Tax Deduction For Home Loan Web 18 Dez 2023 nbsp 0183 32 If the loan is taken jointly each loan holder can claim a deduction for home loan

Web 22 Sept 2023 nbsp 0183 32 The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750 000 of mortgage debt Homeowners who bought houses before December 16 2017 can deduct Web Are My Mortgage Payments Tax Deductible Yes its free online and non binding In Germany the interest paid on your mortgage for own use properties isn t tax deductible However if you buy an investment property it s diffrent

Tax Deduction For Home Loan

Tax Deduction For Home Loan

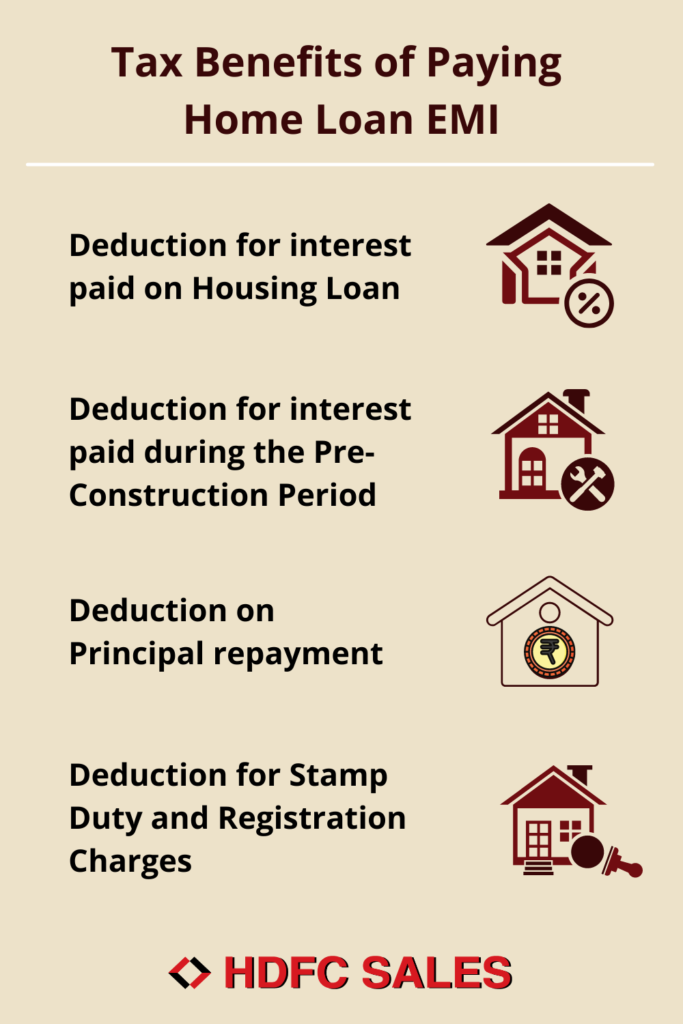

https://www.hdfcsales.com/blog/wp-content/uploads/2021/10/benefits-of-paying-home-loan-emi.png

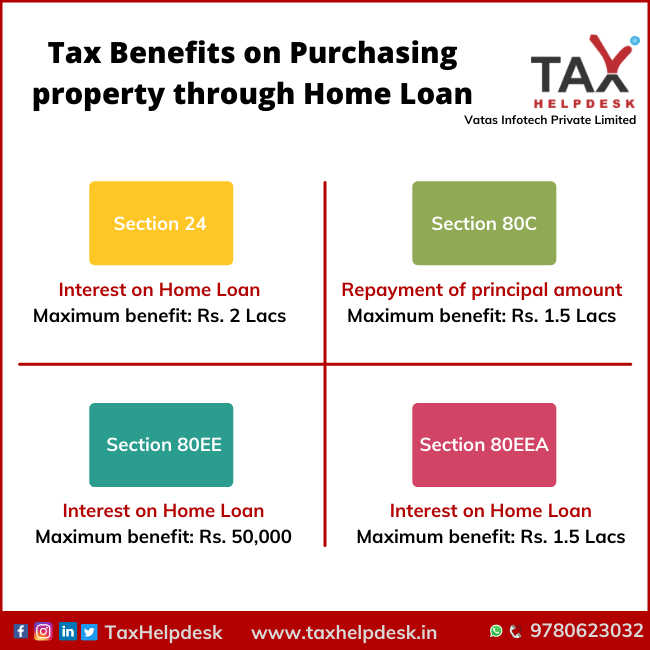

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

Home Loan Tax Benefits Learn To Save Income Tax On Home Loan

https://www.aavas.in/uploads/images/blog/tax-benifits-2022-2023-aavasin-min-195380998.jpg

Web 28 Nov 2023 nbsp 0183 32 Deductible interest for new loans for your personal residence is limited to principal amounts 750 000 Mortgage interest deduction When you repay a mortgage loan the payments are almost completely composed of Web When filing your income taxes you must choose either the standard deduction or itemized deductions not both For the 2023 tax year the standard deductions are Single or married filed

Web 26 Juni 2023 nbsp 0183 32 Dec 16 2017 and later You can deduct the interest on up to 750 000 of mortgage debt or up to 375 000 if you re married and filing separately Oct 14 1987 through Dec 15 2017 You can Web 4 Jan 2023 nbsp 0183 32 Standard deduction rates are as follows Single taxpayers and married taxpayers who file separate returns 12 950 for tax year 2022 Married taxpayers who file jointly and for qualifying widow er s 25 900 for tax year 2022 Heads of household 19 400 for 2022

Download Tax Deduction For Home Loan

More picture related to Tax Deduction For Home Loan

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/Tax-benefits-on-Home-Loan-819x1024.jpeg

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

https://i.ytimg.com/vi/DmRsyjsDM7c/maxresdefault.jpg

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

https://assets-news.housing.com/news/wp-content/uploads/2020/02/26180144/Section-80EE-Income-tax-deduction-for-interest-component-on-home-loan-FB-1200x700-compressed.jpg

Web You can deduct home mortgage interest on the first 750 000 375 000 if married filing separately of indebtedness However higher limitations 1 million 500 000 if married filing separately apply if you are deducting mortgage interest from indebtedness incurred before December 16 2017 Future developments Web 23 Jan 2020 nbsp 0183 32 Here s a description of tax breaks that encourage homeownership including tax deductions tax credits the capital gains exclusion and other tax incentives

Web 22 Nov 2023 nbsp 0183 32 For heads of households the standard deduction is 20 800 With the standard deduction you can reduce your taxable income by a standard amount When you itemize deductions including tax breaks for homeowners you Web 22 M 228 rz 2023 nbsp 0183 32 A tax payer can deduct both the interest paid on a house loan as well as the principal amount that was repaid on the loan In the case of self occupied property section 24 allows a deduction on the interest paid on a house loan up to a maximum of Rs 2 lakh in a given fiscal year

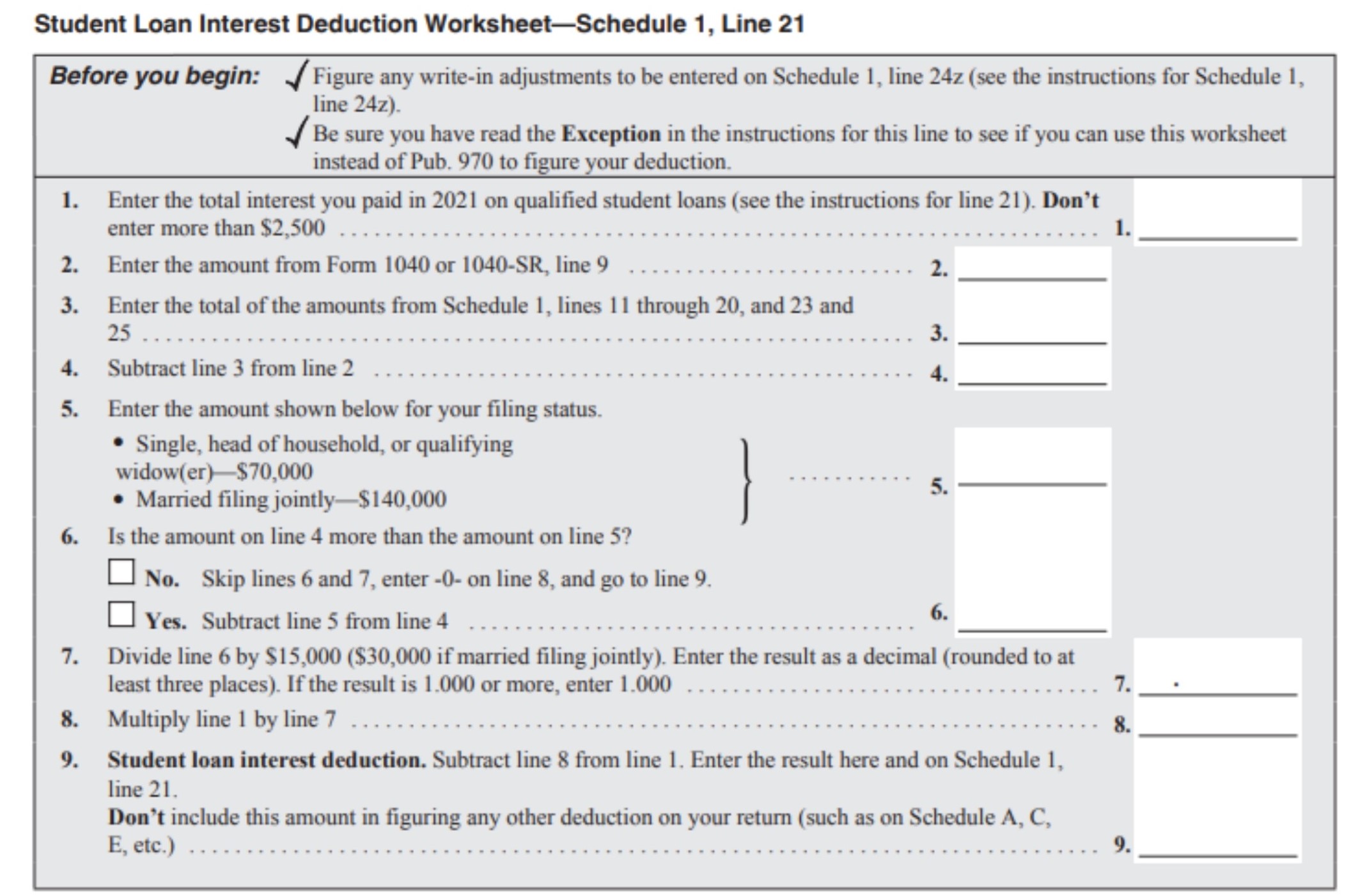

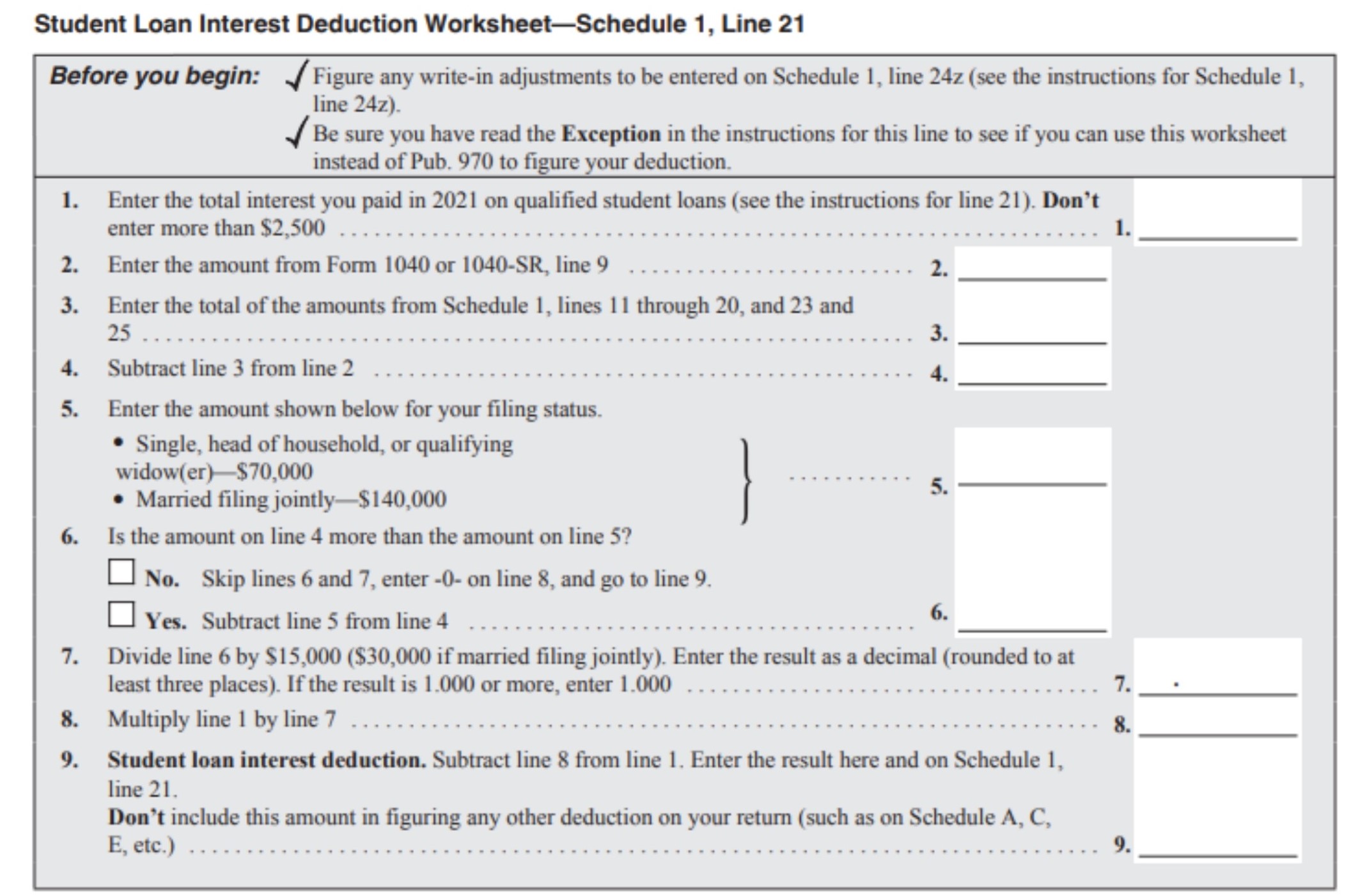

Claiming The Student Loan Interest Deduction

https://www.taxdefensenetwork.com/wp-content/uploads/2022/04/student-loan-interest-deduction-worksheet-1.jpg

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2022/10/Is-plot-loan-eligible-for-tax-exemption-V1-724x1024.png

https://cleartax.in/s/home-loan-tax-benefits

Web 18 Dez 2023 nbsp 0183 32 If the loan is taken jointly each loan holder can claim a deduction for home loan

https://www.nerdwallet.com/article/taxes/mortgage-interest-rate-deduction

Web 22 Sept 2023 nbsp 0183 32 The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750 000 of mortgage debt Homeowners who bought houses before December 16 2017 can deduct

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar

Claiming The Student Loan Interest Deduction

Tax Deductions You Can Deduct What Napkin Finance

Home Loan Mortgage Interest Tax Deduction For 2015 2016

Tax Deductions On Home Loan ComparePolicy

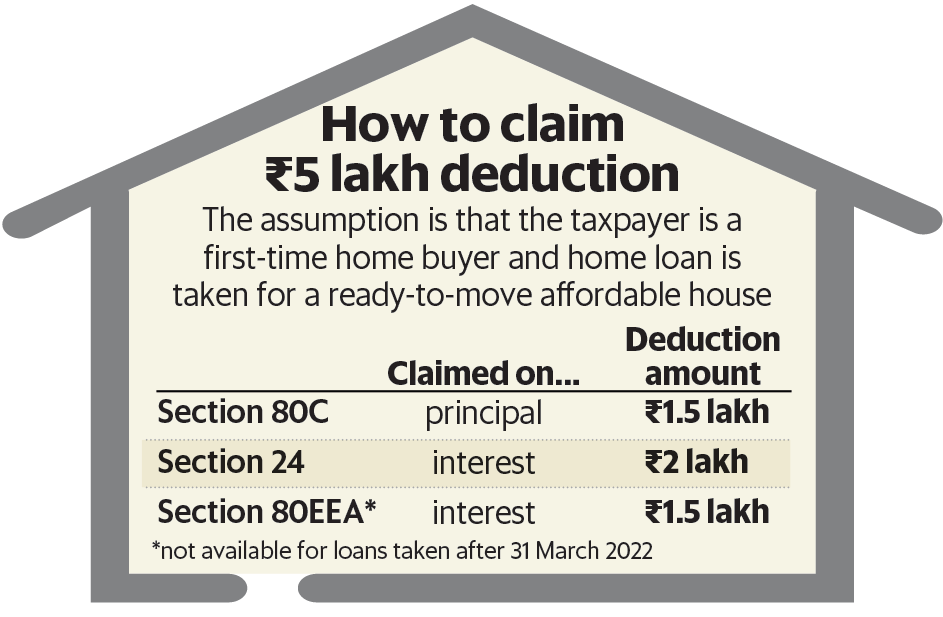

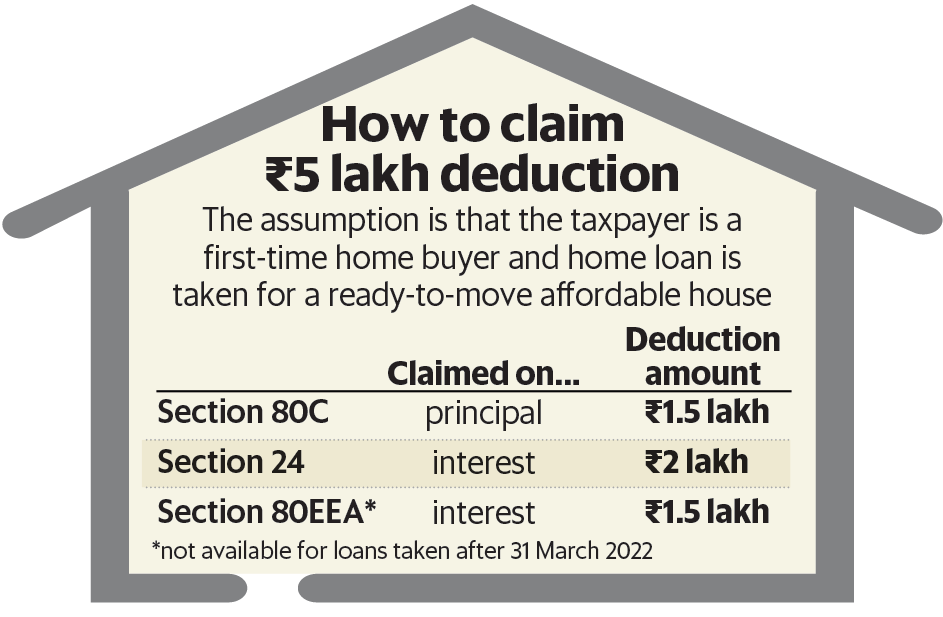

How First time Home Buyers Can Get Up To 5 Lakh Tax Rebate Mint

How First time Home Buyers Can Get Up To 5 Lakh Tax Rebate Mint

Salary Deduction Letter To Employee For Loan Dollar Keg

Income Tax Benefits On Housing Loan In India

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

Tax Deduction For Home Loan - Web 28 Nov 2023 nbsp 0183 32 Deductible interest for new loans for your personal residence is limited to principal amounts 750 000 Mortgage interest deduction When you repay a mortgage loan the payments are almost completely composed of