Member Rebate Program Tax Treatment Web 1 ao 251 t 2018 nbsp 0183 32 In a 2002 announcement the IRS stated that it would not assert that a taxpayer s receipt or personal use of frequent flyer miles or

Web Rebates are used in many vendor market channel programs to accomplish objectives such as jump starting a market overcoming market barriers and supporting a market until economies of scale can reduce production costs The income tax treatment of rebates Web International Ltd GTIL and the member firms are not a worldwide partnership GTIL and each member firm is a separate legal entity Services are delivered by the member firms GTIL does not provide services to clients GTIL and its member firms are not agents of

Member Rebate Program Tax Treatment

Member Rebate Program Tax Treatment

https://hbade.files.wordpress.com/2016/05/q116-full-page-brochure.jpg?w=479&h=677

Unidade Strengthen Relationships With Partners Salesforce Trailhead

https://res.cloudinary.com/hy4kyit2a/f_auto,fl_lossy,q_70/learn/modules/manufacturing-cloud-basics/get-insights-and-plan-better-with-account-forecasts/images/5269dee9ba2798938a74419d66dbddd3_1686069086436.png

Property Tax Rent Rebate Program Maximizing Savings And Support For

https://i0.wp.com/www.rentrebates.net/wp-content/uploads/2023/05/Property-Tax-Rent-Rebate-Program.jpg?ssl=1

Web 6 avr 2022 nbsp 0183 32 1 What is a Rebate 2 What are Supplier Rebates 3 What are the Types of Rebates 4 What is an Example of a Rebate 5 How to Account for Customer Rebates 6 How to Account for Vendor Rebates Web 5 mai 2022 nbsp 0183 32 Key Takeaways Whether credit card rewards are taxable as income depends on how the rewards are received If earned through the use of the card like a cash back bonus the rewards are viewed by

Web 1 mars 2021 nbsp 0183 32 WASHINGTON The Internal Revenue Service today issued guidance for employers claiming the employee retention credit under the Coronavirus Aid Relief and Economic Security Act CARES Act as modified by the Taxpayer Certainty and Disaster Web Evaluate the arguments in consultation with its tax advisors for treating the rebate payments as non taxable under current law as applied to the particular facts of its rebate program weighing the risk of penalty if the IRS takes the position that the rebate

Download Member Rebate Program Tax Treatment

More picture related to Member Rebate Program Tax Treatment

Member Rebate Program MMCA

https://i0.wp.com/mnmca.com/wp-content/uploads/2021/07/free-money.jpg?fit=768%2C513&ssl=1

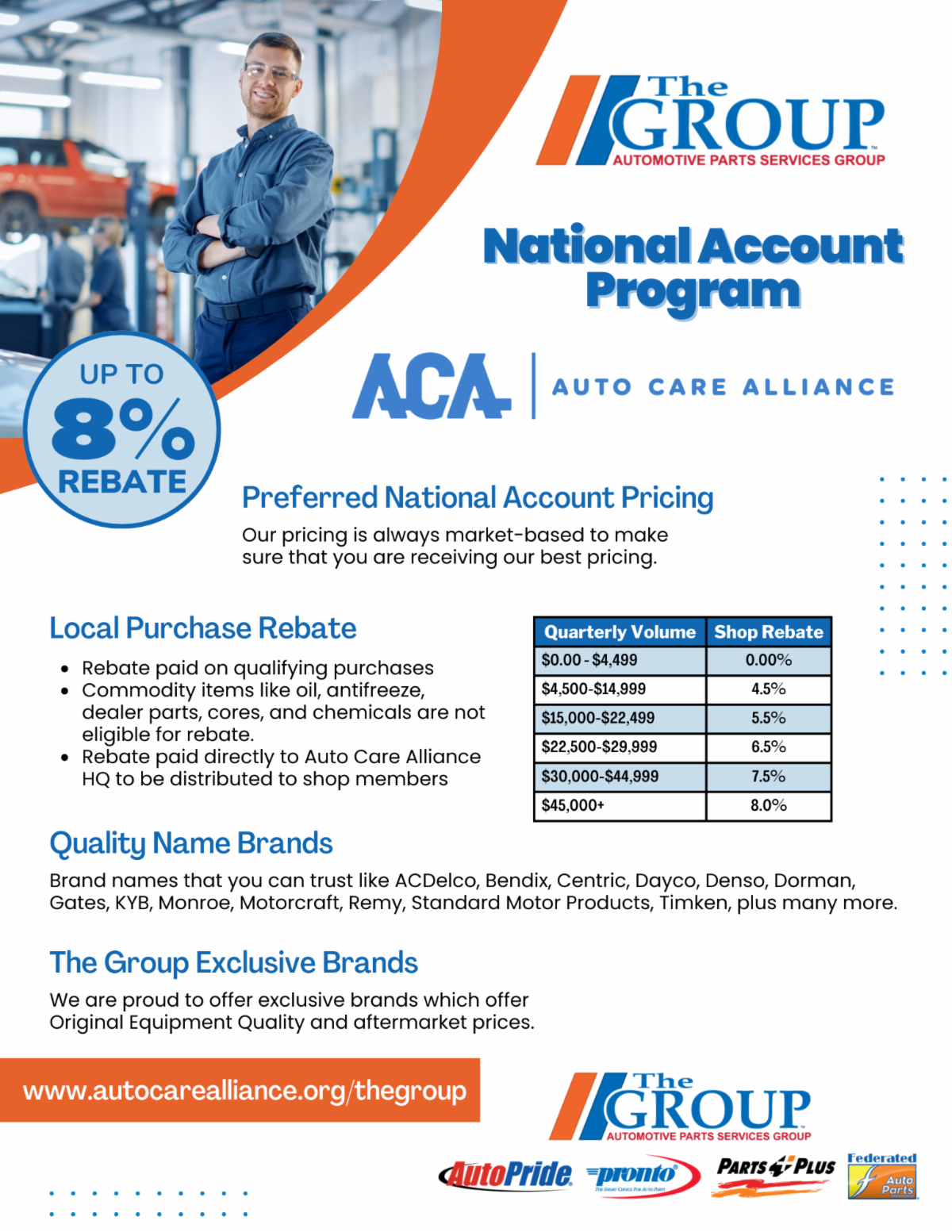

The Group Offers Historic First Rebate Program To ACA Members

https://cf.ctctcdn.com/galileo-uploads/1011094116165/6800701462.png

Member Benefits Member Rebates BNBA Org

http://bnba.org/wp-content/uploads/2019/10/NYSBA-MRP-Flyer.jpg

Web The Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50 of the qualified wages an eligible employer pays to employees after March 12 2020 and before January 1 2021 Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

Web The COVID related Tax Relief Act of 2020 enacted December 27 2020 amended and extended the tax credits and the availability of advance payments of the tax credits for paid sick and family leave under the FFCRA You can get immediate access to the credit Web 11 sept 2017 nbsp 0183 32 If you receive a refund of state and local income taxes whether you have to pick up any income depends If you claimed the standard deduction in the year in which you paid the taxes then a refund is tax free If you itemized only the portion of the refund

CRBRA Member Benefits CAPITAL REGION BUILDERS REMODELERS ASSOCIATION

https://www.crbra.com/uploads/1/3/0/9/130907210/editor/hba-rebates-flyer.jpg?1612902980

Member Rebate Program LinkedIn

https://media-exp1.licdn.com/dms/image/C4E1BAQGoH5nhZxuOhg/company-background_10000/0/1634748805146?e=2147483647&v=beta&t=ChtDsq0E4oSUVCvIUcKGpQPda-Jb0IfrmaXcMmj5vXA

https://www.thetaxadviser.com/issues/2018/a…

Web 1 ao 251 t 2018 nbsp 0183 32 In a 2002 announcement the IRS stated that it would not assert that a taxpayer s receipt or personal use of frequent flyer miles or

https://www.journalofaccountancy.com/issues/2008/oct/tax_treatment_of...

Web Rebates are used in many vendor market channel programs to accomplish objectives such as jump starting a market overcoming market barriers and supporting a market until economies of scale can reduce production costs The income tax treatment of rebates

REMINDER Illinois Tax Rebate Program Filing Due Date Is October 17

CRBRA Member Benefits CAPITAL REGION BUILDERS REMODELERS ASSOCIATION

Member Rebate Programs HBA Of Greater Little Rock

Happy Birthday Air Force Did You Know That With Watson Realty You Can

March 2012 Think Green Rebate Program Amps Up The Value With Rebates

HBA Member Rebate Program Building Industry Association Of The Big Bend

HBA Member Rebate Program Building Industry Association Of The Big Bend

Government Rebate Program Fill Out Sign Online DocHub

Unidad Define Rebate Types For Sales Processes Salesforce Trailhead

City Of Chicago Proper ty Tax Rebate Program CLARETIAN ASSOCIATES

Member Rebate Program Tax Treatment - Web Evaluate the arguments in consultation with its tax advisors for treating the rebate payments as non taxable under current law as applied to the particular facts of its rebate program weighing the risk of penalty if the IRS takes the position that the rebate