How Are Foreign Tax Credits Calculated In Canada In calculating the amount of a foreign tax credit the taxpayer must determine the particular countries to which their income gains and losses should be allocated The taxpayer must

Foreign tax credits Taxpayers that have foreign source income and are resident in Canada at any time in the year are eligible for foreign tax credit relief Separate foreign tax credit calculations To claim a foreign tax credit in Canada follow these steps 1 Calculate Your Foreign Income Determine the total income earned from foreign sources during the tax year Convert the income to Canadian dollars using the exchange rate

How Are Foreign Tax Credits Calculated In Canada

How Are Foreign Tax Credits Calculated In Canada

https://brighttax.com/wp-content/uploads/2022/08/Untitled-design-20-1024x683.png

Foreign Tax Credits In Canada How Much Can You Claim

https://thinkaccounting.ca/wp-content/uploads/Foreign-Tax-Credits-in-Canada.jpg

Foreign Tax Credits A Complete Guide

https://taxsaversonline.com/wp-content/uploads/2022/06/Foreign-Tax-Credits.jpg

Enter Section 126 Of Canada s Income Tax Act Gives A Foreign Tax Credit That Reduces A Canadian Resident Tax Payable In Canada To The Extent Of The Resident s Foreign Tax Liability The rest of this article CRA has published income tax folio S5 F2 C1 Foreign Tax Credit replacing the IT bulletin The foreign non business tax credit is calculated separately for each foreign country However if the total foreign taxes are less than 200 CRA

To claim the Foreign Tax Credit in Canada you must meet certain eligibility requirements set by the Canada Revenue Agency CRA These criteria are designed to The calculation of Canadian FTC begins with the measure of foreign income or profits tax paid by the taxpayer for the year subject to exclusions embedded in the s 126 7

Download How Are Foreign Tax Credits Calculated In Canada

More picture related to How Are Foreign Tax Credits Calculated In Canada

T2209 Tax Form Federal Foreign Tax Credits In Canada 2023 TurboTax

https://turbotax.intuit.ca/tips/images/Untitled-design-32-1-720x370.jpg

Foreign Tax Credit Meaning Example Limitation Carryover

https://www.wallstreetmojo.com/wp-content/uploads/2021/02/what-is-foreign-tax-credit.png

Foreign Tax Credit USA

https://kotaxusa.com/wp-content/uploads/2022/03/A-Complete-Guide-of-foreign-tax-credit-.jpeg

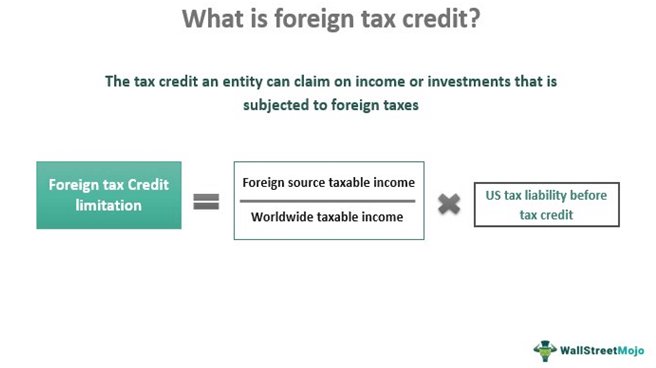

Relief for foreign taxes in the Canadian system is accomplished through a tax credit and deduction mechanism A foreign tax credit of up to 15 for any foreign tax withheld The tax treaty between Canada and the foreign country is an essential document to the computation of FTC Foreign tax credit calculation As mentioned above there are two categories of foreign sourced income non

If you declared foreign income and if you had to pay business or non business taxes on that income in a foreign country you can claim the Federal Foreign Tax Credit If you When income earned by a Canadian tax resident is taxed in a foreign jurisdiction the Canadian Income Tax Act typically allows a taxpayer to claim a credit against Canadian

Employer Tax Credits Extended For Employee Paid Leave Due To COVID 19

https://www.yeoandyeo.com/wp-content/uploads/Tax-Credits-scaled.jpeg

Pre i Mokra ov Letm Income Tax Calculator Bc Norma Kamera Drevo

https://turbotax.intuit.ca/tips/images/self-employed-taxes-canada.jpg

https://www.canada.ca › ...

In calculating the amount of a foreign tax credit the taxpayer must determine the particular countries to which their income gains and losses should be allocated The taxpayer must

https://taxsummaries.pwc.com › canada › corporate › tax...

Foreign tax credits Taxpayers that have foreign source income and are resident in Canada at any time in the year are eligible for foreign tax credit relief Separate foreign tax credit calculations

The Ins And Outs Of Tax Credit For Hong Kong Businesses HKWJ Tax Law

Employer Tax Credits Extended For Employee Paid Leave Due To COVID 19

Fundamentals Of Low Income Housing Tax Credit LIHTC Management

San Francisco Foreign Tax Credit Attorney SF Tax Counsel

How Do I Claim Foreign Tax Credit In USA Leia Aqui Can A US Citizen

How Is Agricultural Income Tax Calculated With Example Updated 2022

How Is Agricultural Income Tax Calculated With Example Updated 2022

Foreign Tax Credits Insights From The Tax Lawyer

How U S Foreign Tax Credits May Work To Keep Money In The Pocket Of A

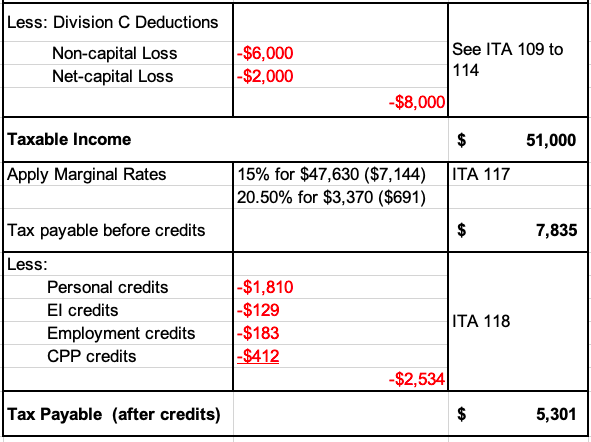

How Do You Get From Net Income For Tax Purposes To Taxable Income To

How Are Foreign Tax Credits Calculated In Canada - A detailed description of the foreign tax credit calculation was found in the Canada Revenue Agency CRA income tax folio S5 F2 C1 Foreign Tax Credit In most cases the