How Do I Calculate Home Office Tax Deduction Verkko 30 kes 228 k 2022 nbsp 0183 32 For the simplified option of calculating your home office deduction do the calculation on Line 30 of Schedule C for sole proprietors or single member LLC

Verkko 3 toukok 2021 nbsp 0183 32 The simplified option is a quick and easy way to determine your home office deduction To determine your deduction simply multiply your office s total square footage by 5 Verkko 6 elok 2020 nbsp 0183 32 Taxpayers who qualify may choose one of two methods to calculate their home office expense deduction The simplified option has a rate of 5 a square

How Do I Calculate Home Office Tax Deduction

How Do I Calculate Home Office Tax Deduction

https://www.taxslayerpro.com/blog/wp-content/uploads/2015/03/Home-office-deduction-and-the-simplified-method-1.jpg

Understanding The Home Office Tax Deduction Houseopedia

https://www.houseopedia.com/wp-content/uploads/2022/04/Understanding-the-Home-Office-Tax-Deduction-1-e1649725159113-770x439.jpeg

Home Office Tax Deduction Simplified Credit Repair Coach

https://onhomebuyingandcreditrepair.com/wp-content/uploads/2018/08/Home-Office-Tax-Deduction-Simplified.jpg

Verkko 10 kes 228 k 2020 nbsp 0183 32 Percentage of square feet Measure the size of your home office and measure the overall size of your home The ratio of the two will yield your home office percentage You can claim 20 of Verkko 28 marrask 2023 nbsp 0183 32 How do I calculate the home office tax deduction Your home office business deductions are based on either the percentage of your home used

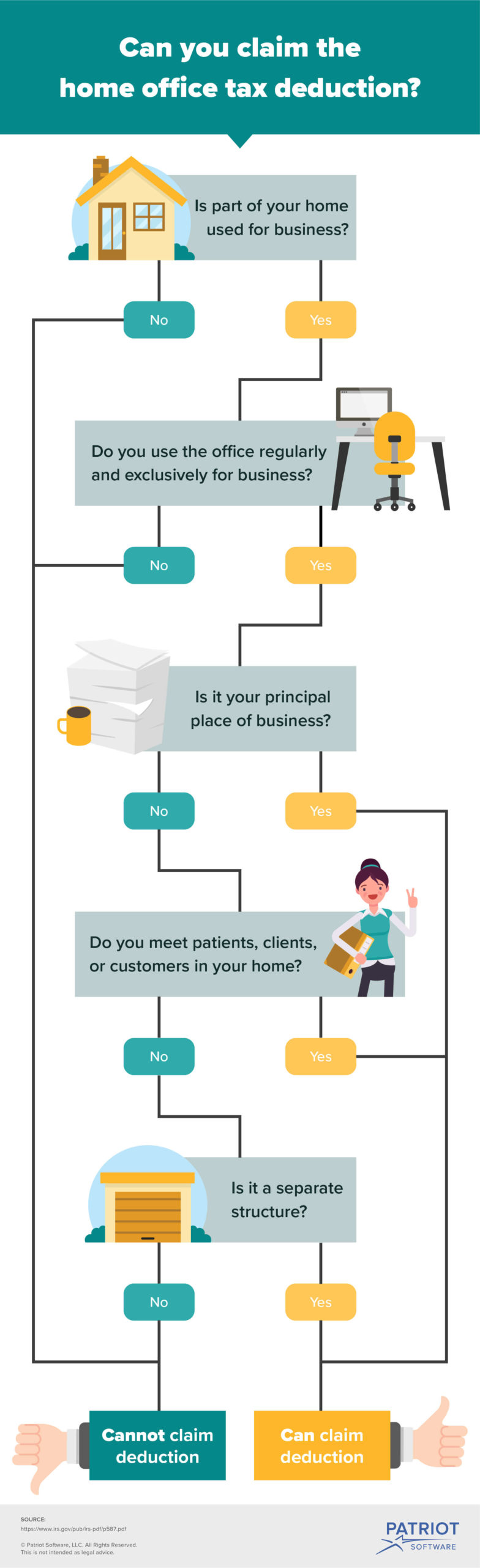

Verkko 26 kes 228 k 2021 nbsp 0183 32 Home Office Deduction at a Glance If you use part of your home exclusively and regularly for conducting business you may be able to deduct Verkko 16 kes 228 k 2023 nbsp 0183 32 To calculate a home office deduction you can choose between the standard method or the simplified option Be accurate with your deduction in case you

Download How Do I Calculate Home Office Tax Deduction

More picture related to How Do I Calculate Home Office Tax Deduction

2024

https://img.cs-finance.com/img/the-basics/how-to-calculate-income-tax-expense.jpg

![]()

Home Office Tax Deductions Calculator 2019 Microsoft Excel Spreadshe

https://cdn.shopify.com/s/files/1/0275/6784/9571/products/Home_Office_Tax_Deductions_Tracking_Tax_Write-off_Calculator_Microsoft_Excel_Spreadsheet3_1200x1200.jpg?v=1578499286

:max_bytes(150000):strip_icc()/200196510-001-56a0a4663df78cafdaa38959.jpg)

How To Calculate Your Home Business E Deduction

https://www.thebalancemoney.com/thmb/H_cOM2HbnZ6l6geBr23anJqi-lc=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/200196510-001-56a0a4663df78cafdaa38959.jpg

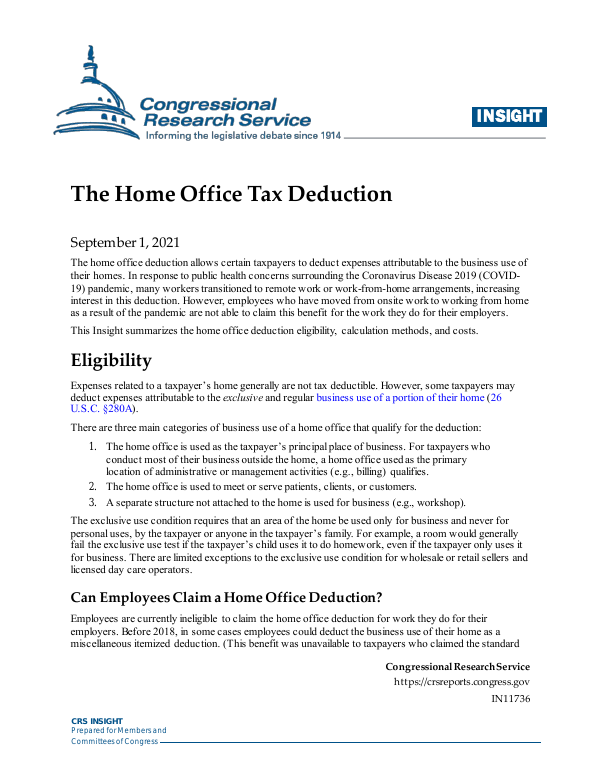

Verkko 15 helmik 2023 nbsp 0183 32 Taxes Home Office Tax Deduction Rules Who Qualifies Advertiser disclosure Home Office Tax Deduction Rules Who Qualifies If you use part of your home for your business you Verkko 19 syysk 2022 nbsp 0183 32 You will only subtract the percentage for your home office So if your home office takes up 10 of your home then you can only deduct 10 of each expense Now you subtract expenses

Verkko 12 jouluk 2023 nbsp 0183 32 The home office tax deduction is an often overlooked tax break for the self employed that covers expenses for the business use of your home including Verkko 10 maalisk 2023 nbsp 0183 32 Two methods for home office deduction There are two options for computing the amount of deduction that can be claimed while computing business

8829 Simplified Method Schedulec Schedulef

https://kb.drakesoftware.com/Site/Uploads/Images/12513 image 3.jpg

How Do I Claim A Home Office Tax Deduction

https://cdn1.thestoryexchange.org/wp-content/uploads/2015/03/22220204/6984657584_561f45afca_b.jpg

https://www.thebalancemoney.com/what-is-the-home-office-tax-deductio…

Verkko 30 kes 228 k 2022 nbsp 0183 32 For the simplified option of calculating your home office deduction do the calculation on Line 30 of Schedule C for sole proprietors or single member LLC

https://www.forbes.com/advisor/taxes/how-to …

Verkko 3 toukok 2021 nbsp 0183 32 The simplified option is a quick and easy way to determine your home office deduction To determine your deduction simply multiply your office s total square footage by 5

Home Office Tax Deduction What Is It And How Can It Help You

8829 Simplified Method Schedulec Schedulef

The Home Office Tax Deduction EveryCRSReport

How To Calculate Home Office Deductions F M Trust

Home Office Tax Deductions Are Fantastic Learn How To Do It

5 Tax Deductions When Selling A Home

5 Tax Deductions When Selling A Home

:max_bytes(150000):strip_icc()/GettyImages-532439992-57734ea03df78cb62c2e3974.jpg)

How To Calculate The Home Office Deduction And Depreciation

Home Office Tax Deduction For Self Employed What Can You Deduct

Home Office Deduction Calculator 2021

How Do I Calculate Home Office Tax Deduction - Verkko 26 kes 228 k 2021 nbsp 0183 32 Home Office Deduction at a Glance If you use part of your home exclusively and regularly for conducting business you may be able to deduct