How Do Federal Energy Tax Credits Work If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by

What are energy tax credits How are they different from deductions In this article we will answer these questions We will look at federal energy tax credits available for The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy

How Do Federal Energy Tax Credits Work

How Do Federal Energy Tax Credits Work

https://www.armaninollp.com/-/media/images/articles/energy-tax-credits-infographic.jpg

Energy Tax Credits Armanino

https://www.armanino.com/-/media/images/hero/energy-tax-credits.jpg

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

These federal tax credits empower Americans to invest in energy efficient upgrades by reducing the cost of making them The Inflation Reduction Act IRA of 2022 Energy tax credits are government incentives to provide tax savings to individuals and businesses when investing in certain energy technologies Energy credits can lower the

The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit Energy tax credits are an excellent way to encourage homeowners and businesses to adopt energy efficient measures By taking advantage of these credits you can reduce your

Download How Do Federal Energy Tax Credits Work

More picture related to How Do Federal Energy Tax Credits Work

Federal Energy Tax Credits For Nonprofits A Guide Simple Solar

https://simplesolar.io/wp-content/uploads/2023/06/shutterstock_228440362.jpg

Make Sure You Get These Federal Energy Tax Credits Consumer Reports

https://article.images.consumerreports.org/t_article_tout,f_auto/prod/content/dam/CRO Images 2017/Home and Garden/March/CR-Home-Hero-Claim-your-energy-tax-credit-03-17

Federal Solar Tax Credit What It Is How To Claim It For 2024

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

You will need to file Form 5695 Residential Energy Credits when you file your tax return for year in which your residential energy property was put in service Learn the steps for The Inflation Reduction Act of 2022 features tax credits for consumers and businesses that save money on energy bills create jobs make homes and buildings more

Unlock the power of clean energy tax credits and explore how the ITC PTC and other federal incentives can fund your renewable energy projects Discover how these The Residential Energy Efficient Property Credit also known as the Residential Clean Energy Credit is a tax credit that the U S Federal Government provides to

Receive Your Tax Credits

https://pacificinterwest.com/wp-content/uploads/2021/04/piw_45Lenergytaxcredits-1.jpg

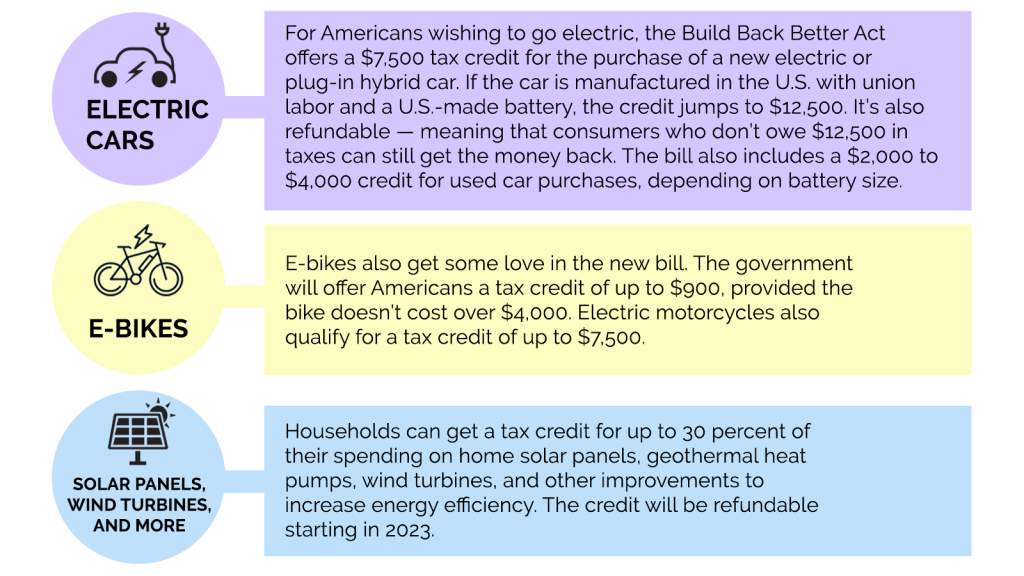

Green Incentives Usually Help The Rich Here s How The Build Back

https://grist.org/wp-content/uploads/2021/12/tax-credits-chart.png?w=1024

https://www.irs.gov › credits-deductions › home-energy-tax-credits

If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by

https://nationaltaxreports.com

What are energy tax credits How are they different from deductions In this article we will answer these questions We will look at federal energy tax credits available for

Clean Energy Tax Credits Mostly Go To The Affluent Is There A Better

Receive Your Tax Credits

The Electric Car Tax Credit What You Need To Know OsVehicle

Federal Energy Tax Credits Are Back The Eco Friendly Cheapass

Tax Credit

2023 Residential Clean Energy Credit Guide ReVision Energy

2023 Residential Clean Energy Credit Guide ReVision Energy

HVAC Rebates And Special Offers In Central PA HB Home Service Team

Geothermal Tax Credits Incentives

Report Shows Major Job And Economic Growth From Solar Tax Credits

How Do Federal Energy Tax Credits Work - The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit