Houston Texas Property Tax Rate 2023 You are still responsible for payment of your property taxes even if you have not received a copy of your property tax statement s Please call 713 274 8000 or send an email to tax office hctx to receive a payment amount for your 2023 property taxes The 2023 property taxes are due January 31 2024

This notice provides information about two tax rates used in adopting the current tax year s tax rate The no new revenue tax rate would Impose the same amount of taxes as last year if you compare properties taxed in both years The no new revenue tax rate is the tax rate for the 2023 tax year that will raise the same amount of property tax revenue for City of Houston from the same properties in both the 2022 tax year and the 2023 tax year

Houston Texas Property Tax Rate 2023

Houston Texas Property Tax Rate 2023

https://californiapolicycenter.org/wp-content/uploads/2017/05/Top_State_Marginal_Tax_Rates.jpg

Texas Has Seventh highest Property Tax Rate In U S Houston Agent

https://houstonagentmagazine.com/wp-content/uploads/sites/7/2022/03/propertytax-1024x615.png

How High Are Property Taxes In Your State American Property Owners

https://propertyownersalliance.org/wp-content/uploads/2020/10/property-taxes-by-state-2020-FV-01-1024x868-1.png

In 2023 the total property taxes collected in Houston are estimated to be 3 964 The average property tax rate in Houston is 1 34 which is slightly higher than the average Harris County property tax rate of 1 19 Property tax rates vary across Houston ZIP codes due to differences in home values Calculate how much you can expect to pay in property taxes on your home in Harris County Texas Compare your rate to the state and national average

We publish school district tax rate and levy information in conjunction with publishing the School District Property Value Study SDPVS preliminary findings which must be certified to the commissioner of education prior to Feb 1 each year We update this information along with the city county and special district rates and levies by August Harris Central Appraisal District HCAD determines appraised value and exemption status for property taxes for the 2024 tax year with the exception of disability and over 65 exemptions January 31 2024 This is the last day to pay 2023 property taxes without incurring delinquent penalty and interest

Download Houston Texas Property Tax Rate 2023

More picture related to Houston Texas Property Tax Rate 2023

Houston Property Tax Guide How To Lower Houston Property Tax

https://assets.site-static.com/userFiles/3705/image/houston-prop-tax-counties-around.jpg

5 Things To Know About Houston Property Tax Texas Protax

https://texasprotax.atxclients.com/wp-content/uploads/2021/12/houston-img.jpg

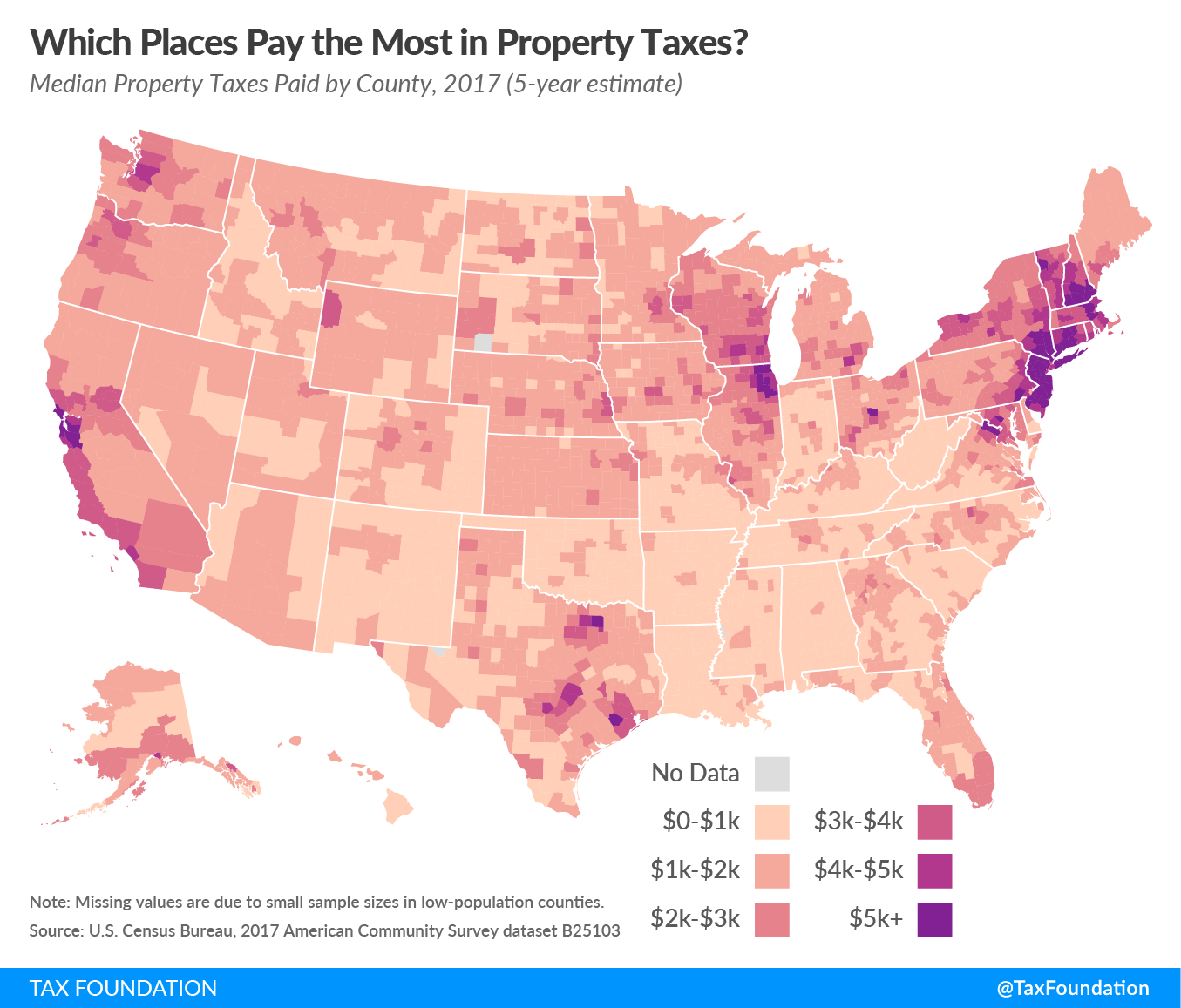

Property Taxes By County Interactive Map Tax Foundation

https://taxfoundation.org/wp-content/uploads/2019/08/Median-Property-Taxes-Paid-by-County-011.png

The proposed property tax rate is 0 533640 per each 100 a decrease from the current rate of 0 55083 The city operates under two revenue caps that limit the amount of property revenue the This notice concerns the 2023 property tax rates for Port of Houston Authority This notice provides information about two tax rates used in adopting the current tax year s tax rate The no new revenue tax rate would Impose the same amount of taxes as last year if you compare properties taxed in both years

Texas 2023 property tax cuts plan What are we voting on What s in the plan If approved how would I get my cuts How would the changes affect homeowners under 65 How would the Effective Tax Rate Effective Maintenance Operations Rate Rollback Tax Rate 2019 0 7200000 0 5616590 0 1583410 0 6818970 0 5202170 0 7201750 2020 0 7200000 0 5687940 0 1512060 0 7152640 0 5609860 0 7318260 2021 0 7200000 0 5592160 0 1607840 0 6801590 0 5406090 0 7203140 2022 0 7200000 0 5402470

Property Taxes On Single Family Homes Rise Across U S In 2021 ATTOM

https://www.attomdata.com/wp-content/uploads/2022/04/2021-Property-Tax-Analysis-Heat-Map-CROPPED.png

Taxes Scolaires Granby

https://1.bp.blogspot.com/-FBZaqEQDH_o/UTeOM4UQVWI/AAAAAAAAAXI/-pdogFJD8xw/s1600/tax+map.png

https://www.hctax.net/Property/PropertyTax

You are still responsible for payment of your property taxes even if you have not received a copy of your property tax statement s Please call 713 274 8000 or send an email to tax office hctx to receive a payment amount for your 2023 property taxes The 2023 property taxes are due January 31 2024

https://www.houstontx.gov/2023-tax-rate/50-212.pdf

This notice provides information about two tax rates used in adopting the current tax year s tax rate The no new revenue tax rate would Impose the same amount of taxes as last year if you compare properties taxed in both years

How Do Pa s Property Taxes Stack Up Nationally This Map Will Tell You

Property Taxes On Single Family Homes Rise Across U S In 2021 ATTOM

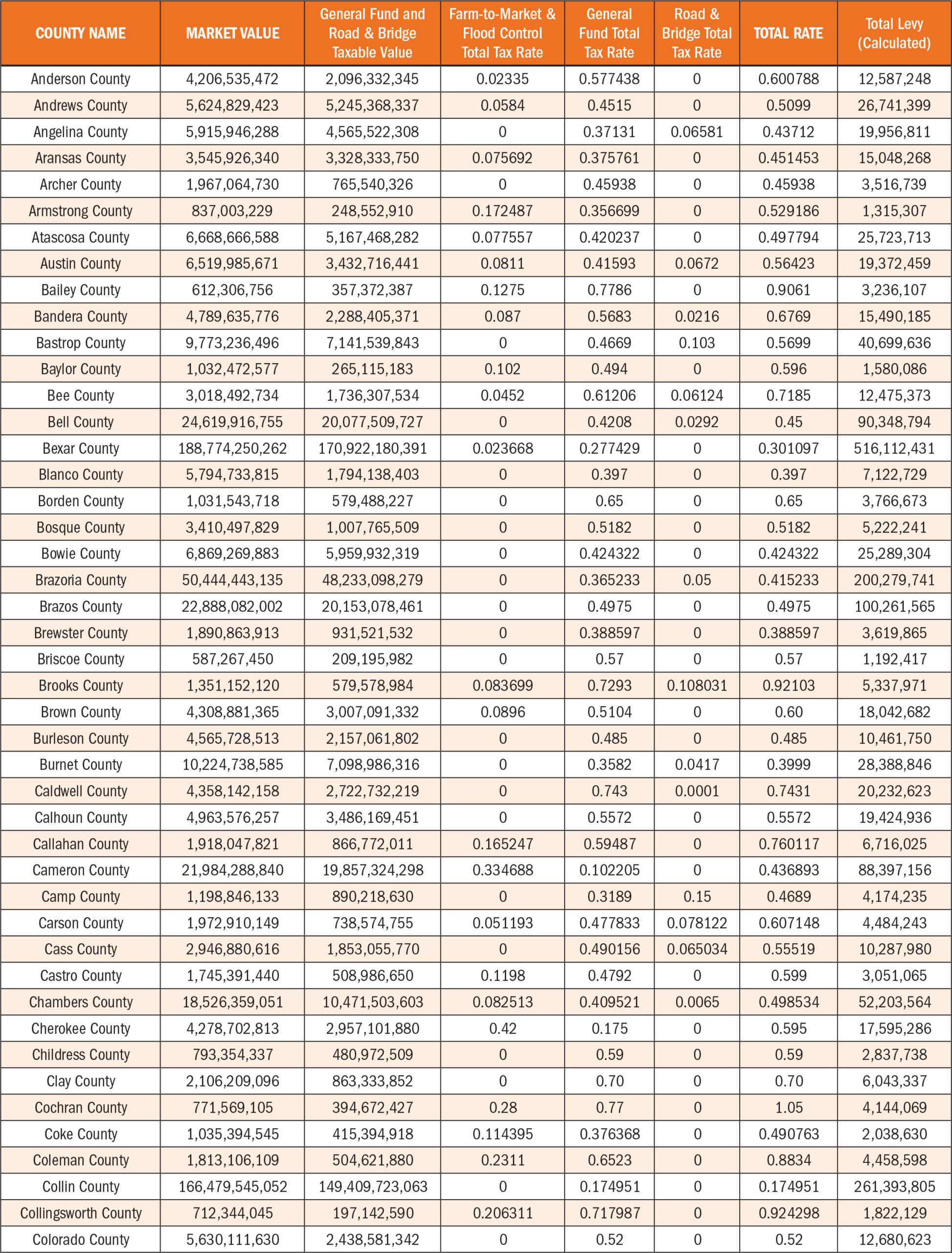

2019 County Property Tax Report Texas County Progress

Practical Tips To Win Your Property Tax Protest In Houston Steph

Sales Tax By State Here s How Much You re Really Paying Sales Tax

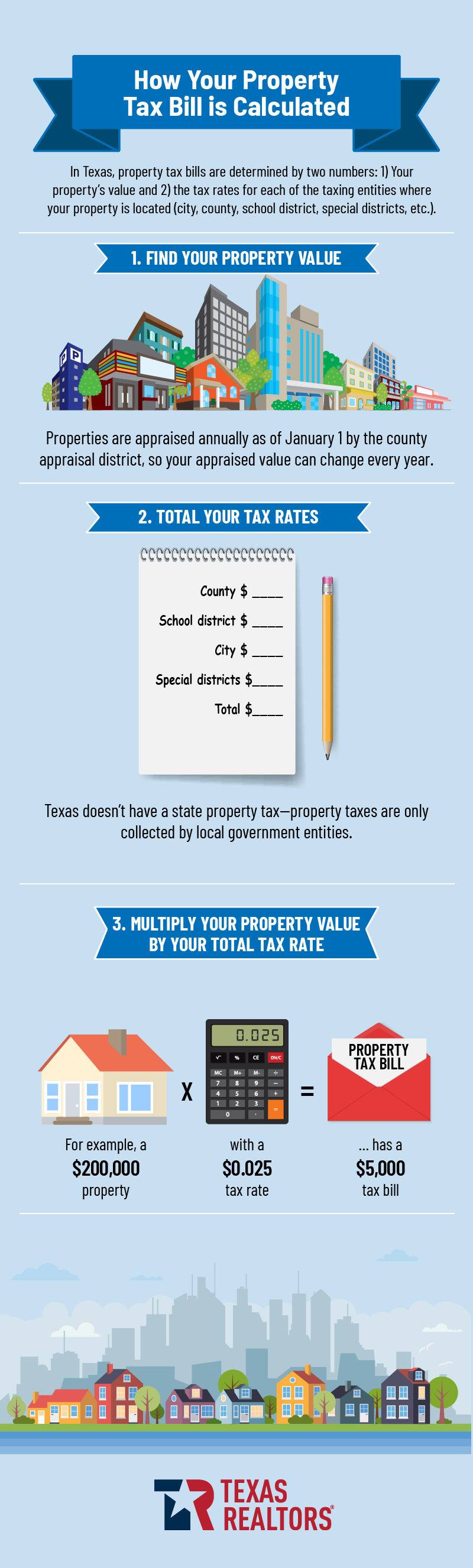

Property Tax Education Campaign Texas REALTORS

Property Tax Education Campaign Texas REALTORS

Tax Assessor Houston County

Comparing Texas And California Taxes One Side Seems Determined To Lose

Property Taxes In Houston Suburbs 13 Cities With Low Rates

Houston Texas Property Tax Rate 2023 - Harris Central Appraisal District HCAD determines appraised value and exemption status for property taxes for the 2024 tax year with the exception of disability and over 65 exemptions January 31 2024 This is the last day to pay 2023 property taxes without incurring delinquent penalty and interest