Tax Deduction For Mortgage Loan This part explains what you can deduct as home mortgage interest It includes discussions on points and how to report deductible interest on your tax return Generally home mortgage interest is any interest you pay on a loan secured

You can deduct the interest from your mortgage payments when you file a tax return but only if the loan is secured by your home Also the loan proceeds must have been used to buy build or improve your main home and Under the Tax Cuts and Jobs Act TCJA of 2017 the mortgage interest deduction is available for up to 750 000 in mortgage debt if you re married and filing jointly single or the head of a household

Tax Deduction For Mortgage Loan

Tax Deduction For Mortgage Loan

https://i0.wp.com/www.MLSMortgage.com/wp-content/uploads/Mortgage-Interest-Tax-Deduction-Calculator.jpg?fit=743%2C908&ssl=1

Mortgage Interest Tax Deduction Calculator MLS Mortgage

https://i1.wp.com/www.MLSMortgage.com/wp-content/uploads/Mortgage-Interest-Tax-Deduction-Calculator-Featured.jpg?fit=1269%2C635&ssl=1

Home Loan Mortgage Interest Tax Deduction For 2015 2016

http://filemytaxesonline.org/wp-content/uploads/2015/07/Home-Mortgage-Large.jpg

Most homeowners can deduct all of their mortgage interest The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up The mortgage interest deduction allows homeowners to deduct the interest they pay on their home mortgage from their taxable income This can help homeowners lower tax bills by reducing

The home mortgage interest deduction HMID allows homeowners who itemize on their tax returns to deduct mortgage interest paid on up to 750 000 worth of their loan principal The HMID is one The IRS may let you deduct interest paid on your mortgage on your federal income tax return To claim this deduction you need to itemize you cannot take the standard deduction

Download Tax Deduction For Mortgage Loan

More picture related to Tax Deduction For Mortgage Loan

Tax Deductions You Can Deduct What Napkin Finance

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05-1.jpg

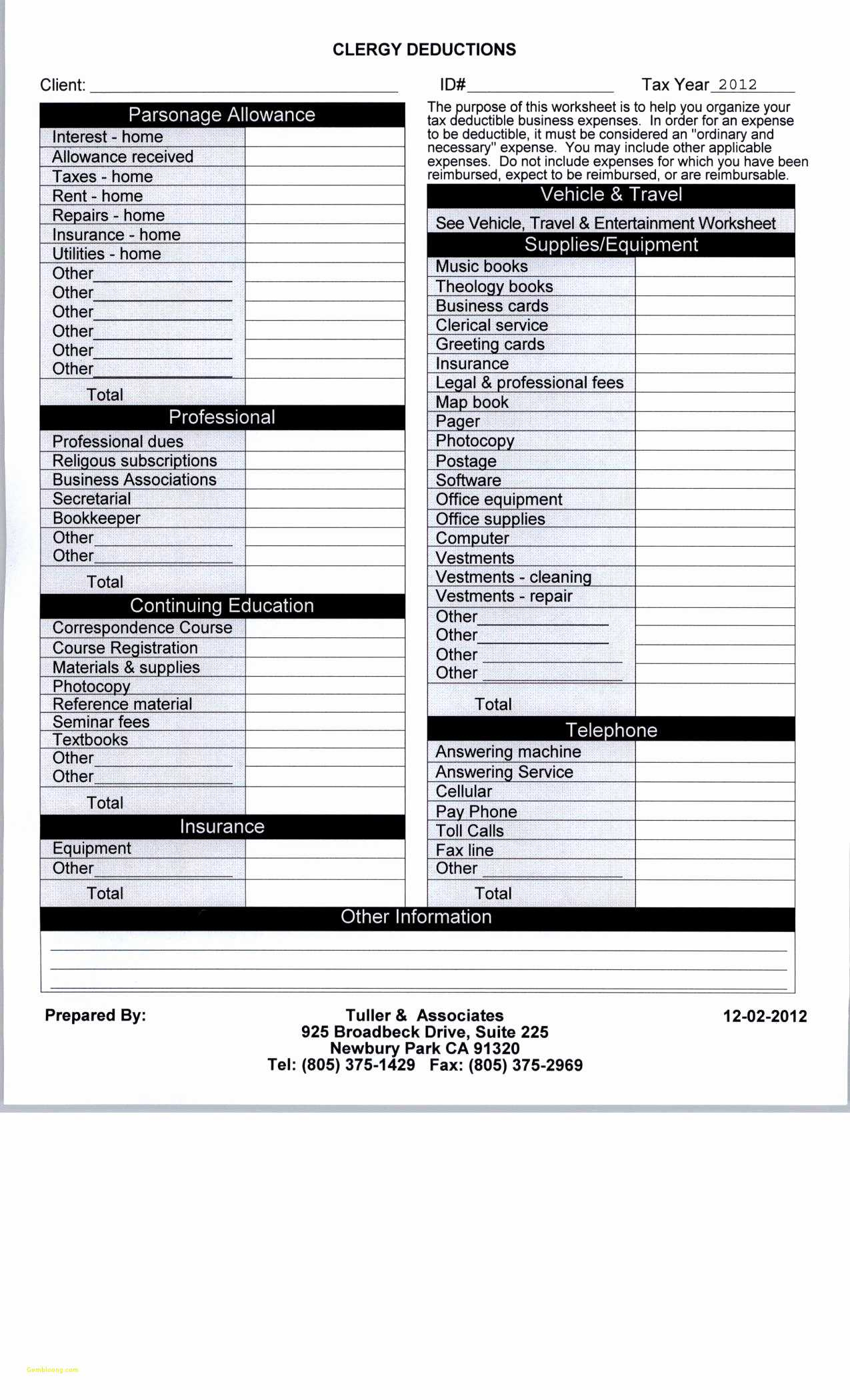

Tax Deduction Spreadsheet Spreadsheet Downloa Tax Deduction Sheet Tax

http://db-excel.com/wp-content/uploads/2019/01/tax-deduction-spreadsheet-for-free-tax-deduction-spreadsheet-along-with-57-beautiful-gallery-tax.jpg

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

The IRS has extensive rules about the tax breaks available for homeowners Let s dive into the tax breaks you should consider as a homeowner 1 Mortgage Interest If you have a mortgage on your home you The mortgage interest tax deduction allows taxpayers to deduct from their taxable income the amount of interest they paid for the year on up to 750 000 of their home loan debt To use this

If you itemize your taxes you can make mortgage tax deductions But what s deductible and what isn t Here s our helpful guide With the mortgage interest deduction MID you can write off a portion of the interest on your home loan lowering your taxable income and potentially moving you into a

35 Mortgage Interest Deduction Limits SchaunShanell

https://www.houselogic.com/wp-content/uploads/2023/02/mortgage-interest-deduction-claim-tax-tips-home-owner.png

Claim Tax Benefit On HRA As Well As Tax Deduction On Home Loan

https://taxguru.in/wp-content/uploads/2018/03/Tax-Saving-through-Join-Home-loan.jpg

https://www.irs.gov › publications

This part explains what you can deduct as home mortgage interest It includes discussions on points and how to report deductible interest on your tax return Generally home mortgage interest is any interest you pay on a loan secured

https://turbotax.intuit.com › tax-tips › h…

You can deduct the interest from your mortgage payments when you file a tax return but only if the loan is secured by your home Also the loan proceeds must have been used to buy build or improve your main home and

How To Deduct Property Taxes On IRS Tax Forms

35 Mortgage Interest Deduction Limits SchaunShanell

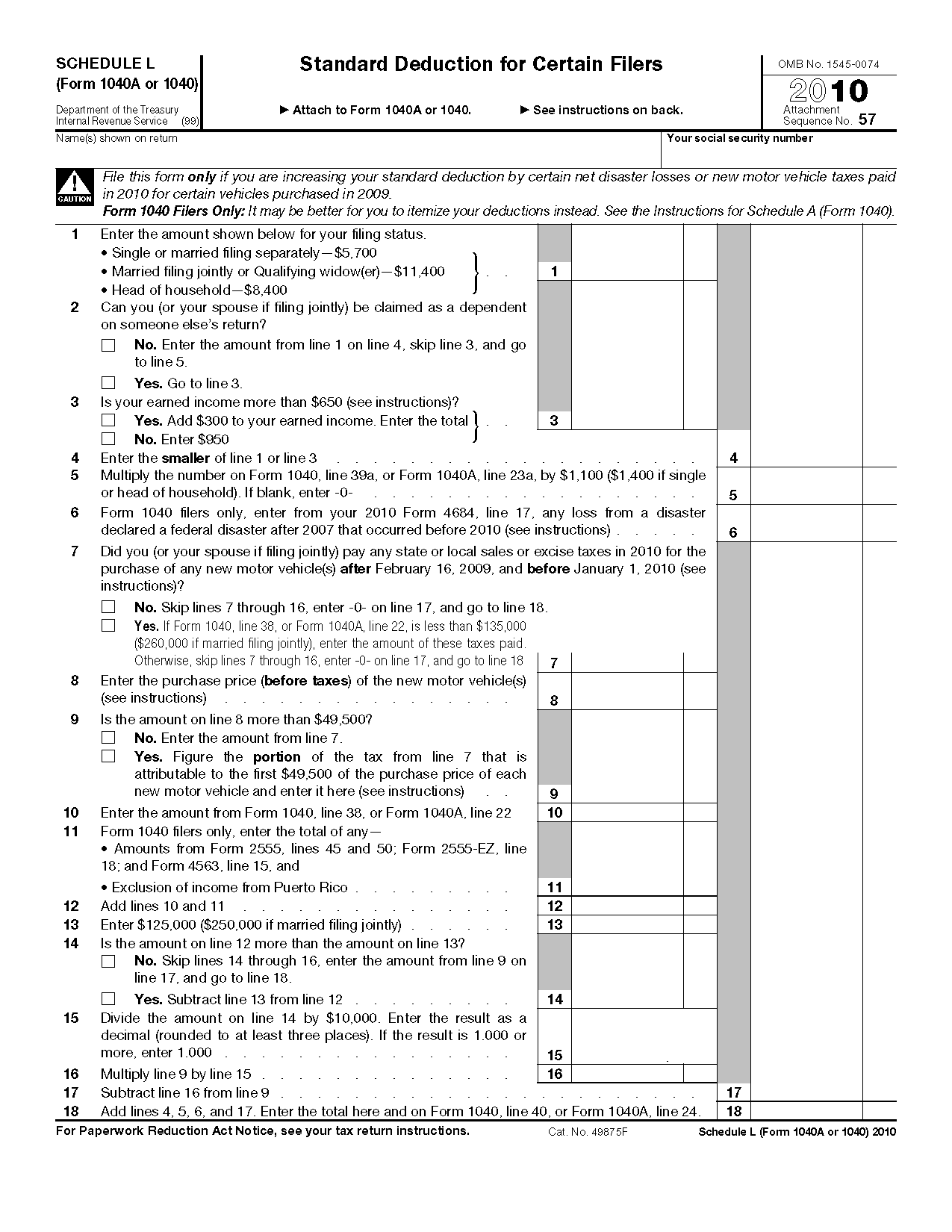

Irs 1040 Form 2020 Printable IRS 1040 2018 Fill And Sign Printable

Home Office Tax Deduction What To Know Fast Capital 360

Income Tax Deductions For The FY 2019 20 ComparePolicy

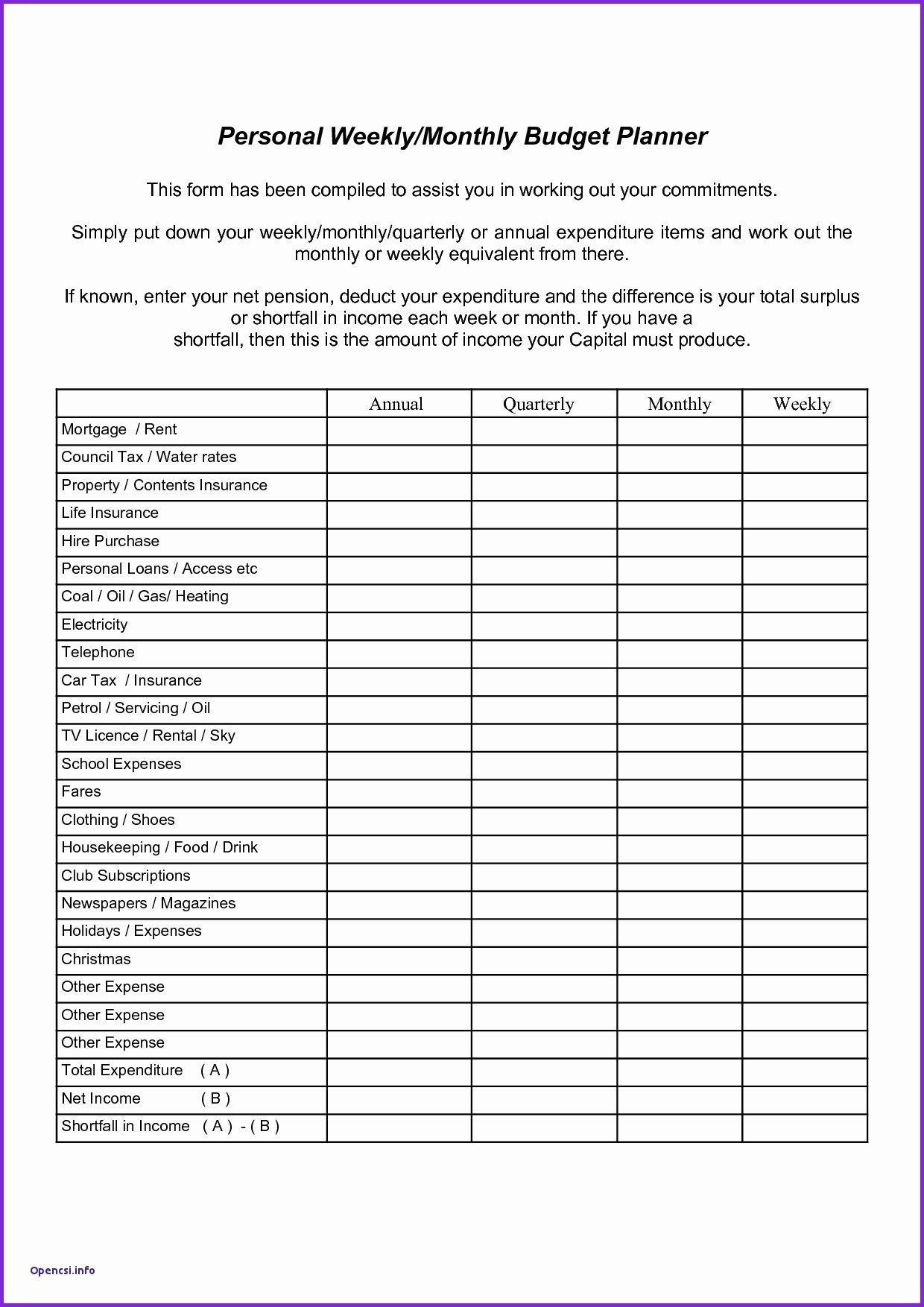

Itemized Deductions Spreadsheet In Business Itemized Deductions

Itemized Deductions Spreadsheet In Business Itemized Deductions

Tax Deduction Spreadsheet Spreadsheet Downloa Tax Deduction Sheet Tax

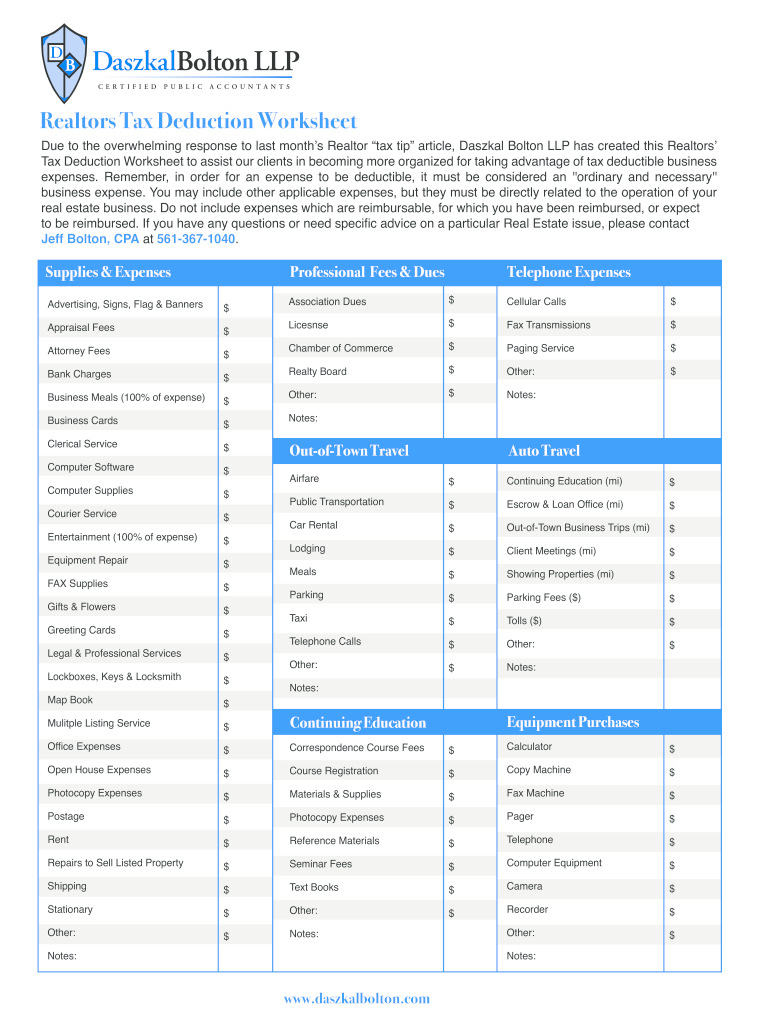

Real Estate Agent Tax Deductions Worksheet 2022 Form Fill Out And

Student Loan Interest Deduction Worksheet 2016 Db excel

Tax Deduction For Mortgage Loan - The home mortgage interest deduction HMID allows homeowners who itemize on their tax returns to deduct mortgage interest paid on up to 750 000 worth of their loan principal The HMID is one