How Do Hmrc Pay Tax Refunds If you think you have paid too much tax and HMRC have not sent you a tax calculation letter find out how to claim a refund If you think you owe tax and you have not received a letter contact

This video looks at how you can view manage and update details and claim a tax refund using the HMRC app To find out more about the HMRC app on GOV UK go You can get a refund on any taxable income you ve paid taxes on including Pay from your current or previous job Pension payments Income from a life or pension annuity A redundancy payment A Self Assessment tax return

How Do Hmrc Pay Tax Refunds

How Do Hmrc Pay Tax Refunds

https://www.swiftrefunds.co.uk/wp-content/uploads/2019/08/tax-refund-min-2-e1566379535551.jpg

How To Pay HMRC Self Assessment Income Tax Bill In The UK

https://www.gatwickaccountant.com/wp-content/uploads/2022/08/How-to-Pay-HMRC-Self-Assessment-Income-Tax-Bill-in-UK.jpg

HMRC Still Suspects QROPS Are Breaking Pension Rules IExpats

https://www.iexpats.com/wp-content/uploads/2015/11/HMRC.jpg

If you ever suspect you might be paying too much tax you can claim a refund from HMRC How to check if you are paying too much tax Start by verifying whether your tax code If you have not received a P800 you can still claim a tax refund by contacting HMRC directly through its online portal or by calling 0300 200 3300 When will I receive my tax

It usually takes between five days to eight weeks to get a tax refund from HMRC although it can take up to 12 weeks How long a tax rebate takes depends on how you Claiming back overpaid tax should be easy enough to do yourself directly through HMRC Matthew Jenkin Senior writer If you think you ve paid too much tax over the course of a financial year then you may be eligible for a

Download How Do Hmrc Pay Tax Refunds

More picture related to How Do Hmrc Pay Tax Refunds

HMRC Pay Tax SME Funding UK Corporation Tax Loan Pay My VAT

https://businessfinance-v4b.com/wp-content/uploads/2020/02/Tax2.jpg

3 Reasons You Shouldn t Receive A Tax Refund Next Year GOBankingRates

https://cdn.gobankingrates.com/wp-content/uploads/2020/05/IRS-Tax-Refund-check-shutterstock_1640116444.jpg

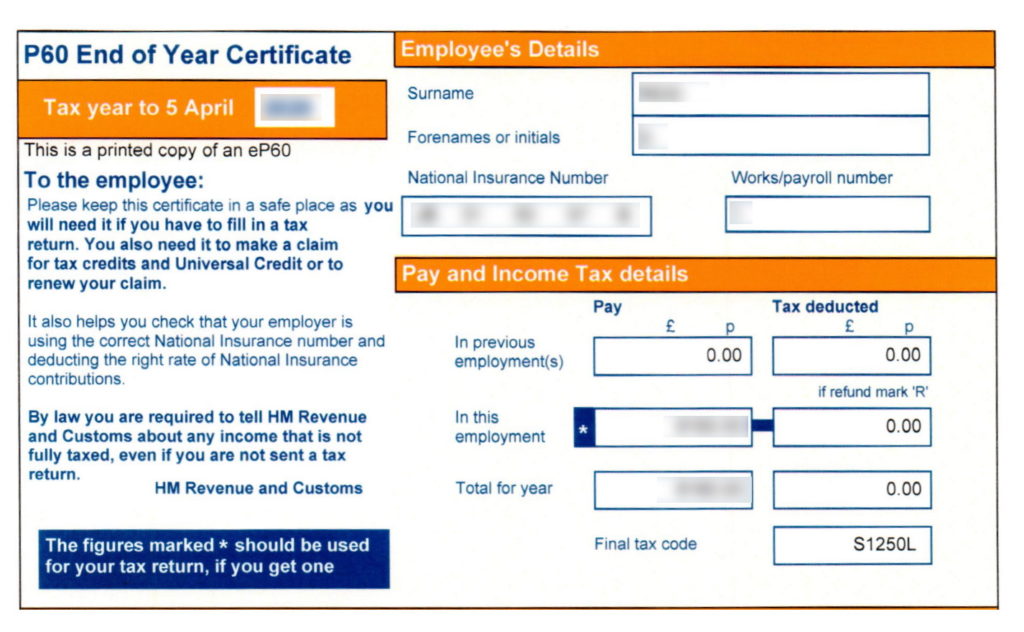

HMRC Tax Refunds Tax Rebates 3 Options Explained

https://www.ratednearme.com/wp-content/uploads/p60-tax-code-used-in-p800-tax-calculation-1024x632.jpg

Tax refunds in the UK can take up to 12 weeks to be processed by HMRC with a further 5 days to 5 weeks added to receive your money There are a number of reasons why you may be owed a tax refund or tax rebate from A tax rebate details the amount of money you re owed back from HMRC after paying more tax than you need to You might be owed a rebate for several reasons such as

If HMRC finds that you ve paid too much income tax you will get a tax refund typically paid back to you in your next wage packet Other things like work expenses and business allowances If your P800 calculation states that you can claim your tax refund online then usually you can go into your Personal Tax Account PTA or the HMRC app and ask HMRC to

P45 Vs P60 What s The Difference Revolut

https://blog.revolut.com/content/images/2020/03/p60-image.png

New HMRC Repayment Policy Could Delay Tax Refunds

https://www.lsbf.org.uk/media/5167038/thinkstockphotos-470517973-1-2.jpg?anchor=center&mode=crop&quality=80&width=1920&height=500&rnd=132276242750000000

https://www.gov.uk/tax-overpayments-and-underpayments

If you think you have paid too much tax and HMRC have not sent you a tax calculation letter find out how to claim a refund If you think you owe tax and you have not received a letter contact

https://www.youtube.com/watch?v=ygbB3OHf28o

This video looks at how you can view manage and update details and claim a tax refund using the HMRC app To find out more about the HMRC app on GOV UK go

Customs Forms Printable Printable Forms Free Online

P45 Vs P60 What s The Difference Revolut

Tax Refunds Will Be Issued During Government Shutdown Bankrate

HMRC Announce Breathing Space On Late Self Assessment Tax Returns

Still Waiting Reasons Why You Haven t Received Your Tax Refund Yet

Budget Boost For HMRC In New Push On Tax Evasion Politics The Guardian

Budget Boost For HMRC In New Push On Tax Evasion Politics The Guardian

Pin On Jamies

How Much Tax Do The Rich Pay This Graph Uses HMRC Data To Flickr

Hmrc Tax Return

How Do Hmrc Pay Tax Refunds - I submitted my 2021 2022 self assessment tax form on 14 July 2022 I had overpaid tax but one year later and HMRC has still not paid it back to me In previous years