How Are Tax Credits Calculated Uk Verkko Usually what you re entitled to is based on your income for the last tax year 6 April 2022 to 5 April 2023 Income includes money from employment before tax and National Insurance including

Verkko 2 huhtik 2014 nbsp 0183 32 Find out what income you need to include in your tax credits claim or to understand how you use GOV UK 100 of foreign pensions income should be included in tax credit calculations Verkko 14 huhtik 2022 nbsp 0183 32 Calculating tax credits for 2011 2012 and earlier years Calculating the second income threshold Introduction This section of the website explains in detail how to calculate tax credits so that advisers can check HMRC calculations Legislation changes in April 2012 meant that the calculation of tax credits was different in the

How Are Tax Credits Calculated Uk

How Are Tax Credits Calculated Uk

https://www.dotnews.co.za/Code/Uploads/Article/2023/BudgetTables/Businesses-–-corporate-tax-rates-unchanged.png

Income Tax Doubles Since 2000 Here Are 2 Allowances To Help Your

https://cliftonnash.co.uk/wp-content/uploads/2021/09/Capture.png

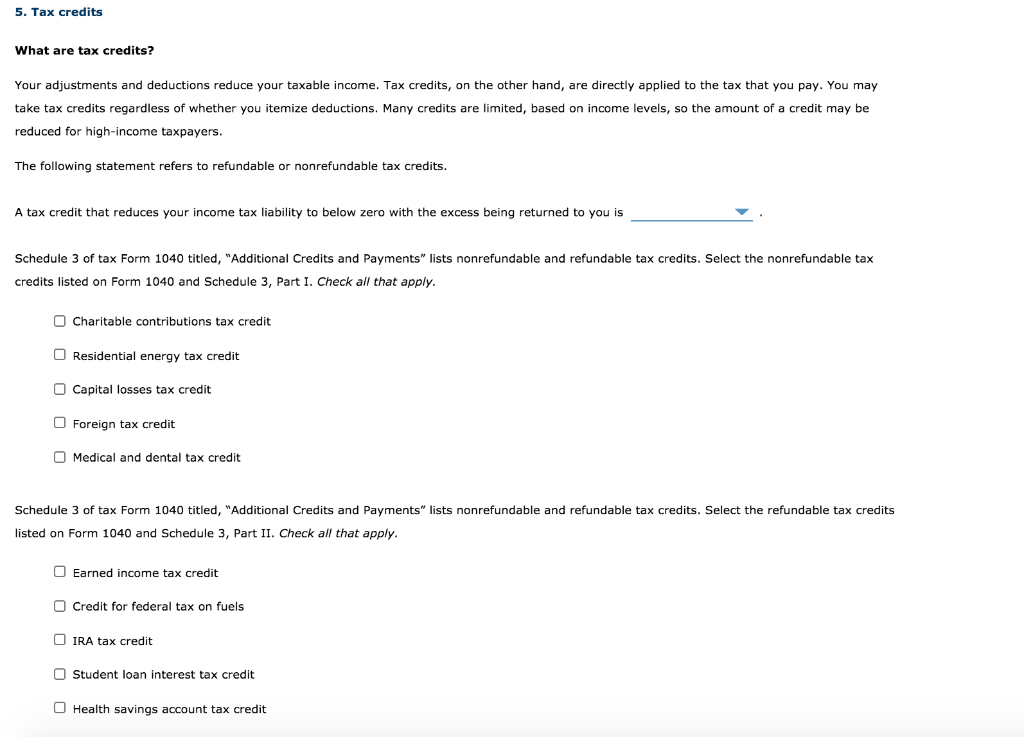

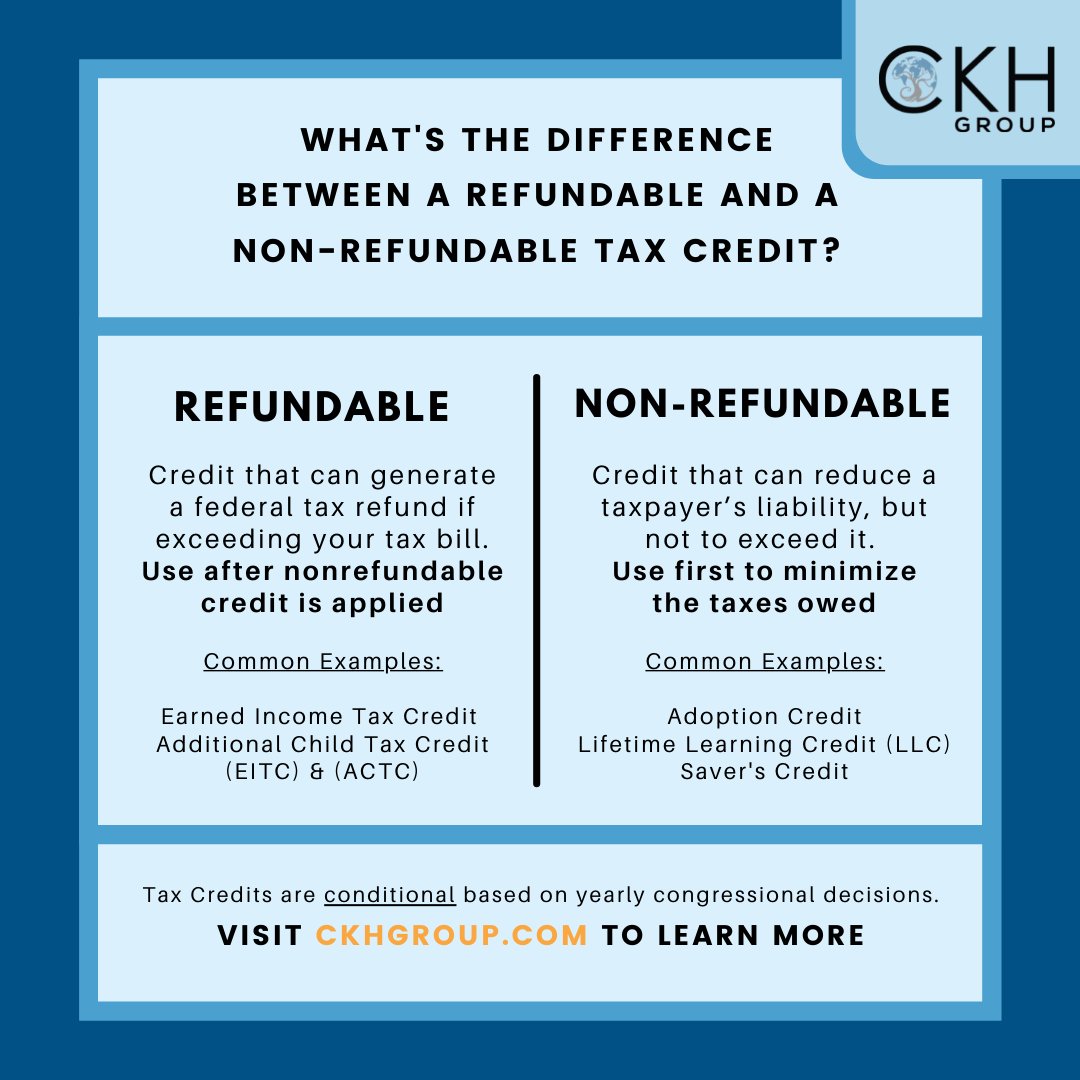

What Are Tax Credits Your Adjustments Deductions And Exemptions

https://img.homeworklib.com/questions/6715d9a0-0f03-11eb-8c88-c90d31bb6c59.png?x-oss-process=image/resize,w_560

Verkko 6 huhtik 2023 nbsp 0183 32 Our guides to child benefit and tax credits explain who Child benefit rates and calculator Discover the UK child benefit rates for 2023 24 Calculate how much child tax credit you are entitled to in the 2023 24 tax year 13 July 2023 Working tax credit explained Verkko This guide explains the procedures for calculating how much tax credit you could get in total But Universal Credit will replace HMRC tax credits The online tool calculates the amount from the current day to the end of the 2022 to 2023 tax year UK tax years run from the 6th of April to the 5th of April in the following year Tax credits are

Verkko Your final tax credit award can be calculated using either your 2022 23 income or your 2023 24 income Which year s income is used depends on whether your income has stayed roughly the same dropped by more than 163 2 500 or gone up by more than 163 2 500 Verkko 2 toukok 2023 nbsp 0183 32 Tax Credits Calculating tax credits income This section of the site explains about how to calculate income for tax credit claims It s important to note that where a claimant has their tax credits terminated because they are moving to universal credit there are separate rules on how to calculate income in those cases

Download How Are Tax Credits Calculated Uk

More picture related to How Are Tax Credits Calculated Uk

How Are R D Tax Credits Calculated In The UK And Who Is Eligible For

https://miro.medium.com/v2/resize:fit:800/1*78Od81u_hmC4vU72gHaozQ.jpeg

Solved 5 Tax Credits What Are Tax Credits Your Adjustments Chegg

https://media.cheggcdn.com/media/4db/4db8bd1d-6102-4a72-a48f-72d1533edb22/phpsxAAGW

How Much Can You Earn And Still Get Tax Credits Who Can Claim And How

https://www.thescottishsun.co.uk/wp-content/uploads/sites/2/2018/04/nintchdbpict000379813847.jpg?strip=all&quality=100&w=1200&h=800&crop=1

Verkko Working Tax Credit how much money you get hours you need to work eligibility claim tax credits when you stop work or go on leave Verkko 4 toukok 2023 nbsp 0183 32 Fergus and Deirdre made a joint claim for tax credits in 2023 24 In the first six months of 2023 24 only Fergus is working Their joint income for 2022 23 was 163 12 000 a year Fergus s annual salary Therefore for the first six months of 2023 24 their tax credit award is based on a joint income of 163 6 000 half a year of Fergus s earnings

Verkko What is working tax credit and child tax credit There are two tax credits child tax credit and working tax credit You can claim one or both of them depending on your household circumstances HM Revenue amp Customs HMRC deals with claims for tax credits Working tax credit or WTC is paid to people who work and are on a low Verkko PART 2 Income for the purposes of tax credits CHAPTER 1 General Calculation of income of claimant 3 1 The manner in which income of a claimant or in the case of a joint claim the aggregate income of the claimants is to be calculated for a tax year for the purposes of Part 1 of the Act is as follows Step One Calculate and then add

Commodities Verified Carbon Unit VCU Credits Trading VERRA VCS

https://5.imimg.com/data5/SELLER/Default/2022/6/TD/NX/EG/5543328/verified-carbon-unit-vcu-credits-trading-1000x1000.png

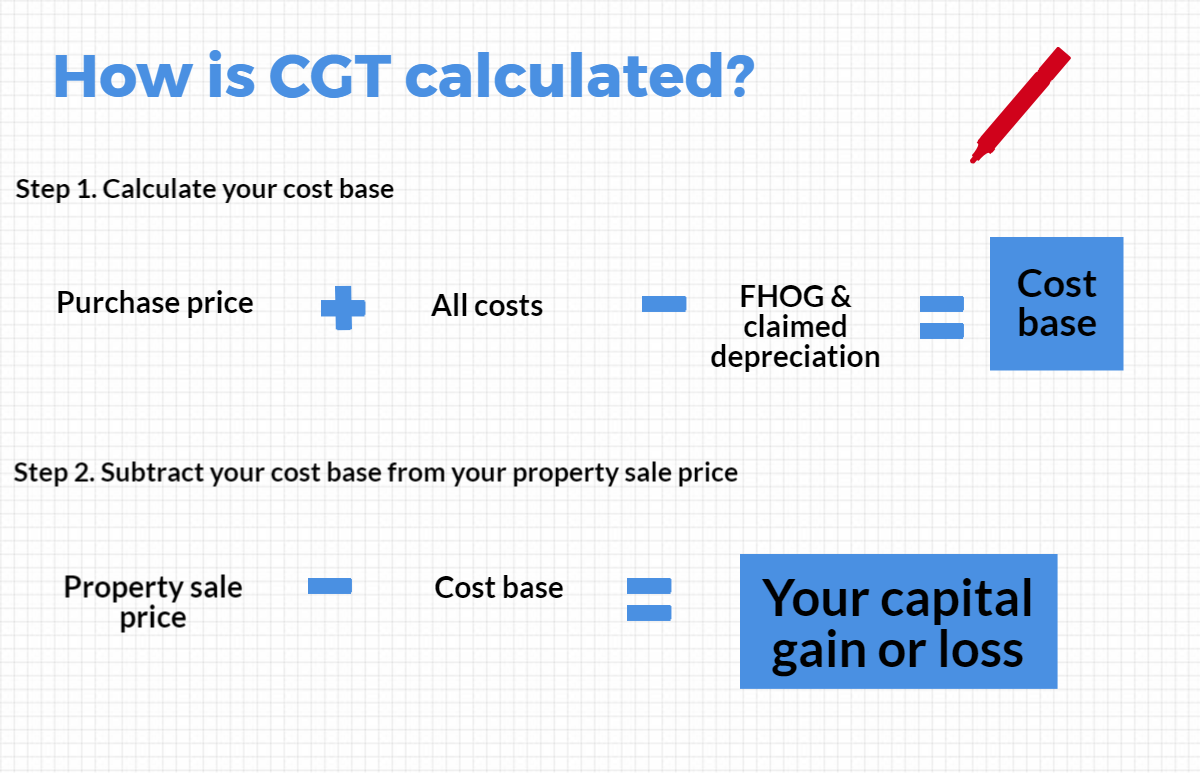

How Is Capital Gains Tax Calculated

https://info.realrenta.com.au/hs-fs/hubfs/How-to-calculate-your-capital-gains-tax.png?width=2310&height=1488&name=How-to-calculate-your-capital-gains-tax.png

https://www.gov.uk/claim-tax-credits/what-counts-as-income

Verkko Usually what you re entitled to is based on your income for the last tax year 6 April 2022 to 5 April 2023 Income includes money from employment before tax and National Insurance including

https://www.gov.uk/guidance/tax-credits-working-out-income

Verkko 2 huhtik 2014 nbsp 0183 32 Find out what income you need to include in your tax credits claim or to understand how you use GOV UK 100 of foreign pensions income should be included in tax credit calculations

What Are The New Stamp Duty Rates How The Tax Is Calculated When The

Commodities Verified Carbon Unit VCU Credits Trading VERRA VCS

How Are Tax Rates Calculated Keygent LLC Independent California

What Is The Difference Between A Tax Credit And A Tax Refund Leia Aqui

Fundamentals Of Low Income Housing Tax Credit LIHTC Management

Everything You Need To Know About Tax Credits Tax Credits Tax Help

Everything You Need To Know About Tax Credits Tax Credits Tax Help

How Are Tax Returns Calculated The Tech Edvocate

How Tax Credits Work YouTube

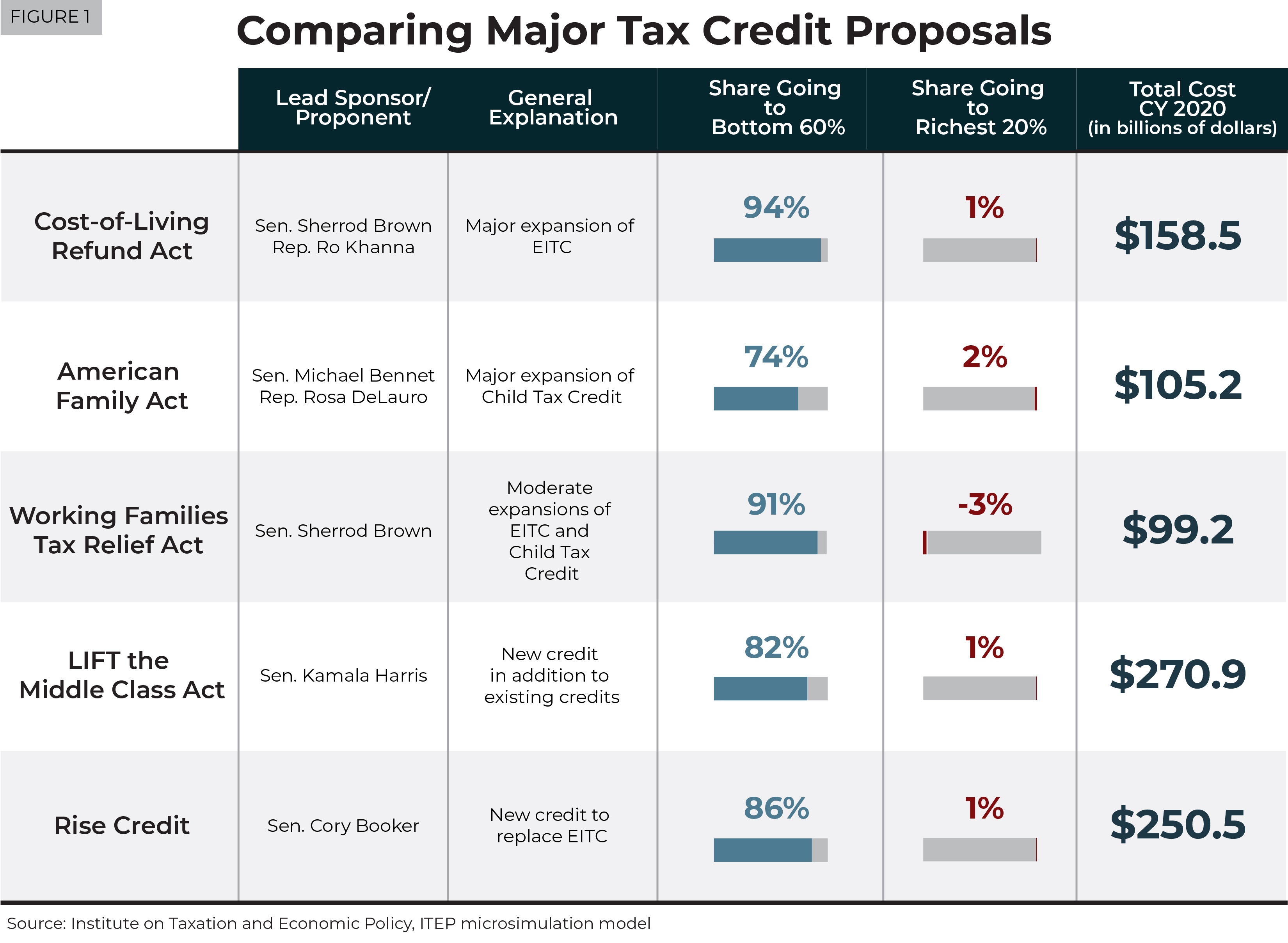

Understanding Five Major Federal Tax Credit Proposals Common Dreams

How Are Tax Credits Calculated Uk - Verkko 6 huhtik 2023 nbsp 0183 32 Our guides to child benefit and tax credits explain who Child benefit rates and calculator Discover the UK child benefit rates for 2023 24 Calculate how much child tax credit you are entitled to in the 2023 24 tax year 13 July 2023 Working tax credit explained