Provident Fund Tax Rebate Web The AW subject to compulsory CPF contribution is capped at 36 000 Employment period 1 Jan 2023 to 31 Dec 2023 Ordinary Wage OW Additional Wage AW CPF Relief

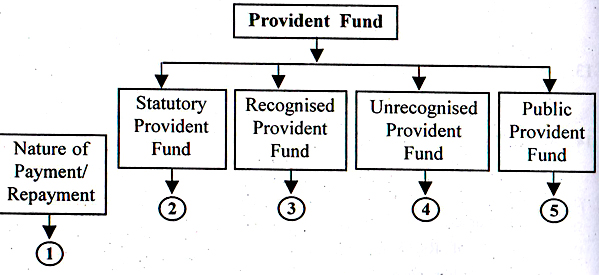

Web 31 mai 2022 nbsp 0183 32 The retirement fund lump sum benefit on which normal tax will be calculated amounts to R682 000 less R50 000 which equals R632 000 R632 000 falls within the Web 20 juin 2023 nbsp 0183 32 Updated on Jun 20th 2023 8 min read CONTENTS Show There are various types of provident fund PF accounts that individuals use for savings Also the

Provident Fund Tax Rebate

Provident Fund Tax Rebate

https://personalfinancemedia.co.za/wp-content/uploads/2022/06/FA2022-06-TB01-Tax-on-provident-fund-withdrawal-benefits-Steven-Jones-graph-2-1024x580.png

Provident Fund Meaning Types Taxation Example Vs Gratuity

https://www.wallstreetmojo.com/wp-content/uploads/2022/12/Provident-Fund.png

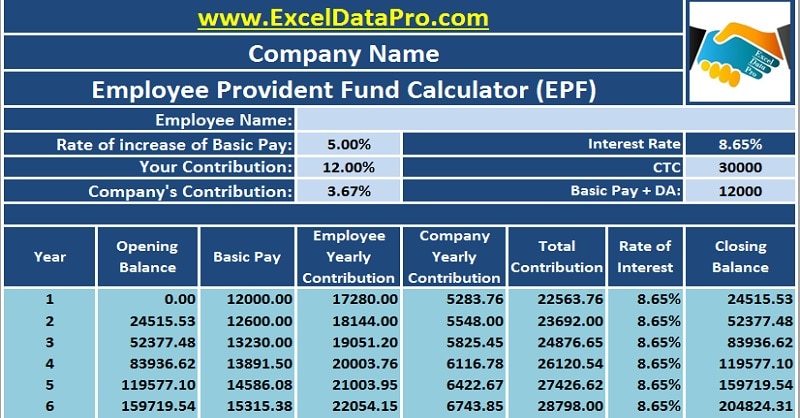

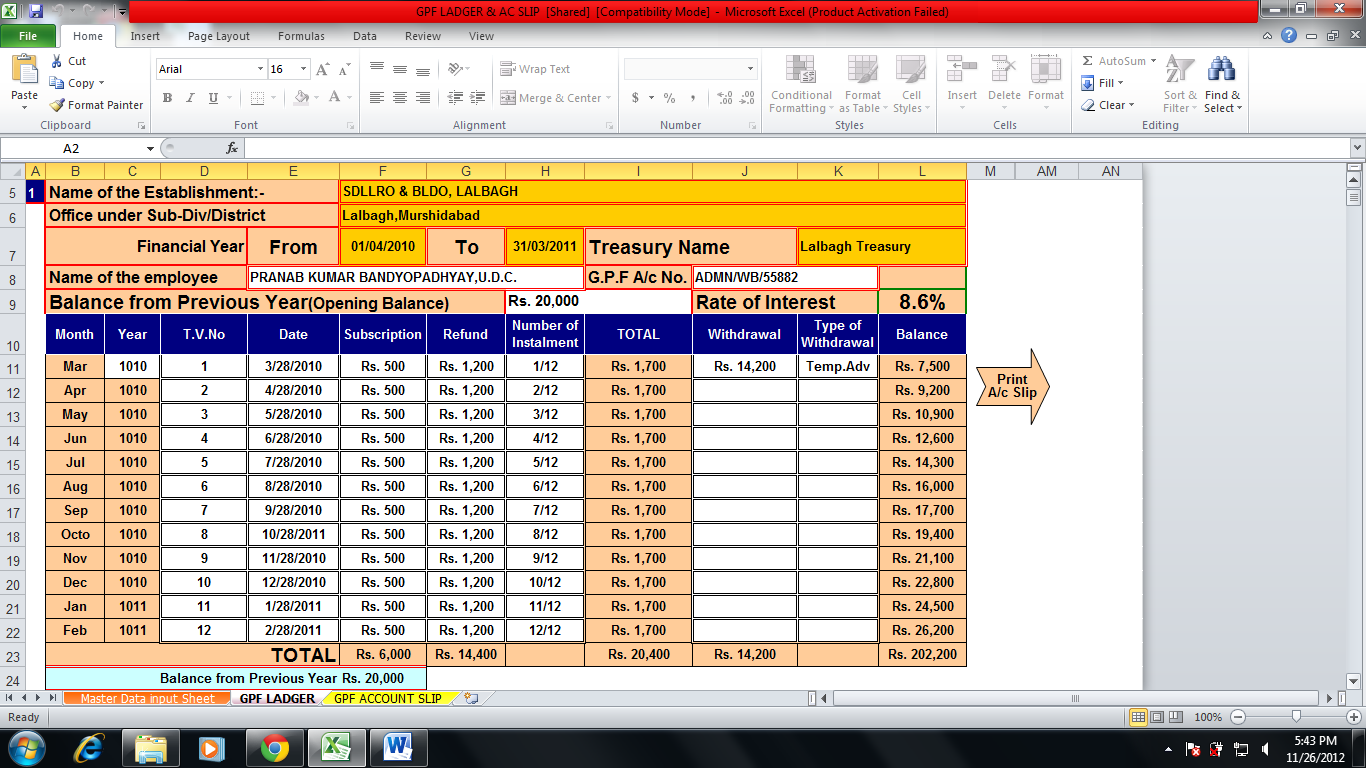

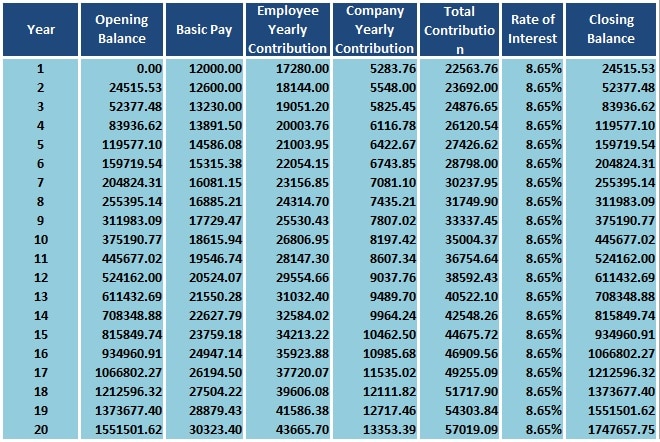

Download Employee Provident Fund Calculator Excel Template

https://d25skit2l41vkl.cloudfront.net/wp-content/uploads/2017/05/Employee-Provident-Fund-Calculator.jpg

Web 2 mars 2016 nbsp 0183 32 I am a member of a provident fund People that contribute to a pension fund get a tax deduction of 7 5 Provident no rebate How will I be treated with the new Web 26 mai 2021 nbsp 0183 32 A s salary contribution in PF is Rupees 480 000 i e 12 of 40 00 000 earlier full amount is tax free but as per the budget 2021 excess tax is charge in excess

Web 2 d 233 c 2020 nbsp 0183 32 Likewise in case you do not have any tax liability or the tax liability on your total income including such withdrawal is less than 10 you may get refund of the tax Web 5 f 233 vr 2021 nbsp 0183 32 After it was declared in the Union Budget 2021 22 that the interest earned on Provident Fund contributions above Rs 2 5 lakh in a financial year will become taxable people are concerned whether

Download Provident Fund Tax Rebate

More picture related to Provident Fund Tax Rebate

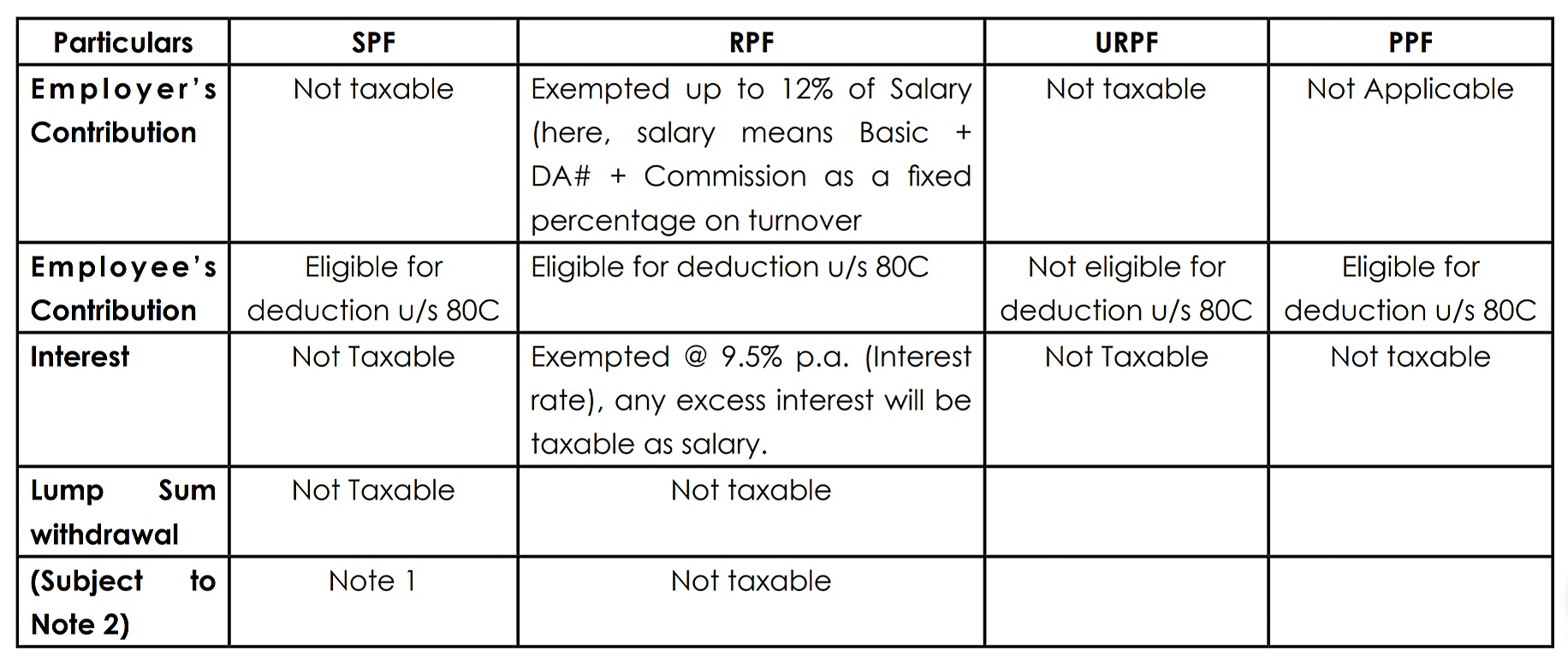

Provident Fund Tax The Oric Network

https://ebizfiling.com/wp-content/uploads/2022/04/Summary-Table-for-PF-Exemption-1-1024x536.png

Graphical Chat Presentation Of Provident Fund Tax Treatement

https://incometaxmanagement.com/Images/Graphical-ITAX/Provident-Fund-1.jpg

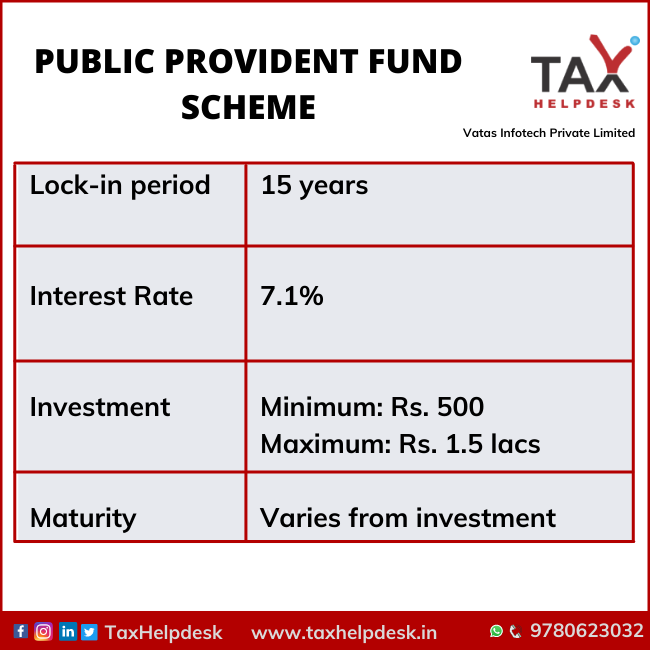

Public Provident Fund PPF Reference Guide Insurance Funda

https://www.insurancefunda.in/wp-content/uploads/2019/04/PPF-Account-Tax-Benefits.png

Web Central Provident Fund CPF Cash Top up Relief Claim tax relief for topping up your own CPF Special Retirement Account or those of your family members to meet basic Web 21 sept 2021 nbsp 0183 32 Provident Fund A provident fund is a compulsory government managed retirement savings scheme similar to the Social Security program in the United States

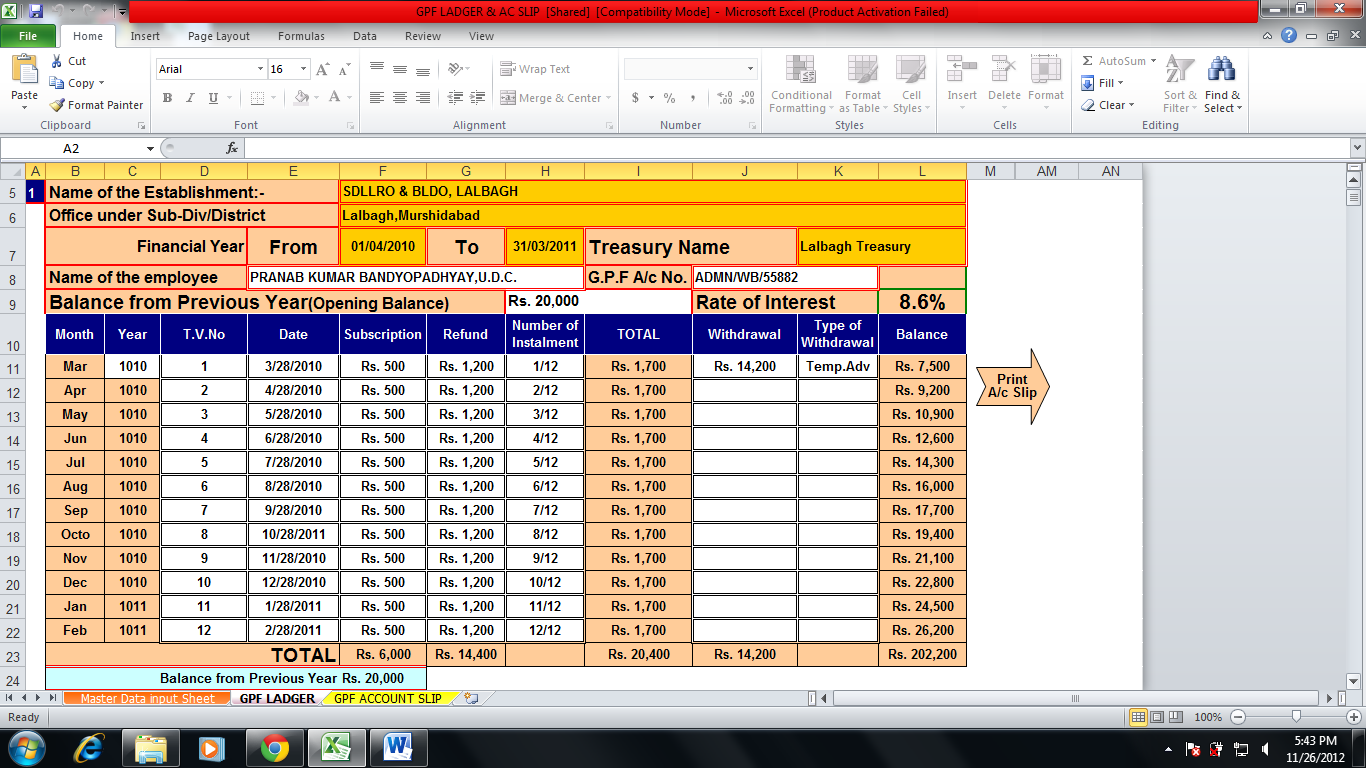

Web 21 f 233 vr 2020 nbsp 0183 32 The deduction can be claimed by an employee under section 80CCD 2 of the Act for maximum of 10 per cent of the total of his her basic salary plus Web 1 avr 2022 nbsp 0183 32 Speaking on General Provident Fund SEBI registered tax and funding professional Jitendra Solanki stated quot In price range 2021 the union finance minister had

General Provident Fund Calculator In Excel Taxalertindia

http://3.bp.blogspot.com/-Ih3bxHXbNTs/ULNdkTI7IBI/AAAAAAAAAe8/T3LU-gtnWws/s1600/pf1.png

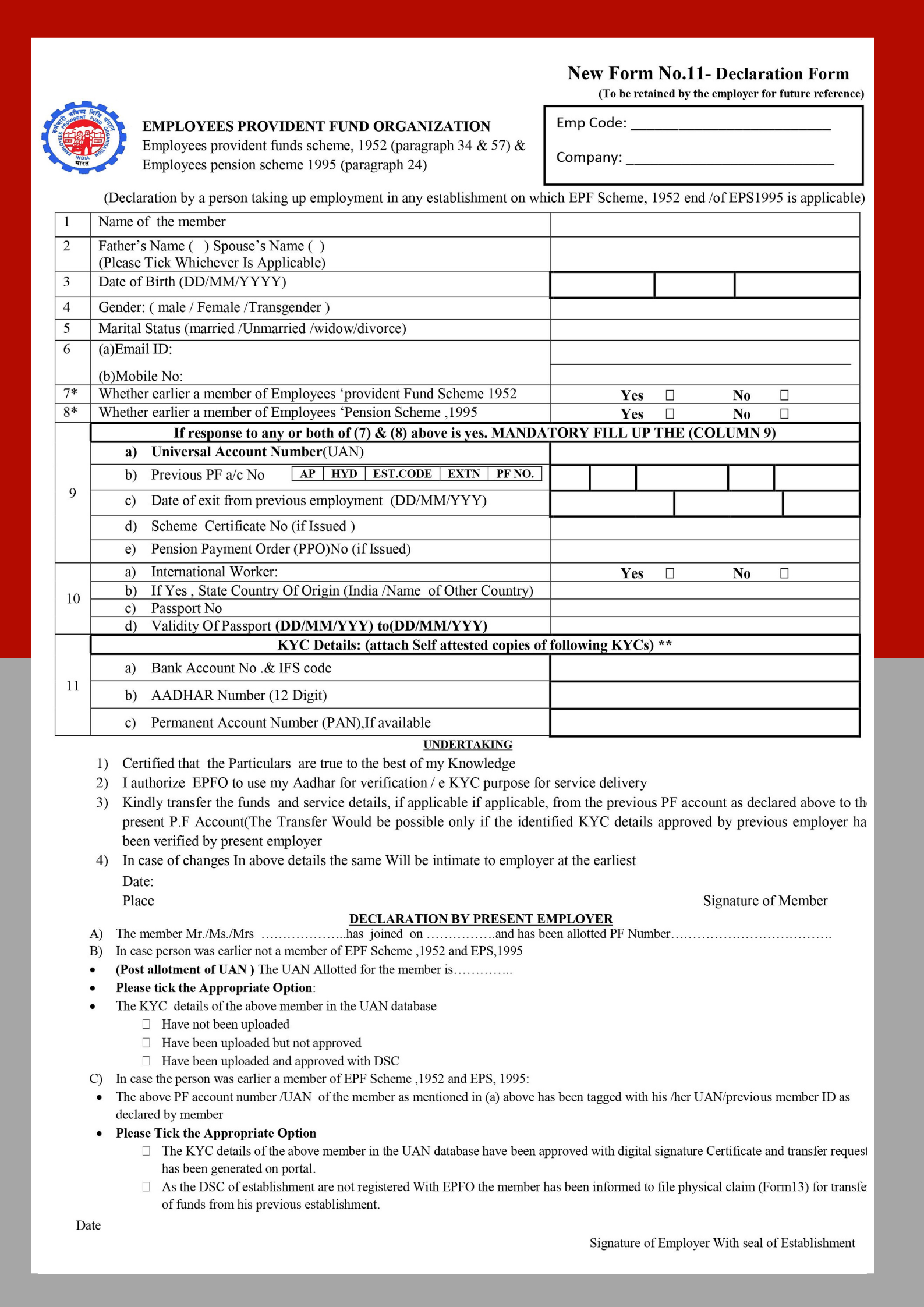

Employees Provident Funds EPF Scheme NextIAS

https://lh4.googleusercontent.com/LSSVJm01E96cwsGwIhiTpNqcxauAzE90iI59E71XkhG7ydkLN8m1oyVBthTg9jkDetfmstw3l8jC4wJUCvQSfgH2dJQSGEslaiGHKJF5aQzhNEk3MOn5XfB4BbyZBaGmdJ6pOQnF

https://www.iras.gov.sg/taxes/individual-income-tax/basics-of...

Web The AW subject to compulsory CPF contribution is capped at 36 000 Employment period 1 Jan 2023 to 31 Dec 2023 Ordinary Wage OW Additional Wage AW CPF Relief

https://www.sars.gov.za/individuals/tax-during-all-life-stages-and...

Web 31 mai 2022 nbsp 0183 32 The retirement fund lump sum benefit on which normal tax will be calculated amounts to R682 000 less R50 000 which equals R632 000 R632 000 falls within the

Public Provident Fund 2

General Provident Fund Calculator In Excel Taxalertindia

Provident Fund Tax Treatment Of Provident Fund For Salary Employee

Know About Public Provident Fund

How To Download Epf Employee Provident Fund E Passbook Online Gambaran

.jpg)

Income From Salaries Section 15 To 17 Graphical Table Presentation

.jpg)

Income From Salaries Section 15 To 17 Graphical Table Presentation

Rebate On Life Insurance Premia Contribution To Provident Fund Etc

80ccc Pension Plan Investor Guruji

Pf Interest Calculator In Excel Free Download King Contold

Provident Fund Tax Rebate - Web 25 mars 2021 nbsp 0183 32 The government has raised the threshold limit of tax exempt contributions to the Provident Fund PF to Rs 5 lakh from Rs 2 5 lakh announced in Budget 2021