Housing Loan Interest Rebate In Income Tax Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

Web 4 avr 2017 nbsp 0183 32 Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution You can claim a Web 2 avr 2022 nbsp 0183 32 New income tax rules from April 2022 Those first time home buyers who have got home loan sanction letter before 1st April 2022 and their property value is less than

Housing Loan Interest Rebate In Income Tax

Housing Loan Interest Rebate In Income Tax

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

Web under Section 24 of the Income Tax Act you can claim a maximum tax rebate of up to 2 lakh on the interest payable on your home loan however note that these deductions Web Tax Deduction for joint home loan If a home loan is taken jointly each borrower can claim deduction on home loan interest up to Rs 2 lakh under Section 24 b and tax deduction

Web By filing under you can get an annual deduction on your home loan interest amount and some much needed relief on the tax on your home loan You can also look into the Web Income tax rebate on home loan Tax deductions Homebuyers in India may deduct up to Rs 1 5 lakhs in principal payments under Section 80C and up to Rs 2 million in interest

Download Housing Loan Interest Rebate In Income Tax

More picture related to Housing Loan Interest Rebate In Income Tax

Home Loan Interest Rates November 2019 Archives Yadnya Investment Academy

https://blog.investyadnya.in/wp-content/uploads/2019/11/Interest-Rates-on-Home-Loan-of-Major-Banks-Dec-2019_Featured.png

Are Home Loan Interest Rates Going Up Funaya Park

https://i.pinimg.com/originals/b7/04/0f/b7040fce085c54337a780ffde783f042.jpg

Good Morning Happy Friday Prayer Quotes

https://eurojatalous.studio.crasman.cloud/file/dl/a/mlIgJQ/VcU04K_p3rwgTMkgcZFrJA/BU-2019-5-Main-article-Chart02.png?fv=7fbb

Web The total claimed tax rebate is Rs 3 50 000 So the remaining amount is Rs 4 50 000 As we know there is no tax obligation for amount up to Rs 2 50 000 The taxable income Web Home Loan Interest Deduction Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution You

Web 5 sept 2023 nbsp 0183 32 Under Section 80EEA of the Income Tax Act in India first time homebuyers investing in affordable property with the help of a home loans get Rs 1 50 lakh income Web 26 oct 2021 nbsp 0183 32 One such important deduction available is on interest paid on a home loan taken for a rented out property The rule foregoes tax benefit on a home loan on a self

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated

https://1.bp.blogspot.com/-1hmzbVNZKYo/XSHkKoX1yfI/AAAAAAAAJ48/rH6dqw_ChNcMLHBhRqZVUOtTkyFQPjeOQCLcBGAs/s1600/Picture-4%2Bof%2BArrears%2BRelief%2BCalculator%2B19-20.jpg

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

https://cleartax.in/s/section-80ee-income-tax-deduction-for-interest...

Web 4 avr 2017 nbsp 0183 32 Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution You can claim a

The Cheapest Home Loans Kotak Mahindra Union Bank Offer The Lowest Rates

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated

Income Tax Deductions List FY 2020 21 Save Tax For AY 2021 22

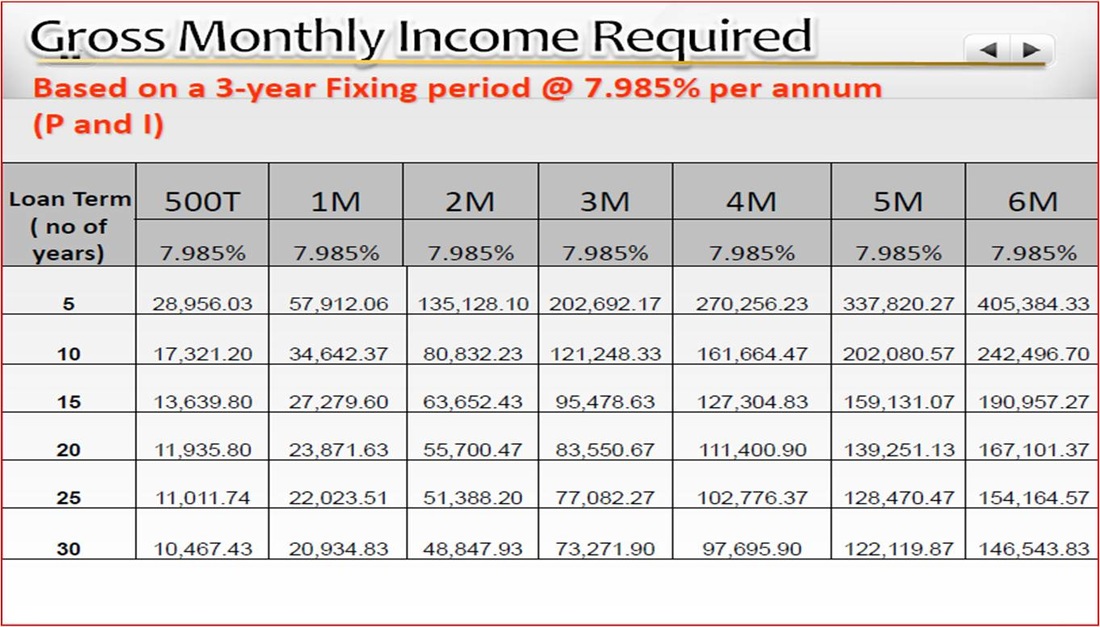

New PAG IBIG Housing Loan Monthly Amortization Table 2023

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

Lic Home Loan Interest Rate 2020 Calculator Online Offer Save 61

Lic Home Loan Interest Rate 2020 Calculator Online Offer Save 61

Form 12BB New Form To Claim Income Tax Benefits Rebate

Famous Greenline Loans Interest Rates References

Am I Qualified In A Pag IBIG Housing Loan BULACAN HOMES

Housing Loan Interest Rebate In Income Tax - Web 1 f 233 vr 2021 nbsp 0183 32 Like can both husband and wife claim income tax deduction for home loan repayment The answer is yes But with a condition The tax benefits for interest