How Do I Contact Hmrc About Corporation Tax Complaints about HMRC online services reporting serious misconduct by HMRC staff Dealing with HMRC Contact details webchat and helplines for enquiries with HMRC on tax Self

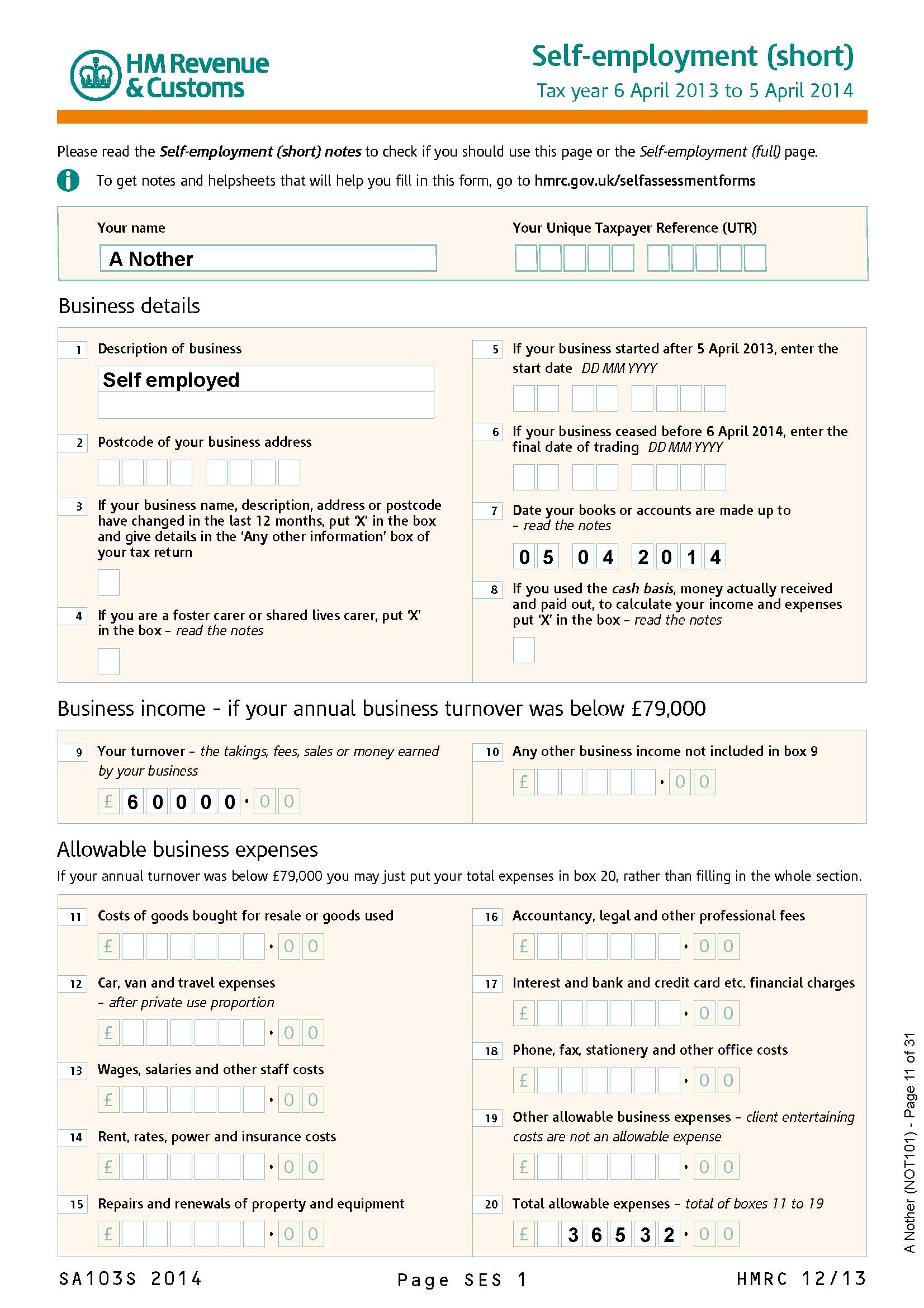

If you need help with Corporation Tax you can appoint an accountant or tax adviser to help you you can find an accountant accredited in the UK contact the Corporation Tax helpline This guide provides a list of regularly used HMRC contact information This includes telephone numbers online contact options and postal addresses together with a number of tips This guide seeks to help direct tax agents to

How Do I Contact Hmrc About Corporation Tax

How Do I Contact Hmrc About Corporation Tax

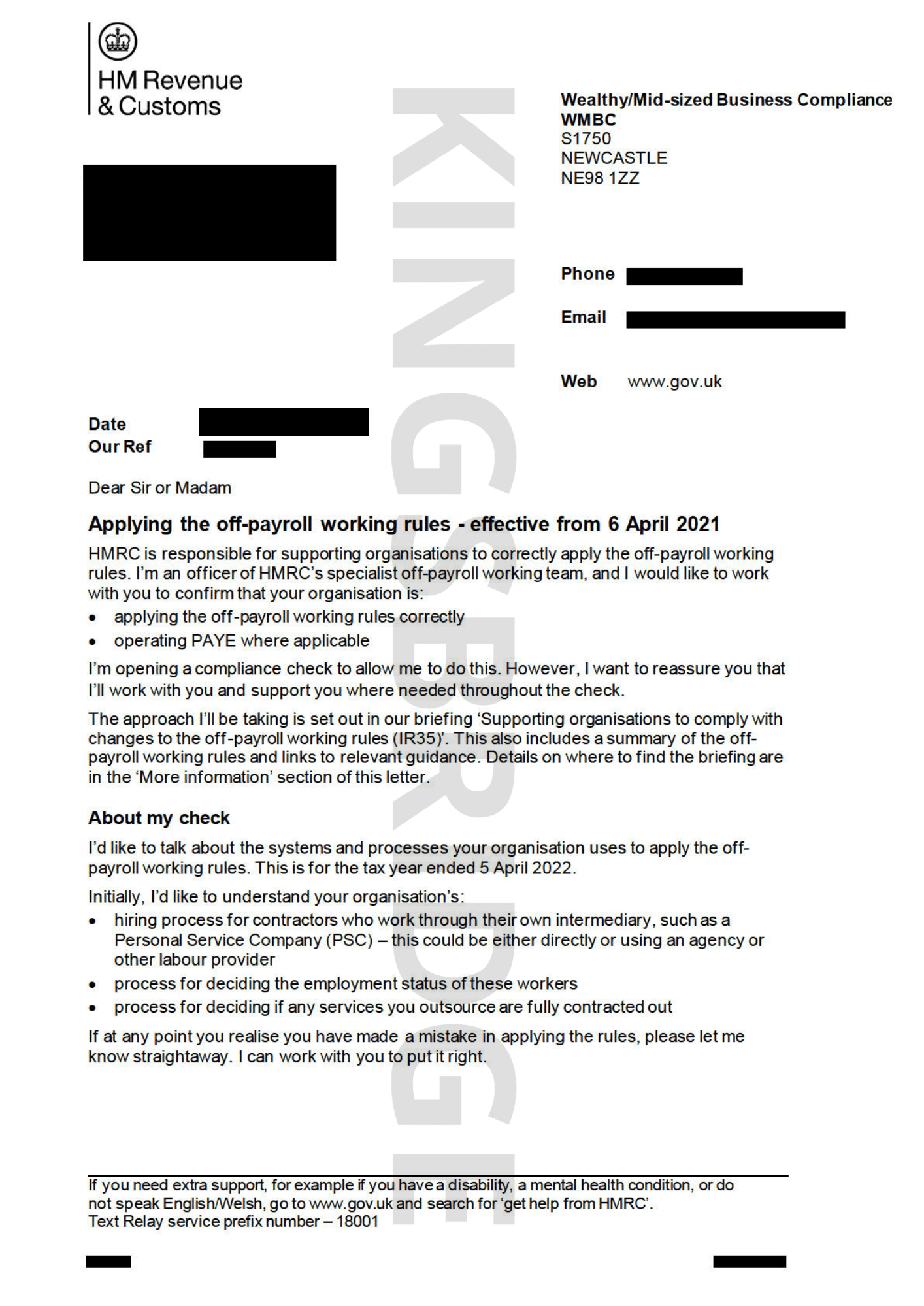

https://cms-admin.kingsbridge.co.uk/app/uploads/2023/02/OPW-Letter_Redacted-watermarked_Page_1-1.png

How Do I Get A Unique Taxpayer Reference UTR For A New Company

https://www.qualityformationsblog.co.uk/wp-content/uploads/2015/04/how-do-i-get-a-unique-taxpayer-reference-utr.jpg

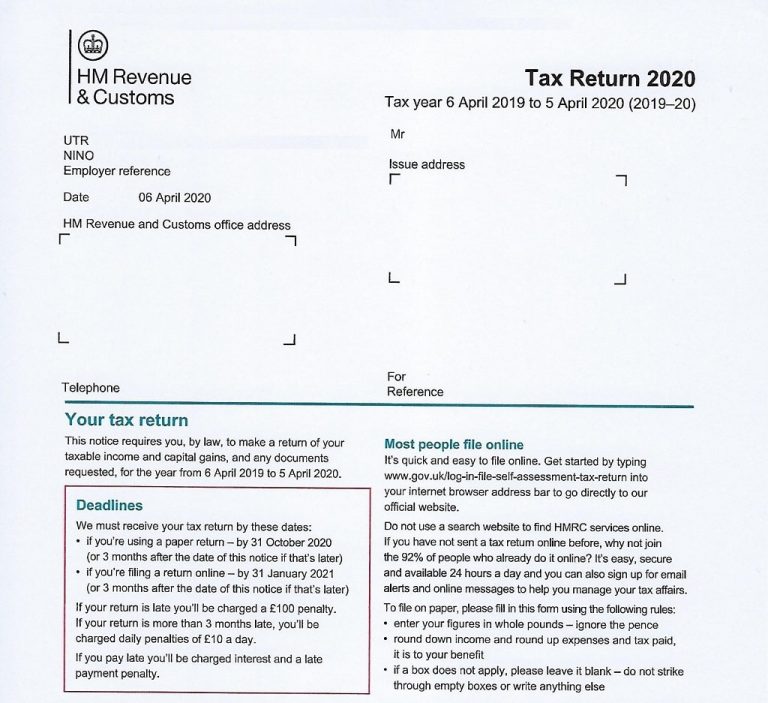

HMRC 2020 Tax Return Form SA100

https://taxhelp.uk.com/wp-content/uploads/SA100-Personal-tax-return-form-example-2020-m-768x703.jpg

The Income Tax Office at HM Revenue Customs HMRC can accept most information over the phone but in certain circumstances you will need to write in This table will help you decide how to You can contact HMRC for various queries about Self Assessment Tax Credits Child Benefit Income Tax National Insurance Tax for Employers VAT Construction Industry Scheme any other taxes or HMRC services Different Ways

To contact HMRC by telephone call 0300 200 3410 and have the company s 10 digit Unique Tax Reference UTR ready You can write to HMRC at the following address always include the company s 10 digit UTR in correspondence Corporation Tax Services HM Revenue and Customs BX9 1AX United Kingdom How Contact HMRC by phone time your call right The time of day you call HMRC can have a big impact on how long you wait to speak to an agent Research by tax investigation insurers PfP found that the best time of day to call was in the morning between 8 30 am and 9 30 am and early lunchtime between noon and 12 30 pm

Download How Do I Contact Hmrc About Corporation Tax

More picture related to How Do I Contact Hmrc About Corporation Tax

What Is A UTR Forces Money

https://forces-money.co.uk/wp-content/uploads/2017/10/Screen-Shot-2018-04-30-at-21.57.46.png

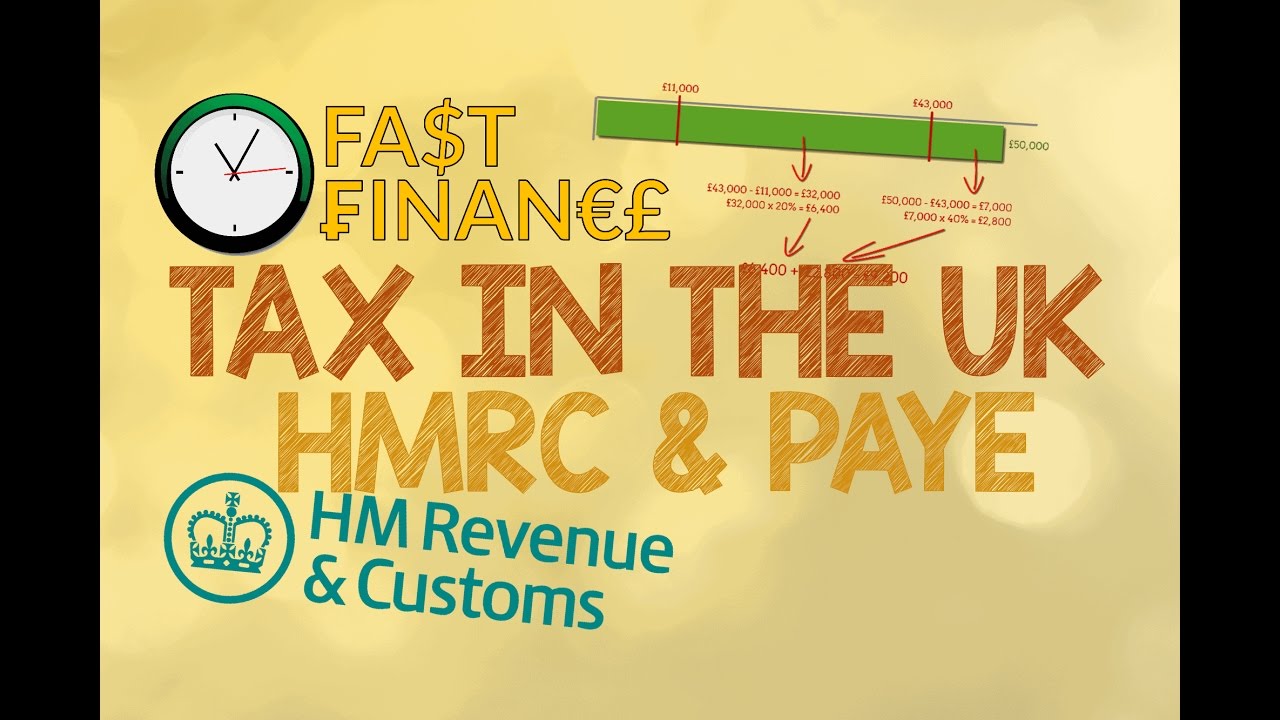

How Does UK Tax Work What You Need To Know About HMRC PAYE YouTube

https://i.ytimg.com/vi/fCRsO22eHEY/maxresdefault.jpg

UK HMRC Form SA970 2012 Fill And Sign Printable Template Online US

https://www.pdffiller.com/preview/22/555/22555659/large.png

We use some essential cookies to make our services work We d also like to use analytics cookies so we can understand how you use our services and to make improvements Contact HMRC for all enquiries regarding corporation tax reporting or payments The telephone number above will put you directly through with an advisor who will be happy to help answer any questions you may have regarding corporation tax

Paying Corporation Tax involves several steps Register for Corporation Tax When you start a new company you need to register it with HMRC for Corporation Tax within three months of starting to do business Use online forms to contact HMRC for Corporation Tax multiple payments by CHAPS and to tell HMRC a Corporation Tax payment is not due

Sample HMRC Letters Business Advice Services

https://businessadviceservices.co.uk/wp-content/uploads/2018/02/VAT-inspection-letter-1.jpg

How Do I Contact HMRC About My Tax Code FreshBooks 2023

https://i0.wp.com/media.freshbooks.com/wp-content/uploads/2022/04/contact-hmrc-for-tax-code-1.jpg

https://www.gov.uk/contact-hmrc

Complaints about HMRC online services reporting serious misconduct by HMRC staff Dealing with HMRC Contact details webchat and helplines for enquiries with HMRC on tax Self

https://www.gov.uk/corporation-tax

If you need help with Corporation Tax you can appoint an accountant or tax adviser to help you you can find an accountant accredited in the UK contact the Corporation Tax helpline

Letter Template Hmrc Penalty Appeal Letter Example 3 Easy Ways To

Sample HMRC Letters Business Advice Services

HMRC Announce Breathing Space On Late Self Assessment Tax Returns

HMRC Letter 2 350PPM Ltd

Apply For A Repayment Of Tax Using R40 Tax Form Tax Forms Savings

HMRC Self Assessment Tax Return Web Site Page On Screen Stock Photo

HMRC Self Assessment Tax Return Web Site Page On Screen Stock Photo

The Most Important HMRC Contact Numbers TaxScouts

Company Tax Return Hmrc Company Tax Return Guide

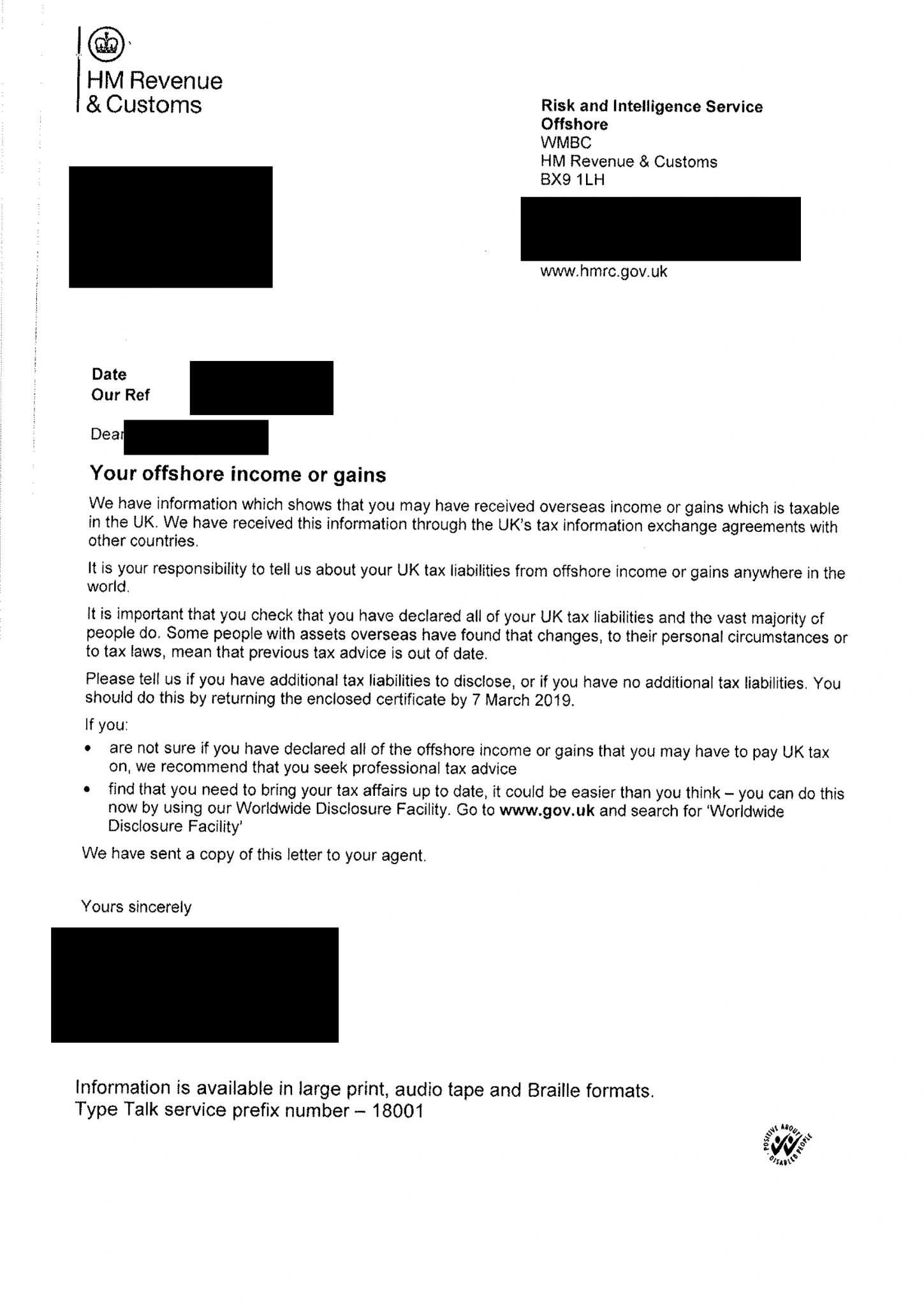

Letter From HMRC About Overseas Assets Income Or Gains

How Do I Contact Hmrc About Corporation Tax - 1 Do your preparation before contacting HMRC In theory your registered address should bring up all of your tax details But not in my experience Before you attempt to contact HMRC