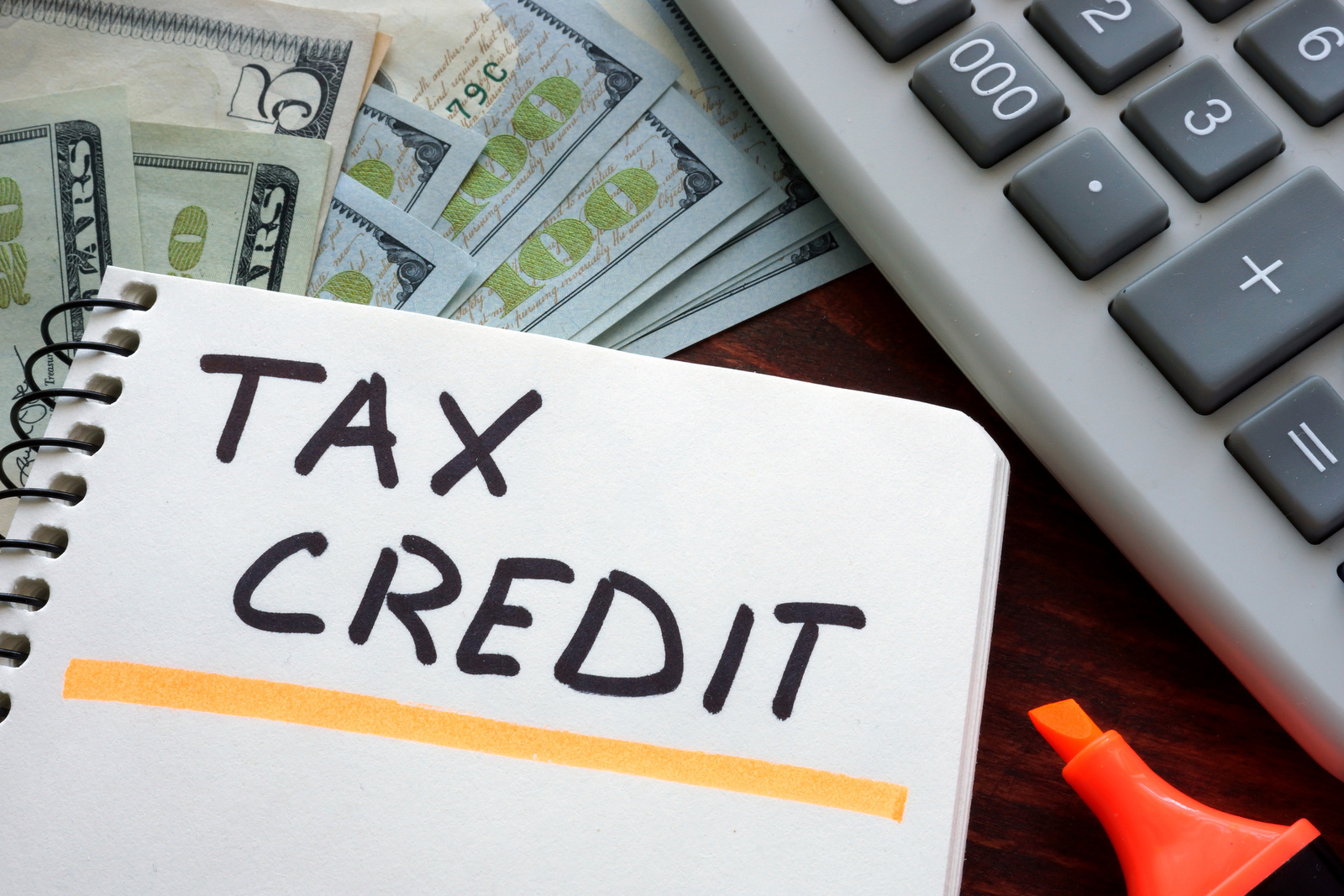

How Do Hybrid Car Tax Credits Work As of late 2023 just seven plug in hybrids are eligible for a federal tax credit but there s a workaround

The IRS will give a federal tax credit of 2 500 to 7 500 for the purchase of new electric vehicles on or after January 1 2019 This Our experts show you how to qualify for a federal tax credit of up to 7 500 by leasing an electric vehicle or plug in hybrid

How Do Hybrid Car Tax Credits Work

How Do Hybrid Car Tax Credits Work

https://environment.co/wp-content/uploads/sites/4/2021/08/Facebook-Image-How-Does-a-Hybrid-Car-Work-min.jpg

All You Need To Know About Electric Vehicle Tax Credits CarGurus

https://static.cargurus.com/images/article/2017/05/19/10/07/all_you_need_to_know_about_tax_credits_for_electric_and_hybrid_vehicles-pic-5583828754740272087-1600x1200.jpeg

What Is A Hybrid Car Tax Credit Hybrid Car Tax Credits Toyota

https://i.pinimg.com/736x/ef/a7/cf/efa7cfc2c0b207174a7cd3b36c7bdc02.jpg

Since 2008 the federal government has offered federal tax credits of up to 7 500 when you purchase an electric vehicle EV or plug in hybrid electric vehicle PHEV For 2024 the list of qualified vehicles for federal tax rebates only includes fully electric vehicles and a small selection of plug in hybrids

Consumers considering a new electric vehicle or plug in hybrid can now obtain instant tax rebates of up to 7 500 on select models Fewer electric car models qualify when compared to last year As of September 2024 the following fully electric and plug in hybrid vehicles may be eligible for either a full or partial tax credit if delivered on or after Jan 1 2024

Download How Do Hybrid Car Tax Credits Work

More picture related to How Do Hybrid Car Tax Credits Work

Facts About Electric Car Tax Credits Signature Auto Group NYC

https://www.signatureautoworld.com/wp-content/uploads/2022/09/Electric-Car-Tax-Credits.jpg

Can I Get A Tax Credit For Buying A Used Hybrid Car Juiced Frenzy

https://i0.wp.com/juicedfrenzy.com/wp-content/uploads/2021/11/Depositphotos_186124840_S.jpg?w=1000&ssl=1

All About Tax Credit For EV PHEV And Hybrid Cars CarBuzz

https://cdn.carbuzz.com/gallery-images/1600/954000/800/954828.jpg

The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in section 30D of the Internal Revenue Code Code for qualified plug in We ll help you determine whether your purchase of an electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on whether you are Planning to buy a

If you place in service a new plug in electric vehicle EV or fuel cell vehicle FCV in 2023 or after you may qualify for a clean vehicle tax credit For more information on how to How EV Tax Credits Work and How to Claim Them Currently the tax credit for purchasing a qualifying new battery electric and plug in hybrid vehicles is either

Hybrid Cars Much More Than Just A Concept Grade Auto Part Blogs

https://gradeautopart.com/blog/wp-content/uploads/2021/08/hybrid-car.jpg

The Electric Car Tax Credit What You Need To Know OsVehicle

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

https://www.caranddriver.com › features

As of late 2023 just seven plug in hybrids are eligible for a federal tax credit but there s a workaround

https://www.caranddriver.com › ... › hybri…

The IRS will give a federal tax credit of 2 500 to 7 500 for the purchase of new electric vehicles on or after January 1 2019 This

How To Plan Deliver A Hybrid Meeting Or Presentation SecondNature

Hybrid Cars Much More Than Just A Concept Grade Auto Part Blogs

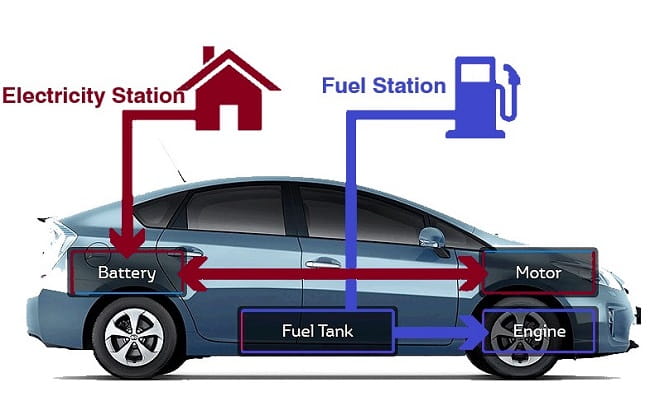

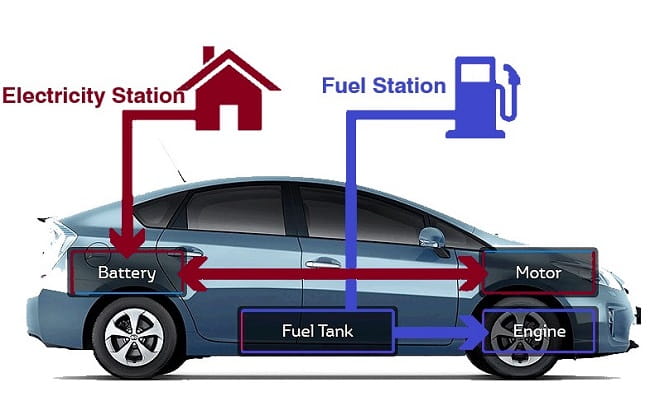

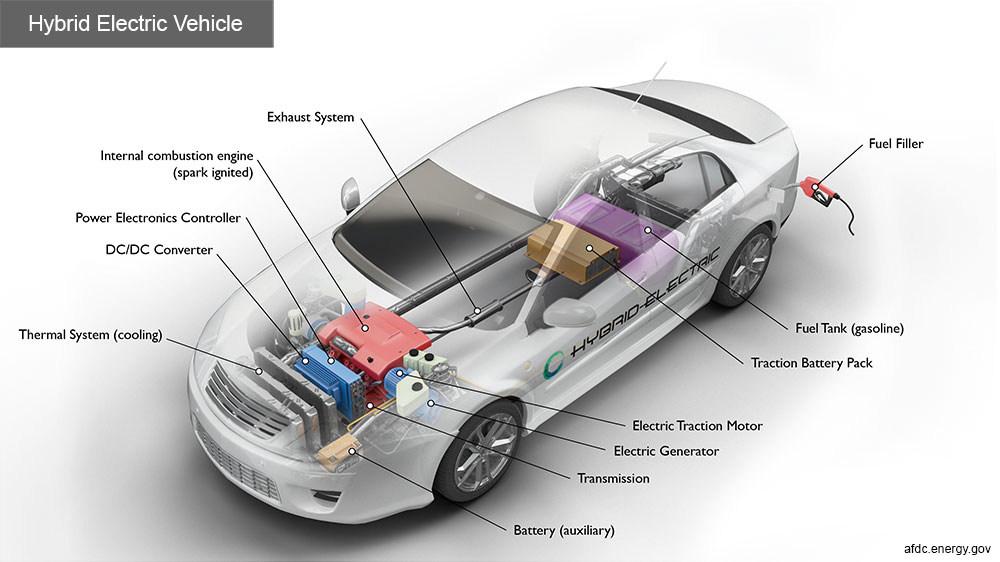

A Guide To Hybrid Cars And How They Work OVO Energy

Can I Get A Tax Credit For Buying A Used Hybrid Car Juiced Frenzy

How Do Hybrid Car Engines Work Hybrid Engine Efficiency

What Is Federal Tax Credit For Electric Cars ElectricCarTalk

What Is Federal Tax Credit For Electric Cars ElectricCarTalk

How Do The Used And Commercial Clean Vehicle Tax Credits Work Blink

Hybrids About Hybrid Cars And Trucks HEV

Hybrid Car Tax Credits For 2022 Taxes In 2022 By Make Model Best

How Do Hybrid Car Tax Credits Work - How Does the Clean Vehicle Tax Credit Work If you buy a new all electric plug in hybrid or fuel cell electric vehicle in 2023 or after you can claim a clean vehicle