05/Article-FB-post.png

TAX BENEFITS ON SECOND HOME LOAN By PNBHousing Issuu

https://image.isu.pub/230607112253-2c6316284067344b4194cdfe81379dfc/jpg/page_1.jpg

How To Claim Tax Benefit On Second Home Loan Tata Capital Blog

https://www.tatacapital.com/blog/wp-content/uploads/2020/05/can-you-claim-tax-benefit-on-your-second-home-loan-banner.jpg

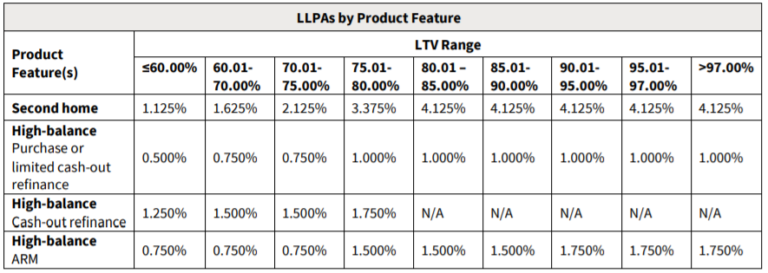

Here s how you can claim tax benefit on your second housing loan Section 80C You can claim deduction on the principal amount for a maximum of Rs 1 5 lakh under section 80C This deduction can be claimed on more than The income tax benefit is limited to the claim of the repayment of interest towards the second home loan The repayment towards the principal amount cannot be claimed The income earned or deemed to be earned as

To claim a tax benefit on your second home loan follow these steps Make sure the home loan is applied and granted under your name In case you are the owner but the loan is sanctioned in your spouse s name you will In this article we explore the key tax benefits and considerations when applying for a second home loan 1 Deductions on Principal Payment Under Section 80C A home loan

Home Loan Comparison Chart Of Leading Banks Loanfasttrack

https://www.loanfasttrack.com/blog/wp-content/uploads/2020/12/Home-Loan-Comparison-768x513.png

When To Claim Tax Benefit On Home Loan And HRA Both BusinessToday

https://akm-img-a-in.tosshub.com/businesstoday/images/story/202011/home_loan_660_271120090951.jpg

https://taxguru.in › income-tax › income-tax-benefits...

You will be able to claim the interest paid on second home loan in fy 23 24 only once you get the possession and any unclaimed interest of prior years can be claimed in 5

https://www.pnbhousing.com › blog › tax-benefits-on-second-home-loan

A Second Home Loan comes with limited tax benefits which depend on the use of the loan and the current income tax law It s prudent to know your home loan eligibility and use an EMI

Here Is The Tax Benefit On Personal Loans That You Can Avail

Home Loan Comparison Chart Of Leading Banks Loanfasttrack

What Are The Income Tax Benefits On Second Home Loan In India

Second Home Loan Rates Skyrocketing In 2022

/sale-of-your-home-3193496-final-5b62092046e0fb005051ed81-5f8516d5ac044c7a811778ba3bebf510.png)

Home Sale Exclusion From Capital Gains Tax

Income Tax Benefits On Housing Loan In India

Income Tax Benefits On Housing Loan In India

Income Tax Benefit On Home Loan Repayment IDFC FIRST Bank

How To Claim Tax Benefits On More Than One Home Loan

What Are The Tax Benefit On Home Loan FY 2020 2021

How To Claim Tax Benefit On Second Home Loan - In this article we will explore the various tax benefits associated with a second home loan empowering you to make informed financial decisions and optimise your savings Tax Rebate