How Do I Get A Nys Sales Tax Exemption Certificate If you expect to make taxable sales in New York State you must register with the Tax Department at least 20 days before you begin business New York State will then send you a Certificate of Authority which must

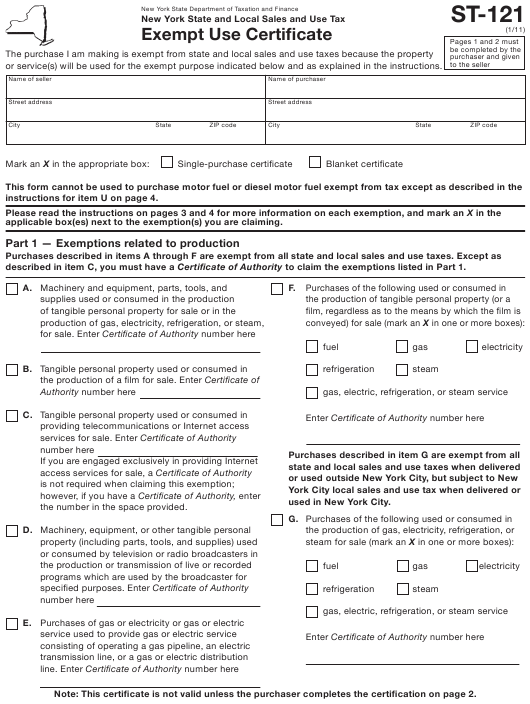

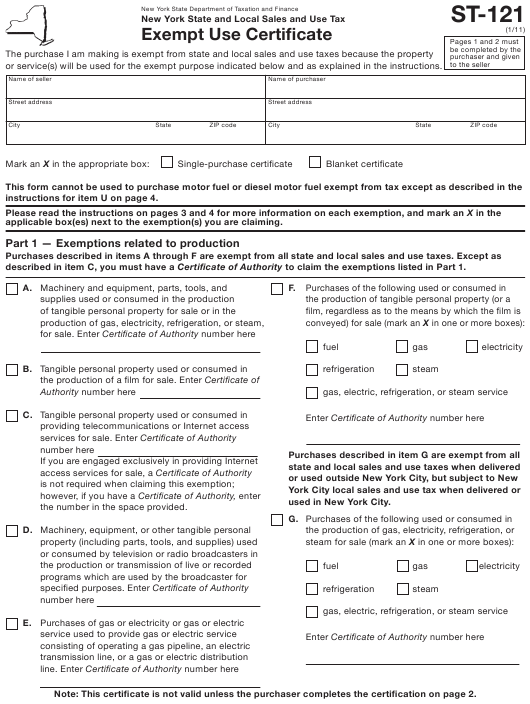

This bulletin explains how to use the certificate what kinds of property and services can be purchased exempt from sales tax using Form ST 121 and penalties that may be imposed for misuse of the certificate Businesses can apply for certificates that exempt them from paying sales tax on certain items These certificates are issued by the New York State Department of Taxation and Finance DTF

How Do I Get A Nys Sales Tax Exemption Certificate

How Do I Get A Nys Sales Tax Exemption Certificate

http://gmpimage.gencomarketplace.com/image/GMP/ResellerTerms/NewYork.png

Sales Exemption Certificate TUTORE ORG Master Of Documents

https://digital.library.unt.edu/ark:/67531/metadc967514/m1/1/med_res/

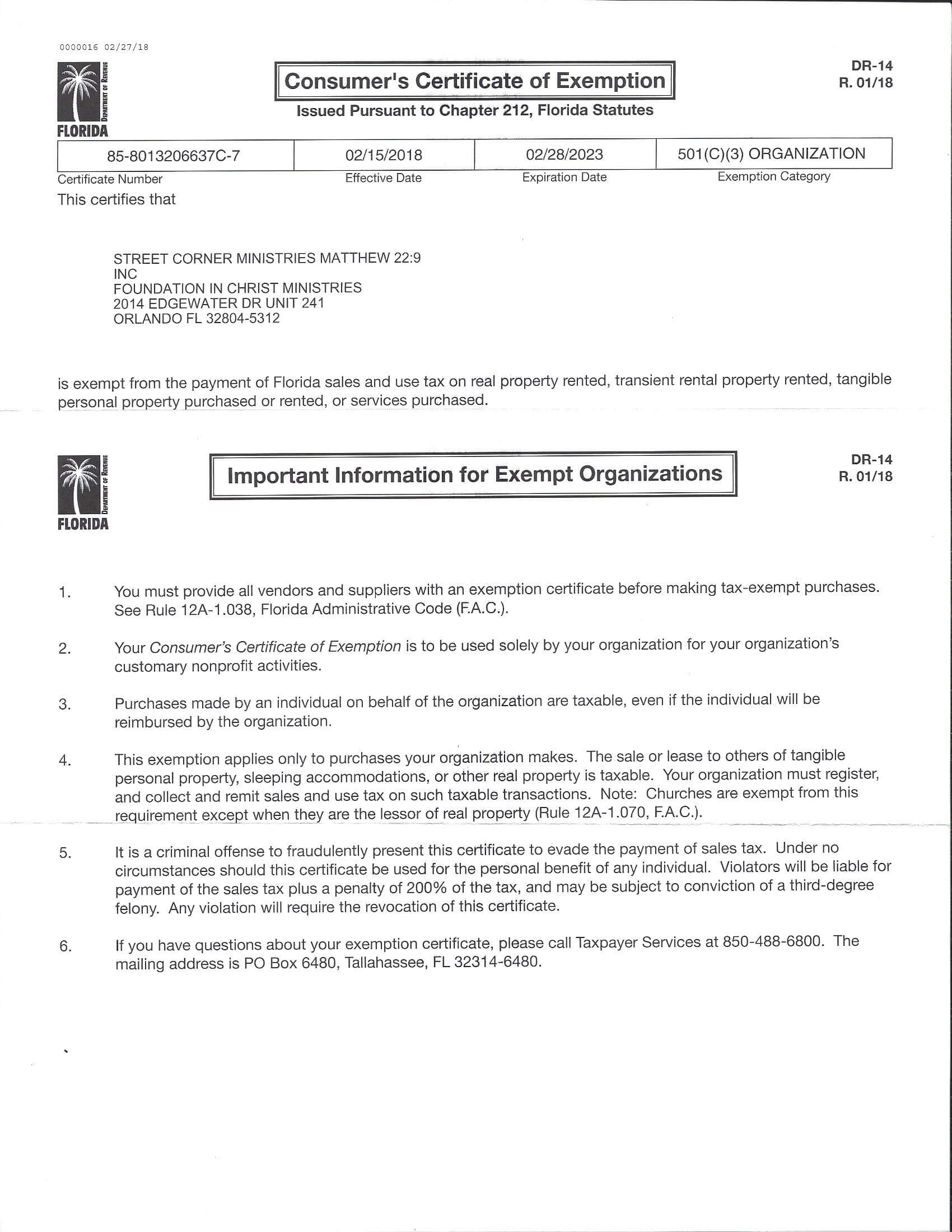

Florida Sales Tax Exemption Certificate Foundation In Christ Ministries

https://eoqsmt5wite.exactdn.com/wp-content/uploads/FL-Sales-Tax-Exemption-Certificate.jpg?strip=all&lossy=1&w=2560&ssl=1

You must register with the Tax Department and obtain a Certificate of Authority if you will be making sales in New York State that are subject to sales tax The Certificate of Authority gives you the right to collect sales tax on your taxable sales and allows you to issue and accept most New York State sales tax exemption certificates Exempt Use Certificate The purchase I am making is exempt from state and local sales and use taxes because the property or service s will be used for the exempt purpose indicated below and as explained in the instructions

New York State and Local Sales and Use Tax Exempt Purchase Certificate for Certain Property and Services Used in Dramatic and Musical Arts Performances ST 122 Instructions on form Exempt Purchase Certificate for an Agent of a New York Governmental Entity available by calling 518 485 2889 If you expect to make taxable sales in New York State you must register with the Tax Department at least 20 days before you begin business New York State will then send you a Certificate of Authority which must

Download How Do I Get A Nys Sales Tax Exemption Certificate

More picture related to How Do I Get A Nys Sales Tax Exemption Certificate

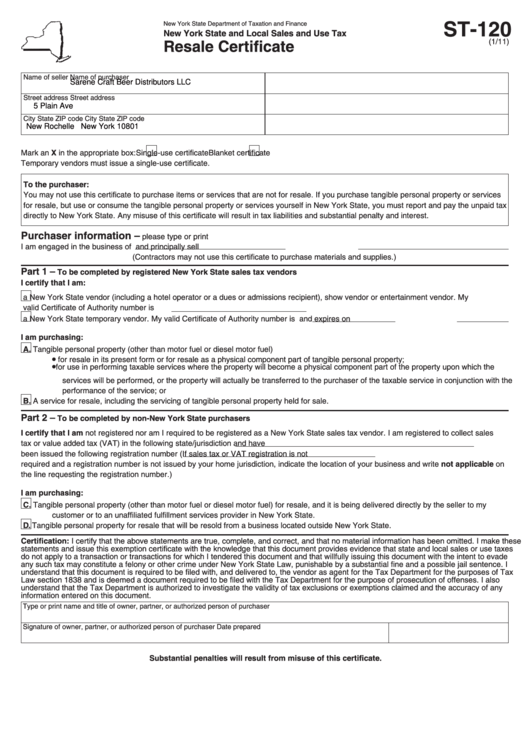

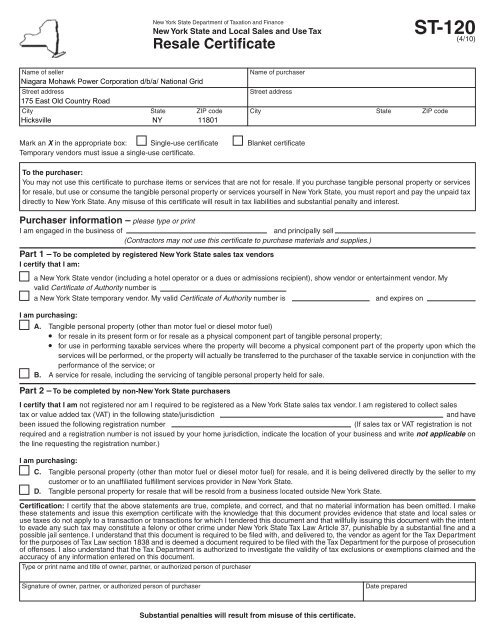

Fillable Form St 120 Resale Certificate New York State Department

https://data.formsbank.com/pdf_docs_html/298/2988/298833/page_1_thumb_big.png

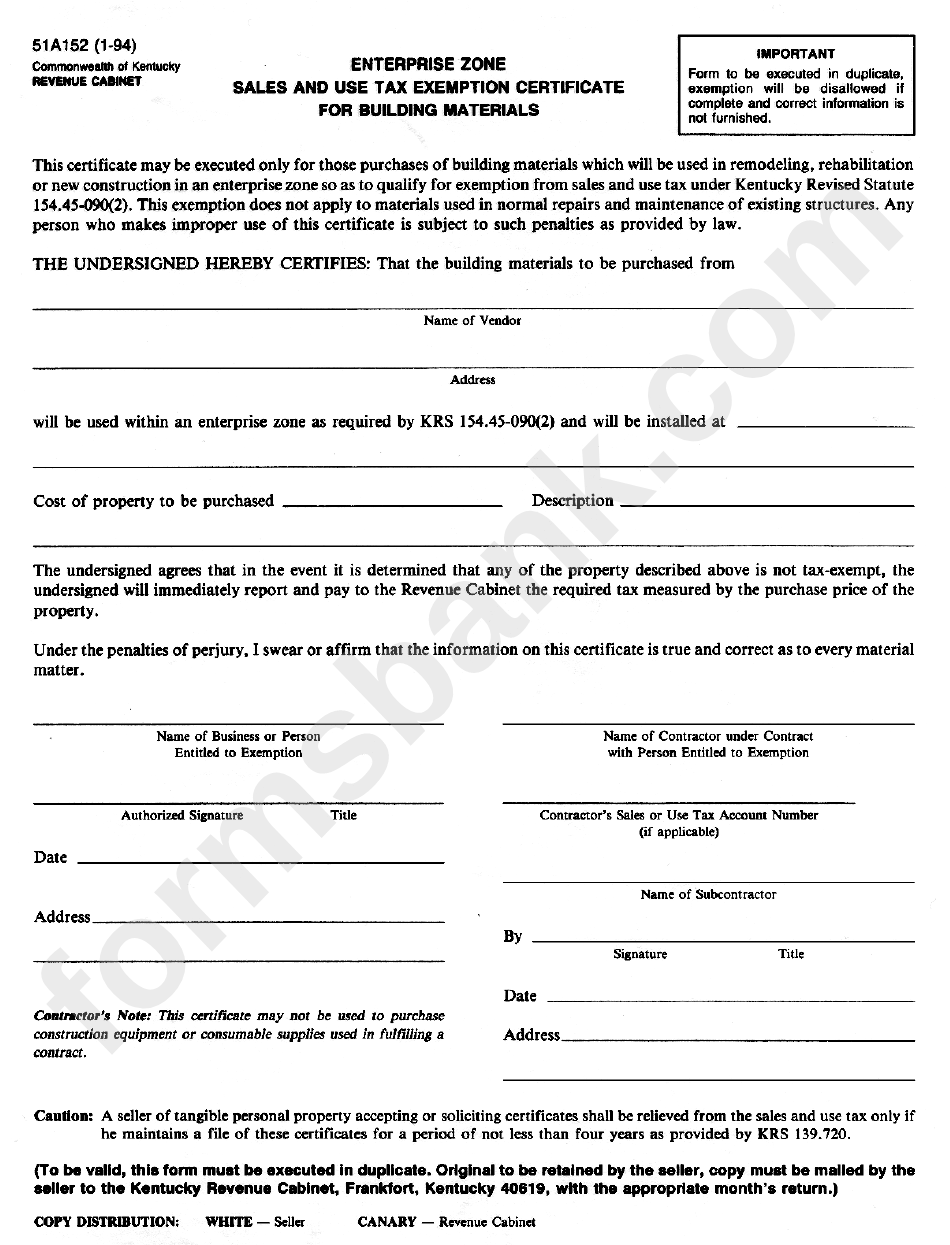

Form 51a152 Sales And Use Tax Exemption Certificate 1994 Printable

https://data.formsbank.com/pdf_docs_html/270/2706/270651/page_1_bg.png

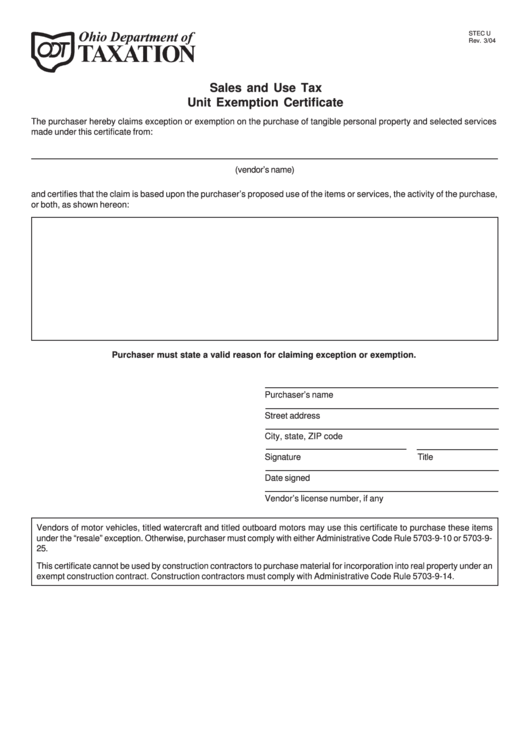

Fillable Sales And Use Tax Unit Exemption Certificate Printable Pdf

https://data.formsbank.com/pdf_docs_html/327/3275/327552/page_1_thumb_big.png

It is the department s goal that all taxpayers meet their sales tax obligations and pay the correct amount of tax due If your business makes sales of property or services that are subject to sales tax it must register for sales tax purposes and obtain a Certificate of Authority Exempt Use Certificate Form ST 121 TB ST 235 Exemption Certificates for Sales Tax TB ST 240 Exemptions for Computer System Hardware Form ST 121 3 TB ST 243 Exemptions Relating to Guide Hearing and Service Dogs TB ST 245 Farmers and Commercial Horse Boarding Operators Exemption Form ST 125

Instructions New Effective June 1 2018 use box C in Part 1 to purchase restaurant type food or drink for resale For more information see TSB M 18 1 S Summary of Sales and Use Tax Changes Enacted in the 2018 2019 Budget Bill Form ST 120 Resale Certificate is a sales tax exemption certificate The ST 120 Resale Certificate is one of the many sales tax exemption certificates issued by the New York Department of Taxation and Finance NYSDTF An ST 120 enables a purchasing business or entity to buy tangible property or services without paying New York s sales tax

Nys Sales Tax Exempt Form St 121 ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/form-st-121-download-fillable-pdf-or-fill-online-exempt-use-certificate.png

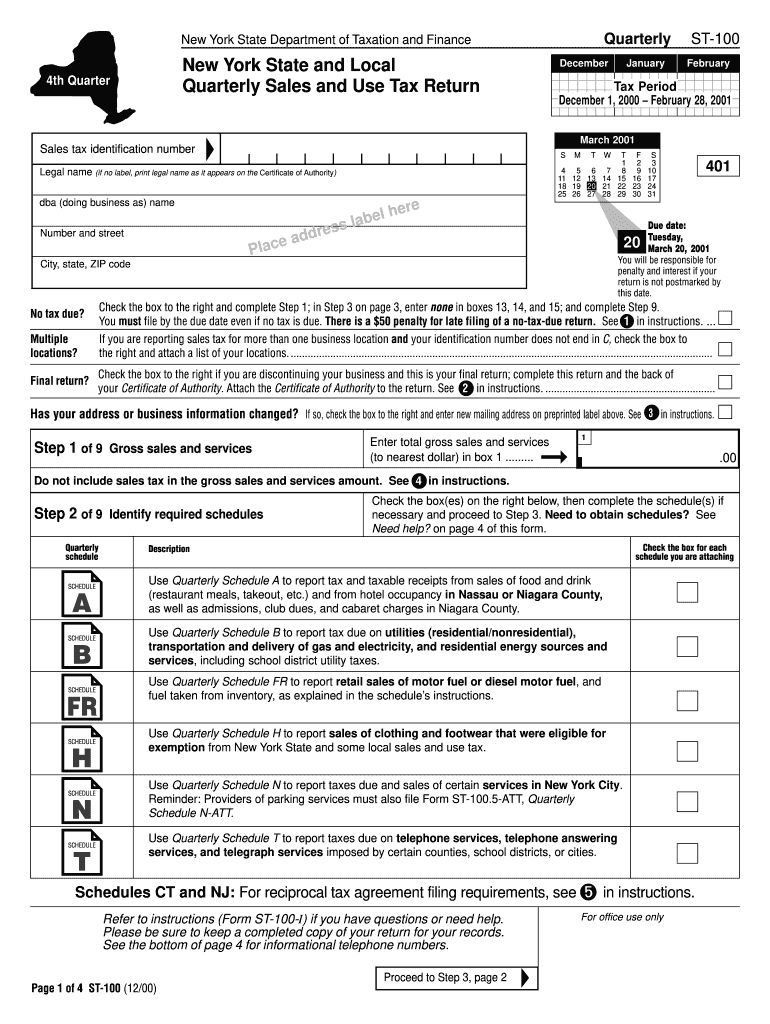

Printable Nys Sales Tax Form St 100

https://www.pdffiller.com/preview/100/49/100049568/large.png

https://www.tax.ny.gov/pubs_and_bulls/tg_bulletins/...

If you expect to make taxable sales in New York State you must register with the Tax Department at least 20 days before you begin business New York State will then send you a Certificate of Authority which must

https://www.tax.ny.gov/.../exempt_use_certificate.htm

This bulletin explains how to use the certificate what kinds of property and services can be purchased exempt from sales tax using Form ST 121 and penalties that may be imposed for misuse of the certificate

New York State Tax GoldDealer

Nys Sales Tax Exempt Form St 121 ExemptForm

California Sales Tax Exemption Certificate Video Bokep Ngentot

New York Sales Tax Exemption Form National Grid

2011 2023 Form NY DTF ST 119 1 Fill Online Printable Fillable Blank

PENNSYLVANIA EXEMPTION CERTIFICATE This Form Cannot Be Used To

PENNSYLVANIA EXEMPTION CERTIFICATE This Form Cannot Be Used To

Form St 127 Nys And Local Sales And Use Tax Exemption Certificate

Sales Use Tax Exempt Form 2023 North Carolina ExemptForm

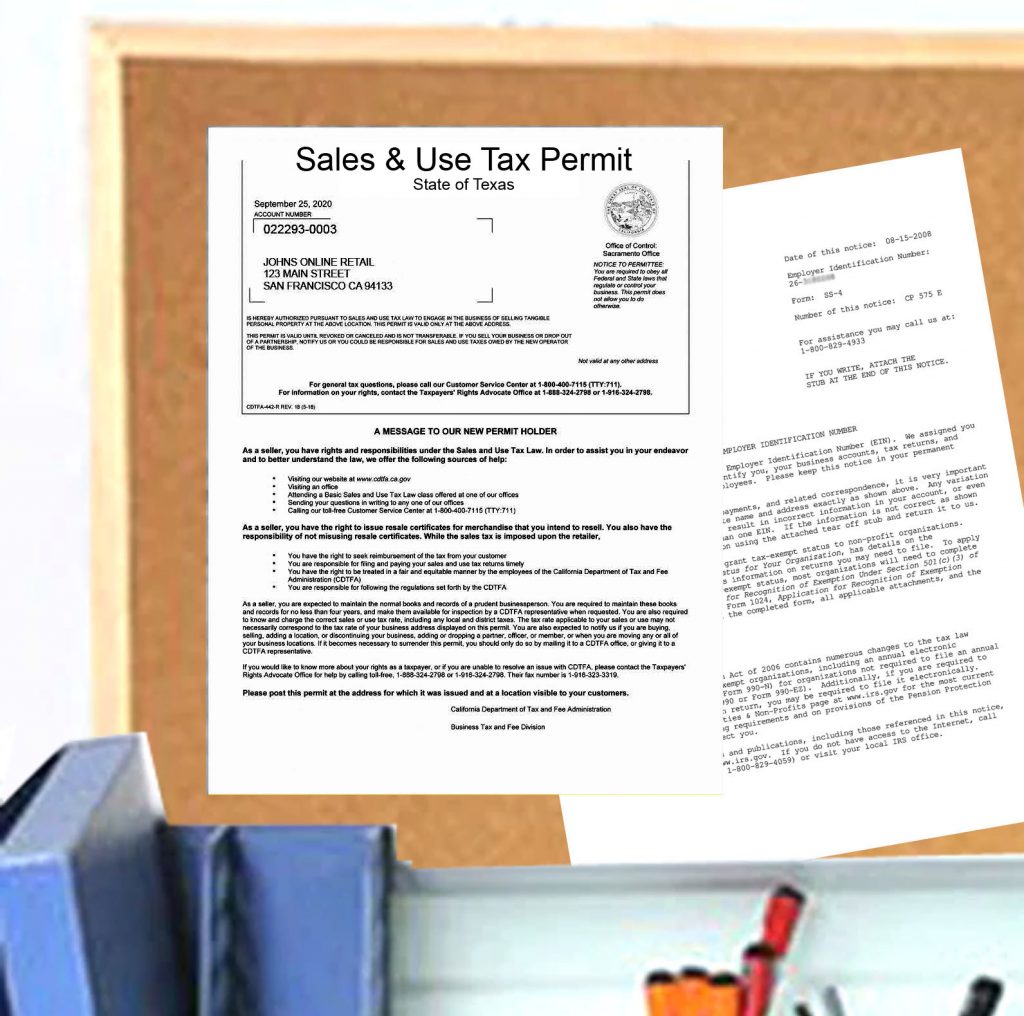

Texas Seller s Permit TX Tax Permit Resale Certificate Fast Filings

How Do I Get A Nys Sales Tax Exemption Certificate - If you expect to make taxable sales in New York State you must register with the Tax Department at least 20 days before you begin business New York State will then send you a Certificate of Authority which must