How Do I Claim My Tuition Tax Credit From Previous Year In Canada To claim your tuition fees you may receive an official tax receipt from your educational institution instead to reflect the amount of eligible tuition fees you have paid for a

How to claim the tuition tax credit TurboTax makes it easy to claim the tuition tax credit when you file your student income taxes Here are the basic steps You will get a T2202 for entering your tuition tax credits When you enter the values on that form in tax software it will do the calculations for you However the tax credit are non

How Do I Claim My Tuition Tax Credit From Previous Year In Canada

How Do I Claim My Tuition Tax Credit From Previous Year In Canada

https://www.thesun.ie/wp-content/uploads/sites/3/2018/10/NINTCHDBPICT0004403735981.jpg?strip=all&quality=100&w=1920&h=1080&crop=1

How Do I Claim Funds For The Swap Fee Atomic Wallet Knowledge Base

https://d33v4339jhl8k0.cloudfront.net/docs/assets/5ce54e092c7d3a6d82bdd37a/images/6363a0f67a6ea671e2400be6/file-5HD8bqu9rF.jpg

Everything You Need To Know About The College Tuition Tax Credit

https://cdn.collegereaction.com/who_should_claim_the_tuition_credit.png

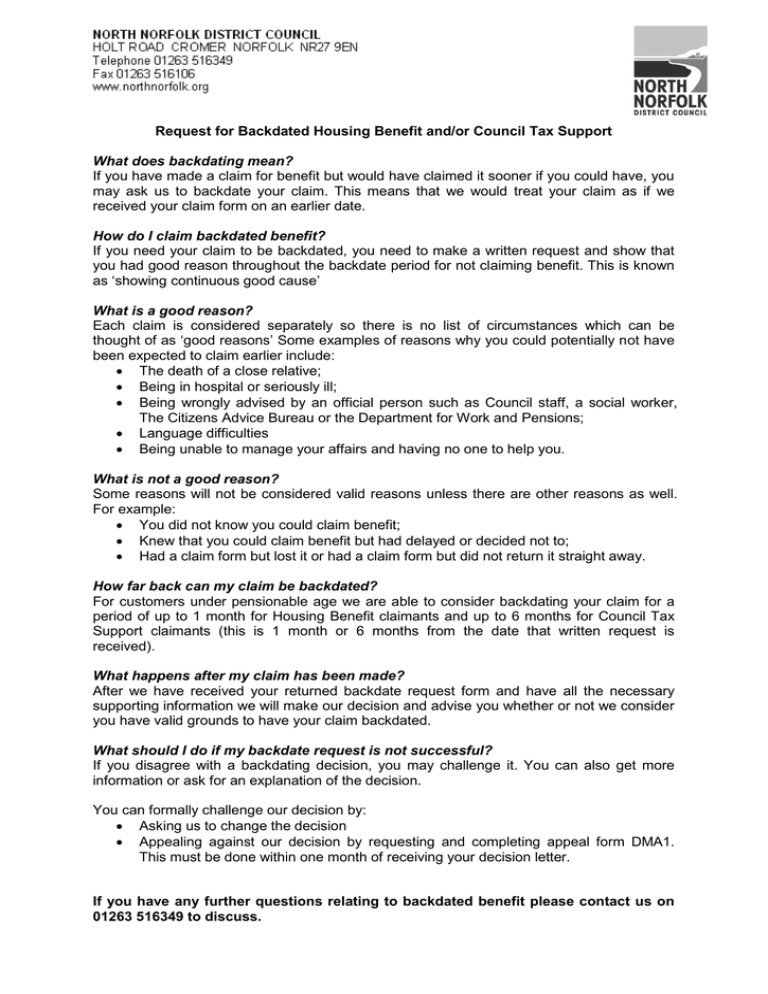

If you were a student in a previous year you might have carried forward your unused federal tuition education and textbook amounts You can claim these unused amounts Students enrolled at designated educational institutions receive a form T2202 the Tuition and Enrollment Certificate which tells the CRA how much tuition can be claimed on your tax return

Use Schedule 11 of your income tax return to claim your tuition tax credits and determine any unused amount to transfer or carry forward to a future year For illustration purposes let s assume you have income tax Where to find unused tuition credits The best way to find your unused tuition amounts is by logging in your CRA MyAccount You can also review the prior year s Notice of Assessment NOA that was

Download How Do I Claim My Tuition Tax Credit From Previous Year In Canada

More picture related to How Do I Claim My Tuition Tax Credit From Previous Year In Canada

What Is The Tuition Tax Credit Who Is Eligible And How To Claim It

https://cms.moneygenius.ca/wp-content/uploads/2023/04/what-is-the-tuition-tax-credit.jpg

Document 12927281

https://s2.studylib.net/store/data/012927281_1-bb2f843a32d7c5fbc00b0ec65690255f-768x994.png

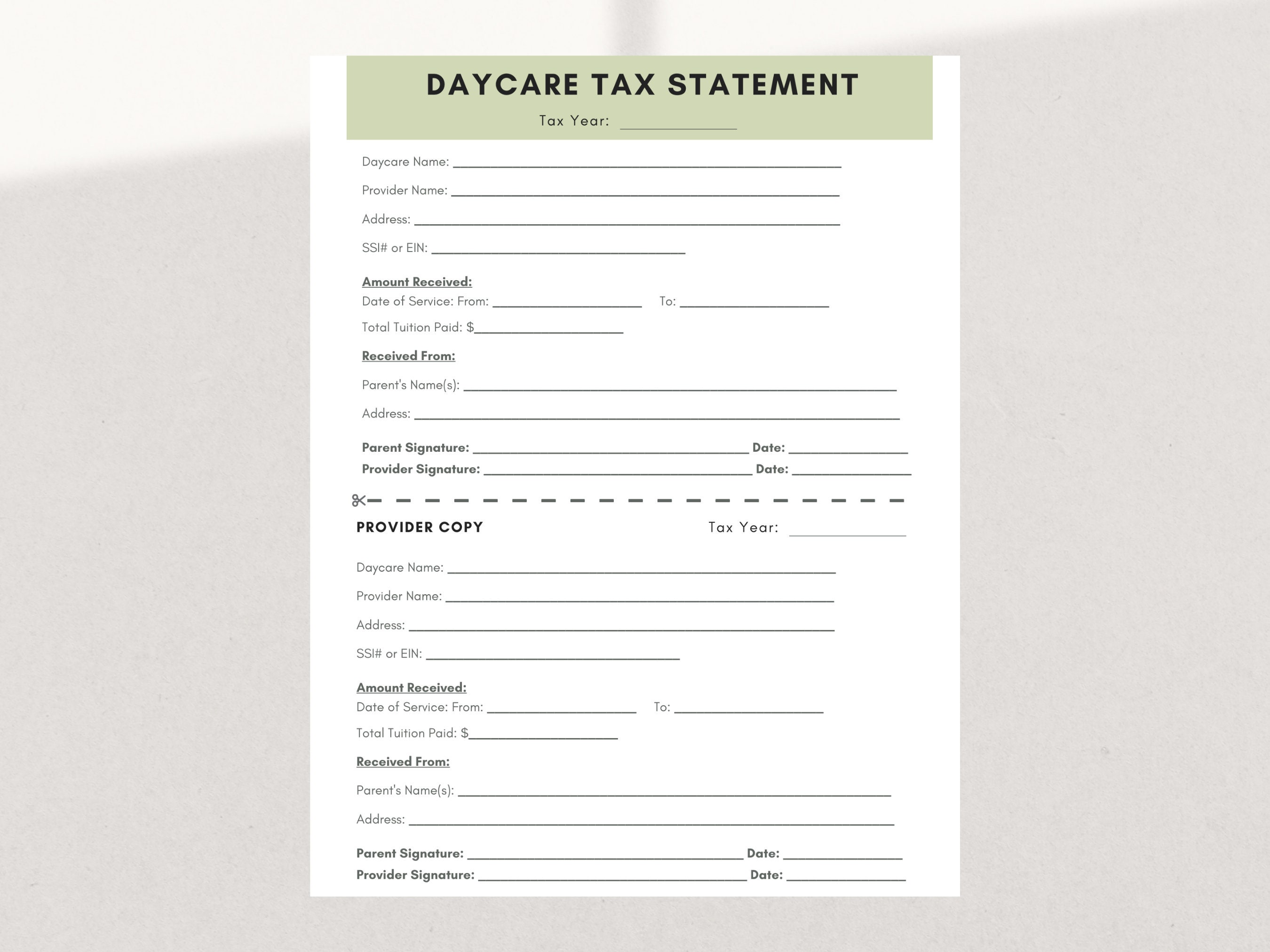

Daycare Tax Statement End Of Year Tuition Report For Parents

https://i.etsystatic.com/10352854/r/il/ec9265/3618084393/il_fullxfull.3618084393_ehdc.jpg

You can claim the tuition tax credit if you received the T2202 certificate or another tax certificate like the TL11A from your school and if the eligible tuition fees you paid was Claiming the tuition credit from your child is a two step process The first step is for your child to claim the tuition amount by completing federal Schedule 11 and

Line 32400 Tuition amount transferred from a child or grandchild Any remaining credit calculated on Schedule 11 by a student can be transferred to one of the following How do I claim my education tax credit You can claim your tuition tax credit in Canada when you file your tax return You will need to present the correct form

How To Fill TD1 2022 Personal Tax Credits Return Form Federal YouTube

https://i.ytimg.com/vi/Hg0fOlxqHpU/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AHUBoAC4AOKAgwIABABGF4gXiheMA8=&rs=AOn4CLC7ze0pzDjIJ1ES8fmIbkbvoylfOw

What Is Previous Year In Income Tax Under Section 3

https://navi.com/blog/wp-content/uploads/2023/01/Previous-Year-in-Income-Tax.webp

https://www.canada.ca/en/revenue-agency/services/...

To claim your tuition fees you may receive an official tax receipt from your educational institution instead to reflect the amount of eligible tuition fees you have paid for a

https://turbotax.intuit.ca/tips/understanding-tuition-tax-credits-6549

How to claim the tuition tax credit TurboTax makes it easy to claim the tuition tax credit when you file your student income taxes Here are the basic steps

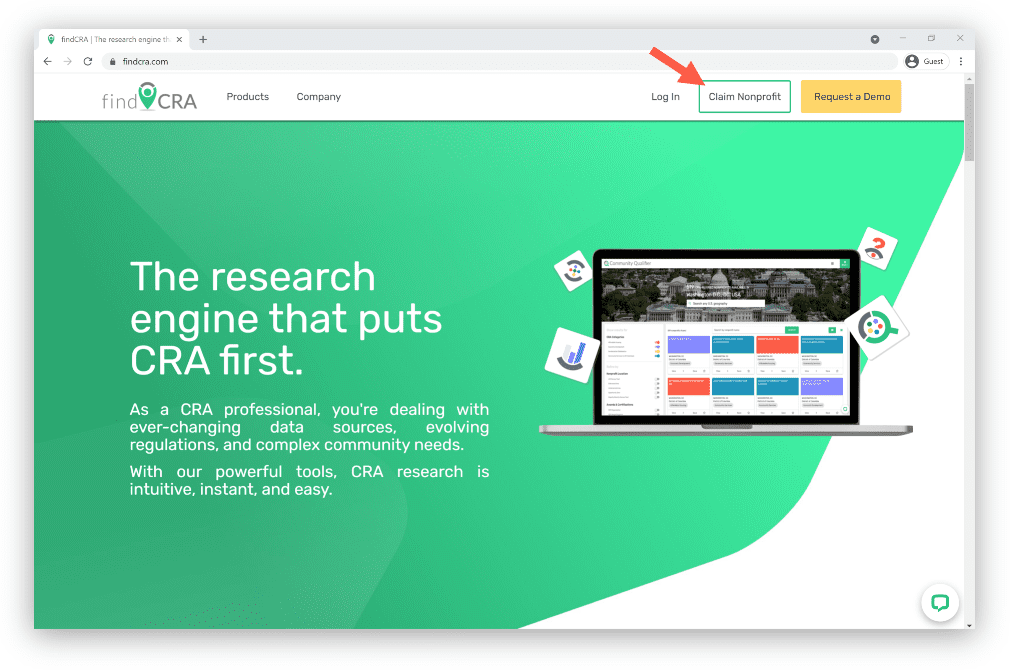

FindCRA Help Center How Do I Claim My Nonprofit Profile

How To Fill TD1 2022 Personal Tax Credits Return Form Federal YouTube

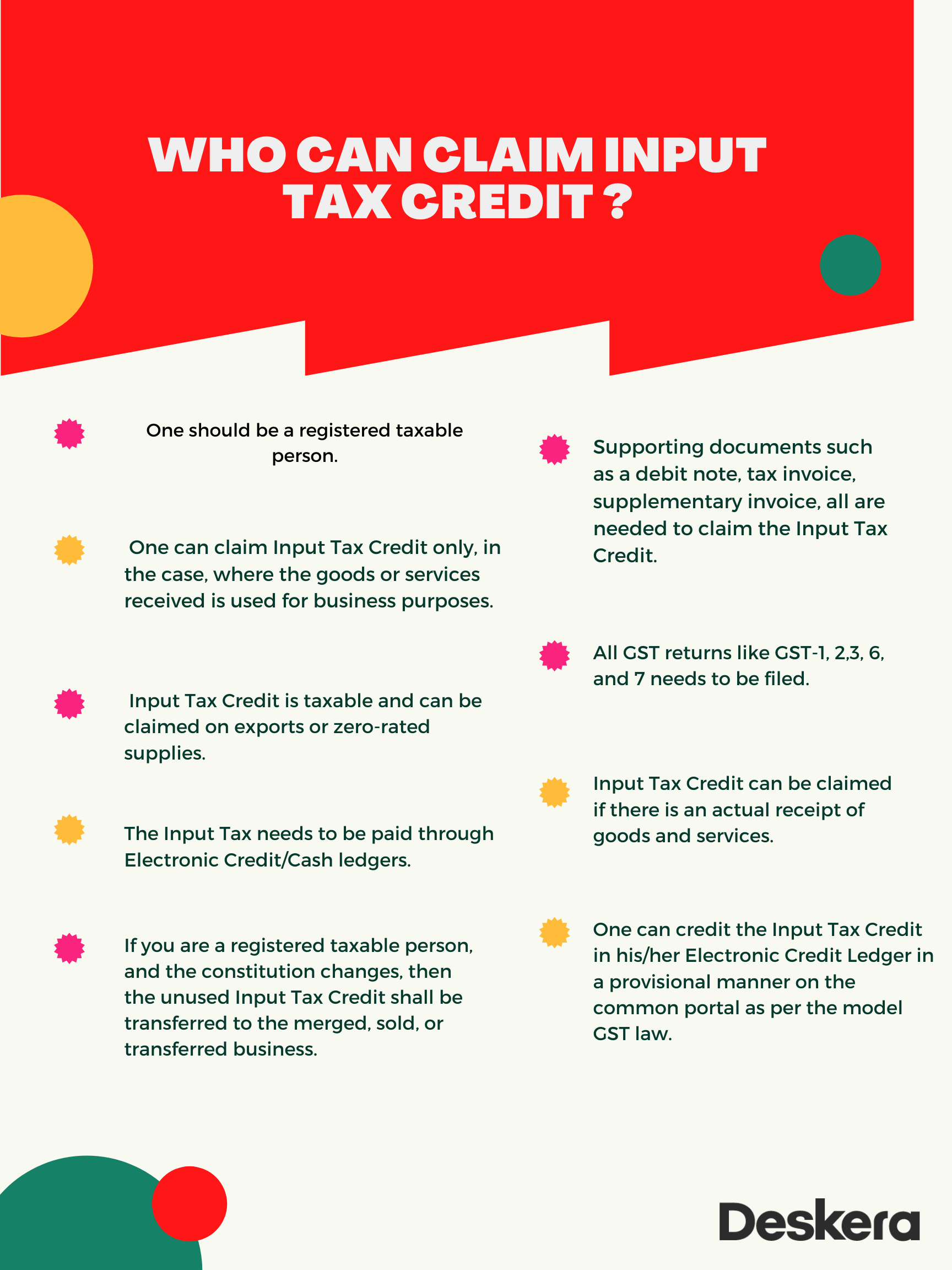

What Is Input Credit ITC Under GST

How Do I Claim My Tuition On My CanadianTax Return T2202A Form

How To Claim Back Income Tax How Do I Claim Back Tax Video Dailymotion

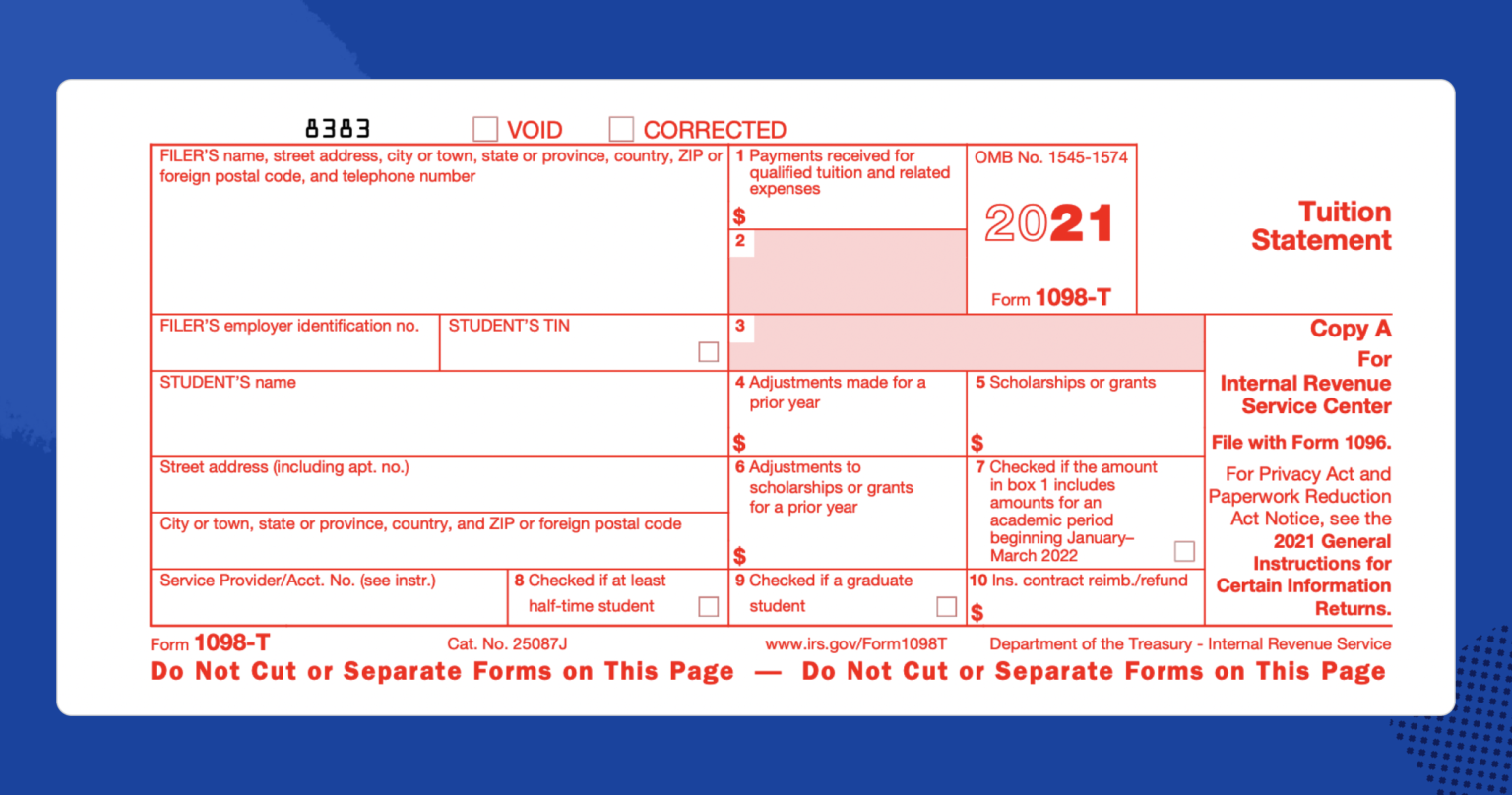

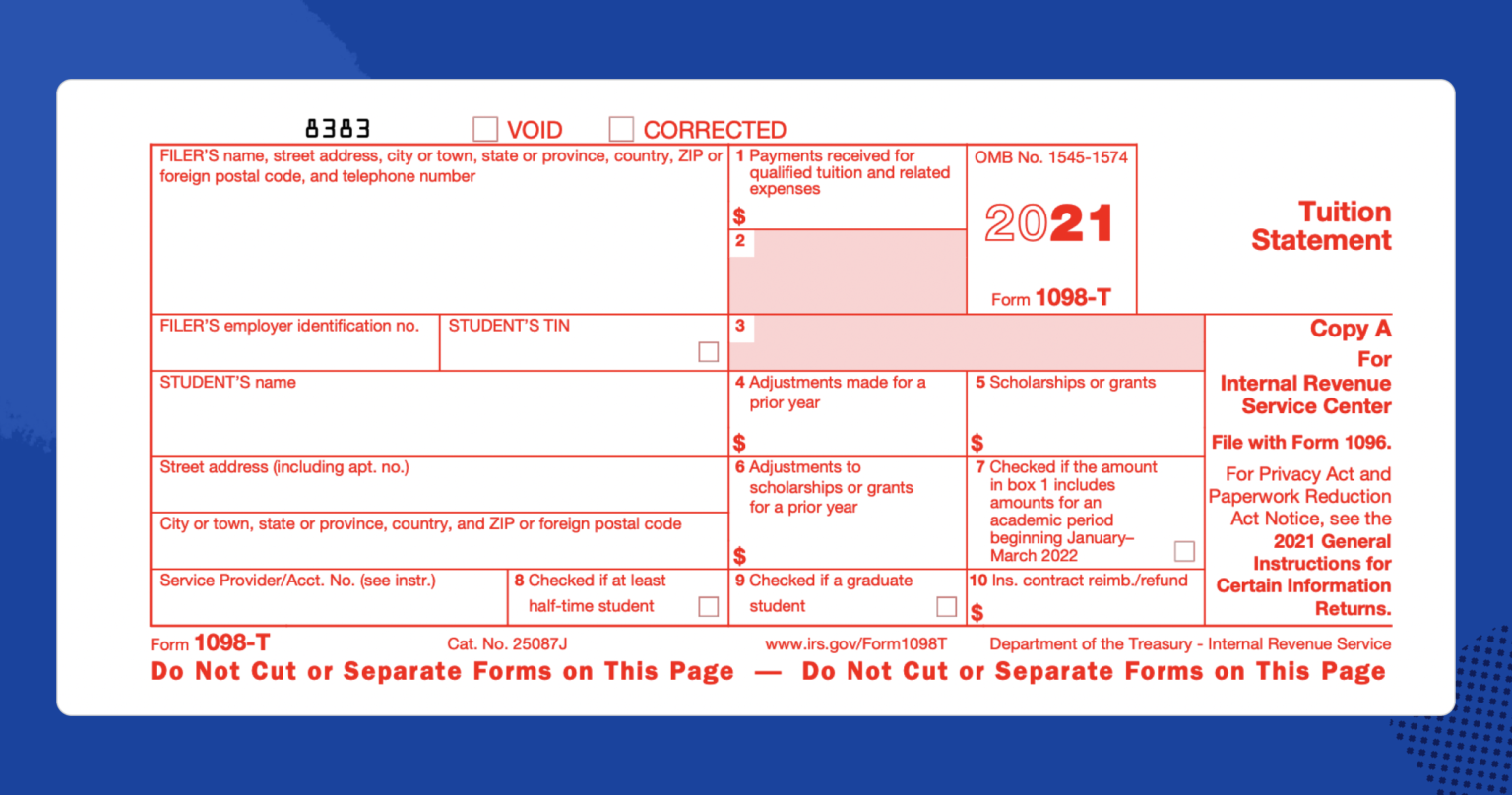

1098 T Form How To Complete And File Your Tuition Statement

1098 T Form How To Complete And File Your Tuition Statement

Rules For Claiming A Parent As A Dependent TaxSlayer

Asset Write Off E guide Retinue Accounting

How Do I Claim The Federal Tax Credit For My Solar System

How Do I Claim My Tuition Tax Credit From Previous Year In Canada - Where to find unused tuition credits The best way to find your unused tuition amounts is by logging in your CRA MyAccount You can also review the prior year s Notice of Assessment NOA that was