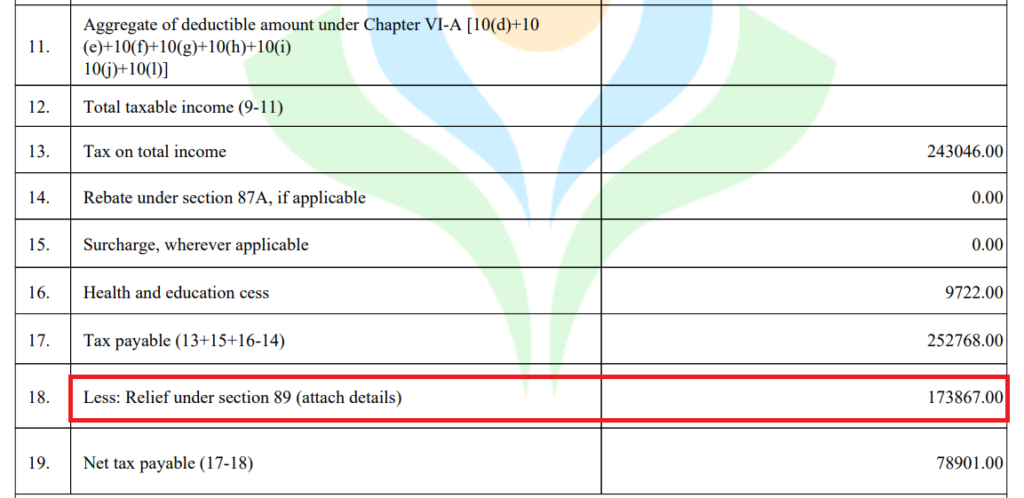

How Can I Show Arrears Of Salary In Itr Make sure you include the salary arrears as part of your current year s income when filing your Income Tax Return ITR But do note that you are requesting relief according to Section 89 1

Understand the tax implications of arrears of salary and explore relief options under Section 89 1 Learn the calculation process for tax relief and the importance of filing Form 10E to claim relief Relief under section 89 1 for arrears of salary is available in the following cases Salary received in advance or as arrears Family pension received late as arrears More than 12 months salary received in one financial year Commuted pension The compensation received from the employer as compensation for termination of employment Gratuity

How Can I Show Arrears Of Salary In Itr

How Can I Show Arrears Of Salary In Itr

https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Graphic/paid-in-arrears-reasons-companies-pay-arrears-us-1.jpg

Salary Arrears Definition Processing And Payments Pocket HRMS

https://www.pockethrms.com/wp-content/uploads/2022/08/salary-arrears.png

What Are Arrears In Accounting Kashoo

https://kashoo.com/wp-content/uploads/2014/11/Arrears.png

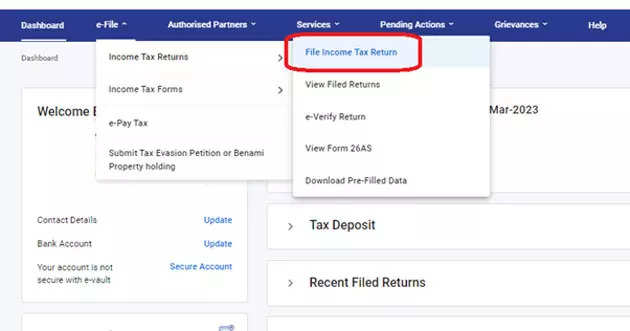

How to claim tax relief on Salary Arrears under Section 89 1 Arrears or Salary advances are taxable in the year of receipt The income tax department allows tax relief u s 89 of the Income Tax Act to save the taxpayer from the additional tax burden All registered users being an Individual on the e Filing portal can furnish particulars of their income in Form 10E for claiming relief as per Section 89 of Income Tax Act 1961 3 3 Form at a Glance Form 10E has seven parts Annexure I Arrears Salary Family Pension received in arrears Annexure I Salary Family Pension received in

In case of receipt in arrears or advance of any sum in the nature of salary relief u s 89 can be claimed In order to claim such relief the assessee has to file Form 10E It is advisable that Form 10E be filed before filing of Income Tax Return We explain how to calculate tax on arrears and claim tax benefit u s 89 1 in income tax return with example We take a simple example Amit is a government employee and he has received his long awaited salary dues as arrears Here are the numbers This arrears was due from last 3 financial years as follows

Download How Can I Show Arrears Of Salary In Itr

More picture related to How Can I Show Arrears Of Salary In Itr

Salary Slip Calculator Excel Lockqqueen

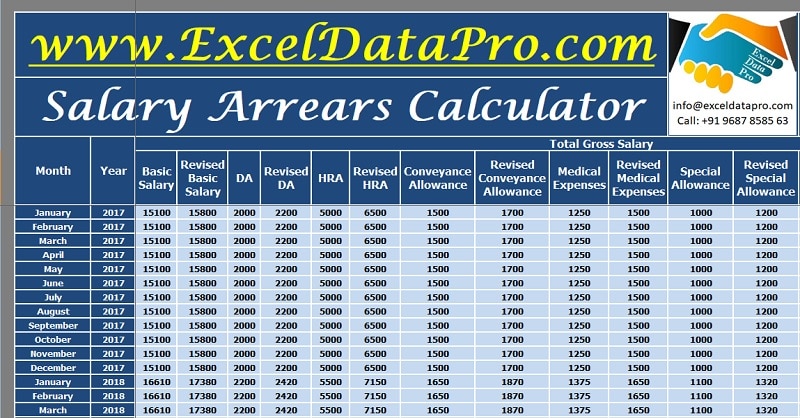

https://exceldatapro.com/wp-content/uploads/2019/06/Salary-Arrears-Calculator.jpg

Arrears Of Salary Taxability Relief Under Section 89 1 Learn By

https://assets.learn.quicko.com/wp-content/uploads/2021/02/11153055/Salary-Arrears-1024x498.png

Payment Of Dearness Allowance Dearness Relief W e f 01 01 2020 01 07

https://www.staffnews.in/wp-content/uploads/2022/08/payment-of-da-dr-nc-jcm-letter-18-08-2022.jpg

Can you claim income tax relief for arrears Yes If the assessee has received a portion of his salary in arrears or in advance or received a family pension in arrears the Income Tax Act allows you to claim tax relief under section 89 1 To claim the amount back under section 89 1 which was paid to due arrears it is mandatory to fill the form without filling the fill you cannot claim back the amount

[desc-10] [desc-11]

EXCEL Of Salary Arrears Calculator xlsx WPS Free Templates

https://newdocer.cache.wpscdn.com/photo/20190827/db747e315044488cb199dc91b3ce9164.jpg

How To File ITR 1 For FY 2022 23 With Salary Income From House

https://img.etimg.com/photo/msid-100894075/itr-1-1.jpg

https://www.livemint.com/money/personal-finance/...

Make sure you include the salary arrears as part of your current year s income when filing your Income Tax Return ITR But do note that you are requesting relief according to Section 89 1

https://taxguru.in/income-tax/arrears-salary...

Understand the tax implications of arrears of salary and explore relief options under Section 89 1 Learn the calculation process for tax relief and the importance of filing Form 10E to claim relief

ITR Filing How To Calculate Relief For Salary Arrears And Claim It

EXCEL Of Salary Arrears Calculator xlsx WPS Free Templates

Can I Get Child Support Arrears Dismissed Phoenix Divorce And Family

How To Save Tax On Arrears Of Salary How To Claim Tax Benefit On

Arrears Of Salary Relief U s 89 EZTax

Calls In Arrear Accounting Entries On Issue Of Shares GeeksforGeeks

Calls In Arrear Accounting Entries On Issue Of Shares GeeksforGeeks

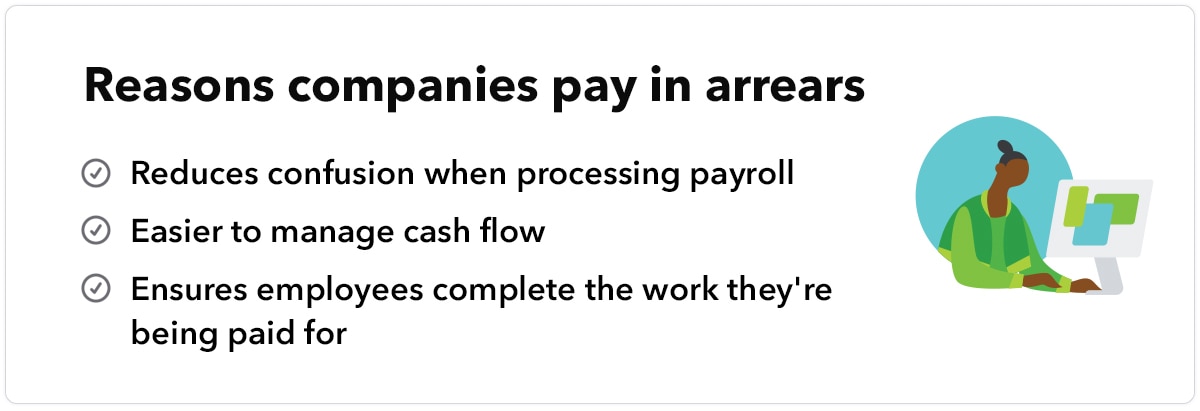

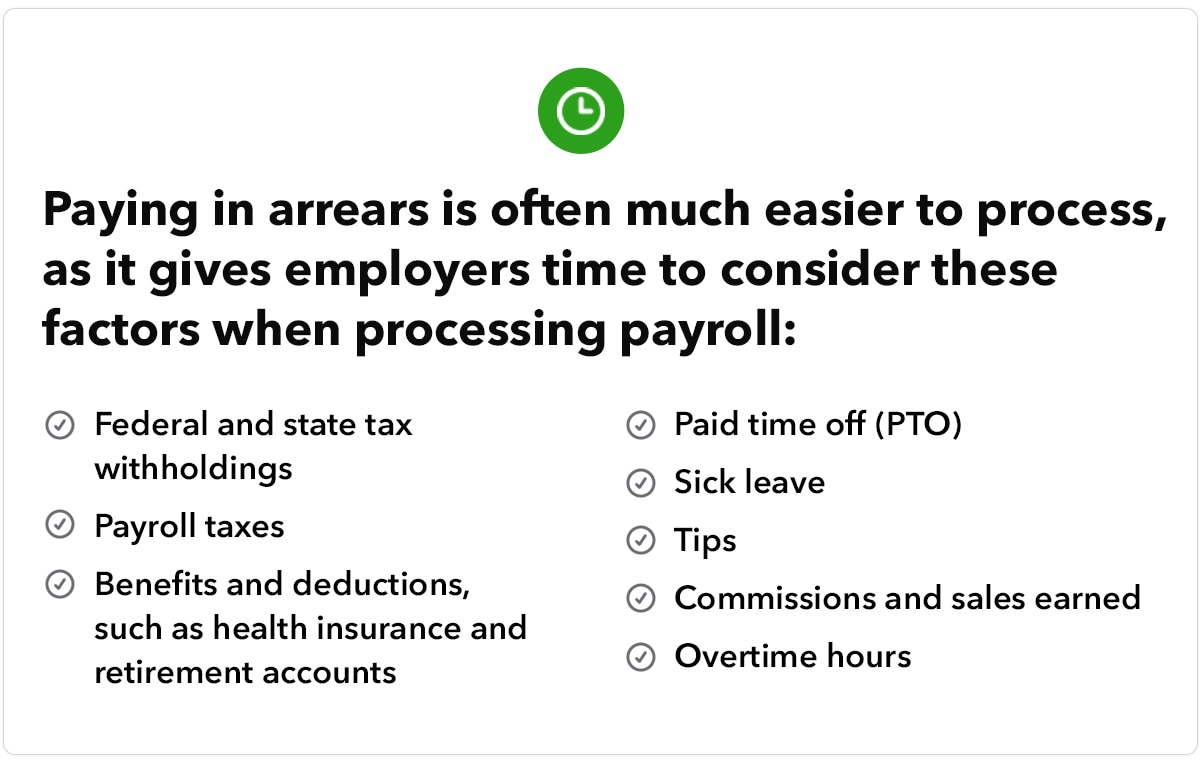

Arrears Billing And Payments What Does It Mean QuickBooks

Tax Deduction On Employee Salary Arrears U S 89 With Calculation

Salary Increments And Arrear Calculations

How Can I Show Arrears Of Salary In Itr - How to claim tax relief on Salary Arrears under Section 89 1 Arrears or Salary advances are taxable in the year of receipt The income tax department allows tax relief u s 89 of the Income Tax Act to save the taxpayer from the additional tax burden