How Do I Claim Tax Back In France Search contact point You have to file your tax return sometimes called a tax return every year if your tax domicile is in France

To claim back the VAT You must export the goods with you to the UK within three months of purchase You must get your VAT refund forms stamped by customs How To Get Your Refund Option 1 Immediate Refund Some stores usually high end ones will actually give you the refund immediately but often it s at a lower rate than you

How Do I Claim Tax Back In France

How Do I Claim Tax Back In France

https://www.wikihow.com/images/c/ca/Claim-Tax-Back-Step-15-Version-2.jpg

How To Claim Tax Back In Ireland

https://blog.irishtaxrebates.ie/wp-content/uploads/2022/01/Blog-Image-how-do-i-claim-tax-back.jpg

Maximising Your Tax Return 5 Deductions You Need To Know About AR

https://www.aradvisors.com.au/awcontent/aradvisors/images/news/teasers/maximisetaxreturn.jpg

Stores like Galeries Lafayette are making the process easier than ever for getting your VAT back in France At the Galeries Lafayette Haussmann store head to the tax refund desk on the ground floor near the Rolex As a visitor to France you can claim a tax refund for value added tax or VAT on eligible goods you take home I Who is eligible You qualify for a tax refund if you are a

The unit price net of tax the amount of VAT owed and the legally applicable VAT rate Procedures To obtain a VAT refund the tax representative must file a refund claim The French tax return d claration des revenus is the first step to paying your income taxes in France As an expat living in France in 2023 you will need to know the French tax regulations and learn how to file your tax

Download How Do I Claim Tax Back In France

More picture related to How Do I Claim Tax Back In France

Revenue Reminding Public To Claim Tax Back In Time For Christmas From

https://www.thesun.ie/wp-content/uploads/sites/3/2019/11/cash.png

Can You Claim Tax Back At JFK Airport

https://ap.cdnki.com/r_can-you-claim-tax-back-at-jfk-airport---9c521a744461288722bc8325ec1b5f9e.webp

10 Easy Ways To Save On Tax Swift Tax Refunds

https://www.swiftrefunds.co.uk/wp-content/uploads/2021/10/Tax-code-min-2048x1365.jpg

How do you want to make the claim By mail On the spot View information View all information without filling any situation If you dispute the validity or regularity of Taxation for those leaving France You are liable for tax on everything you earned in France prior to your departure as well as on any French earnings that are taxable in

Ask what the value of the purchase needs to be in order to apply for a refund and whether all the goods you intend to buy are included Ask if you will get Tax free shopping how is the VAT refunded Can t I just pay the VAT free price in the shop No You must pay the full VAT inclusive price for the goods in the shop you will

Irish Tax FAQ s The Complete Guide Irish Tax Rebates

http://blog.irishtaxrebates.ie/wp-content/uploads/2018/03/currency-3077900.jpg

Hecht Group Does Pennymac Pay Property Taxes

https://img.hechtgroup.com/1663215364372.jpg

https://www.service-public.fr/particuliers/vosdroits/F358?lang=en

Search contact point You have to file your tax return sometimes called a tax return every year if your tax domicile is in France

https://www.frenchentree.com/brexit/uk-travellers...

To claim back the VAT You must export the goods with you to the UK within three months of purchase You must get your VAT refund forms stamped by customs

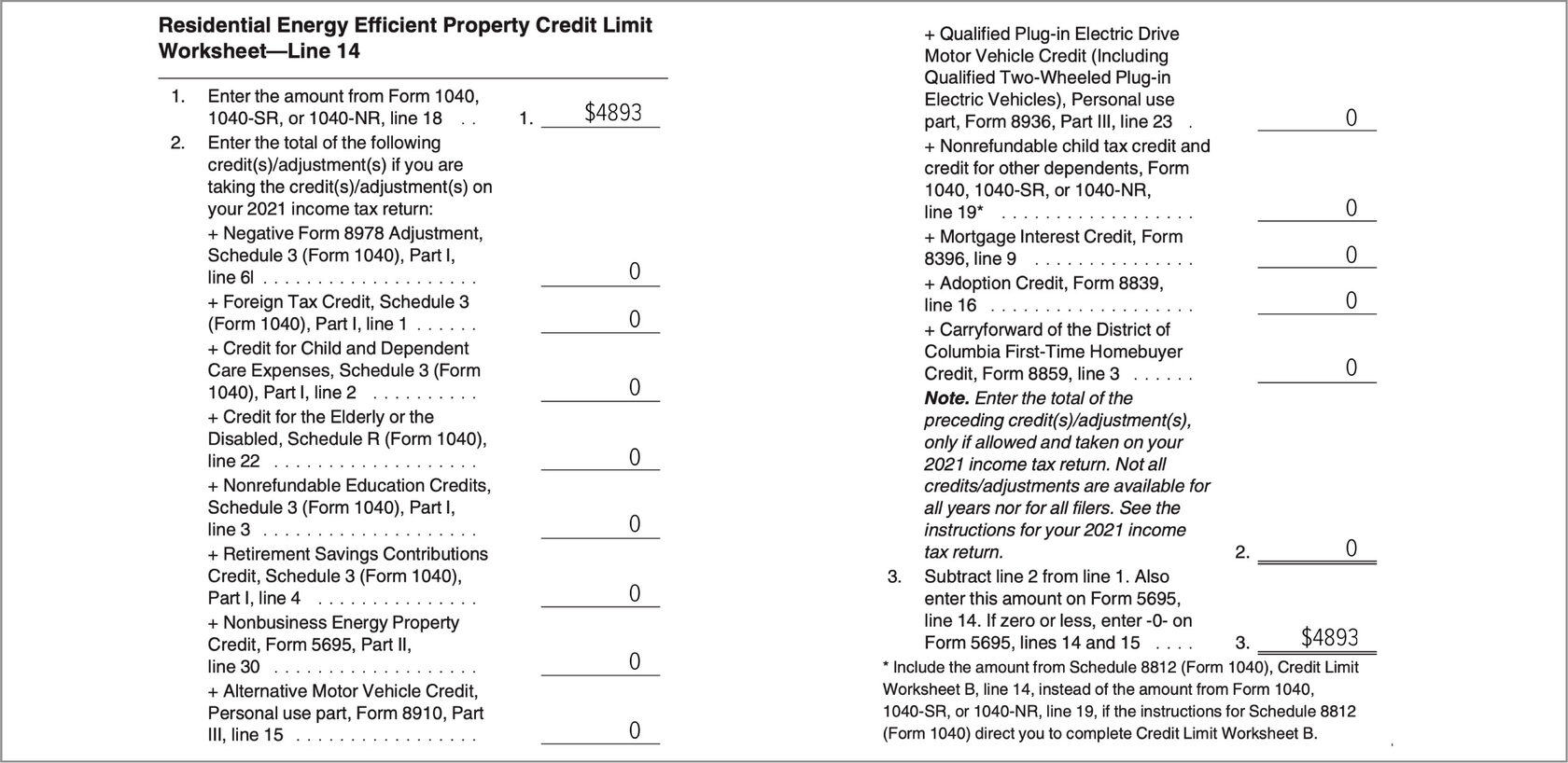

The Electric Car Tax Credit What You Need To Know OsVehicle

Irish Tax FAQ s The Complete Guide Irish Tax Rebates

How To Claim Tax Back Taxfiler

How To Claim Back Income Tax How Do I Claim Back Tax Video Dailymotion

How To Claim Tax Back Ireland Tax Returns Submitted In 3 Easy Steps

Can I Claim Back Tax Paid In The US

Can I Claim Back Tax Paid In The US

Child Tax Credit How Do I Claim The Remaining Payment And How Do I

How To Claim Tax Back From SARS

How Do I Claim The Solar Tax Credit A1 Solar Store

How Do I Claim Tax Back In France - If your pension is taxed in France and all pensions are liable other than government service pensions there is a general 10 abatement with a minimum of 422 and a