Hvac Rebate 2024 Roxanne Downer Updated On December 31 2023 Why You Can Trust Us The federal Inflation Reduction Act passed in 2022 expanded and extended federal income tax credits available for energy efficiency home improvements including HVAC system components An array of Energy Star certified equipment is eligible for the tax credits including

For heat pump and heat pump water heater projects the tax credit amount is 30 of the total project cost includes equipment and installation up to a 2 000 maximum So if your project You can receive up to 3 200 in federal tax credits for installing qualifying HVAC equipment into an existing home split between ACs furnaces or boilers 1 200 and air source heat pumps and biomass stoves 2 000 Your HVAC system must fulfill high energy efficiency requirements to qualify for tax credits

Hvac Rebate 2024

Hvac Rebate 2024

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2023-05/Summary-ITC-and-PTC-Values-Chart-2023.png?itok=_P0koCpu

Why Carrier Cool Cash Is The Best 2023 HVAC Rebate Apollo

https://apolloheatingandair.com/wp-content/uploads/2023/02/Carrier-–-Turn-to-the-Experts-of-HVAC-Systems-.jpg

HVAC Rebate Program Call Christensen Heating Cooling To Learn More

https://christensenair.com/wp-content/uploads/2022/04/Team-1536x1024.jpg

GUIDE 2024 Federal Tax GUIDE 2024 Federal Tax Credits for HVAC Systems Posted on December 21 2023 by Spurk HVAC Nothing disrupts daily life like an unexpected breakdown of your home s heating or cooling system That moment when you realize your HVAC unit has called it quits can be both frustrating and financially daunting 2024 Rebates for Heating and Cooling Equipment These rates apply to equipment installed January 1 2024 through May 31 2024 Applications must be submitted within 60 days of installation and no later than June 30 2024 Rebates are subject to change Check focusonenergy for current rebate amounts Are You Eligible for Income Qualified Rebates

2024 HEATING AND COOLING REBATE APPLICATION FOR SINGLE FAMILY MULTIFAMILY AND CONDOS 1 of 2 Step 3 Complete Your Application Submit the application within 60 days Incomplete or missing information will delay processing Required documentation Completed and signed rebate application both pages Invoice sales receipt Home Energy Rebates are not yet available but DOE expects many states and territories to launch their programs in 2024 Our tracker shows which states and territories have applied for and received funding

Download Hvac Rebate 2024

More picture related to Hvac Rebate 2024

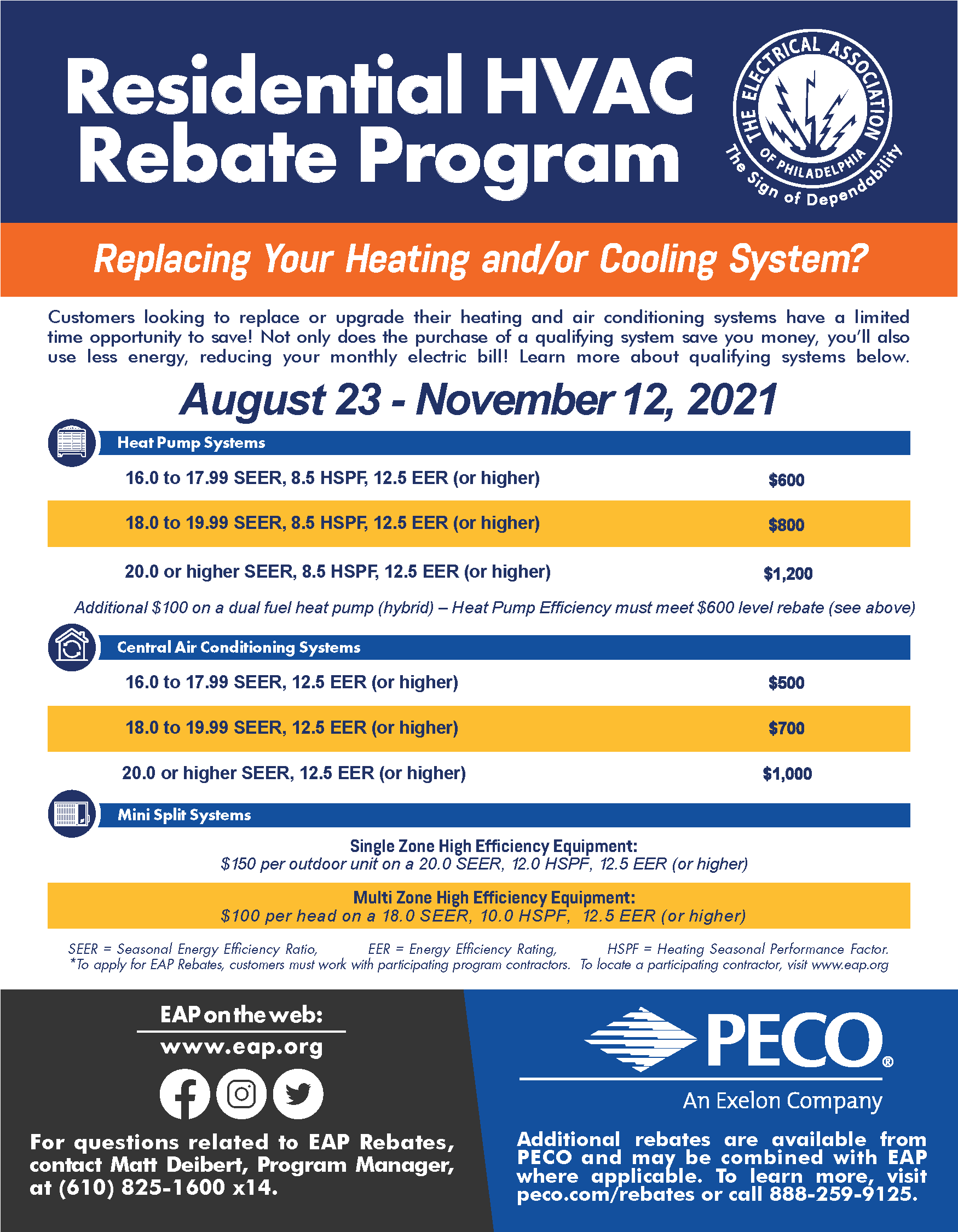

Residential HVAC Rebates

https://eap.org/images/Consumers/Fall 2021 Rebate Flyer Back final Edit.png

Keeping The Same Person For HVAC Service

https://www.accentsfloraldesign.com/wp-content/uploads/2021/05/HVAC-problems.jpg

2023 Xcel Energy Rebate Opportunities

https://www.long.com/hubfs/HVAC-Equipment-Fans-SM.jpg

Home energy audits The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit 2024 Government Rebates for HVAC Replacements The terms and conditions of government rebates or grants can differ depending on the time of year location and other variables Modernize recommends checking with the Database of State Incentives for Renewables Efficiency to see if you re eligible before applying or hiring a contractor

All HVAC rebates require invoice or bill of sale and AHRI Certificate WATER HEATERS HEAT PUMP WATER HEATER 500 SMART WI FI ENABLED ELECTRIC STORAGE WATER HEATER 300 ELECTRIC STORAGE WATER HEATER 50 REQUIREMENTS Minimum UEF 90 Equipment must be new 2023 Rebate Applications must be submitted by Friday Dec 15 Many Inflation Reduction Act rebates on green technology such as heat pumps and induction stoves being installed in homes in this Riverside subdivision went into effect Jan 1 but homeowners

HVAC Tune Up Rebate Indiana Connection

https://www.indianaconnection.org/wp-content/uploads/2021/04/HVAC-Tune-Up-Rebate-Flyer-SEI-WEB.jpg

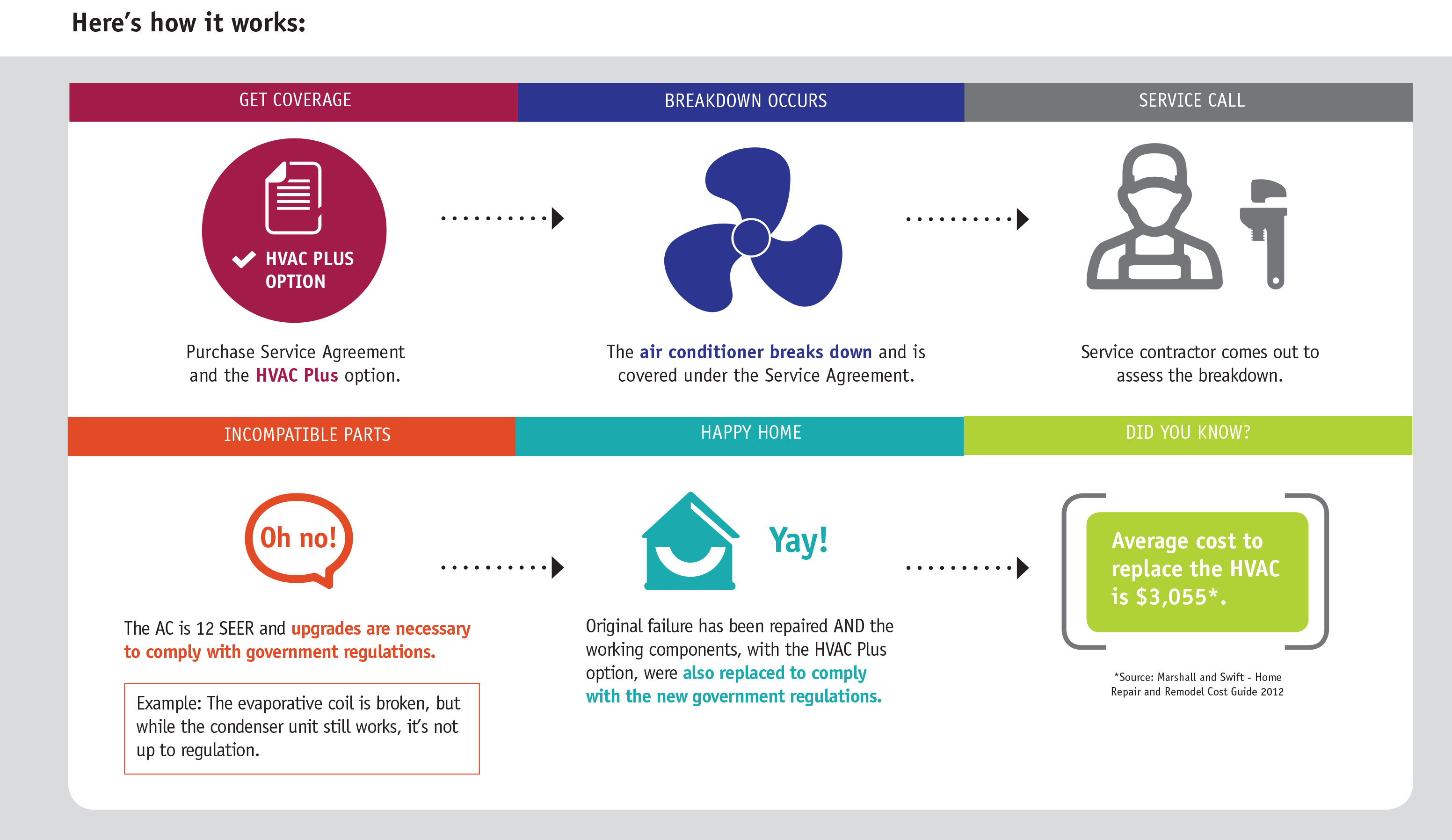

HVAC Plus 2 10 HBW

http://www.2-10.com/wp-content/uploads/2015/05/HVAC-Plus-LandingPages-howitworksv3.png

https://todayshomeowner.com/hvac/guides/hvac-tax-credit/

Roxanne Downer Updated On December 31 2023 Why You Can Trust Us The federal Inflation Reduction Act passed in 2022 expanded and extended federal income tax credits available for energy efficiency home improvements including HVAC system components An array of Energy Star certified equipment is eligible for the tax credits including

https://www.forbes.com/home-improvement/hvac/heat-pump-tax-credit/

For heat pump and heat pump water heater projects the tax credit amount is 30 of the total project cost includes equipment and installation up to a 2 000 maximum So if your project

Mobil One Offical Rebate Printable Form Printable Forms Free Online

HVAC Tune Up Rebate Indiana Connection

Conservation Residential Rebate Center Groton Utilities

Lensrebates Alcon Com

GreenON HVAC rebate Aire One Heating And Cooling

HVAC

HVAC

Get Up To A 300 Rebate On Bausch Lomb Contact Lenses Sunshine Optometry

Tri Cities HVAC Rebates To Take Advantage Of Before The Summer

HVAC And Energy saving Products Indiana Michigan Power

Hvac Rebate 2024 - Save Up to 2 000 on Costs of Upgrading to Heat Pump Technology These energy efficient home improvement credits are available for 30 of costs up to 2 000 and can be combined with credits up to 1 200 for other qualified upgrades made in one tax year Air Source Heat Pumps Heat Pump Water Heaters Biomass Stoves or Boilers