Housing Loan Interest Deduction In Old Tax Regime If you purchase a house categorized as affordable housing you can receive additional income tax benefits on the interest paid for the home loan exceeding the standard

On the interest payments for a home loan you can claim tax deductions of up to Rs 2 lakh as per Section 24 of the Income Tax Act If you are a first time homeowner additional tax deductions However if you borrowed the loan from 1 st April 2019 to 31 st March 2022 you can claim deduction of up to Rs 1 50 000 under section 80EEA for the interest paid thereon only under

Housing Loan Interest Deduction In Old Tax Regime

Housing Loan Interest Deduction In Old Tax Regime

https://im.indiatimes.in/content/2023/Feb/Old-Vs-New-Tax-Regime-Which-One-To-Pick-After-Budget-2023_63db747264d86.jpg

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/Tax-benefits-on-Home-Loan-819x1024.jpeg

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution or a housing finance company You can claim a deduction of up to Rs 50 000 per Home loan holders may be able to save more money on taxes under the old tax regime by claiming maximum principal and interest rate deductions However employers have set deadlines for employees to

Tax deductions in the Old Tax Regime Section 24 b Deduction from Income from House Property on interest paid on housing loan housing improvement loan In case of self If you have bought a house with the help of a home loan you become eligible to get income tax deduction on interest payment up to Rs 2 lakh annually provided the house is self occupied Moreover you can also claim

Download Housing Loan Interest Deduction In Old Tax Regime

More picture related to Housing Loan Interest Deduction In Old Tax Regime

New Tax Regime Vs Old Which Is Better For You Rupiko

https://rupiko.in/wp-content/uploads/2020/08/New-vs-Old-Tax-Regime-1.png

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

https://i.ytimg.com/vi/DmRsyjsDM7c/maxresdefault.jpg

Do You Know When Old And New Tax Regimes Give The Same Tax Liability

https://akm-img-a-in.tosshub.com/businesstoday/styles/medium_crop_simple/public/images/story/202302/break-even-point-for-old-and-new-tax-regime-.jpg?itok=h3-wLBy8

Section 24 b of Income Tax Act What is the maximum deduction limit The maximum tax deduction is Rs 2 00 000 for self occupied houses However this limit will be You can claim tax deductions on both the principal and interest paid towards your home loan in a financial year For the unversed home loan tax deductions are offered under

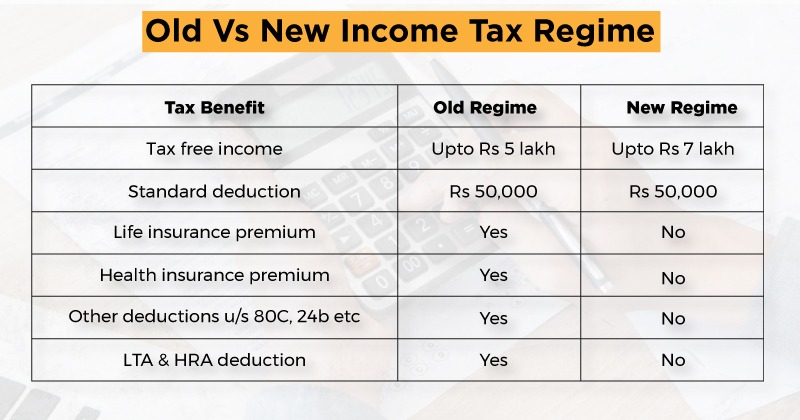

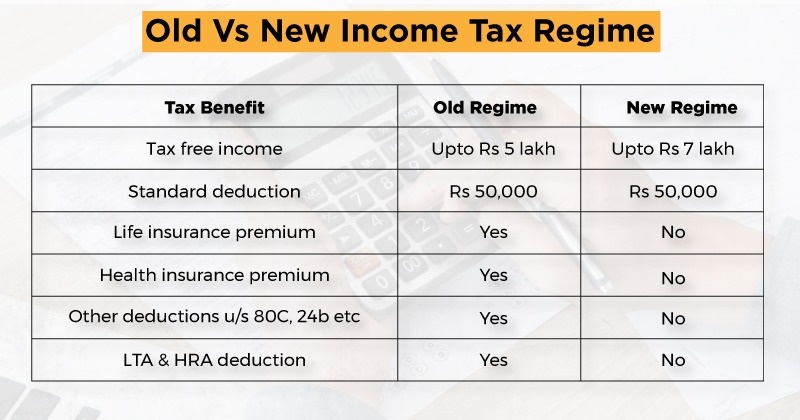

Explore HRA exemptions and home loan deductions under old tax regime to minimize tax liability effectively Learn to claim both benefits wisely In summary the old tax regime offers significant benefits to home loan borrowers who can claim deductions on both principal and interest payments while the new regime offers simplicity and

1040 Q A 5 11 Student Loan Interest Deduction On Vimeo

https://i.vimeocdn.com/video/765016744-ddebfe8104bef6d503fb7580384f47cb0f6cf703e0ad20062f62f00184b5f659-d

Claiming The Student Loan Interest Deduction

https://www.taxdefensenetwork.com/wp-content/uploads/2022/04/student-loan-interest-deduction-worksheet-1-2048x1352.jpg

https://www.godrejcapital.com › media-blog › knowledge...

If you purchase a house categorized as affordable housing you can receive additional income tax benefits on the interest paid for the home loan exceeding the standard

https://www.godigit.com › income-tax › home-loan-tax-benefits

On the interest payments for a home loan you can claim tax deductions of up to Rs 2 lakh as per Section 24 of the Income Tax Act If you are a first time homeowner additional tax deductions

Income Tax Under New Regime Understand Everything

1040 Q A 5 11 Student Loan Interest Deduction On Vimeo

Is Student Loan Interest Tax Deductible RapidTax

Union Budget 2023 24 Why Old Tax Regime Is Still Better Than New Tax

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

Old Vs New Tax Regime Which Is Better In AY 2023 24

Old Vs New Tax Regime Which Is Better In AY 2023 24

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar

Old Tax Regime And New Tax Regime Explained In 3 Scenarios Forum

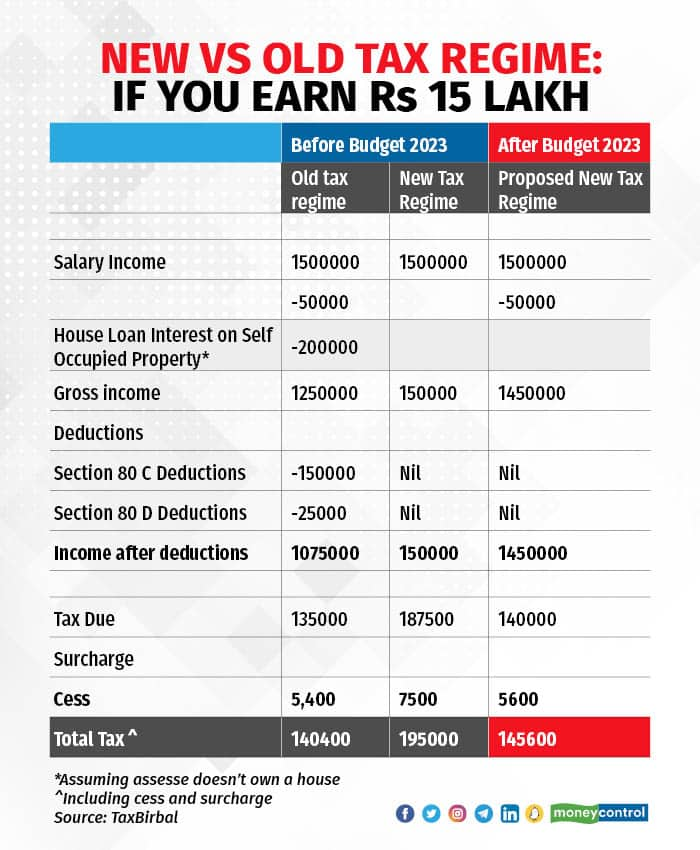

Old Or New Which Tax Regime Should You Use For An Income Of Rs 15 Lakh

Housing Loan Interest Deduction In Old Tax Regime - Do you have a housing loan If yes then you can claim the Interest expense on the housing loan under section 24 and a deduction of principal repayment of the housing loan