How Do I Get A Sales Tax Exemption Certificate In Georgia Web 17 Mai 2023 nbsp 0183 32 Getting Started Is a Sales Tax Certificate of Exemption the same as a Sales Tax Number Steps for filling out the ST 5 Georgia Sales Tax Certificate of Exemption Step 1 Download Form ST 5 Step 2 Certify the exemption being claimed Step 3 Identify the seller s information Step 4 Identify the buyer s information

Web Sellers may verify a sales tax number by using the Sales Tax ID Verification Tool Do certificates of exemption or letters of authorization expire Most certificates of exemption and letters of authorization do not expire with the exception of the Georgia Agricultural Tax Exemption GATE certificate which expires on an annual basis Web This page explains how to make tax free purchases in Georgia and lists six Georgia sales tax exemption forms available for download Contents List of printable Georgia sales tax exemption certificates How to use Georgia sales tax exemption certificates

How Do I Get A Sales Tax Exemption Certificate In Georgia

How Do I Get A Sales Tax Exemption Certificate In Georgia

https://i2.wp.com/prosecution2012.com/wp-content/uploads/2021/05/georgia-sales-tax-certificate-of-exemption-form-st-5.jpg

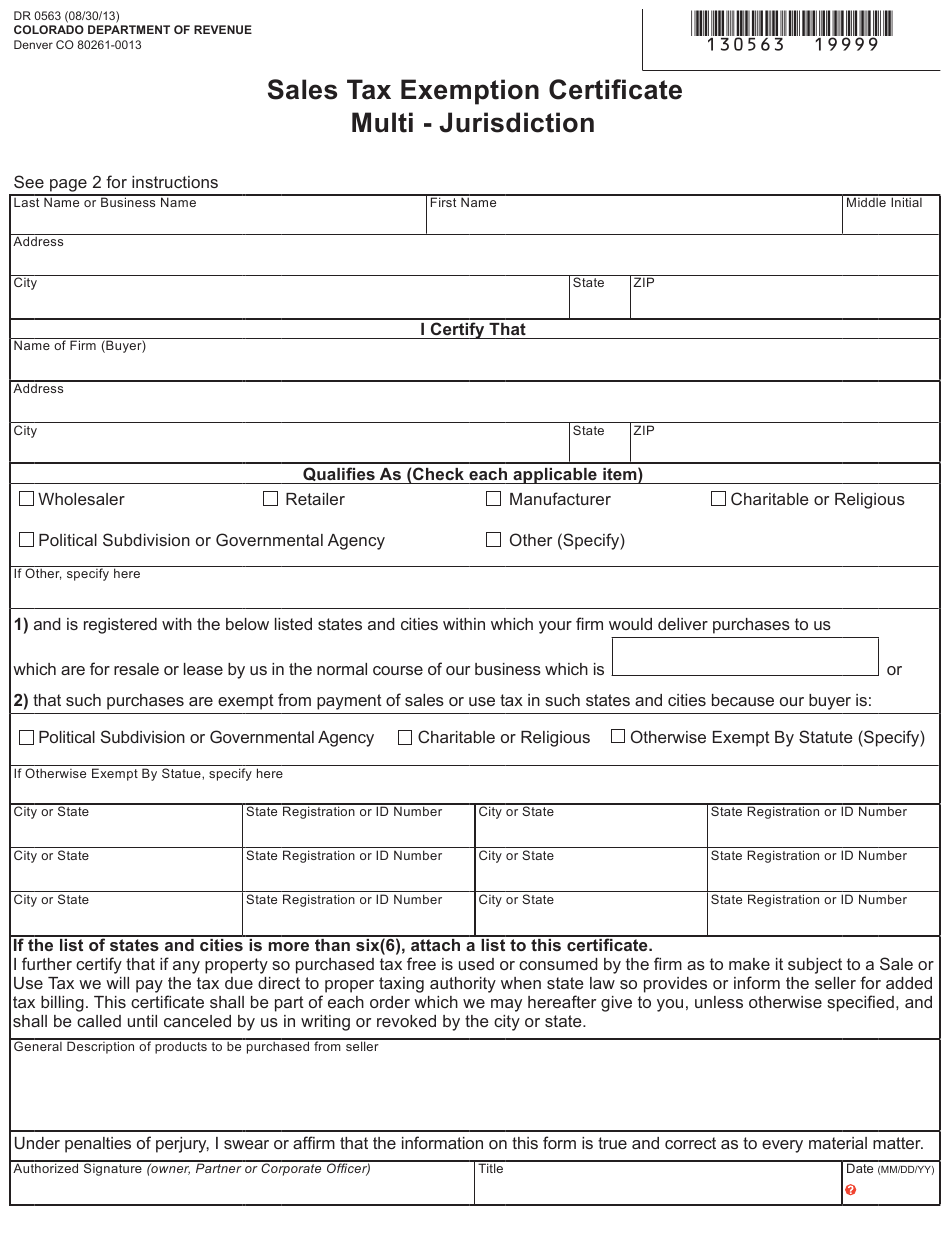

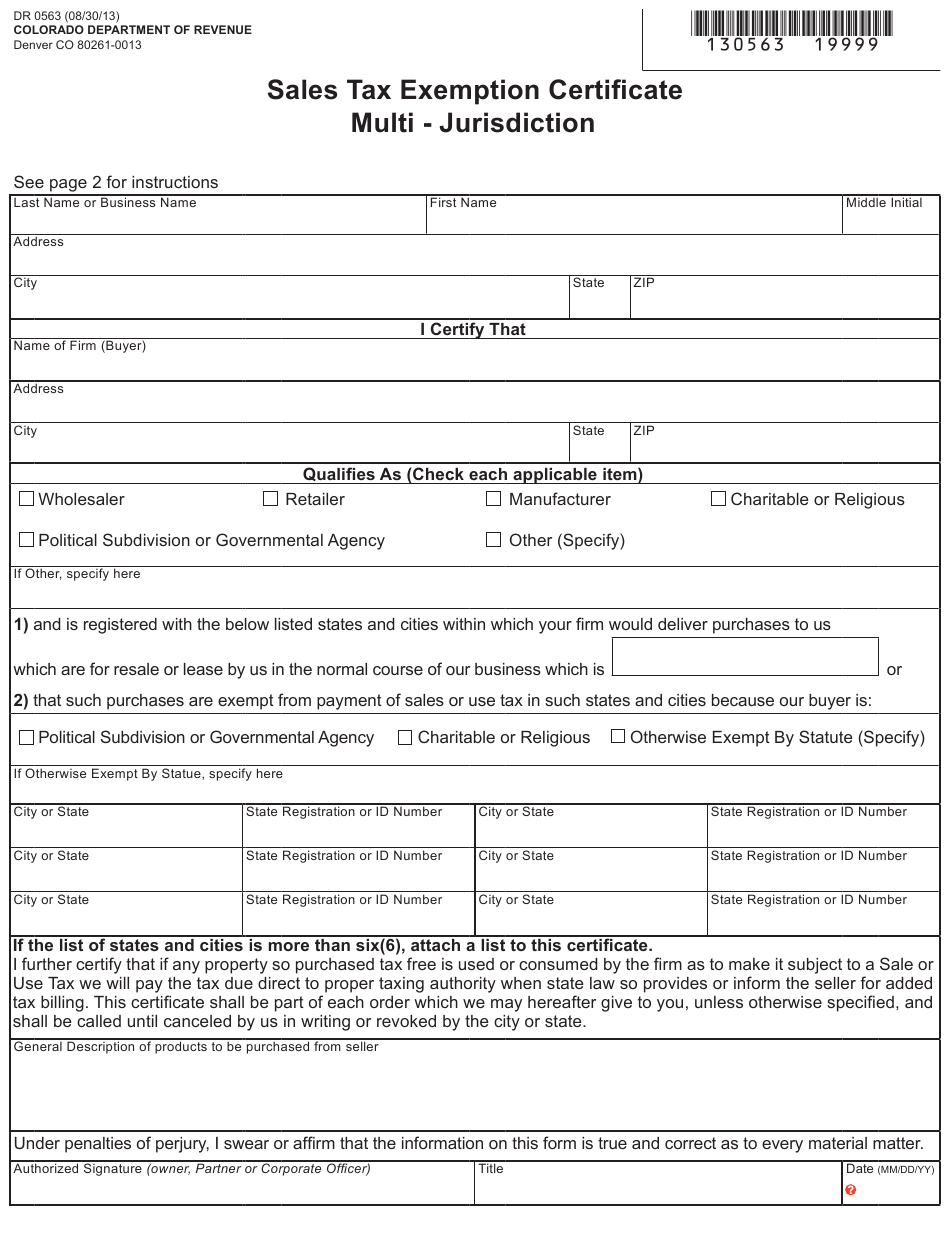

How To Get A Sales Tax Exemption Certificate In Colorado ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/form-dr0563-download-fillable-pdf-or-fill-online-sales-tax-exemption-3.png

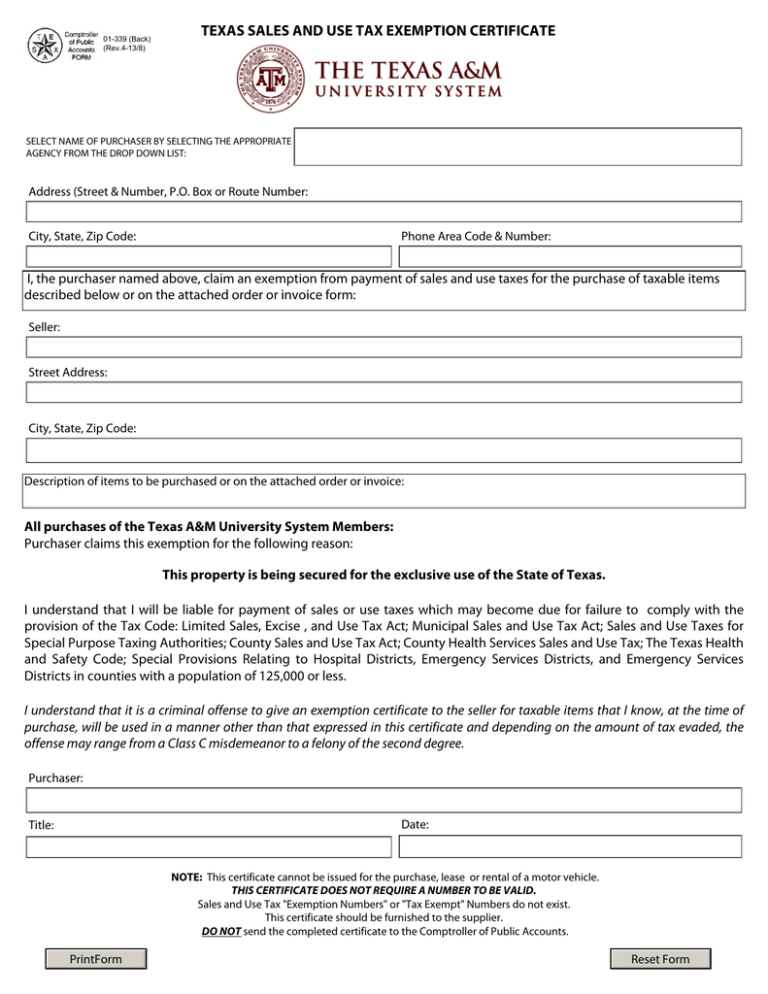

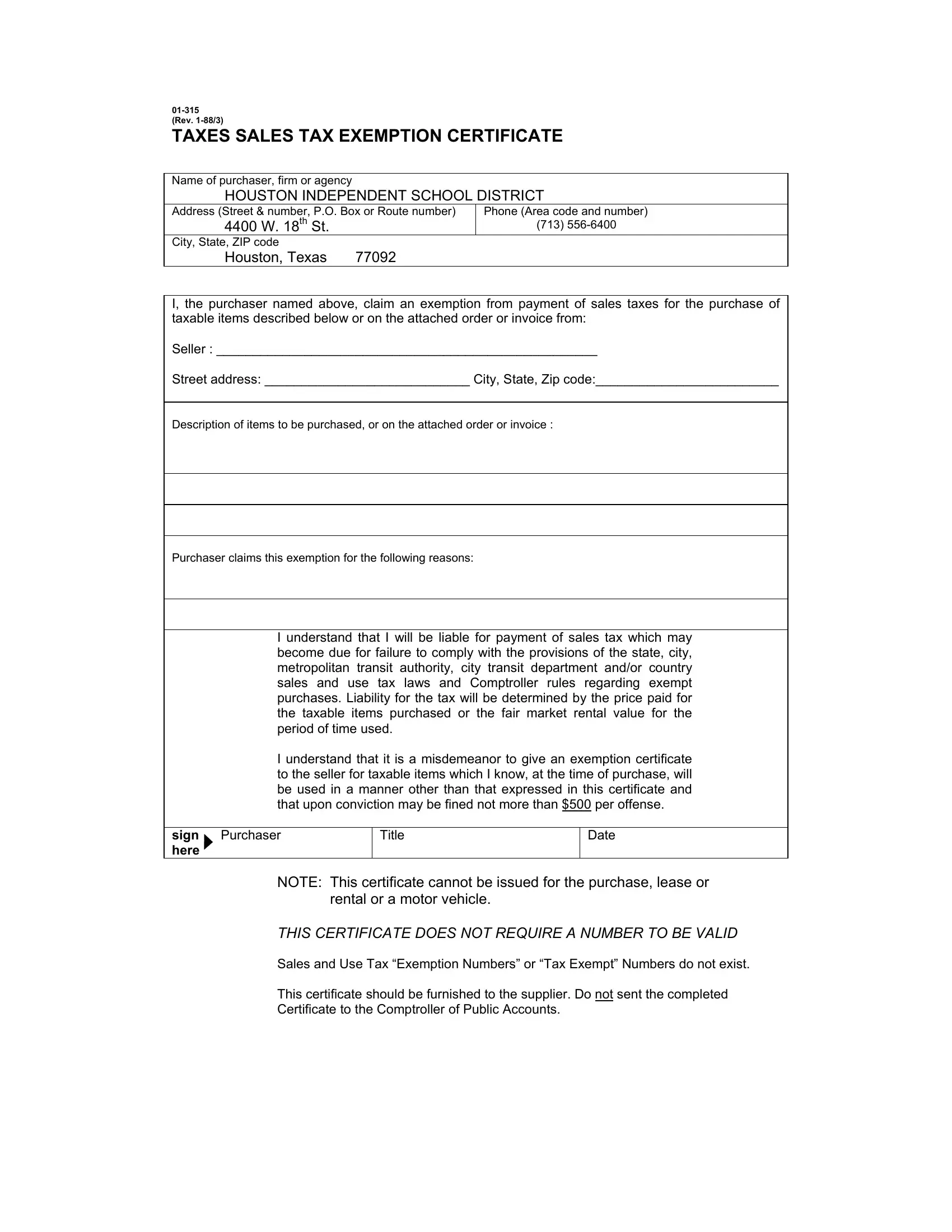

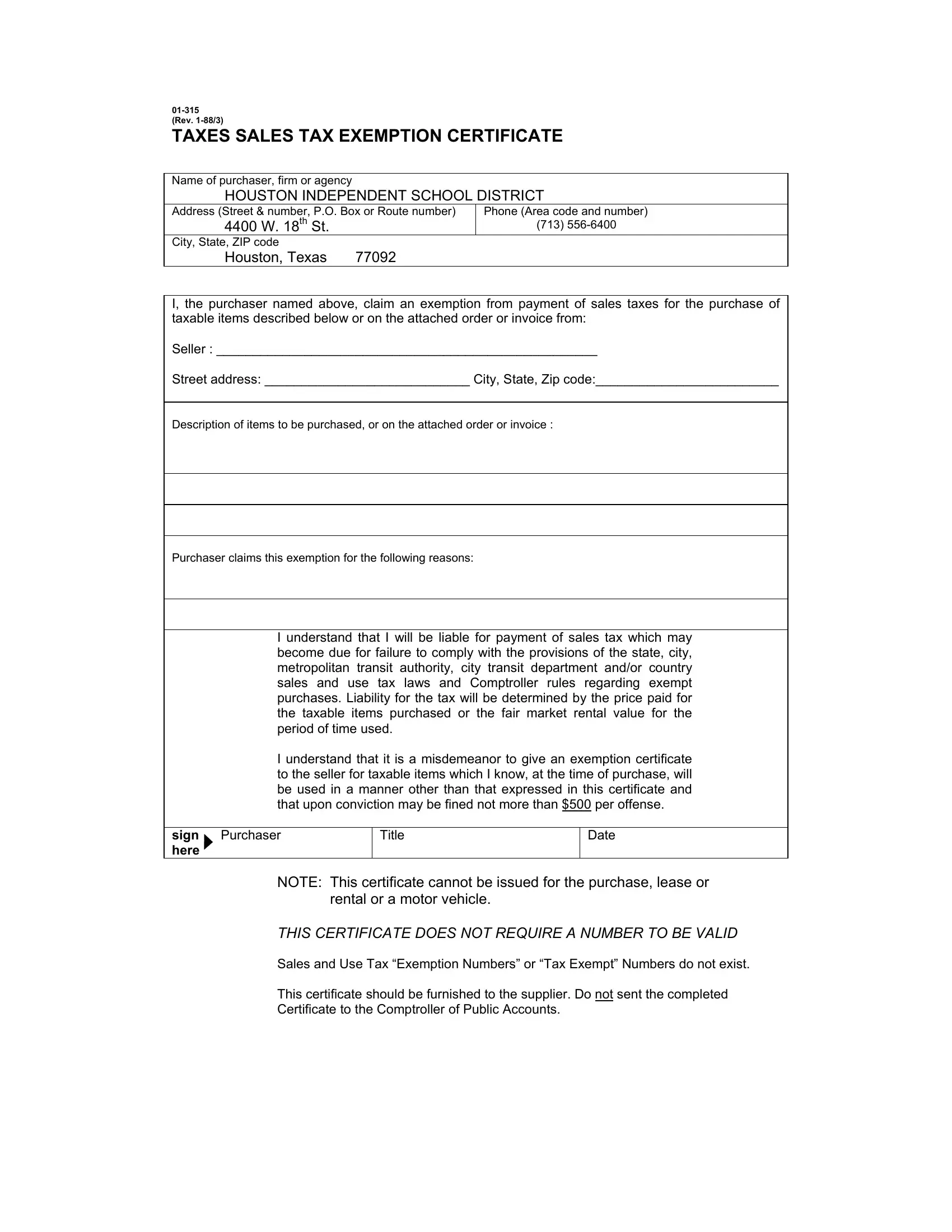

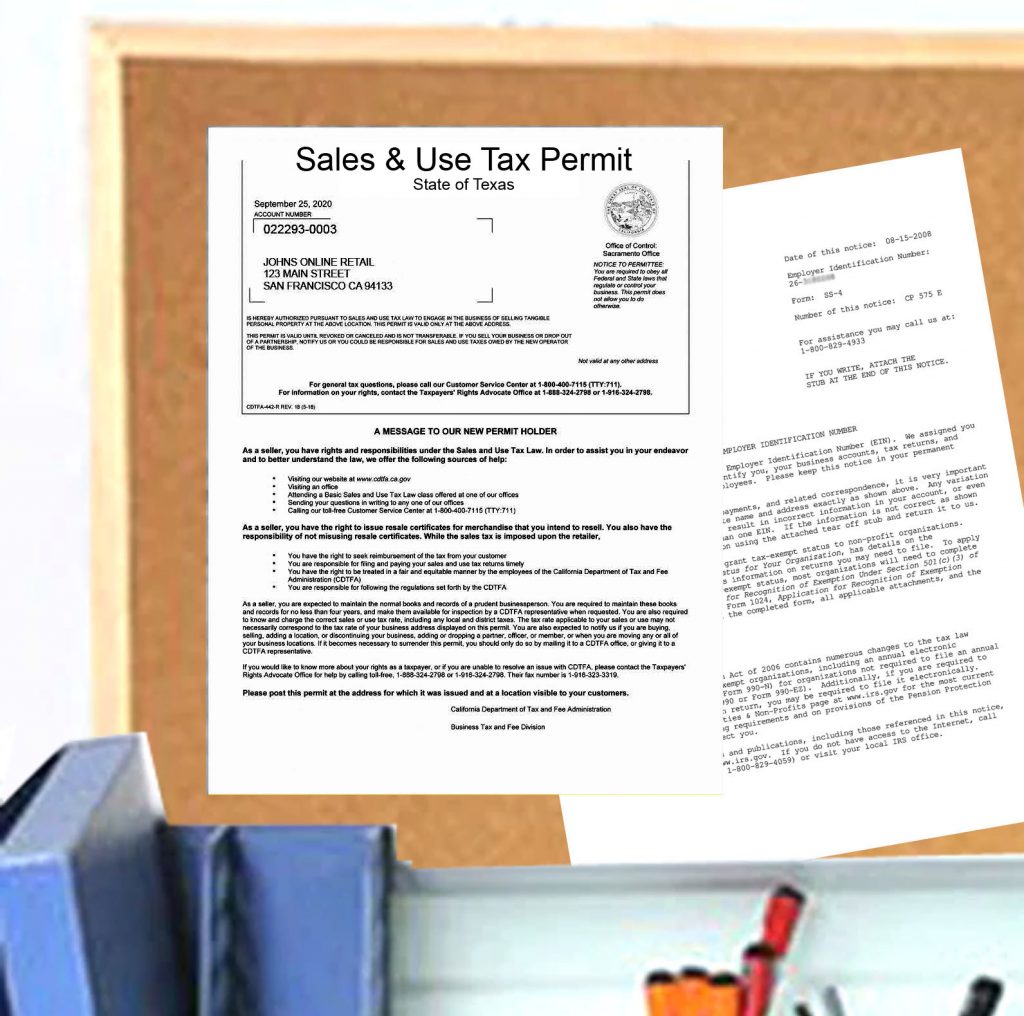

Texas Sales And Use Tax Exemption Certification Forms Docs 2023

https://blanker.org/files/images/01-339b.png

Web Use GTC to register your business Any individual or entity meeting the definition of quot dealer quot in O C G A 167 48 8 2 must register for a sales and use tax number and certificate of registration regardless of whether all sales will be online out of Web Who is required to obtain a Georgia sales and use tax number Any individual or entity meeting the definition of a dealer in O C G A 167 48 8 2 is required to register for a sales and use tax number regardless of whether all sales will be online out of state wholesale or exempt from tax O C G A 167 48 8 59

Web Once you have that you are eligible to issue a resale certificate Therefore you can complete the ST 5 tax exemption certificate form by providing your Georgia Sales Tax Number STEP 1 Obtain a Georgia Sales Tax Permit STEP 2 Fill out the ST 5 tax exemption certificate form Web Download the ST 5 Sales Tax Certificate of Exemption form from the Georgia Department of Revenue website This form allows you to claim exemption from state sales tax on qualifying purchases Learn more about the eligibility and requirements for this exemption

Download How Do I Get A Sales Tax Exemption Certificate In Georgia

More picture related to How Do I Get A Sales Tax Exemption Certificate In Georgia

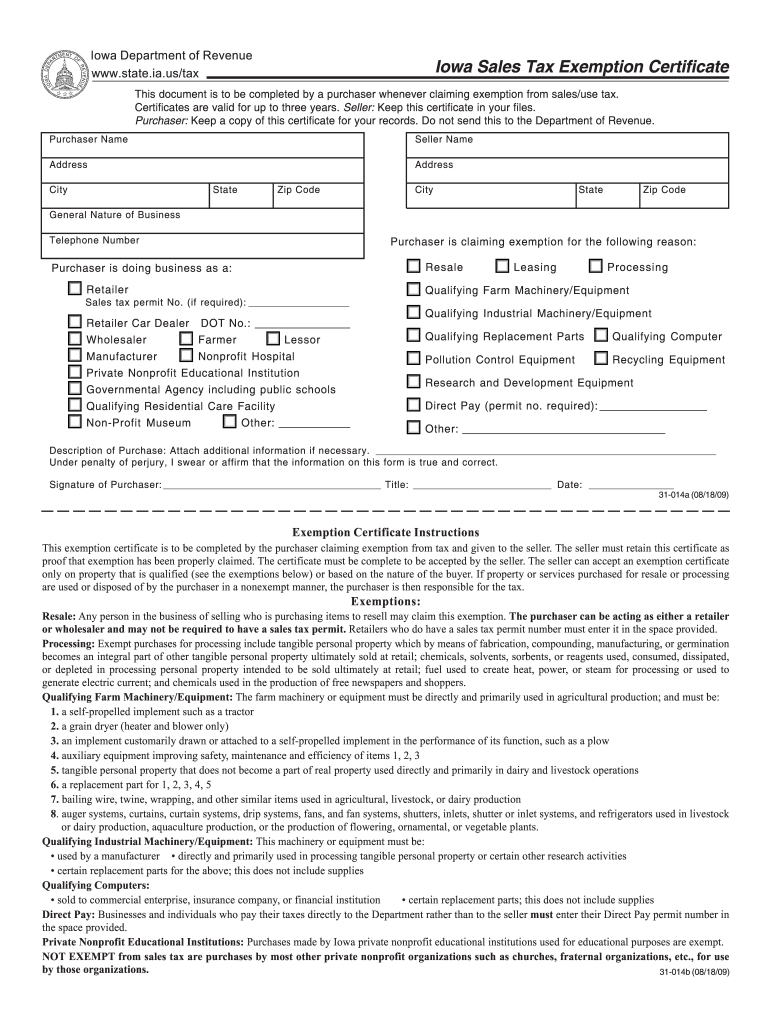

Iowa Sales Tax Exemption Certificate Prntbl concejomunicipaldechinu

https://www.signnow.com/preview/0/211/211451/large.png

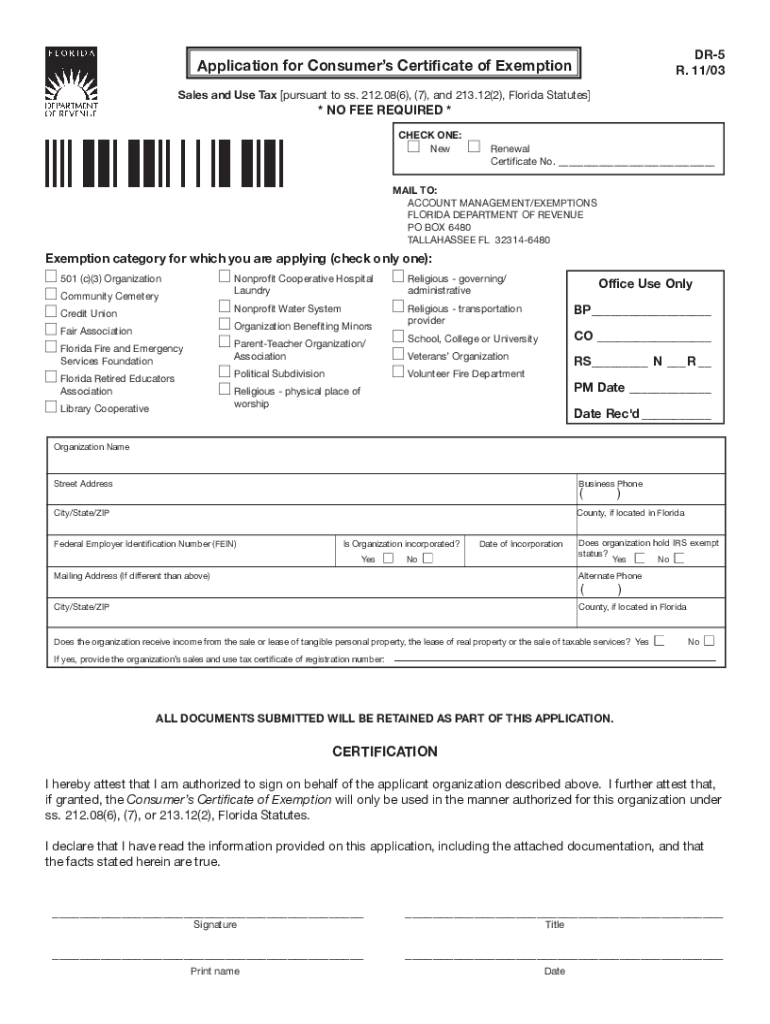

Florida Sales Tax Exemption Certificate Form Video Bokep Ngentot

https://www.pdffiller.com/preview/0/74/74054/large.png

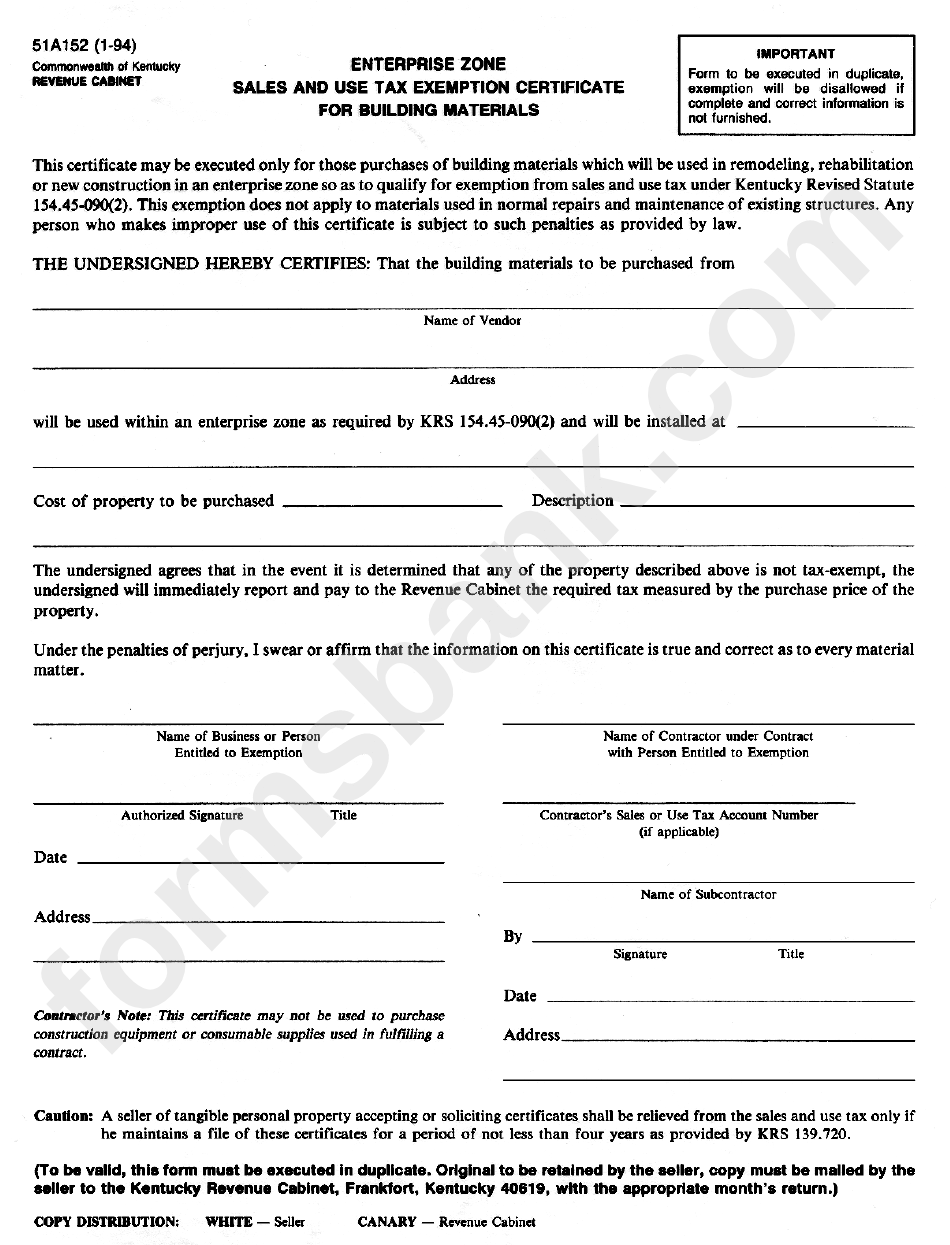

Form 51a152 Sales And Use Tax Exemption Certificate 1994 Printable

https://data.formsbank.com/pdf_docs_html/270/2706/270651/page_1_bg.png

Web Sales amp Use Tax On this page find information and forms related to sales and use taxes Georgia sales and use tax generally applies to all tangible goods sold You can file and pay sales and use tax online using the Georgia Tax Center Web SUPPLIER DATE SUPPLIER S ADDRESS CITY STATE ZIP CODE THE UNDERSIGNED HEREBY CERTIFIES that all purchases made after this date will qualify for the tax free or tax exempt treatment indicated below Check the Applicable Box The terms purchase and sale include leases and rentals 1

Web Apply For Your Georgia Sales and Use Tax Certificate of Registration Now Get Your Georgia Sales and Use Tax Certificate of Registration Online You can easily acquire your Georgia Sales and Use Tax Certificate of Registration online using the Georgia Tax Center website Web 17 Feb 2023 nbsp 0183 32 Manufacturers Do states use the same exemption certificates for all exempt purchases No Most states have certificates for specific types of exemptions And collecting the wrong certificate for an exemption is often the same as having no certificate The seller can be liable for the uncollected taxes

Sales Tax Exempt Certificate Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/50/825/50825271/large.png

2017 PAFPI Certificate of TAX Exemption Certificate Of

https://www.certificateof.com/wp-content/uploads/2018/06/2017-PAFPI-Certificate-of-TAX-Exemption.jpg

https://startingyourbusiness.com/georgia-sales-tax-certificate-of...

Web 17 Mai 2023 nbsp 0183 32 Getting Started Is a Sales Tax Certificate of Exemption the same as a Sales Tax Number Steps for filling out the ST 5 Georgia Sales Tax Certificate of Exemption Step 1 Download Form ST 5 Step 2 Certify the exemption being claimed Step 3 Identify the seller s information Step 4 Identify the buyer s information

https://dor.georgia.gov/taxes/business-taxes/sales-use-tax/nontaxable...

Web Sellers may verify a sales tax number by using the Sales Tax ID Verification Tool Do certificates of exemption or letters of authorization expire Most certificates of exemption and letters of authorization do not expire with the exception of the Georgia Agricultural Tax Exemption GATE certificate which expires on an annual basis

Virginia Sales Tax Exemption Form St 11 Fill Out And Sign Printable

Sales Tax Exempt Certificate Fill Online Printable Fillable Blank

2023 Sales Tax Exemption Form Texas ExemptForm

Sales Certificate Template

California Sales Tax Exemption Form Video Bokep Ngentot

Texas Sales Tax Exemption Certificate PDF Form FormsPal

Texas Sales Tax Exemption Certificate PDF Form FormsPal

Georgia Sales Tax Exemption Form St 5 ExemptForm

Alabama State Sales And Use Tax Certificate Of Exemption Form Ste 1

Texas Seller s Permit TX Tax Permit Resale Certificate Fast Filings

How Do I Get A Sales Tax Exemption Certificate In Georgia - Web Who is required to obtain a Georgia sales and use tax number Any individual or entity meeting the definition of a dealer in O C G A 167 48 8 2 is required to register for a sales and use tax number regardless of whether all sales will be online out of state wholesale or exempt from tax O C G A 167 48 8 59